India Sanitary Ware Market Size, Share, Trends and Forecast by Material, Type, Application, End User, and Region, 2026-2034

India Sanitary Ware Market Summary:

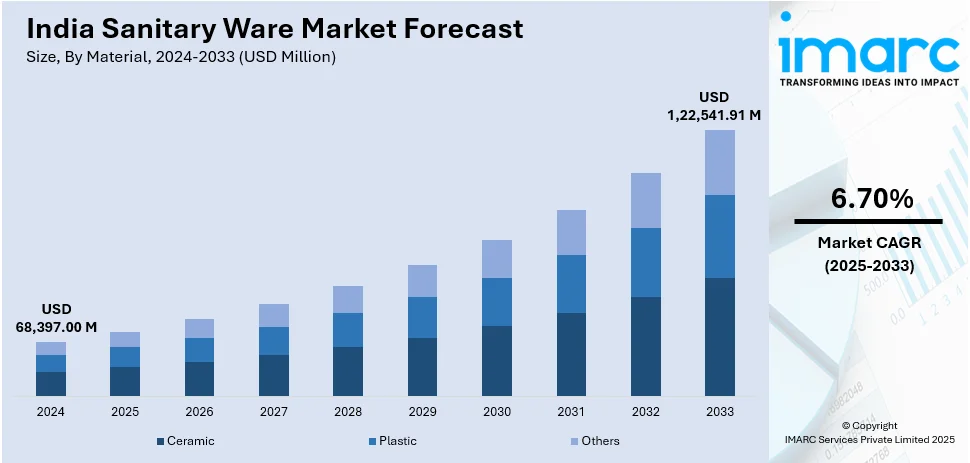

The India sanitary ware market size reached USD 68,397.00 Million in 2025. The market is expected to reach USD 1,22,541.91 Million by 2034, exhibiting a growth rate (CAGR) of 6.70% during 2026-2034. The market growth is attributed to rapid urbanization, rising disposable income, premium product adoption, smart bathrooms, government sanitation initiatives, real estate growth, hospitality expansion, and increased hygiene awareness. Moreover, rising health consciousness, coupled with the growing aspiration for modern living standards, is redefining consumer priorities and augmenting the India sanitary ware market share.

Market Insights:

- Based on region, the market is divided into North India, South India, East India, and West India.

- On the basis of material, the market is segmented into ceramic, plastic, and others.

- Based on type, the market is categorized as toilet sink/water closet, wash basins, pedestals, cisterns, and others.

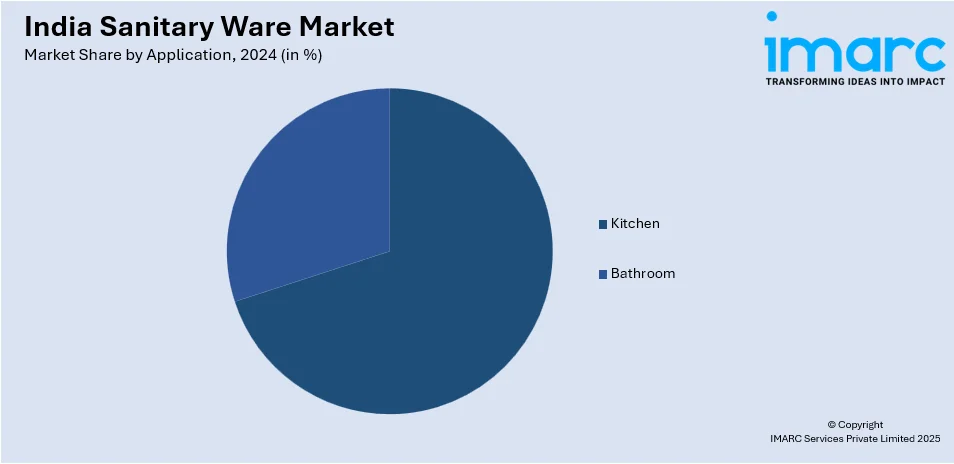

- On the basis of application, the market is divided into kitchen and bathroom.

- Based on end user, the market is segmented into residential and commercial.

Market Size & Forecast:

- 2024 Market Size: USD 68,397.00 Million

- 2033 Projected Market Size: USD 1,22,541.91 Million

- CAGR (2025-2033): 6.70%

India Sanitary Ware Market Trends:

Adoption of Smart Bathroom Technologies

The Indian market for sanitary ware is growing significantly as smart bathroom technologies gain higher acceptance. Smart fixtures like sensor faucets, smart toilets, and showers with automatic operation are being added by consumers in their homes out of a need for greater convenience, hygiene, and water savings. This move is in tandem with the wider trend of the adoption of smart homes, which is expected to cover almost 400 million households worldwide by the year 2027. India's smart bathroom market is also growing at a fast pace. This is being driven by a rising awareness of hygiene and smart technology benefits among consumers. Industry players are moving in by making available products with features such as touchless technology and customized settings. For example, Kohler debuted a series of intelligent bathroom fixtures, such as touchless faucet products and enhanced toilet technologies, at the CES 2020 conference. The incorporation of Internet of Things (IoT) technology in bathroom settings enables live monitoring of water consumption, leading to sustainability that is a desire among most customers. This trend is expanding the sanitary ware market size in India.

