India Scandium Market Size, Share, Trends and Forecast by Product Type, Application, End Use Industry, and Region, 2026-2034

India Scandium Market Size and Share:

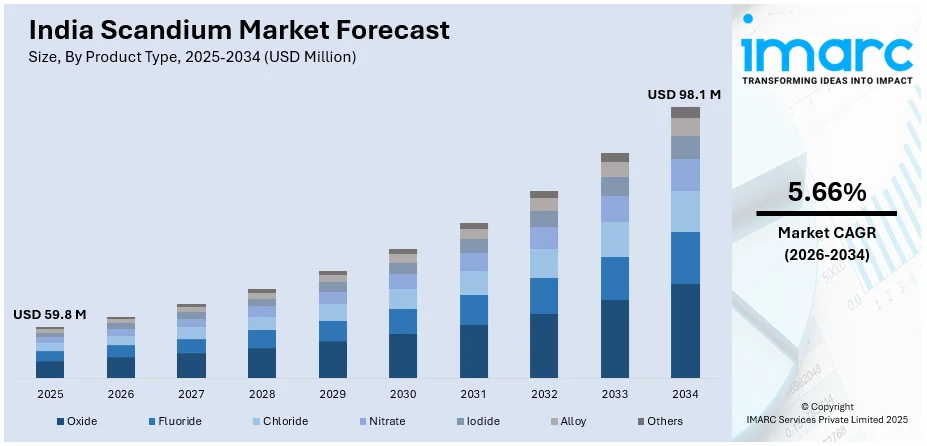

The India scandium market size reached USD 59.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 98.1 Million by 2034, exhibiting a growth rate (CAGR) of 5.66% during 2026-2034. The increasing demand from aerospace, defense, and electronics sectors, government initiatives promoting rare-earth element extraction, recent strategic discoveries enhancing resource availability, advancements in extraction technology, international collaborations, and rising focus on sustainable, clean energy technologies and advanced materials are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 59.8 Million |

| Market Forecast in 2034 | USD 98.1 Million |

| Market Growth Rate (2026-2034) | 5.66% |

India Scandium Market Trends:

Scandium Discovery to Boost Strategic Resource Potential

India's identification of substantial scandium and other rare earth deposits highlights the country's increasing focus on securing critical minerals essential for technological advancements. With scandium playing a pivotal role in electronics, clean energy solutions, aerospace manufacturing, and defense applications, the discovery is poised to enhance self-sufficiency, reduce dependency on imports, and stimulate growth across key industries. This development aligns with India's broader ambition of fostering indigenous technological capabilities, particularly in sectors demanding lightweight, high-performance materials. Moreover, as global demand for scandium rises, driven by environmental sustainability goals and expanding aerospace projects, India's domestic reserves could significantly strengthen its strategic positioning. Such mineral explorations underline India's efforts toward becoming a competitive hub for advanced materials and high-tech manufacturing. For example, in April 2023, scientists from the CSIR-National Geophysical Research Institute (NGRI) in Hyderabad identified significant deposits of 15 rare earth elements, including scandium, in Andhra Pradesh's Anantapur district. This discovery could bolster India's scandium market, supporting advancements in electronics, clean energy, aerospace, automotive, and defense sectors.

To get more information on this market Request Sample

India Eyes Scandium Growth Amid Technological Advancements

India is increasingly focusing on the extraction and utilization of scandium, a critical rare earth element essential for high-tech industries such as aerospace, electronics, defense, and renewable energy. Despite its considerable resource base, India's current scandium production remains limited. However, ongoing improvements in extraction technologies present a promising opportunity to significantly enhance production capacity. Such advancements could enable India to unlock larger reserves, substantially reducing dependence on imports and strengthening its strategic position in global markets. Additionally, increased scandium production aligns with India's ambitions to promote self-sufficiency in strategic minerals and advanced materials. Enhanced extraction capabilities would support sustainable growth and innovation across multiple technology-driven sectors, marking India’s strategic shift toward securing vital resources domestically. Based on a study titled ‘On the Supply Dynamics of Scandium, Global Resources, Production, Oxide and Metal Price, a Prospective Modelling Study Using WORLD7,’ India has significant scandium potential, with feasible extractable resources estimated at 6.1 million tonnes, of which 676,000 tonnes are currently viable. Despite an annual extraction potential of 1,500 tonnes, production stood at just 45 tonnes in 2022. Technological advancements could boost output to 450 tonnes annually, expanding total recoverable scandium resources to approximately 1.5 million tonnes, significantly strengthening India’s strategic position in global scandium markets.

