India Seafood Market Size, Share, Trends and Forecast by Type, Form, Distribution Channel, and Region, 2025-2033

Market Overview:

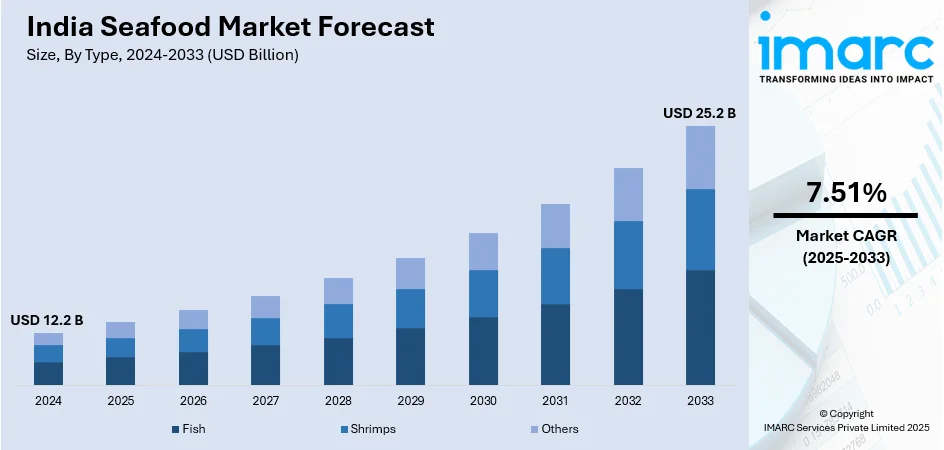

India seafood market size reached USD 12.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 25.2 Billion by 2033, exhibiting a growth rate (CAGR) of 7.51% during 2025-2033. The government's focus on sustainable fishing practices and aquaculture projects for ensuring environmental responsibility is primarily augmenting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.2 Billion |

| Market Forecast in 2033 | USD 25.2 Billion |

| Market Growth Rate (2025-2033) | 7.51% |

Seafood pertains to edible aquatic animals featured in a diverse array of culinary dishes. This category encompasses a wide variety of fishes, including anchovy, bass, pomfrets, bluefish, carp, cod, flounder, haddock, halibut, herring, mahi-mahi, salmon, sardines, trout, and tuna. Additionally, it includes various shellfish and crustaceans, such as crabs, crayfishes, lobsters, prawns, shrimps, abalone, clams, conch, mussels, octopuses, oysters, scallops, and calamari. Caviar, derived from the roe or unfertilized eggs of the sturgeon fish family, is also part of the seafood category. Renowned for its rich nutritional profile, seafood serves as an abundant source of essential nutrients such as iron, zinc, iodine, magnesium, and potassium. The consumption of seafood is linked to improved brain health and a decreased risk of neurodegenerative disorders.

To get more information on this market, Request Sample

India Seafood Market Trends:

The India seafood market is experiencing substantial growth, driven by a combination of cultural preferences, economic factors, and increasing awareness of the health benefits associated with seafood consumption. Additionally, the escalating demand for seafood in India is deeply rooted in its rich cultural and coastal heritage. Coastal regions, especially in states like Kerala, West Bengal, and Goa, have a long-standing tradition of incorporating a variety of seafood into their local cuisines. Fish, in particular, is a staple in many Indian households and is often considered a healthy and protein-rich dietary choice. Moreover, as economic prosperity grows in India, there is an observed shift in dietary preferences towards higher protein consumption, and seafood fits well into this trend. The market is witnessing an increased appetite for both domestic and imported seafood products, reflecting changing consumer lifestyles and preferences. Besides this, as awareness of these nutritional benefits spreads, consumers are choosing seafood as a part of their diet to promote heart health, bone growth, and overall well-being. Furthermore, government initiatives to promote aquaculture and fisheries also contribute to the expansion of the seafood market in India. As consumer preferences evolve and awareness continues to rise, the seafood market is poised to grow over the forecasted period.

India Seafood Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, form, and distribution channel.

Type Insights:

- Fish

- Shrimps

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fish, shrimps, and others.

Form Insights:

- Fresh/Chilled

- Frozen/Canned

- Processed

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes fresh/chilled, frozen/canned, and processed.

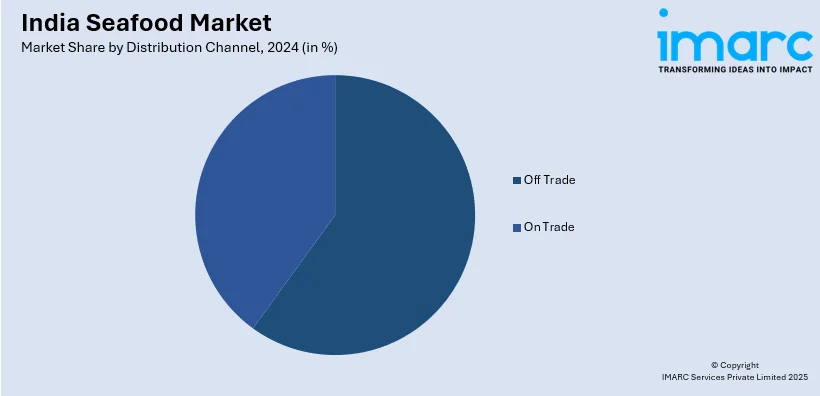

Distribution Channel Insights:

- Off Trade

- On Trade

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes off trade and on trade.

Regional Insights:

- North India

- West and Central India

- South India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West and Central India, South India, and East India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided. Some of the key players include:

- Apex Frozen Foods Ltd.

- Avanti Feeds Ltd.

- Coastal Corporation Limited

- Geo Seafood

- JMJ Seafoods Pvt Ltd

- Nekkanti Sea Foods

- Silver Sea Food

- Zeal Aqua

(Please note that this is only a partial list of the key players, and the complete list is provided in the report.)

India Seafood Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fish, Shrimps, Others |

| Forms Covered | Fresh/Chilled, Frozen/Canned, Processed |

| Distribution Channels Covered | Off Trade, On Trade |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Companies Covered | Apex Frozen Foods Ltd., Avanti Feeds Ltd., Coastal Corporation Limited, Geo Seafood, JMJ Seafoods Pvt Ltd, Nekkanti Sea Foods, Silver Sea Food, Zeal Aqua, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India seafood market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India seafood market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India seafood industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India seafood market was valued at USD 12.2 Billion in 2024.

The India seafood market is projected to exhibit a CAGR of 7.51% during 2025-2033, reaching a value of USD 25.2 Billion by 2033.

The India seafood market is propelled by rising health-conscious consumption, preferences for protein-rich diets, and expanding middle-class demand. Growth in aquaculture and domestic marine farming boosts supply, while improved cold-chain and logistics enhance accessibility. Export opportunities and the popularity of coastal cuisines are further fueling market expansion across urban and rural areas.

Some of the major players in the India seafood market include Apex Frozen Foods Ltd., Avanti Feeds Ltd., Coastal Corporation Limited, Geo Seafood, JMJ Seafoods Pvt Ltd, Nekkanti Sea Foods, Silver Sea Food, Zeal Aqua, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)