India Seed Treatment Market Size, Share, Trends and Forecast by Function, Crop Type, and Region, 2025-2033

India Seed Treatment Market Overview:

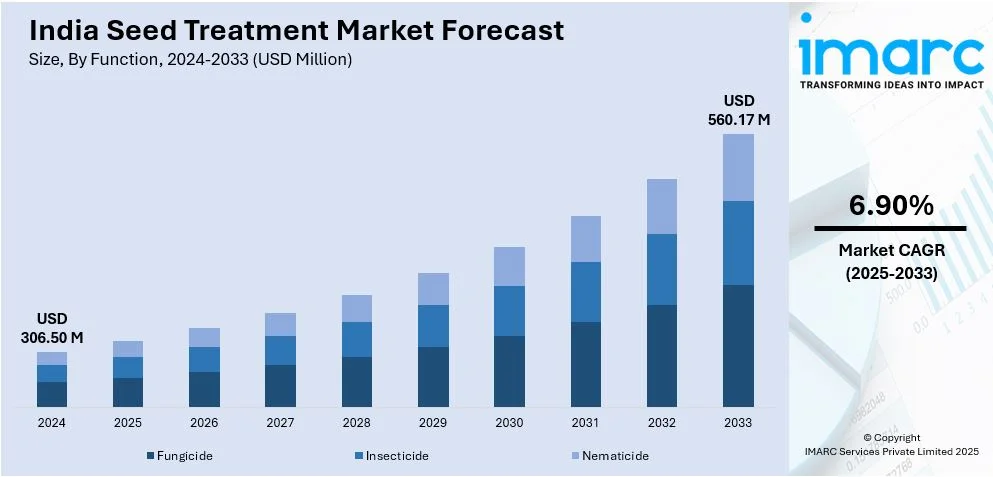

The India seed treatment market size reached USD 306.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 560.17 Million by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. The market is driven by rising use of bio-based solutions, emphasis on crop protection and yield improvement, and growth in precision agriculture practices, promoting sustainable agriculture and enhancing agricultural productivity in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 306.50 Million |

| Market Forecast in 2033 | USD 560.17 Million |

| Market Growth Rate 2025-2033 | 6.90% |

India Seed Treatment Market Trends:

Rising Adoption of Bio-Based Seed Treatments

The use of bio-based seed treatments is on the rise in India with the growing emphasis on sustainable agriculture. For instance, in November 2024, the Indian Institute of Oilseeds Research (IIOR) formalized a technology of seed treatment using a biopolymer and entered MoUs with Srikar Agritech, Hyderabad, and Yaduka Agritech, Kolkata, for commercialization. Moreover, bio-based treatments, made from beneficial microorganisms, plant extracts, and natural compounds, provide excellent pest and disease control while building the resistance of the crops. The treatments enhance germination, stimulate root growth, and improve nutrient uptake, leading to improved yields. With intensifying fears over soil health deterioration and chemical residues in crops, farmers are opting for safer alternatives. Government policies encouraging organic farming and sustainable agriculture further contribute to demand for bio-based seed treatments. Research and development (R&D) are also improving product effectiveness and shelf life, bringing bio-based solutions within easier reach of farmers. With the agriculture industry adopting environmentally friendly practices, demand for bio-based seed treatments will increase, thereby boosting the productivity of crops and ensuring soil fertility in the long term in India.

To get more information on this market, Request Sample

Increased Focus on Crop Protection and Yield Enhancement

Seed treatment is highly becoming a favored Indian agricultural practice to achieve efficient crop protection and realize the maximum yield potential. Treated seeds are being used by farmers to protect against soil-borne disease, pests, and fungal infections especially during the susceptible early stages of growth. Treated seeds are enriched with fungicides, insecticides, and nematicides, which grant specific protection without overuse of chemicals. Besides, improvements in seed coating technology enable uniform covering to provide consistent treatment for seeds. The incorporation of micronutrients and growth promoters into seed treatment is also facilitating quicker germination and stronger root establishment. Government policies facilitating the supply of treated seeds and farmer training schemes are also encouraging usage. With agricultural output being a major area of interest in order to address the accelerating food needs, the application of seed treatment solutions is likely to amplify, leading to healthier produce and increased yields in India's agricultural sector.