India Scandium Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on product type, application, and end use industry.

Product Type Insights:

- Oxide

- Fluoride

- Chloride

- Nitrate

- Iodide

- Alloy

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes oxide, fluoride, chloride, nitrate, iodide, alloy, and others.

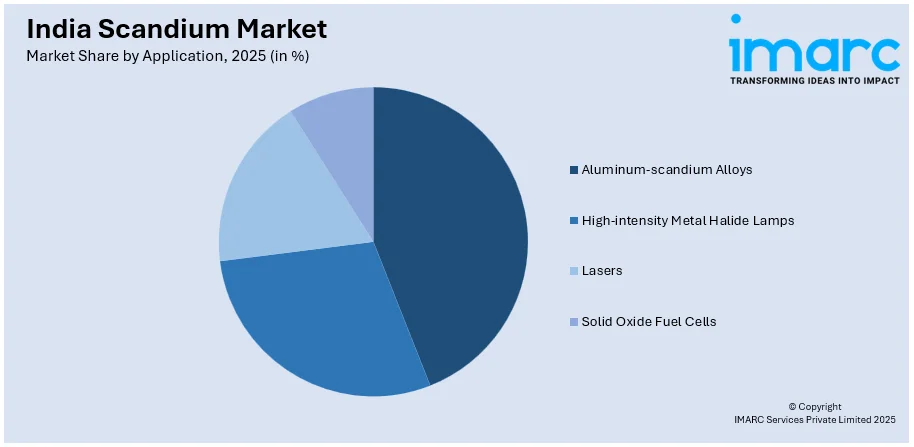

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Aluminum-scandium Alloys

- High-intensity Metal Halide Lamps

- Lasers

- Solid Oxide Fuel Cells

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes aluminum-scandium alloys, high-intensity metal halide lamps, lasers, and solid oxide fuel cells.

End Use Industry Insights:

- Aerospace and Defense

- Ceramics

- Lighting

- Electronics

- 3D Printing

- Sporting Goods

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes aerospace and defense, ceramics, lighting, electronics, 3D printing, sporting goods, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Scandium Market News:

- In December 2024, India and the US signed a memorandum of understanding to enhance cooperation on critical mineral supply chains, including strategic elements like scandium, lithium, and cobalt. The agreement focuses on joint exploration, extraction, processing, recycling, and recovery efforts to strengthen supply chain resilience. This collaboration aims to reduce reliance on dominant global suppliers, positioning India strategically in the global scandium market essential for clean energy and advanced technology sectors.

- In July 2024, Vedanta Aluminium, India's leading aluminum producer, in collaboration with NITI Aayog and premier research institutions, hosted a strategic session on red mud utilization. The initiative aims to extract valuable elements like scandium from red mud, a byproduct of bauxite refining, to bolster India's self-reliance in rare earth oxides. This effort underscores a commitment to sustainable practices and resource optimization in the aluminum industry.

India Scandium Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Oxide, Fluoride, Chloride, Nitrate, Iodide, Alloy, Others |

| Applications Covered | Aluminum-scandium Alloys, High-intensity Metal Halide Lamps, Lasers, Solid Oxide Fuel Cells |

| End Use Industries Covered | Aerospace and Defense, Ceramics, Lighting, Electronics, 3D Printing, Sporting Goods,Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India scandium market performed so far and how will it perform in the coming years?

- What is the breakup of the India scandium market on the basis of product type?

- What is the breakup of the India scandium market on the basis of application?

- What is the breakup of the India scandium market on the basis of end use industry?

- What are the various stages in the value chain of the India scandium market?

- What are the key driving factors and challenges in the India scandium market?

- What is the structure of the India scandium market and who are the key players?

- What is the degree of competition in the India scandium market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India scandium market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India scandium market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India scandium industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)