India Service Virtualization Market Size, Share, Trends and Forecast by Component, Deployment, Vertical, and Region, 2025-2033

India Service Virtualization Market Overview:

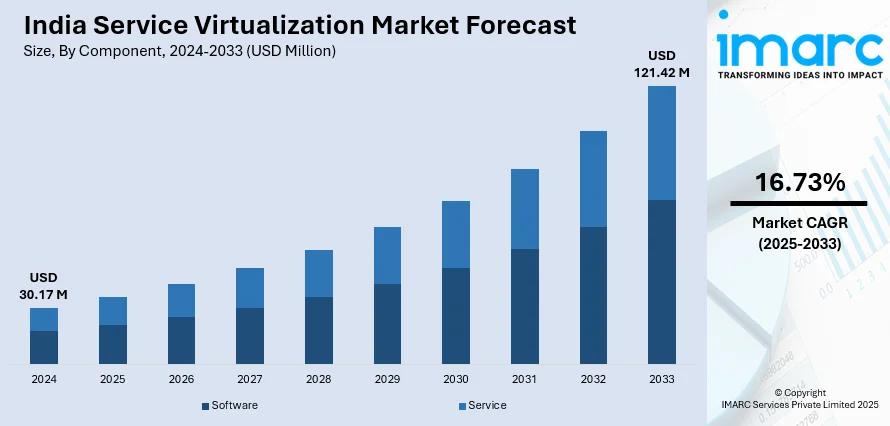

The India service virtualization market size reached USD 30.17 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 121.42 Million by 2033, exhibiting a growth rate (CAGR) of 16.73% during 2025-2033. Key factors driving market include rapid adoption of agile software development, increasing CI/CD implementation, demand for cost-effective testing, digital transformation initiatives, cloud computing expansion, IT infrastructure modernization, automation in software testing, AI-driven development, enhanced DevOps practices, regulatory compliance needs, and growing enterprise reliance on virtualized environments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 30.17 Million |

| Market Forecast in 2033 | USD 121.42 Million |

| Market Growth Rate 2025-2033 | 16.73% |

India Service Virtualization Market Trends:

Adoption of Agile and DevOps Methodologies

Since Indian businesses aim at improving their software development practices, Agile and DevOps have risen as favored strategies. Agile concentrates on iterative delivery, adaptability, and rigorous collaboration between cross-functional groups, allowing enterprises to react speedily to marketplace needs. DevOps adds an extra layer through a culture of collaboration between Ops and development, with the end goal of shrinking development lifecycles and frequency of deployment. Service virtualization fits very well with these practices by making parallel development and testing possible. By emulating the behavior of dependent systems that are not accessible or hard to reach, service virtualization allows development and testing to go forward in parallel without causing bottlenecks. This results in accelerated detection and isolation of problems, better software quality, and much less time-to-market. Banking, e-commerce, and healthcare are some of the industries in India that are highly adopting service virtualization to enable faster digital transformations and keep the competitive advantage high.

To get more information on this market, Request Sample

Rising Need for Continuous Integration and Continuous Delivery (CI/CD)

The rising use of CI/CD pipelines has become a standard practice of contemporary Indian software development. CI/CD techniques allow organizations to automate the compilation, testing, and deployment of programs, allowing for quick and consistent delivery of software changes. Testing in CI/CD systems is problematic, however, when using external services or systems that cannot be accessed or simulated. Service virtualization solves this problem through the simulation of the behavior of these outside dependencies, enabling developers and testers to verify applications with continuous assurance without having to wait for real services to be present. This integration maximizes the effectiveness of CI/CD pipelines, minimizes testing cycles, and ensures that software releases are faster yet of better quality. As Indian companies extensively embrace DevOps methodologies to enhance operational effectiveness, the need for service virtualization is also likely to rise accordingly.

India Service Virtualization Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, deployment, and vertical.

Component Insights:

- Software

- Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and service.

Deployment Insights:

- On-Premises

- Cloud

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes on-premises and cloud.

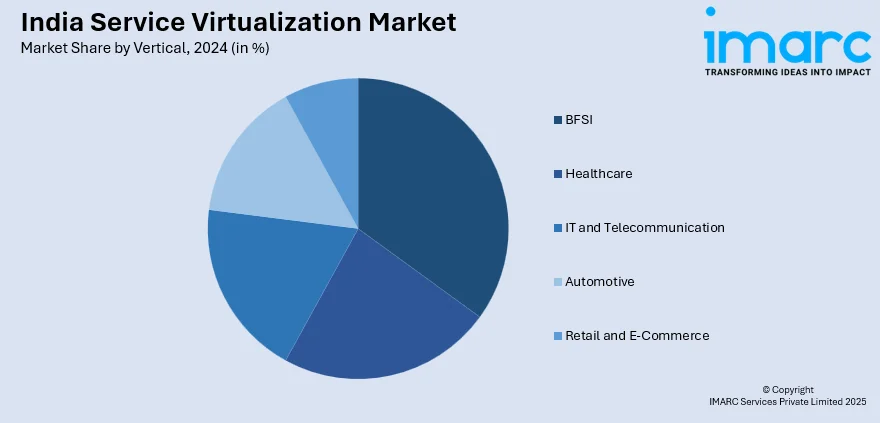

Vertical Insights:

- BFSI

- Healthcare

- IT and Telecommunication

- Automotive

- Retail and E-Commerce

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes BFSI, healthcare, IT and telecommunication, automotive, and retail and e-commerce.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Service Virtualization Market News:

- February 2025: Red Hat announced the availability of OpenShift 4.18 with features that bolster virtualization, networking, and security. Such enhancements ease management of virtual machines and facilitate workloads for artificial intelligence. In India's market for service virtualization, these developments provide resources to streamline activities and strengthen virtualized environment security.

- February 2025: Dassault Systèmes launched "3D UNIV+RSES," combining generative AI with worldwide IP Lifecycle Management to heighten virtual twin experiences. The innovation provides Indian businesses with sophisticated tools for simulating and testing apps, tying in with the country's increasing focus on agile software development and service virtualization. Using such AI-based virtual environments, Indian businesses can accelerate cycles of development and enhance software quality.

India Service Virtualization Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Software, Service |

| Deployments Covered | On-Premises, Cloud |

| Verticals Covered | BFSI, Healthcare, IT and Telecommunication, Automotive, Retail and E-Commerce |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India service virtualization market performed so far and how will it perform in the coming years?

- What is the breakup of the India service virtualization market on the basis of component?

- What is the breakup of the India service virtualization market on the basis of deployment?

- What is the breakup of the India service virtualization market on the basis of vertical?

- What are the various stages in the value chain of the India service virtualization market?

- What are the key driving factors and challenges in the India service virtualization market?

- What is the structure of the India service virtualization market and who are the key players?

- What is the degree of competition in the India service virtualization market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India service virtualization market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India service virtualization market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India service virtualization industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)