India Semiconductor Rectifier Market Size, Share, Trends and Forecast by Product Type, Type, Industry Vertical, and Region, 2025-2033

India Semiconductor Rectifier Market Size and Share:

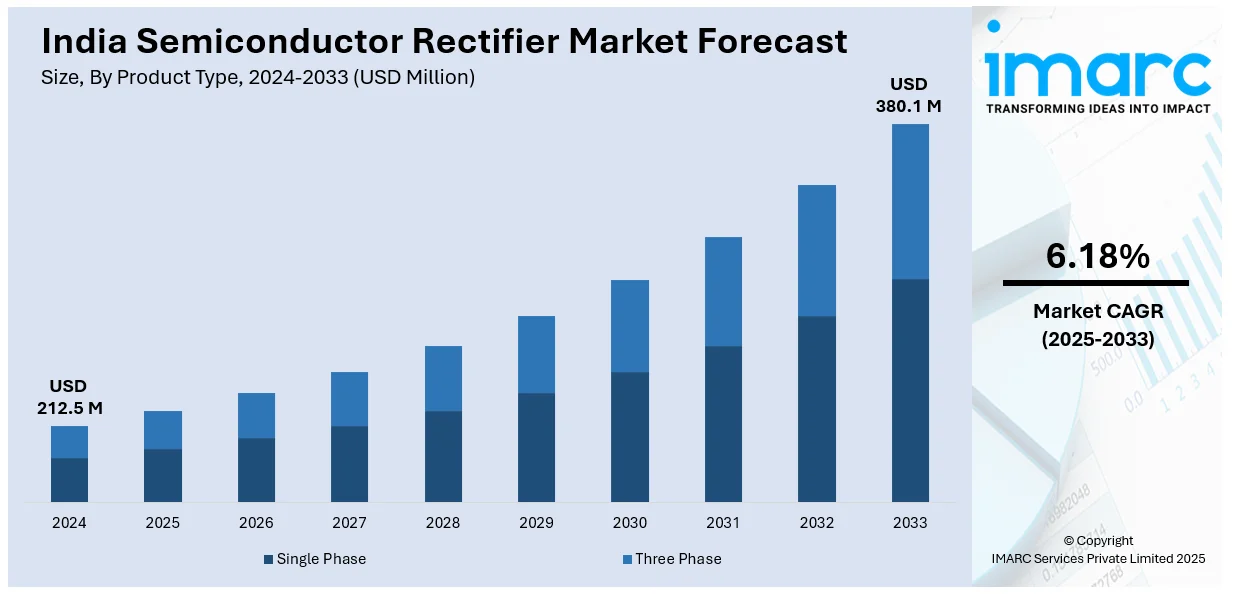

The India semiconductor rectifier market size reached USD 212.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 380.1 Million by 2033, exhibiting a growth rate (CAGR) of 6.18% during 2025-2033. The market is driven by increasing demand from renewable energy systems, growing adoption of electric vehicles (EVs), and rapid expansion in consumer electronics manufacturing. Government initiatives supporting clean energy, EV infrastructure, and local electronics production further boost market growth, alongside rising need for efficient power conversion and voltage regulation technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 212.5 Million |

| Market Forecast in 2033 | USD 380.1 Million |

| Market Growth Rate (2025-2033) | 6.18% |

India Semiconductor Rectifier Market Trends:

Rising Demand from Renewable Energy Sector

India’s rapid expansion of renewable energy is fueling demand in the semiconductor rectifier market. By December 2024, India’s installed renewable energy capacity reached 209.44 GW, up 15.84% from 180.80 GW the previous year. This surge, driven by solar and wind projects, has increased the need for efficient power conversion components like rectifiers to manage fluctuating energy inputs and support grid stability. Devices such as solar inverters, wind turbines, and charge controllers rely on rectifiers for AC-DC conversion. Government initiatives like the National Solar Mission and rising investments in decentralized energy systems are accelerating deployment. Apart from this, off-grid and hybrid power configurations for rural regions are increasing demand for small, sturdy, and efficiency-oriented rectifiers that can accommodate varied environmental exposure, highlighting the pivotal position held by rectifiers in India's clean energy era.

To get more information on this market, Request Sample

Growth in Automotive Electrification

India's automotive industry is transitioning to electrification, which is fueling greater application of semiconductor rectifiers. Hybrid electric vehicles (HEVs), electric vehicles (EVs), and charging infrastructure for batteries all demand sophisticated rectification technology to enable efficient energy transfer and battery management. Rectifiers are indispensable in EV onboard chargers, power control units, and regenerative braking circuits. The government incentive of FAME for EV adoption and infrastructure investments have hastened this trend. With increasing automotive companies investing in electric mobility, the need for small, heat-resistant, and energy-efficient rectifiers is growing. The movement towards smart mobility solutions is also driving innovations in rectifier design for high-frequency, low-loss, and high-speed switching applications.

Expansion of Consumer Electronics Manufacturing

India’s position as a global electronics manufacturing hub is accelerating growth in the semiconductor rectifier market. Backed by the Production Linked Incentive (PLI) scheme, domestic electronics production surged from $37 billion in 2016 to $105 billion in 2023—a 180% increase. This rise spans smartphones, televisions, computing devices, and home appliances, all of which rely on semiconductor rectifiers for voltage control, battery charging, and power regulation. The expansion of smart homes and Intent of Things (IoT) ecosystems has further boosted demand for compact, low-power rectification components capable of handling variable voltage loads. In response, manufacturers are focusing on developing high-efficiency rectifiers suited for high-density circuit boards. This aligns with ongoing miniaturization in consumer electronics and portable devices, reinforcing the market’s momentum amid India's broader manufacturing and digital infrastructure push.

