India Screws and Bolts Market Size, Share, Trends and Forecast by Product Type, Material, Coating, Distribution Channel, End-Use Industry, and Region, 2026-2034

India Screws and Bolts Market Overview:

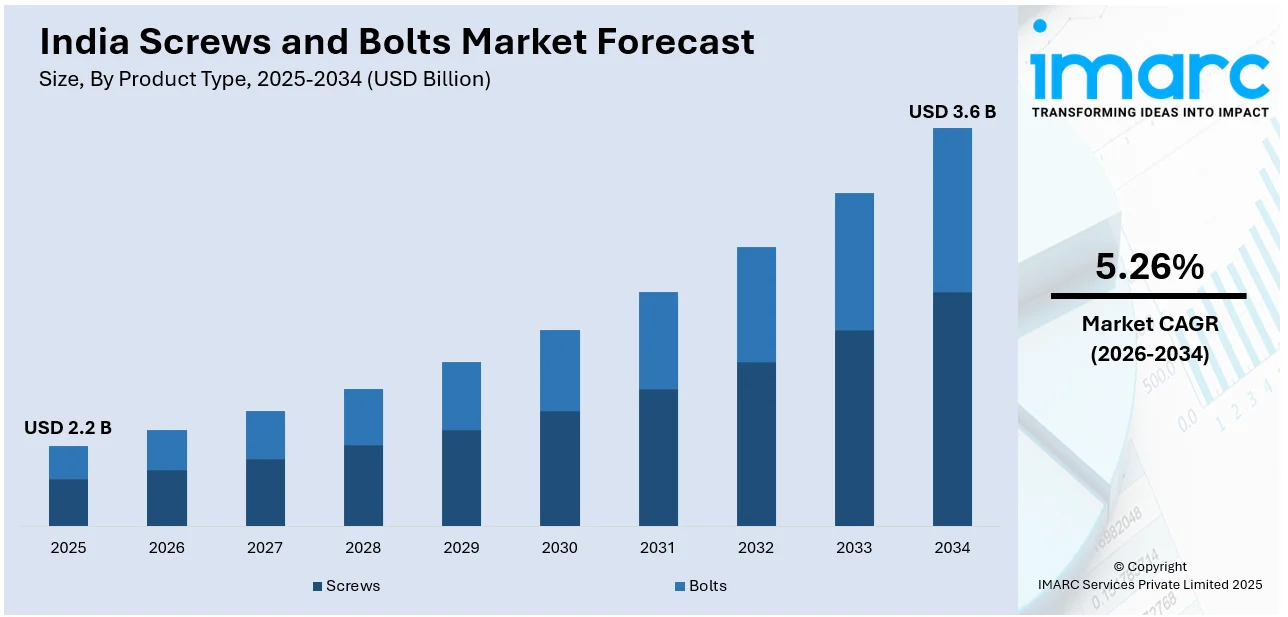

The India screws and bolts market size reached USD 2.2 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 3.6 Billion by 2034, exhibiting a growth rate (CAGR) of 5.26% during 2026-2034. The rising construction activities, increasing automotive production, expanding aerospace sector, growing manufacturing industry, technological advancements in fastening solutions, demand for lightweight and durable materials, infrastructure development projects, and the rapid growth of the electronics sector are some of the major factors augmenting the India screws and bolts market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.2 Billion |

| Market Forecast in 2034 | USD 3.6 Billion |

| Market Growth Rate 2026-2034 | 5.26% |

India Screws and Bolts Market Trends:

Increasing Demand from Infrastructure and Construction Sectors

The growing infrastructure and construction sectors in India are significantly driving the demand for screws and bolts. Rapid urbanization, government initiatives such as Smart Cities Mission and Housing for All and increasing investments in commercial and residential projects are increasing the need for high-quality fasteners. For instance, according to an industry report on December 18, 2024, India's Smart Cities Mission has invested INR 1.47 Lakh Crore (about USD 17,711.1 Million) to improve urban living and has finished 91% of its projects. To further improve public safety and security, more than 84,000 CCTV cameras have been placed throughout these cities. With extensive public infrastructure projects, including the installation of smart poles, surveillance systems, and urban mobility solutions, the need for reliable bolts and screw solutions is increasing. Bolts and screws are essential for securing critical components in these installations, thereby contributing to the market expansion. The market for screws and bolts is growing steadily due to the construction of new roads, railroads, metro projects, and industrial advancements. Additionally, the use of sophisticated fastening techniques has increased as a result of the focus on strong, earthquake-resistant constructions. The growing preference for stainless steel and corrosion-resistant bolts in coastal and humid regions is further driving India screws and bolts market growth. Increased use of standardized fasteners is partly a result of the growth of prefabricated buildings and modular construction methods. The market for screws and bolts is anticipated to increase steadily over the next several years as India's infrastructure continues to be developed at an accelerated rate.