Expansion of Precision Agriculture Practices

The integration of precision agriculture technologies is driving the demand for customized seed treatment solutions in India. For example, in October, 2023, RiceTec launched its 2024 SQUAD® seed treatment lineup, providing SQUAD Pro, SQUAD Gulf, and SQUAD Delta to provide greater protection against insects and diseases in rice production. Furthermore, farmers are increasingly using data-driven insights to apply seed treatments tailored to specific crop needs and local soil conditions. Precision application ensures efficient use of seed treatment products, minimizing wastage and reducing environmental impact. Additionally, advancements in seed coating and film-forming technologies are enhancing the uniformity and durability of treatments. Digital platforms offering real-time monitoring of crop health and predictive analytics are further encouraging the use of treated seeds. As awareness of precision farming grows and access to agri-tech solutions expands, the adoption of customized seed treatment solutions is set to boost, contributing to improved crop performance and sustainable farming practices.

India Seed Treatment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on function and crop type.

Function Insights:

- Fungicide

- Insecticide

- Nematicide

The report has provided a detailed breakup and analysis of the market based on the function. This includes fungicide, insecticide, and nematicide.

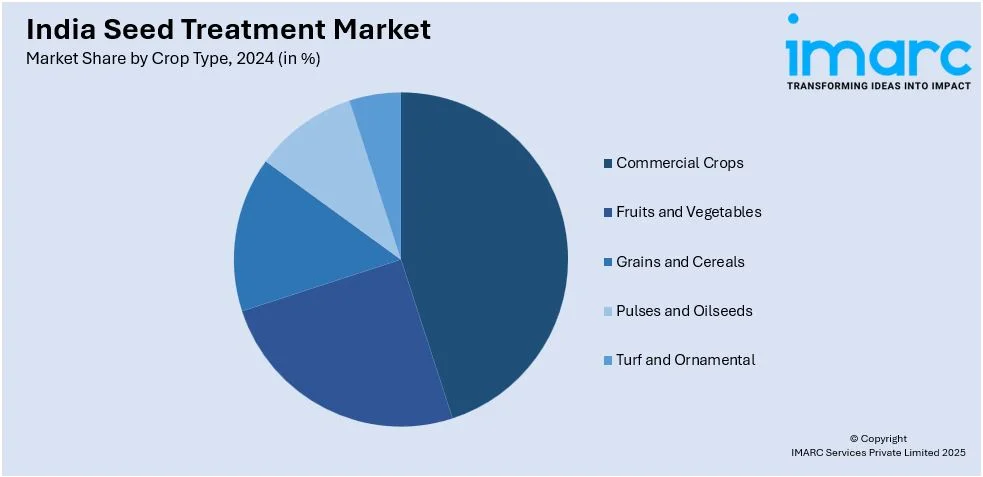

Crop Type Insights:

- Commercial Crops

- Fruits and Vegetables

- Grains and Cereals

- Pulses and Oilseeds

- Turf and Ornamental

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes commercial crops, fruits and vegetables, grains and cereals, pulses and oilseeds, and turf and ornamental.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Seed Treatment Market News:

- In March 2024, BharatRohan introduced an enhanced SeedAssure®, incorporating drone technology and data analytics for hybrid seed trials. The platform provides real-time crop monitoring, predictive analytics, and customizable insights, allowing seed companies to assess seed performance correctly and speed up high-quality seed development across various climatic conditions.

India Seed Treatment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Functions Covered | Fungicide, Insecticide, Nematicide |

| Crop Types Covered | Commercial Crops, Fruits and Vegetables, Grains and Cereals, Pulses and Oilseeds, Turf and Ornamental |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India seed treatment market performed so far and how will it perform in the coming years?

- What is the breakup of the India seed treatment market on the basis of function?

- What is the breakup of the India seed treatment market on the basis of crop type?

- What is the breakup of the India seed treatment market on the basis of region?

- What are the various stages in the value chain of the India seed treatment market?

- What are the key driving factors and challenges in the India seed treatment?

- What is the structure of the India seed treatment market and who are the key players?

- What is the degree of competition in the India seed treatment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India seed treatment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India seed treatment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India seed treatment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)