India Saree Market Size, Share, Trends and Forecast by Type of Saree, Price Range, Distribution Channel, and Region, 2026-2034

India Saree Market Summary:

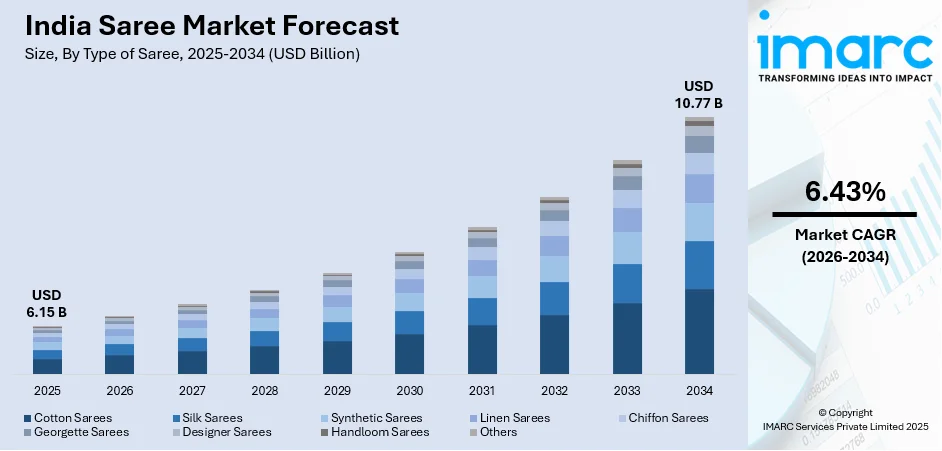

The India saree market size was valued at USD 6.15 Billion in 2025 and is projected to reach USD 10.77 Billion by 2034, growing at a compound annual growth rate of 6.43% from 2026-2034.

India’s saree industry reflects a dynamic blend of age-old cultural traditions and modern fashion trends. Time-honoured weaving practices are increasingly complemented by contemporary production methods, resulting in a wide range of designs and price points. These offerings cater to varied consumer needs, spanning everyday wear, ceremonial functions, and festive occasions across diverse age groups, income segments, and regions throughout the country.

Key Takeaways and Insights:

-

By Type of Saree: Cotton sarees dominate the market with a share of 23% in 2025, driven by their versatility, breathability, and affordability, making them suitable for daily wear across climate zones and socioeconomic segments throughout the country.

-

By Price Range: Economy sarees lead the market with a share of 55% in 2025, reflecting the price-conscious purchasing behavior of the majority consumer base seeking value-oriented options that balance quality with affordability for regular usage.

-

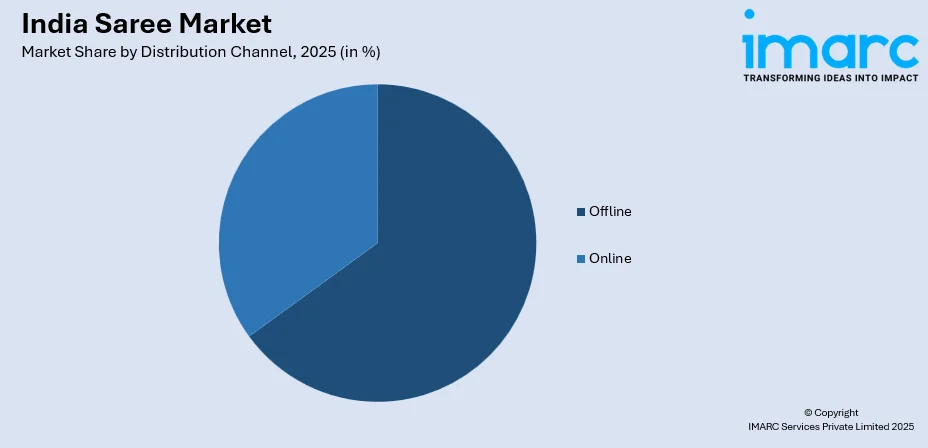

By Distribution Channel: Offline represents the largest segment with a market share of 65% in 2025, as consumers prefer tactile evaluation of fabric quality, draping characteristics, and color accuracy before making purchase decisions for significant wardrobe investments.

