India Sensors Market Size, Share, Trends and Forecast by Type, Technology, End User Industry, and Region, 2026-2034

India Sensors Market Overview:

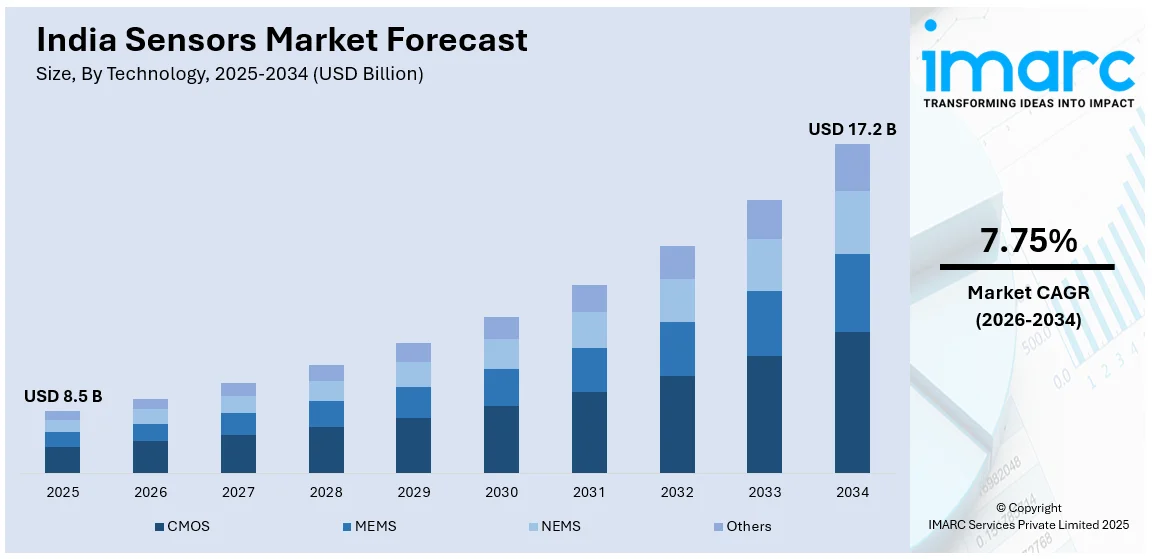

The India sensors market size reached USD 8.5 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 17.2 Billion by 2034, exhibiting a growth rate (CAGR) of 7.75% during 2026-2034. The market is growing owing to the surge in demand for MEMS and NEMS-enabled IoT devices, industrial automation, and consumer electronics driven by the growth of MEMS and NEMS technologies, government policies, and increased adoption in automotive, healthcare, and intelligent infrastructure applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 8.5 Billion |

| Market Forecast in 2034 | USD 17.2 Billion |

| Market Growth Rate 2026-2034 | 7.75% |

India Sensors Market Trends:

Rising Demand for Smart and IoT-Enabled Sensors

India's sensor industry is witnessing huge growth as the use of smart technologies and Internet of Things (IoT) enabled devices gains traction across industries. According to the sources, in August 2024, Institute of Advanced Study in Science and Technology (IASST) created a smartphone-based fluorescence sensor to detect L-dopa levels in Parkinson's patients, allowing for accurate dosage adjustments. The low-cost, portable system improves disease management, particularly in remote locations. Moreover, with increasing digital infrastructure and government programs, such as Smart Cities Mission, demand for sensors in smart home, automated industrial equipment, and connected healthcare applications is on the rise. Advanced sensors like motion, pressure, and temperature sensors are being used in IoT ecosystems to promote automation and efficiency. The spread of 5G technology is also promoting sensor uptake in real-time monitoring uses, such as predictive maintenance and asset tracking. The automotive industry is also embedding IoT-based sensors to facilitate technologies like advanced driver assistance systems (ADAS) and vehicle-to-everything (V2X) communication. The greater emphasis on data-driven decision-making is also promoting sensor installation in industries like manufacturing and agriculture. This trend will continue, fueled by growing digital connectivity and technology advances in low-power, miniaturized sensors.

To get more information on this market Request Sample

Growing Adoption of MEMS and NEMS Sensors in Consumer Electronics

Increasing consumer electronics demand for small and powerful devices is driving the use of Micro-Electro-Mechanical Systems (MEMS) and Nano-Electro-Mechanical Systems (NEMS) sensors in India. MEMS-based accelerometers, gyroscopes, and pressure sensors are becoming more reliant on smartphones, wearables, and smart home appliances to expand their functionality. With boosting health monitoring focus, wearable fitness gadgets and smartwatches are combining biosensors and motion sensors to track heart rate, oxygen levels, and exercise. MEMS and NEMS technologies have the benefits of low power consumption, miniaturization, and enhanced sensitivity, and are hence suited to next-generation consumer products. Besides, cost reductions are being promoted by advances in semiconductor manufacturing, bringing these sensors within reach of makers. As the Indian market moves towards high-tech devices, growing penetration of MEMS and NEMS sensors across gaming, augmented reality (AR), and virtual reality (VR) applications will propel the market further ahead.

