India Sanitary Faucets Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Indian Sanitary Faucets Market Size and Share:

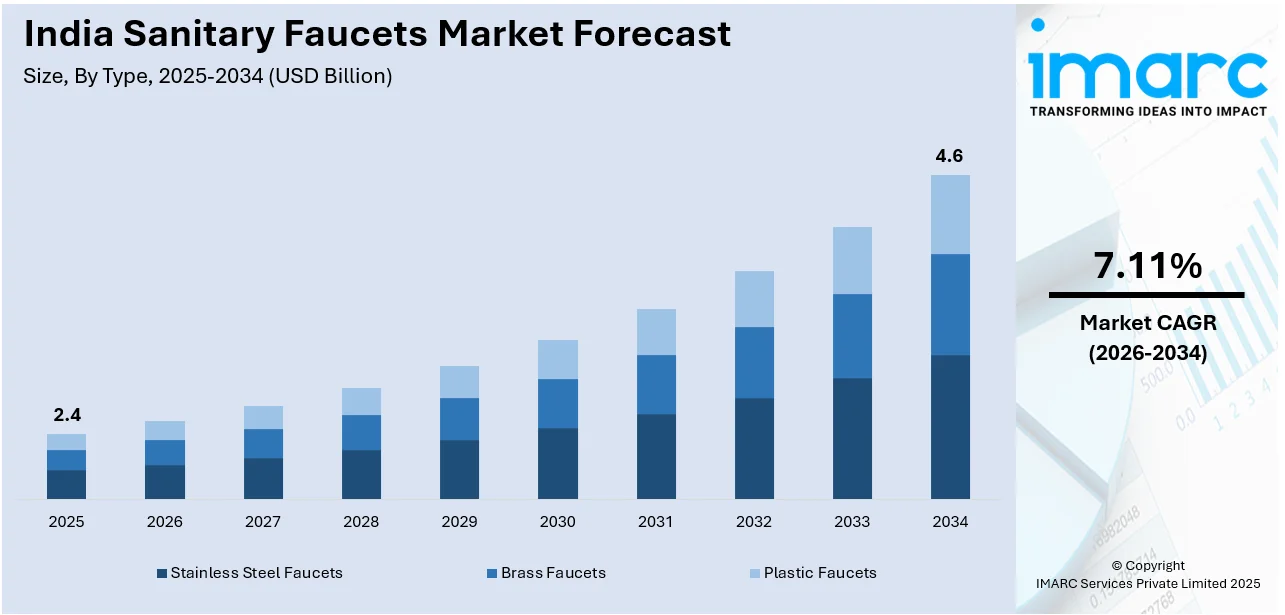

The Indian sanitary faucets market size reached USD 2.4 Billion in 2025. The market is expected to reach USD 4.6 Billion by 2034, exhibiting a growth rate (CAGR) of 7.11% during 2026-2034. The market growth is attributed to rapid urbanization and expanding real estate projects, growing hospitality and commercial sectors increasing installations of premium, sensor-based faucets.

Market Insights:

- On the basis of region, the market has been divided into North India, South India, East India, and West India.

- On the basis of type, the market has been divided into stainless steel faucets, brass faucets, and plastic faucets.

