India School Furniture Market Size, Share, Trends and Forecast by Product, Material, and Region, 2025-2033

India School Furniture Market Overview:

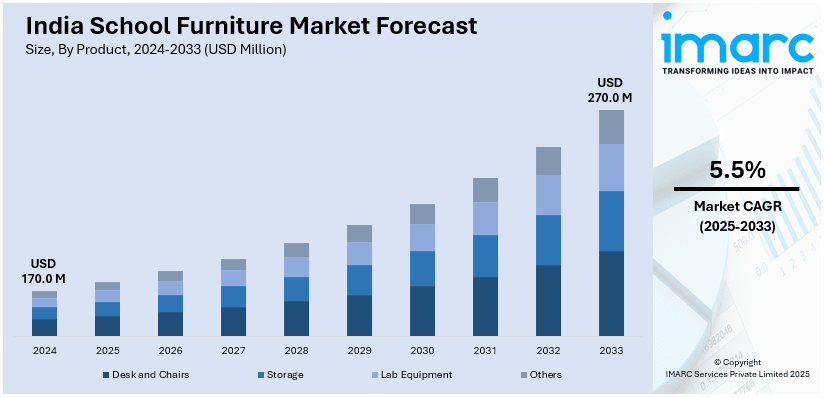

The India school furniture market size reached USD 170.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 270.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.5% during 2025-2033. The rise in education infrastructure investments, growing demand for flexible and ergonomic furniture, smart classroom adoption, government education development initiatives, rising student population, sustainability focus, and transition to modern learning environments are driving the India school furniture market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 170.0 Million |

| Market Forecast in 2033 | USD 270.0 Million |

| Market Growth Rate 2025-2033 | 5.5% |

India School Furniture Market Trends:

Increasing Demand for Ergonomic and Flexible Furniture

The India school furniture market growth is driven by the growing demand for ergonomic and flexible furniture to enhance student comfort and improve posture. Schools are shifting towards height-adjustable desks, modular seating, and posture-supporting chairs to create dynamic learning environments. With increasing awareness of the impact of furniture on student health and concentration, institutions are investing in high-quality materials that promote better learning outcomes. Notably, Godrej Interio, a division of Godrej & Boyce, is actively expanding its presence in India's educational furniture sector. In fiscal year 2023, the company partnered with state governments—including those of Telangana, Andhra Pradesh, Odisha, and Jammu & Kashmir—to supply nearly 200,000 school furniture units. This initiative aligns with the government's New Education Policy, aiming to enhance early childhood education and improve learning quality in government schools. Additionally, the rise of smart classrooms and hybrid learning has fueled the demand for multifunctional furniture that can be easily reconfigured. This trend is expected to continue as schools prioritize student well-being and adaptability in learning spaces.

To get more information on this market, Request Sample

Growing Adoption of Sustainable and Durable Materials

Sustainability is becoming a key focus in the Indian school furniture market, with institutions opting for eco-friendly and durable materials. For instance, it was announced on March 4, 2025, that the India Expo Mart & Centre in Greater Noida, Delhi NCR, would host INDIAWOOD 2025, the largest trade show for woodworking and furniture manufacture, from March 6–9, 2025. With the furniture business estimated to be worth USD 25.75 Billion in 2025 and expected to grow to USD 37.18 Billion by 2030, India is a global leader in this 25th anniversary edition. It will include specialist forums like "Surface in Motion" and the "India Mattresstech Expo," which will focus on innovations in mattress manufacturing and surface technology, respectively. Schools are increasingly investing in furniture made from responsibly sourced wood, recycled plastic, and metal to reduce environmental impact. Government initiatives promoting sustainability in educational infrastructure are also driving this shift. Moreover, manufacturers are focusing on long-lasting, low-maintenance designs to reduce costs and enhance durability. The trend toward green furniture solutions aligns with the broader movement of environmental consciousness, ensuring that schools provide safe, non-toxic, and sustainable learning environments for students, which, in turn, is positively impacting the India school furniture market outlook.

India School Furniture Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product and material.

Product Insights:

- Desk and Chairs

- Storage

- Lab Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes desk and chairs, storage, lab equipment, and others.

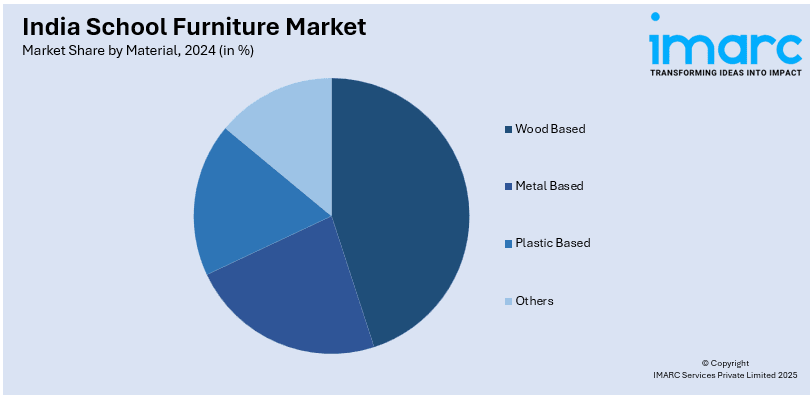

Material Insights:

- Wood Based

- Metal Based

- Plastic Based

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes wood based, metal based, plastic based, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India School Furniture Market News:

- On July 30, 2024, India's flagship furniture, interiors, and design show, INDEXPLUS 2024, was announced to take place at Yashobhoomi (India International Convention and Expo Centre) in Dwarka, New Delhi, from August 9 to August 11, 2024. By bringing together top suppliers and discriminating customers in a design-focused setting, the event seeks to present a wide range of styles and concepts. In order to promote creativity and cooperation within the sector, state-of-the-art furniture options and the newest interior design trends were showcased for the attendees.

India School Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Desk and Chairs, Storage, Lab Equipment, Others |

| Materials Covered | Wood Based, Metal Based, Plastic Based, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India school furniture market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India school furniture market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India school furniture industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The school furniture market in India was valued at USD 170.0 Million in 2024.

The India school furniture market is projected to exhibit a CAGR of 5.5% during 2025-2033, reaching a value of USD 270.0 Million by 2033.

Key factors driving the India school furniture market include rising student enrollments, government investments in educational infrastructure, and modernization of classrooms. Growing private school presence, demand for ergonomically designed and durable furniture, and increasing awareness about conducive learning environments further support market expansion across urban and rural schools.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)