India Semiconductor Foundry Market Size, Share, Trends and Forecast by Technology Node, Foundry Type, Application, and Region, 2025-2033

India Semiconductor Foundry Market Overview:

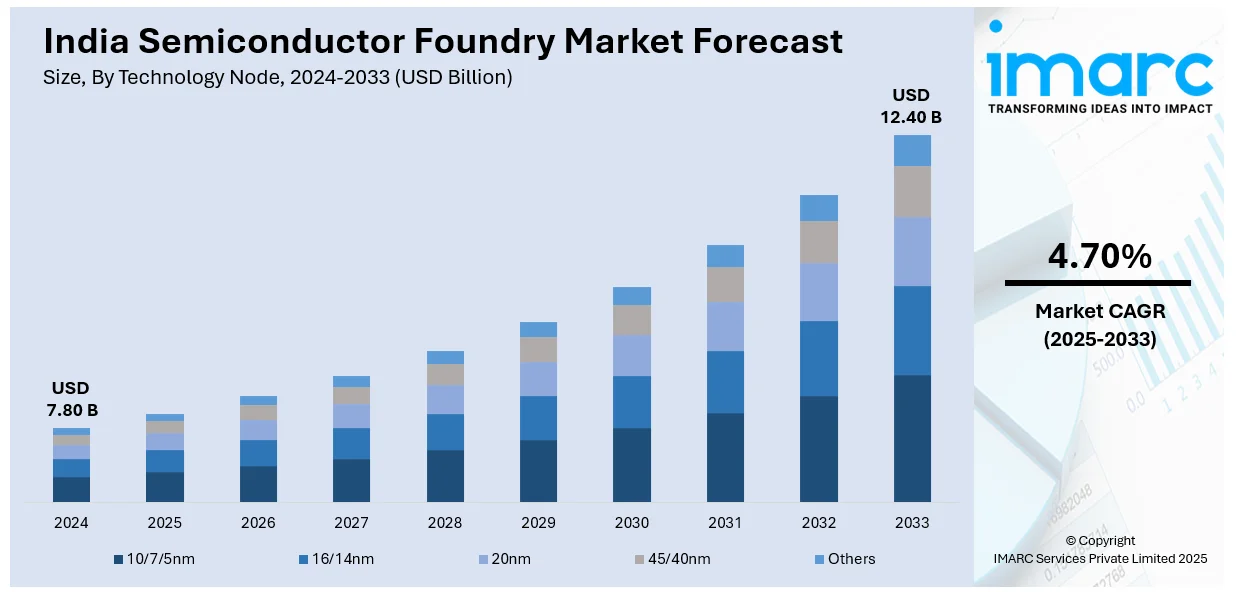

The India semiconductor foundry market size reached USD 7.80 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 12.40 Billion by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. Supportive government initiatives like Make in India and the PLI scheme, rising demand for consumer electronics, increasing investments in domestic chip manufacturing, and the push for self-reliance in semiconductor production are fueling the market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7.80 Billion |

| Market Forecast in 2033 | USD 12.40 Billion |

| Market Growth Rate 2025-2033 | 4.70% |

India Semiconductor Foundry Market Trends:

Surge in Foreign Direct Investments (FDI)

India's semiconductor sector is attracting significant foreign direct investment (FDI), reinforcing its potential as a global manufacturing hub. In September 2024, Israel’s Tower Semiconductor partnered with India’s Adani Group to announce a $10 billion semiconductor project in Maharashtra. Similarly, Dutch firm NXP Semiconductors pledged over $1 billion to strengthen R&D efforts in India, highlighting confidence in its growing semiconductor ecosystem. The sector’s expansion is further fueled by semiconductor equipment manufacturers, such as U.S.-based Lam Research, which committed over $1 billion in February 2025 to develop Karnataka’s semiconductor infrastructure. These investments align with India's ambitions, supported by a $10 billion government incentive package, including the Production Linked Incentive (PLI) and Design Linked Incentive (DLI) schemes. As global semiconductor companies recognize India's potential, the Indian Electronics and Semiconductor Association (IESA) projects the market to grow from $52 billion in 2024-25 to $103.4 billion by 2030, at a 13% CAGR. Increased FDI is expected to enhance domestic manufacturing, reduce import dependency, and strengthen India’s role in the global semiconductor supply chain. The establishment of fabrication plants and R&D centers will drive job creation and technological advancements, cementing India’s position as a key player in the industry.

To get more information on this market, Request Sample

Rising Demand for Consumer Electronics

The consumer electronics market in India is experiencing unprecedented growth, which in turn is driving the semiconductor foundry market. India's smartphone market is rapidly expanding, with companies like Apple and Samsung eyeing the country as a significant growth market. Despite global challenges in the smartphone industry, India's relatively low smartphone penetration rate of around 50% presents a vast opportunity for growth. Moreover, companies are increasingly considering India as a manufacturing hub to cater to the growing demand and mitigate geopolitical risks associated with manufacturing in China. This shift is expected to boost local semiconductor manufacturing, as components like CPUs are integral to consumer electronics. In line with this, the Indian government's initiatives, such as the 'Make in India' campaign and the PLI scheme, are encouraging domestic production of consumer electronics. These policies aim to achieve a 40% local value addition in electronics manufacturing by 2030, further driving the demand for locally produced semiconductors. Furthermore, the escalating demand for consumer electronics necessitates a robust semiconductor manufacturing ecosystem. This demand-supply dynamic is prompting investments in semiconductor fabrication plants and research facilities, thereby strengthening India's position in the global semiconductor market.