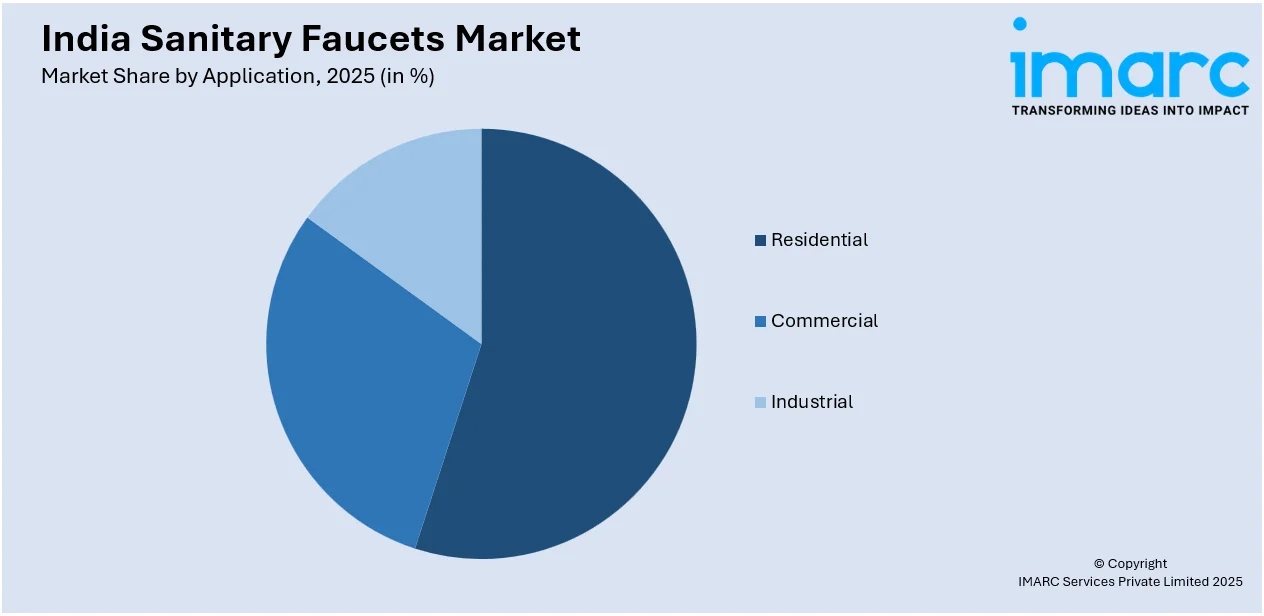

- On the basis of application, the market has been divided into residential, commercial, and industrial.

Market Size and Forecast:

- Market Size in 2025: USD 2.4 Billion

- Market Forecast in 2034: USD 4.6 Billion

- Market Growth Rate (2026-2034): 7.11%

India Sanitary Faucets Market Trends:

Increasing Number of Housing Development Projects

The rising population in urban areas is catalyzing the demand for modern and efficient plumbing solutions. Government initiatives like Housing for All and Smart Cities Mission are accelerating residential and commercial construction. Expanding real estate projects are boosting the need for advanced, stylish, and durable sanitary faucets. The Indian real estate market is projected to grow significantly, potentially reaching US$ 5-7 trillion by 2047, as per IBEF. This rapid expansion is driving the demand for high-quality sanitary fittings across residential and commercial sectors. Urban customers are prioritizing modern interiors, influencing the India sanitary faucets market outlook. The growth of high-rise apartments and gated communities is increasing the installation of premium sanitary fittings. Smart city infrastructure developments are further fueling the demand for automated and water-efficient faucet solutions. Builders and developers are integrating high-quality sanitary faucets to enhance property value and appeal. The rise in nuclear families and compact housing designs is encouraging space-saving and multifunctional faucets. Inflating disposable income among urban dwellers is further propelling the shift toward luxury bathroom fittings. Commercial establishments like hotels, malls, and office spaces are investing in premium sanitary fixtures to align with evolving consumer expectations. As real estate continues expanding, the sanitary faucets market is experiencing steady and sustained growth.

To get more information on this market Request Sample

Expanding Hospitality and Commercial Sectors

Increasing hotel constructions and renovations are fueling the demand for premium, stylish, and durable sanitary fittings. Luxury hotels and resorts are installing high-end faucets to enhance guest experience and brand value. The growing restaurant and café industry is investing in aesthetic and functional faucets for modern restrooms. Shopping malls and retail outlets are incorporating advanced faucet designs to maintain hygiene and visual appeal. Expanding corporate offices are increasing the demand for sensor-based and touchless faucets to improve hygiene and water efficiency, which is a key factor strengthening the India sanitary faucets market growth. Rising coworking spaces are adopting stylish and water-efficient faucets to enhance workplace infrastructure. Government investments in public infrastructure including airports and railway stations are promoting high-quality sanitary faucet installations. The Union Budget 2025-26 has allocated ₹2,541.06 crore to the tourism industry for improving infrastructure, skill development, and travel facilitation, further driving the demand for commercial sanitary fittings. Hospitals and healthcare facilities are installing sensor-based faucets to maintain strict hygiene and infection control. Educational institutions and universities are upgrading restrooms with durable and water-efficient sanitary fittings. The demand for sustainable and eco-friendly faucets is increasing due to corporate sustainability initiatives. Smart technology adoption in commercial spaces is driving the use of IoT-enabled and automated faucets. As commercial infrastructure expands, the India sanitary faucets market forecast indicates continued strong and sustained growth.