-

By Region: North India exhibits a clear dominance with a 36% share in 2025, propelled by dense population centers, strong cultural affinity for traditional attire, and the concentration of major textile manufacturing hubs and retail distribution networks.

-

Key Players: The India saree market features a fragmented competitive structure with established handloom cooperatives, regional textile mills, and emerging designer labels operating across price tiers to serve diverse consumer preferences and occasions.

To get more information on this market Request Sample

The saree industry in India remains deeply rooted in regional weaving traditions while simultaneously adapting to shifting consumer preferences toward convenience, digital shopping experiences, and sustainable production practices. The sector benefits from government policy support for handloom artisans, growing appreciation for heritage textiles among younger demographics, and increasing global recognition of Indian textile craftsmanship. In fiscal year 2025, India shipped cotton yarn, fabrics, made-up textiles, and handloom products valued at approximately USD 10.56 billion, reflecting the country’s strong presence in global textile exports. Market participants are responding to evolving demand patterns by expanding product portfolios to include fusion designs, ready-to-wear options, and customization services. The convergence of traditional retail channels with digital platforms is reshaping distribution strategies, enabling access to authentic regional sarees across geographic boundaries while maintaining the cultural significance that defines this enduring garment category.

India Saree Market Trends:

Integration of Technology in Traditional Textile Retail

Digital transformation is reshaping how consumers discover and purchase traditional sarees through virtual platforms. For instance, in November 2024, Pune-based entrepreneur Purtika Choudhury launched Chhunchi, The Needles Craft, an online platform dedicated to handloom sarees. The digital-first store enables consumers to discover region-specific weaves from across India through curated collections and visual storytelling, reflecting how e-commerce platforms are expanding the reach of traditional sarees and connecting artisans directly with digitally engaged consumers. Retailers are implementing augmented reality features that allow buyers to visualize draping styles and color combinations on digital avatars before completing transactions. Artificial intelligence algorithms analyze browsing patterns and previous purchases to recommend regional weaves that align with individual preferences and occasion requirements. Social media platforms have evolved into influential discovery channels where artisans showcase intricate weaving processes, connecting directly with consumers who value transparency in production methods and authentic storytelling around heritage textiles.

Revival of Regional Weaving Techniques Through Contemporary Design

Contemporary designers are reimagining traditional weaving patterns by incorporating modern color palettes and minimalist aesthetics that appeal to urban professionals seeking versatile wardrobe options. Ancient techniques such as jamdani, patola, and baluchari are being adapted for lighter fabrics and contemporary silhouettes that accommodate active lifestyles while preserving the essence of regional craftsmanship. Fashion weeks and cultural exhibitions are providing platforms for master weavers to collaborate with emerging designers, creating collections that bridge generational preferences and expand market reach beyond traditional consumer segments.

Emphasis on Transparent Supply Chains and Ethical Production

Growing consumer awareness regarding production conditions has prompted brands to adopt traceability systems that document the journey from raw material sourcing to finished product delivery. Certification programs identifying genuine handloom products are gaining traction as buyers seek assurance of artisan welfare and environmental responsibility. Textile manufacturers are establishing direct relationships with weaving clusters to ensure fair compensation while maintaining quality standards that differentiate handcrafted sarees from mass-produced alternatives in an increasingly competitive marketplace. For instance, in August 2025, the government announced increased budget allocations for handloom schemes from INR 219.85 crore in 2020-21 to INR 367.67 crore in 2024-25, supporting weaver welfare and cluster development.

