India Servo Motors and Drives Market Size, Share, Trends, and Forecast by Product Type, Voltage Range, System, Communication Protocol, End Use Industry, and Region, 2025-2033

India Servo Motors and Drives Market Overview:

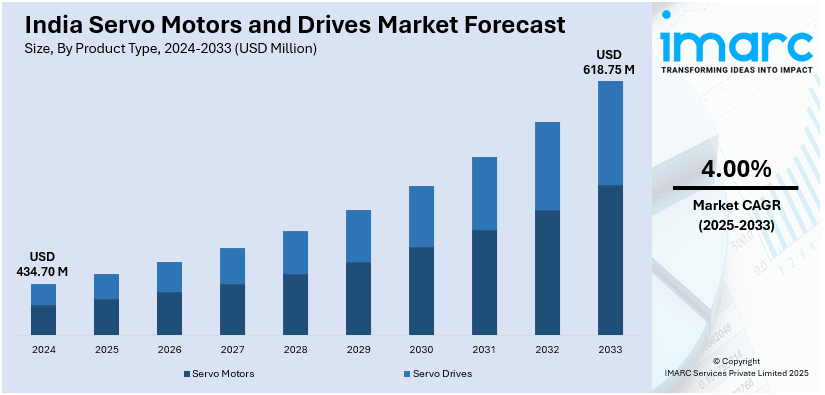

The India servo motors and drives market size reached USD 434.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 618.75 Million by 2033, exhibiting a growth rate (CAGR) of 4.00% during 2025-2033. The market is growing with rising industrial automation, energy efficiency requirements, and the development of electric vehicles and renewable energy industries. Moreover, the use of high-precision motion control solutions in manufacturing, robotics, and smart infrastructure is fueling market growth, supported by government policies and sophisticated automation technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 434.70 Million |

| Market Forecast in 2033 | USD 618.75 Million |

| Market Growth Rate 2025-2033 | 4.00% |

India Servo Motors and Drives Market Trends:

Rising Demand for Industrial Automation and Smart Manufacturing

The India servo motors and drives market is expanding rapidly, propelled by the widespread adoption of industrial automation and smart manufacturing. For instance, as per industry reports, India’s industrial automation sector is projected to expand at a CAGR of 14.26%, reaching USD 29.43 Billion by FY2029. Several industries, including the automotive, electronics, packaging, and food processing sectors, are implementing servo systems to improve manufacturing processes in terms of precision, efficiency, and productivity. With the advent of Industry 4.0 in India, robotics, CNC machines, and automated assembly lines, all prime areas for motion control by servo motors, are being widely utilized. Additionally, the increasing demand for computer numerical control (CNC) machining and robot-driven production are expected to accelerate the demand for high-performance servos. Companies are also utilizing programmable logic controllers (PLCs) and connected devices under the Industrial IoT (IIoT), to improve the monitoring of production in real-time and the ability to predict industrial maintenance — all of which facilitates the need for advanced servo motor and drive solutions. Moreover, as companies push to achieve greater output, energy efficiency, and limited downtime, the adoption of servo motors with intelligent feedback mechanisms becomes an imperative offering. With policy initiatives, i.e., Make in India, promoting local manufacturers, the growth of servo applications with automation in India is likely to continue, allowing India to become a growing market for servo technology.

To get more information on this market, Request Sample

Increasing Use of Servo Motors in Electric Vehicles and Renewable Energy

The electric vehicle (EV) boom and the rapid expansion of renewable energy projects are creating new growth opportunities in India’s servo motors and drives market. For instance, in May 2024, India’s electric vehicle market witnessed a 20.88% increase, reaching 1.39 Million units in sales, showcasing a growing demand across the region, as industry reports suggested. In addition, servo motors play a crucial role in EV manufacturing, battery production, and charging station automation, enabling precise motion control in robotic assembly lines. The growing EV ecosystem in India, supported by government incentives and policies, is pushing automotive manufacturers to invest in high-performance servo drives for EV powertrain testing, motor control, and advanced robotic welding. Similarly, in the renewable energy sector, servo motors are widely used in solar panel tracking systems, wind turbine blade control, and hydroelectric dam automation, optimizing energy generation efficiency. As India expands its solar and wind energy capacities, demand for servo-based motion control systems in renewable power infrastructure is increasing. Additionally, advancements in battery storage solutions and smart grid automation are further driving the need for precise and energy-efficient servo motor applications, reinforcing their importance in India’s sustainable energy and mobility transition.