Expansion of Industrial Automation and Smart Manufacturing

The drive towards Industry 4.0 is speeding up the uptake of sensors for industrial automation and intelligent manufacturing in India. For instance, in January 2024, Jeep India teamed up with Bosch to test the ADAS sensors in the for higher safety and automation. The testing vehicle was caught in Bengaluru, indicating leaps in India's sensor technology for cars. Moreover, pressure, temperature, proximity, and optical sensors are used extensively for real-time monitoring, predictive maintenance, and process optimization. The manufacturing industry is adopting automation to boost efficiency, lower operating costs, and increase quality control. Government initiatives like Make in India and Production-Linked Incentive (PLI) plans are also encouraging investment in automated manufacturing plants, leading to industrial sensors demand. The combination of AI and machine learning with smart factories also improves the capability of sensors, enabling industries to adopt data-driven decision-making for higher productivity. Higher emphasis on workplace safety also leads to the adoption of environmental and gas sensors in harmful environments. As the industrial sector has grown rapidly and is highly adopting interconnected systems, automation through sensors will be key to India's manufacturing revolution.

India Sensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, technology and end user industry.

Type Insights:

- Radar Sensor

- Optical Sensor

- Biosensor

- Touch Sensor

- Image Sensor

- Pressure Sensor

- Temperature Sensor

- Proximity and Displacement Sensor

- Level Sensor

- Motion and Position Sensor

- Humidity Sensor

- Accelerometer and Speed Sensor

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes radar sensor, optical sensor, biosensor, touch sensor, image sensor, pressure sensor, temperature sensor, proximity and displacement sensor, level sensor, motion and position sensor, humidity sensor, accelerometer and speed sensor, and others.

Technology Insights:

- CMOS

- MEMS

- NEMS

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes CMOS, MEMS, NEMS, and others.

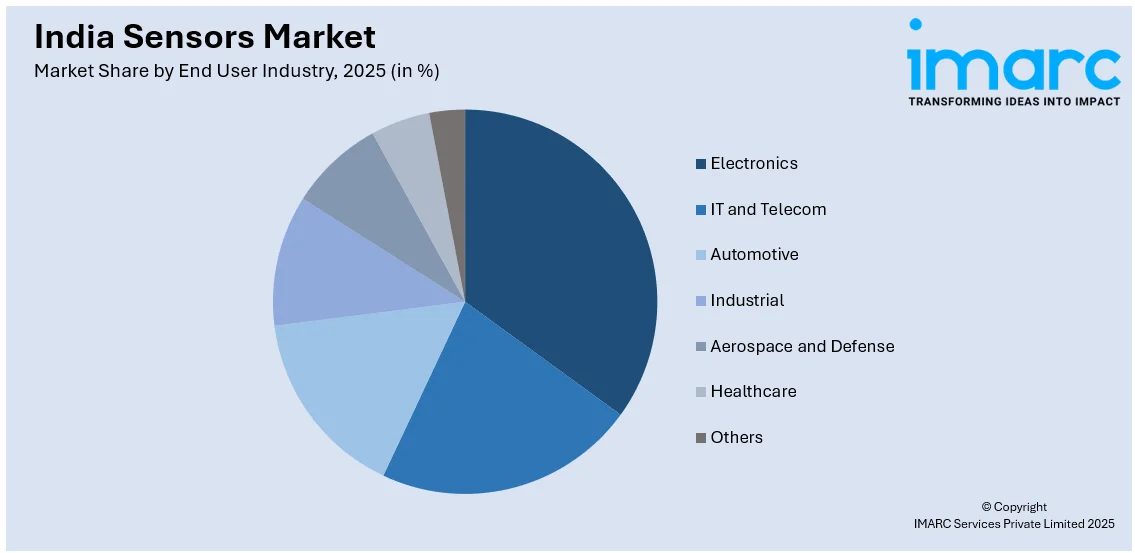

End User Industry Insights:

Access the comprehensive market breakdown Request Sample

- Electronics

- IT and Telecom

- Automotive

- Industrial

- Aerospace and Defense

- Healthcare

- Others

The report has provided a detailed breakup and analysis of the market based on the end user industry. This includes electronics, IT and telecom, automotive, industrial, aerospace and defense, healthcare, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sensors Market News:

- In November 2024, ISRO made a move towards creating made-in-India car sensors, minimizing dependence on imports. The project will help catalyze large-scale, low-cost production, boosting domestic manufacturing and making India's sensor supply chain robust enough for upcoming car technologies.

- In January 2023, GalaxEye, a Chennai-based startup, announced the launching of Mission Drishti, the first multi-sensor satellite globally. It is the first satellite to integrate Synthetic Aperture Radar (SAR) and optical sensors, allowing round-the-clock Earth observation, going beyond night-time and cloud cover constraints, useful for agriculture, disaster management, defense, and insurance industries.

India Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Radar Sensor, Optical Sensor, Biosensor, Touch Sensor, Image Sensor, Pressure Sensor, Temperature Sensor, Proximity and Displacement Sensor, Level Sensor, Motion and Position Sensor, Humidity Sensor, Accelerometer and Speed Sensor, Others |

| Technologies Covered | CMOS, MEMS, NEMS, Others |

| End User Industries Covered | Electronics, IT and Telecom, Automotive, Industrial, Aerospace and Defense, Healthcare, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sensors market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sensors market in India was valued at USD 8.5 Billion in 2025.

The India sensors market is projected to exhibit a CAGR of 7.75% during 2026-2034, reaching a value of USD 17.2 Billion by 2034.

The growth of India’s sensors market is driven by increasing use of smart technologies, industrial automation, and connected devices. Expanding applications in vehicles, medical tools, and manufacturing, along with supportive government projects and rising tech investments, are significantly boosting sensor demand nationwide.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)