Market Outlook 2026-2034:

The forecast period anticipates sustained expansion driven by rising disposable incomes in tier-two and tier-three cities, where traditional attire maintains cultural significance for religious ceremonies and social gatherings. Urbanization patterns are creating new consumer segments that value convenience without compromising on cultural authenticity, prompting innovation in fabric technology and draping styles. Export opportunities are expanding as global appreciation for sustainable fashion and artisanal craftsmanship grows among international buyers seeking unique textile products. The market generated a revenue of USD 6.15 Billion in 2025 and is projected to reach a revenue of USD 10.77 Billion by 2034, growing at a compound annual growth rate of 6.43% from 2026-2034.

India Saree Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type of Saree | Cotton Sarees | 23% |

| Price Range | Economy Sarees | 55% |

| Distribution Channel | Offline | 65% |

| Region | North India | 36% |

Type of Saree Insights:

- Cotton Sarees

- Silk Sarees

- Synthetic Sarees

- Linen Sarees

- Chiffon Sarees

- Georgette Sarees

- Designer Sarees

- Handloom Sarees

- Others

Cotton sarees dominate with a market share of 23% of the total India saree market in 2025.

Cotton sarees maintain their leadership position through inherent fabric characteristics that align with the tropical and subtropical climate conditions prevalent across most Indian regions. The natural fiber composition ensures superior moisture absorption and air circulation, making these garments suitable for extended wear during daily activities and professional settings. Manufacturing processes for cotton sarees range from traditional handloom techniques to mechanized production, creating price points that accommodate diverse economic segments while preserving the essential comfort attributes that drive sustained consumer preference.

The versatility of cotton as a base material enables extensive experimentation with dyeing techniques, block printing, and embroidery applications that cater to regional aesthetic preferences and occasion-specific requirements. Smaller textile units and independent weavers find cotton sarees particularly viable for production given the relatively lower raw material costs and established supply chain networks for cotton yarn. This accessibility supports employment generation in rural areas while maintaining competitive pricing structures that reinforce market dominance across consumer demographics seeking practical yet culturally appropriate attire options.

Price Range Insights:

- Economy Sarees

- Mid-Range Sarees

- Premium/Luxury Sarees

Economy sarees lead with a share of 55% of the total India saree market in 2025.

Economy sarees represent the accessible entry point for the majority of Indian consumers who prioritize functional value over premium materials or intricate craftsmanship. This segment encompasses synthetic blends, machine-woven cotton variants, and standardized designs that reduce production costs while maintaining acceptable quality standards for daily wear and routine social occasions. The pricing structure aligns with the purchasing power of middle and lower-income households, enabling wardrobe rotation without significant financial strain during festival seasons when multiple garment purchases become customary.

Distribution efficiency in the economy segment benefits from established wholesale networks connecting textile hubs with retail outlets in smaller towns and rural markets where traditional attire remains the preferred clothing choice. Manufacturers targeting this segment focus on operational efficiency through bulk production runs, simplified design variations, and cost-effective material sourcing that maintains profit margins while delivering affordability to end consumers. The segment's resilience stems from consistent demand across demographic groups who view sarees as essential wardrobe components rather than aspirational fashion statements.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

Offline exhibits a clear dominance with a 65% share of the total India saree market in 2025.

Traditional brick-and-mortar retail continues to dominate saree transactions due to the tactile and visual evaluation requirements inherent in textile purchases. Physical stores enable customers to assess fabric weight, drape characteristics, color accuracy under natural lighting conditions, and embellishment quality through direct handling before committing to purchases that often represent significant wardrobe investments. Experienced sales personnel provide consultation on suitable fabrics for specific occasions, body types, and regional styling preferences, creating personalized shopping experiences that build customer loyalty and repeat business.

The offline channel encompasses diverse retail formats ranging from specialized saree showrooms in metropolitan areas to small boutiques in neighborhood markets and temporary stalls during festival periods. These physical touchpoints serve important social and cultural functions beyond mere transactions, acting as gathering spaces where women exchange fashion advice and maintain community connections. The persistence of cash-based transactions in smaller markets and the preference for immediate possession without delivery delays further reinforce the offline channel's market leadership despite growing digital alternatives.