India Servo Motors and Drives Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product type, voltage range, system, communication protocol, and end use industry.

Product Type Insights:

- Servo Motors

- Servo Drives

The report has provided a detailed breakup and analysis of the market based on the product type. This includes servo motors and servo drives.

Voltage Range Insights:

- Low Voltage

- Medium and High Voltage

A detailed breakup and analysis of the market based on the voltage range have also been provided in the report. This includes low voltage and medium and high voltage.

System Insights:

- Linear System

- Rotary System

The report has provided a detailed breakup and analysis of the market based on the system. This includes linear system and rotary system.

Communication Protocol Insights:

- Fieldbus

- Industrial Ethernet

- Wireless

A detailed breakup and analysis of the market based on the communication protocol have also been provided in the report. This includes fieldbus, industrial ethernet, and wireless.

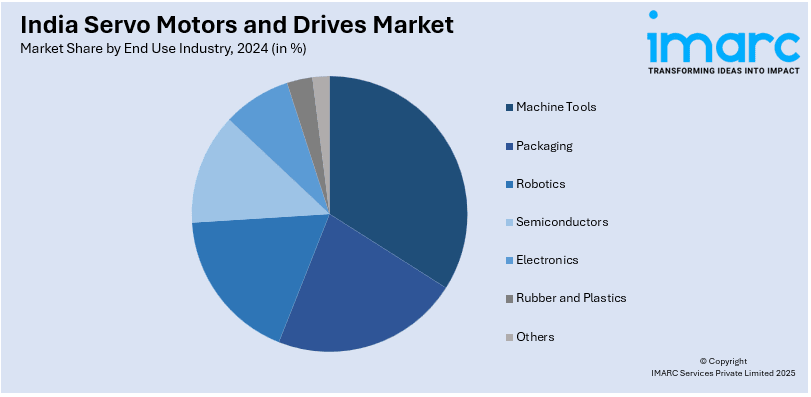

End Use Industry Insights:

- Machine Tools

- Packaging

- Robotics

- Semiconductors

- Electronics

- Rubber and Plastics

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes machine tools, packaging, robotics, semiconductors, electronics, rubber and plastics, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Servo Motors and Drives Market News:

- In October 2024, Nidec Motor Corporation announced a partnership with Ashok Leyland to develop next-generation E-Drives for commercial electric vehicles in India. This collaboration aims to enhance the electric mobility solutions that support local manufacturing, R&D, and supply chain expansion. Nidec's E-Drive technology will improve efficiency and sustainability in India's commercial vehicle market.

India Servo Motors and Drives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Servo Motors, Servo Drives |

| Voltage Ranges Covered | Low Voltage, Medium and High Voltage |

| Systems Covered | Linear System, Rotary System |

| Communication Protocols Covered | Fieldbus, Industrial Ethernet, Wireless |

| End Use Industries Covered | Machine Tools, Packaging, Robotics, Semiconductors, Electronics, Rubber and Plastics, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India servo motors and drives market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India servo motors and drives market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India servo motors and drives industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The servo motors and drives market in India was valued at USD 434.70 Million in 2024.

The India servo motors and drives market is projected to exhibit a CAGR of 4.00% during 2025-2033, reaching a value of USD 618.75 Million by 2033.

The growth of the India servo motors and drives market is being fueled by increasing automation in the automotive, electronics, and manufacturing industries, along with a higher demand for precise motion control. The rise of robotics and CNC machinery, coupled with technological progress in efficiency and integration and greater industrial investments, is also contributing to market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)