To get more information on this market Request Sample

Technological Advancements and Rising Industrial Automation

The adoption of advanced manufacturing technologies and automation in industries is a key driver of the screws and bolts market in India. The rise of precision engineering, CNC machining, and 3D printing has improved the quality and efficiency of fastener production. Industries such as automotive, aerospace, and machinery manufacturing are increasingly using customized, high-performance bolts to enhance durability and safety, which is positively impacting India screws and bolts market outlook. Numerous applications are seeing an increase in the use of lightweight, very durable materials like titanium and alloy-based fasteners. For instance, according to an industry report on August 2023, Sundram Fasteners, a prominent manufacturer of high-precision components, contributed to India's Chandrayaan-3 mission by supplying specialized fasteners and components essential for the spacecraft's assembly and functionality. These components were designed to withstand the extreme conditions of space travel, ensuring the mission's success. This highlights the advanced engineering capabilities of Indian manufacturers and underscores the growing demand for high-quality fastening solutions in critical applications. The slow introduction of smart fasteners with sensors for real-time monitoring is further stimulating innovation. Small and medium businesses (SMEs) may now purchase high-quality fastening solutions due to the expansion of e-commerce platforms, which has also made specialty screws and bolts more accessible. The need for precisely manufactured screws and nuts is anticipated to increase dramatically as industries continue to embrace automation and digitization.

India Screws and Bolts Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, material, coating, distribution channel, and end-use industry.

Product Type Insights:

- Screws

- Wood Screws

- Machine Screws

- Self-Tapping Screws

- Others

- Bolts

- Hex Bolts

- Carriage Bolts

- Anchor Bolts

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes screws (wood screws, machine screws, self-tapping screws, and others) and bolts (hex bolts, carriage bolts, anchor bolts, and others).

Material Insights:

- Metal

- Plastic

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metal, plastic, and others.

Coating Insights:

- Zinc-Plated

- Hot-Dip Galvanized

- Black Oxide

- Others

The report has provided a detailed breakup and analysis of the market based on the coating. This includes Zinc-plated, hot-dip galvanized, black oxide, and others.

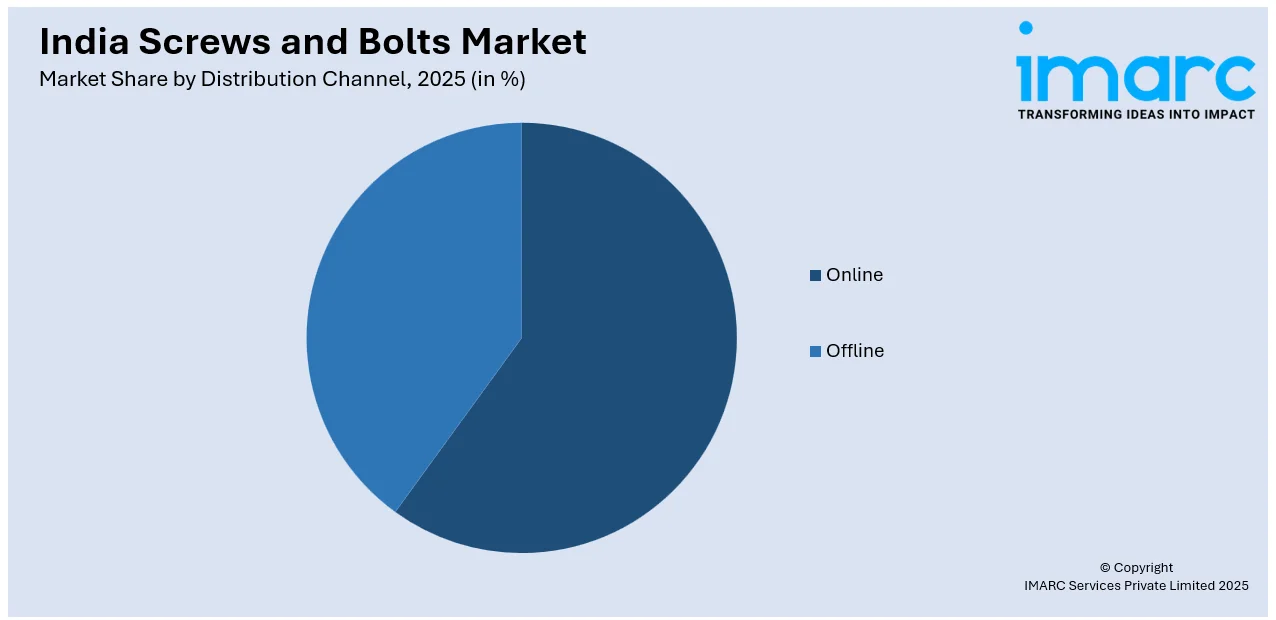

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

End-Use Industry Insights:

- Construction

- Automotive

- Aerospace

- Manufacturing

- Electronics

- Others

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes construction, automotive, aerospace, manufacturing, electronics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Screws and Bolts Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Materials Covered | Metal, Plastic, Others |

| Coatings Covered | Zinc-Plated, Hot-Dip Galvanized, Black Oxide, Others |

| Distribution Channels Covered | Online, Offline |

| End-Use Industries Covered | Construction, Automotive, Aerospace, Manufacturing, Electronics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India screws and bolts market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India screws and bolts market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India screws and bolts industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India screws and bolts market was valued at USD 2.2 Billion in 2025.

The India screws and bolts market is projected to exhibit a CAGR of 5.26% during 2026-2034, reaching a value of USD 3.6 Billion by 2034.

India's screws and bolts market is driven by growth in construction, infrastructure development, and expanding automotive and machinery manufacturing. Increased demand for durable and specialized fasteners, along with industrial modernization and government support for local manufacturing, also fuels the market. Technological advancements and export opportunities further contribute to its growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)