Region Insights:

- North India

- South India

- East India

- West India

North India exhibits a clear dominance with a 36% share of the total India saree market in 2025.

North India's market leadership stems from the concentration of major population centers including Delhi, Punjab, Haryana, and Uttar Pradesh, where sarees maintain strong cultural relevance across religious ceremonies, wedding festivities, and formal social gatherings. The region benefits from established textile manufacturing clusters in Varanasi, Lucknow, and surrounding areas that specialize in silk weaving and intricate embroidery techniques that command premium positioning. Urban centers in this zone demonstrate robust purchasing power among middle and upper-middle-class households who allocate substantial budgets for traditional attire that reflects social status and cultural identity.

Regional preferences in North India favor richer color palettes, heavier fabrics with metallic threadwork, and elaborate border designs that distinguish formal occasion wear from everyday garments. The presence of major retail corridors and shopping districts in cities like Delhi and Jaipur creates competitive marketplaces where diverse saree varieties from across India are available alongside locally produced specialties. Distribution networks connecting manufacturing hubs with retail outlets throughout smaller towns ensure market penetration across urban and semi-urban areas, sustaining the region's dominant position in aggregate market share.

Market Dynamics:

Growth Drivers:

Why is the India Saree Market Growing?

Increasing Workforce Participation and Professional Dress Codes

Rising employment rates among women across service sectors, government institutions, and corporate environments are expanding the addressable market for sarees suitable for professional settings. India has recorded a significant rise in women’s participation in the workforce, with the Female Labour Force Participation Rate climbing from 23.3% in 2017–18 to 41.7% in 2023–24, highlighting a notable shift in employment trends over the past few years. Organizations have their dress codes that promote the use of traditional clothing, which has a stable demand for easy-care fabric that would not require washing and would still have a nice look during working days. This demographic change exposes younger buyers to wearing sarees earlier in their buying process and sets the long-term wearing habits that may not be ceremonial. This tendency is explicitly encouraged by educational establishments and governmental offices, especially since they declare that they prefer traditional dress codes that comply with cultural norms and meet the demands of the modern workplace. The market expansion is the result, the volume expansion depends on the new consumer acquisition, and the value expansion is aimed at the working professionals who require better quality fabrics and the latest designs that combine the traditional features with the new functions of the workplace.

Preservation of Cultural Heritage Through Government Initiatives

Policy interventions supporting handloom sectors through subsidies, marketing assistance, and skill development programs are revitalizing traditional weaving communities while ensuring product authenticity that resonates with heritage-conscious consumers. Geographical indication registrations for regional weaves create protected market positions that enable premium pricing while safeguarding artisan livelihoods. Public procurement preferences for handloom products and exhibition platforms organized through textile ministries increase visibility for traditional sarees among urban consumers who value cultural preservation. These systematic efforts address supply-side challenges that historically limited handloom availability while simultaneously building consumer awareness around the importance of supporting traditional crafts. The intersection of cultural policy and commercial viability strengthens the handloom segment specifically while reinforcing broader market confidence in sarees as enduring wardrobe investments with authentic cultural significance.

Evolution of Occasion-Specific Fashion Categories

Growing affluence among urban and semi-urban households is driving segmentation of saree purchases across multiple occasion categories ranging from casual daily wear to elaborate ceremonial attire for weddings and festivals. This diversification encourages larger wardrobe collections as consumers seek appropriate options for different social contexts rather than relying on multipurpose garments. The emergence of designer categories specifically targeting younger demographics with fusion designs and contemporary draping styles expands market boundaries beyond traditional consumer segments. Fashion media coverage of celebrity appearances in heritage sarees during film promotions and cultural events reinforces aspirational appeal across age groups. Social occasions increasingly serve as platforms for showcasing personal style through carefully curated saree selections, motivating purchases that align with current trends while maintaining cultural authenticity that distinguishes these garments from Western fashion alternatives.

Market Restraints:

What Challenges the India Saree Market is Facing?