Sustainable Materials and Eco-Friendly Manufacturing

Environmental consciousness is driving significant changes in faucet manufacturing processes and material selection across India. Manufacturers are increasingly adopting recycled metals and eco-friendly materials to reduce their environmental footprint. Water-saving technologies like aerators and flow restrictors are becoming standard features in modern faucets, aligning with India's water conservation goals. Lead-free brass and antimicrobial coatings are gaining popularity due to health and safety concerns among Indian consumers. Sustainable packaging solutions using biodegradable materials are being implemented to reduce plastic waste. Energy-efficient manufacturing processes are being adopted to minimize carbon emissions during production. Local sourcing of raw materials is being prioritized to reduce transportation costs and environmental impact. Certification programs for eco-friendly faucets are encouraging manufacturers to adopt greener practices. Water efficiency ratings are becoming important purchasing criteria for environmentally conscious consumers. The circular economy approach is being embraced, with manufacturers offering take-back programs for old faucets. These sustainability initiatives are shaping the India sanitary faucets market report as the industry moves toward more responsible manufacturing practices.

Growth, Opportunities, and Challenges in the Indian Sanitary Faucets Market:

- Growth Drivers: The rapid urbanization across India is creating unprecedented demand for modern sanitary solutions in both residential and commercial sectors. Government initiatives like Smart Cities Mission and Housing for All are accelerating infrastructure development, directly boosting faucet installations. Rising disposable income among middle-class consumers is driving the shift toward premium and technologically advanced faucet products.

- Market Opportunities: The untapped rural market presents significant expansion opportunities as government initiatives improve rural infrastructure and sanitation facilities. Digital integration and IoT-enabled smart faucets offer new revenue streams for manufacturers targeting tech-savvy urban consumers. Export opportunities to neighboring countries and emerging markets can leverage India's competitive manufacturing capabilities and cost advantages.

- Market Challenges: Intense competition from both domestic and international players is pressuring profit margins and market share distribution. Raw material price volatility, particularly for brass and stainless steel, affects manufacturing costs and pricing strategies. Quality control and counterfeit products in the unorganized sector pose challenges to established brands and consumer confidence.

India Sanitary Faucets Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Stainless Steel Faucets

- Brass Faucets

- Plastic Faucets

The report has provided a detailed breakup and analysis of the market based on the type. This includes stainless steel faucets, brass faucets, and plastic faucets.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, commercial, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Latest News and Developments:

- In February 2025, Jaquar Group expanded its Bhiwadi, Rajasthan facility, making it the world's largest single-unit faucet production plant. This INR 300 Crore investment highlights the focus of the company on sustainability and technological innovation, reinforcing its global expansion strategy.

- In November 2024, CERA announced the grand re-opening of its revamped CERA Style Studio showroom in Ahmedabad. The showroom is designed especially for architects, developers, and customers to showcase their premium range of sanitaryware, faucets, tiles, and home wellness products. The state-of-the-art manufacturing facilities use advanced technologies including 3D printing, robotic glazing, and automatic chrome plating for faucets.

- In August 2024, Japanese sanitaryware giant TOTO announced plans to expand aggressively in India’s Tier-II and Tier-III cities, driven by rising urbanisation, higher disposable incomes, and growing hygiene awareness. The company, which has been manufacturing in Gujarat for over a decade, aims to add 40 new channel partners in 2024 to strengthen its distribution and dealership network. This move, including the launch of new collections of toilets, basins, faucets, and showers, highlights the intensifying competition and consumer demand.

- In April 2024, Duravit launched three new faucet series, Wave, Circle, and Manhattan, offering premium design at competitive prices. These collections feature EasyClean, FreshStart, and MinusFlow technologies, promoting sustainability. They cater to modern bathrooms while aligning with Duravit's eco-friendly commitment, with diverse aesthetics.

India Sanitary Faucets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Stainless Steel Faucets, Brass Faucets, Plastic Faucets |

| Applications Covered | Residential, Commercial, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sanitary faucets market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sanitary faucets market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sanitary faucets industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sanitary faucets market in India was valued at USD 2.4 Billion in 2025.

The India sanitary faucets market is projected to exhibit a CAGR of 7.11% during 2026-2034, reaching a value of USD 4.6 Billion by 2034.

The India sanitary faucets market is driven by rapid urbanization, increasing disposable incomes, and a booming real estate sector. The growing consumer preference for modern, aesthetically appealing, and smart bathroom fittings, along with rising awareness about hygiene and water conservation, further propels market growth. Expanding hospitality and commercial sectors also contribute significantly.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)