India Semiconductor Foundry Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on technology node, foundry type, application.

Technology Node Insights:

- 10/7/5nm

- 16/14nm

- 20nm

- 45/40nm

- Others

The report has provided a detailed breakup and analysis of the market based on the technology node. This includes 10/7/5nm, 16/14nm, 20nm, 45/40nm, and others.

Foundry Type Insights:

- Pure Play Foundry

- IDMs

A detailed breakup and analysis of the market based on the foundry type have also been provided in the report. This includes pure play foundry and IDMs.

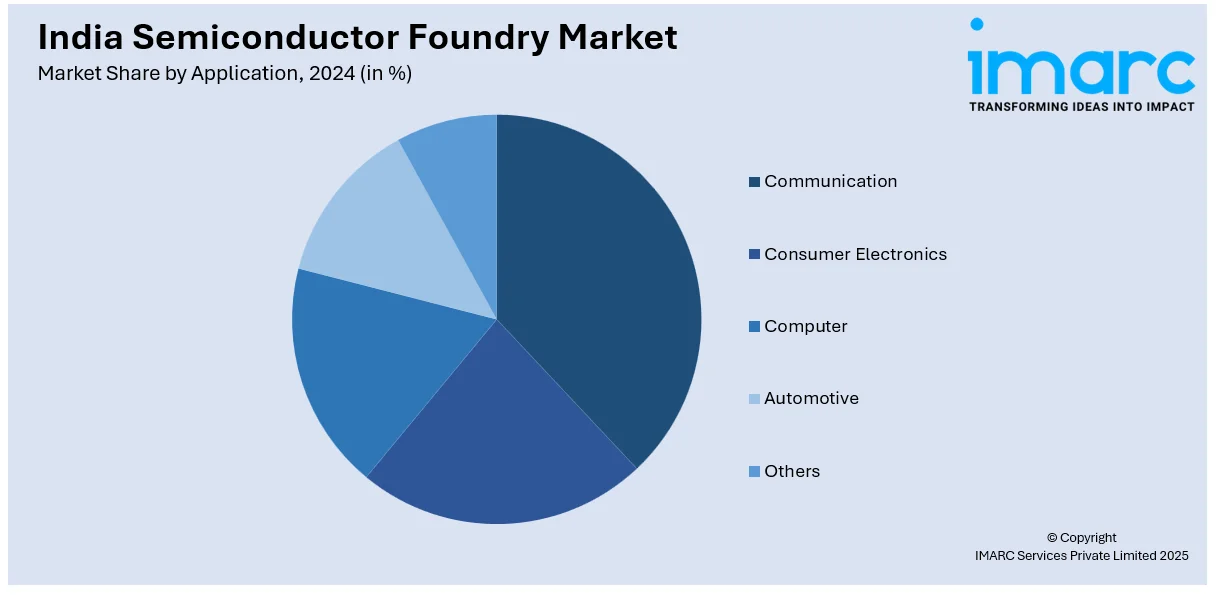

Application Insights:

- Communication

- Consumer Electronics

- Computer

- Automotive

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes communication, consumer electronics, computer, automotive, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Semiconductor Foundry Market News:

- September 2024: India, in partnership with the United States, launched its first semiconductor fabrication plant for national security. This facility is designed to produce chips for defense applications and critical telecommunications. The announcement came after discussions between Prime Minister Narendra Modi and U.S. President Joe Biden on September 21, 2024.

- September 2024: Tata Electronics is advancing its semiconductor manufacturing capabilities by developing two new fabrication facilities in Dholera, Gujarat. The first plant, under construction since March, is expected to begin operations in 2026, with a planned production capacity of up to 50,000 wafers per month to support industries such as automotive, artificial intelligence, and wireless communication.

India Semiconductor Foundry Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Nodes Covered | 10/7/5nm, 16/14nm, 20nm, 45/40nm, Others |

| Foundry Types Covered | Pure Play Foundry, IDMs |

| Applications Covered | Communication, Consumer Electronics, Computer, Automotive, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India semiconductor foundry market performed so far and how will it perform in the coming years?

- What is the breakup of the India semiconductor foundry market on the basis of technology node?

- What is the breakup of the India semiconductor foundry market on the basis of foundry type?

- What is the breakup of the India semiconductor foundry market on the basis of application?

- What are the various stages in the value chain of the India semiconductor foundry market?

- What are the key driving factors and challenges in the India semiconductor foundry market?

- What is the structure of the India semiconductor foundry market and who are the key players?

- What is the degree of competition in the India semiconductor foundry market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India semiconductor foundry market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India semiconductor foundry market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India semiconductor foundry industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)