India Semiconductor Rectifier Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, type and industry vertical.

Product Type Insights:

- Single Phase

- Three Phase

The report has provided a detailed breakup and analysis of the market based on the product type. This includes single phase, and three phase.

Type Insights:

- Low Current Rectifier

- Medium Current Rectifier

- High Current Rectifier

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes low current rectifier, medium current rectifier, and high current rectifier.

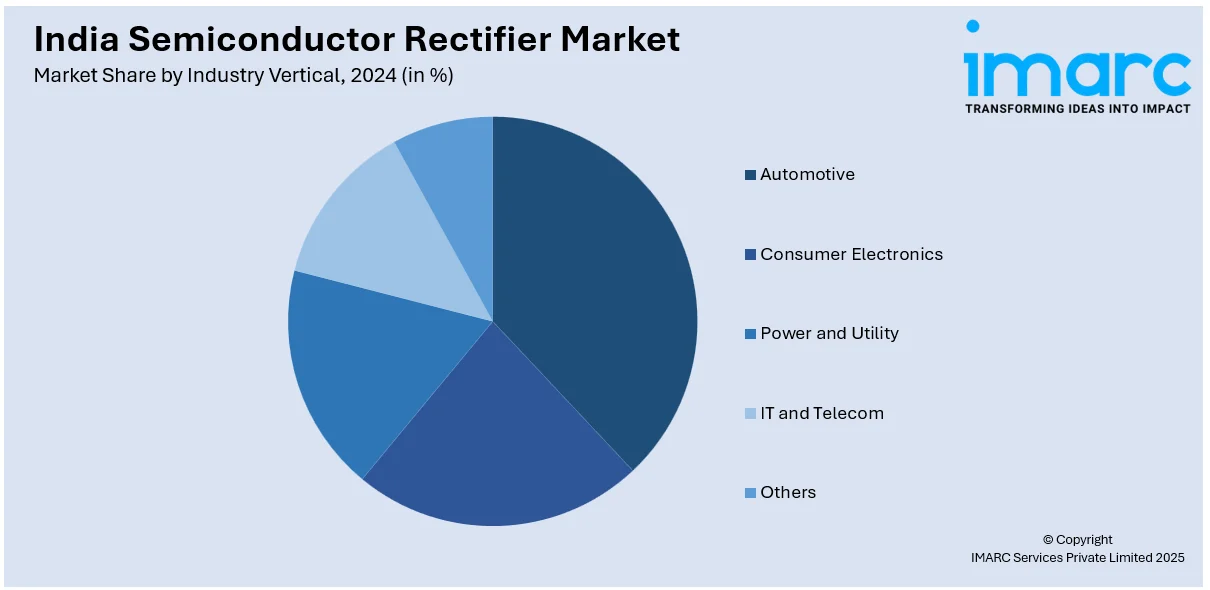

Industry Vertical Insights:

- Automotive

- Consumer Electronics

- Power and Utility

- IT and Telecom

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes automotive, consumer electronics, power and utility, IT and telecom, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Semiconductor Rectifier Market News:

- In March 2025, India achieved a major milestone with the announcement of its first Made-in-India semiconductor chip, set for mass production by 2025. Revealed at the Madhya Pradesh Global Investor Summit, the development highlights India’s progress in semiconductor technology under the Indian Semiconductor Mission (ISM), launched in 2021. Aligned with the "Atmanirbhar Bharat" initiative, this move aims to reduce import dependency and strengthen India’s domestic semiconductor manufacturing ecosystem.

- In February 2025, CDIL Semiconductors launched India’s first indigenous high-efficiency Solar Bypass Diodes, enhancing solar panel performance and longevity. Manufactured in Mohali, these diodes reduce energy losses from shading and dust, aligning with the PM Surya Ghar Muft Bijli Yojana. With a 25 million unit capacity expansion, CDIL strengthens India’s renewable energy goals and semiconductor self-reliance, offering a cost-effective, locally made alternative to imports for solar infrastructure and clean energy development.

India Semiconductor Rectifier Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Single Phase, Three Phase |

| Types Covered | Low Current Rectifier, Medium Current Rectifier, High Current Rectifier |

| Industry Verticals Covered | Automotive, Consumer Electronics, Power and Utility, IT and Telecom, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India semiconductor rectifier market performed so far and how will it perform in the coming years?

- What is the breakup of the India semiconductor rectifier market on the basis of product type?

- What is the breakup of the India semiconductor rectifier market on the basis of type?

- What is the breakup of the India semiconductor rectifier market on the basis of industry vertical?

- What is the breakup of the India semiconductor rectifier market on the basis of region?

- What are the various stages in the value chain of the India semiconductor rectifier market?

- What are the key driving factors and challenges in the India semiconductor rectifier market?

- What is the structure of the India semiconductor rectifier market and who are the key players?

- What is the degree of competition in the India semiconductor rectifier market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India semiconductor rectifier market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India semiconductor rectifier market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India semiconductor rectifier industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)