To get more information on this market, Request Sample

Rising Demand for Luxury and Premium Sanitary Ware

The main driver of the market for sanitation products is the rise in popularity of premium and luxury products. Affluent buyers are now getting inclined towards high-grade bathroom fittings that are not only visually appealing but are also efficient in their functionality. This is part of a larger increase in luxury spending in India, which has led to greater sales of luxury and sophisticated real estate properties. It is estimated that the Indian market for luxury sanitary ware would grow at 9% CAGR and reach $12 billion by 2029. To take advantage of this increasing demand, companies like Kohler and Hansgrohe, are establishing more experience centers and retail shops in other Indian cities. Kohler, for instance, plans on launching these types of outlets across major cities which could position India as one of the top hubs for such facilities. This insight is indicative of a wider Indian lifestyle trend that is emerging, which is the need for better and more unique living spaces. The high sales of disposable income and movement to urban areas is expected to drive the demand for luxury sanitary wares, hence propelling India sanitary ware market growth.

Urbanization and Technology Integration

The market is reshaped by the combined forces of rapid urbanization and advancing technology. As urbanization in India is expected to reach nearly 40% by 2030, the need for contemporary housing, commercial developments, and public infrastructure is growing rapidly. This urban expansion is driving the adoption of smart, compact, efficient, and aesthetically designed sanitary solutions in both residential and institutional projects. Simultaneously, technological innovations are transforming consumer expectations, with touchless faucets, sensor-based flush systems, and IoT-enabled smart bathrooms gaining traction across urban centers. Enhanced materials such as anti-bacterial coatings and water-saving mechanisms are aligning with the push for sustainable and hygienic solutions, particularly in high-density environments. Real estate developers and public sector projects are increasingly integrating these advanced systems to meet both regulatory and user standards. As per the sanitary ware industry analysis in India, urban growth and tech integration are fostering a new era of functionality and efficiency in the market, particularly in Tier I and II cities.

Government-Led Sanitation Initiatives Driving Demand

The market has witnessed notable momentum owing to sustained government initiatives aimed at improving sanitation infrastructure. Programs such as the Swachh Bharat Mission (SBM), launched in 2014, significantly increased household access to toilets across urban and rural areas. As of September 2024, the initiative had facilitated the development of more than 6.3 Million individual household toilets and over 630,000 public sanitation facilities across the country. This has resulted in the increased demand for basic sanitary fittings, ceramic wares, and related products, thereby significantly augmenting the sanitary ware market share in India. Moreover, the continuation of Jal Jeevan Mission and AMRUT 2.0 (Atal Mission for Rejuvenation and Urban Transformation) has further fueled investments in urban water and sanitation systems, spurring institutional and residential sanitary ware installations. Additionally, the PM Awas Yojana, which aims to provide housing for all, mandates proper sanitation facilities in every unit, expanding sanitary ware consumption in low-income and rural segments. These large-scale infrastructure interventions have broadened market accessibility, particularly for domestic manufacturers, while reinforcing hygienic practices and sanitation awareness among India’s growing population.

India Sanitary Ware Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on material, type, application, and end user.

Material Insights:

- Ceramic

- Plastic

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes ceramic, plastic, and others.

Type Insights:

- Toilet Sink/Water Closet

- Wash Basins

- Pedestals

- Cisterns

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes toilet sink/water closet, wash basins, pedestals, cisterns, and others.

Application Insights:

- Kitchen

- Bathroom

The report has provided a detailed breakup and analysis of the market based on the application. This includes kitchen and bathroom.

End User Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes residential and commercial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sanitary Ware Market News:

- November 2024: Ruhe expanded its footprint in India by establishing special experience centers for sanitaryware, bath fittings, and kitchen fixtures. The goal is to give clients cutting-edge designs, high-quality materials, and innovative features. The centers are intended to provide a hands-on encounter with the varied product variety, resulting in a shopping experience unlike anything before.

- October 2024: Aquant, a leading provider of premium bathroom solutions, opened a 2,800 sq. ft. display center in Mahalaxmi, Mumbai. The center, designed by MuseLAB, offers visitors first-hand experience of Aquant's luxurious bath fittings, sanitary ware, stylish faucets, and indulgent spa concepts.

India Sanitary Ware Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Ceramic, Plastic, Others |

| Types Covered | Toilet Sink/Water Closet, Wash Basins, Pedestals, Cisterns, Others |

| Applications Covered | Kitchen, Bathroom |

| End Users Covered | Residential, Commercial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sanitary ware market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sanitary ware market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sanitary ware industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sanitary ware market in India was valued at USD 68,397.00 Million in 2024.

The India sanitary ware market is projected to exhibit a CAGR of 6.70% during 2025-2033, reaching a value of USD 1,22,541.91 Million by 2033.

Rapid urban growth, shifting lifestyle preferences, and a greater emphasis on hygiene are fueling demand in India’s sanitary ware market. Rising disposable incomes, evolving interior design trends, and sanitation-focused government programs are also encouraging the adoption of stylish, durable bathroom fixtures across various consumer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)