Competition from Alternative Ethnic Wear Formats

Contemporary ethnic wear categories including kurtis, anarkalis, and palazzo sets offer convenience advantages that appeal to younger consumers seeking traditional aesthetics without the complexity of saree draping. These alternatives require minimal styling effort while delivering comparable cultural appropriateness for most social occasions, creating substitution threats particularly among urban millennials with time-constrained lifestyles. Ready-to-wear formats eliminate the skill requirements associated with traditional saree draping, lowering barriers to entry for ethnic wear adoption among consumers unfamiliar with regional draping techniques.

Maintenance Requirements and Storage Limitations

Delicate fabrics, intricate embellishments, and traditional weaving techniques demand specialized care including dry cleaning for premium varieties and careful folding methods to prevent creasing and embroidery damage. Urban housing constraints limit dedicated storage space for saree collections, particularly in metropolitan areas where smaller living units restrict wardrobe capacity. The cumulative cost and effort associated with proper maintenance may discourage frequent purchases or lead to preference for lower-maintenance synthetic alternatives that sacrifice traditional appeal for practical convenience in daily usage scenarios.

Limited Product Standardization and Quality Assurance

The fragmented nature of saree production across numerous small-scale units and independent weavers creates inconsistencies in fabric quality, color fastness, and construction standards that complicate purchase decisions for consumers lacking textile expertise. Absence of comprehensive quality certification systems outside premium handloom segments increases purchase risk, particularly for online transactions where physical evaluation is impossible. Counterfeit products misrepresenting material composition or regional origin undermine consumer confidence while disadvantaging legitimate producers who maintain authentic production methods and fair pricing structures aligned with actual material and labor costs.

Competitive Landscape:

The India saree market operates through a multi-layered competitive structure encompassing government-supported handloom cooperatives, family-owned textile mills with regional specializations, and emerging designer brands targeting premium segments. Market fragmentation remains pronounced with numerous small-scale producers serving local markets through traditional retail channels, while larger organized players leverage brand recognition and multi-channel distribution to capture urban consumer segments. Competition increasingly centers on product differentiation through unique design elements, fabric innovation, and storytelling around artisan heritage rather than pure price competition. Vertical integration strategies connecting manufacturing with branded retail are enabling select players to control quality while capturing higher margins, though the majority of market participants continue operating within specialized segments of the value chain. Digital platforms are democratizing market access for smaller producers while simultaneously intensifying competition as geographic barriers to entry diminish across distribution channels.

Recent Developments:

-

February 2025: Designer Ridhi Mehra introduced the 'Ever After' saree capsule collection featuring corset belts and jackets that merge traditional elements with contemporary styling for modern consumers seeking versatile ethnic wear options.

-

January 2025: Taneira launched a campaign promoting Silk Mark-certified handwoven sarees featuring celebrity endorsements to enhance consumer trust in product authenticity while supporting artisan communities through verified sourcing partnerships.

India Saree Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type of Sarees Covered | Cotton Sarees, Silk Sarees, Synthetic Sarees, Linen Sarees, Chiffon Sarees, Georgette Sarees, Designer Sarees, Handloom Sarees, Others |

| Price Ranges Covered | Economy Sarees, Mid-Range Sarees, Premium/Luxury Sarees |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India saree market size was valued at USD 6.15 Billion in 2025.

The India saree market is expected to grow at a compound annual growth rate of 6.43% from 2026-2034 to reach USD 10.77 Billion by 2034.

Cotton sarees dominated the India saree market with a share of 23% in 2025, driven by their natural breathability, versatile styling options, and price accessibility across diverse consumer segments seeking comfortable daily wear options.

Key factors driving the India saree market include increasing workforce participation among women requiring professional ethnic wear, government initiatives supporting handloom artisans and heritage textile preservation, and evolving occasion-specific fashion categories that encourage diversified wardrobe collections.

Major challenges include competition from convenient alternative ethnic wear formats such as kurtis and palazzo sets, maintenance requirements and storage constraints associated with traditional sarees, and limited product standardization that complicates quality assessment for consumers making purchase decisions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)