India Shared Warehousing Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Shared Warehousing Market Size and Share:

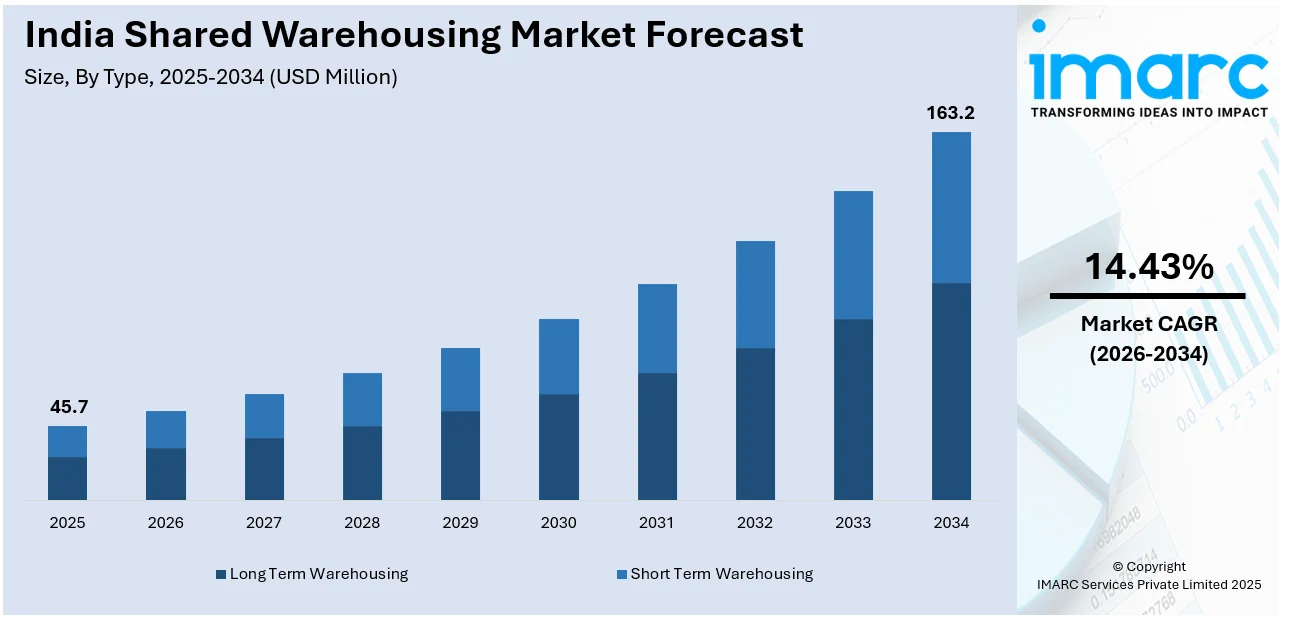

The India shared warehousing market size reached USD 45.7 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 163.2 Million by 2034, exhibiting a growth rate (CAGR) of 14.43% during 2026-2034. The market is growing with increasing e-commerce demand, regulatory backing, and cross-border logistics expansion. Moreover, government policies such as GST registration structures and e-commerce export centers increase transparency, simplify operations, and enhance efficiency, thereby stimulating investment in scalable, technology-enabled storage facilities in major logistics centers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 45.7 Million |

| Market Forecast in 2034 | USD 163.2 Million |

| Market Growth Rate (2026-2034) | 14.43% |

India Shared Warehousing Market Trends:

Regulatory Support for E-Commerce Warehousing

India's shared warehousing industry is growing with increasing e-commerce demand, regulatory backing, and cross-border logistics expansion. Moreover, government policies such as GST registration structures and e-commerce export centers increase transparency, simplify operations, and enhance efficiency. For example, in May 2024, GST authorities introduced a registration framework for shared e-commerce warehouses. This initiative aims to simplify geo-tagging procedures, reducing tax-related risks for multiple suppliers using a single warehouse. The system prevents fraudulent registrations while ensuring that warehouse operators are not held accountable for tax defaults by individual suppliers. This regulatory clarity is set to improve confidence among logistics providers and e-commerce companies, making shared warehousing a more reliable option. Businesses will benefit from smoother compliance, reducing operational disruptions and enabling better inventory management. The initiative is expected to attract more investment in shared warehousing infrastructure, fostering long-term market stability. Additionally, it will encourage structured growth by integrating digital monitoring tools for better tracking and risk assessment. As compliance becomes more streamlined, the shared warehousing sector in India will continue to expand, supporting the evolving needs of e-commerce and logistics players.

To get more information on this market Request Sample

Growing Demand for Cross-Border Logistics

The expansion of global trade and e-commerce has created a rising demand for efficient cross-border logistics. Businesses require warehousing solutions that can support fast order fulfillment while meeting international shipping standards. Shared warehousing is playing a key role in improving logistics efficiency by offering flexible storage and distribution solutions. To support this growing demand, India is developing infrastructure that facilitates quicker export processing and minimizes logistical challenges for businesses engaged in global trade. In August 2024, the Indian government announced plans to establish e-commerce export hubs (ECEH) under a public-private partnership model. These hubs will integrate warehousing, customs clearance, and fulfillment centers, allowing businesses to process international shipments more efficiently. The initiative aims to reduce turnaround time, enhance predictability, and support seamless re-import processes for returns. This development strengthens India's position in global e-commerce by offering structured warehousing solutions that cater to exporters. With improved logistics capabilities, businesses can expand their international reach, benefiting from lower shipping costs and faster delivery timelines. The initiative is expected to unlock new opportunities for sectors like apparel, jewelry, and consumer goods, which have high export potential. As e-commerce exports grow, shared warehousing will become an essential part of India's trade infrastructure, thereby fostering efficiency and scalability in the logistics sector.

India Shared Warehousing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Long Term Warehousing

- Short Term Warehousing

The report has provided a detailed breakup and analysis of the market based on the type. This includes long term warehousing and short term warehousing.

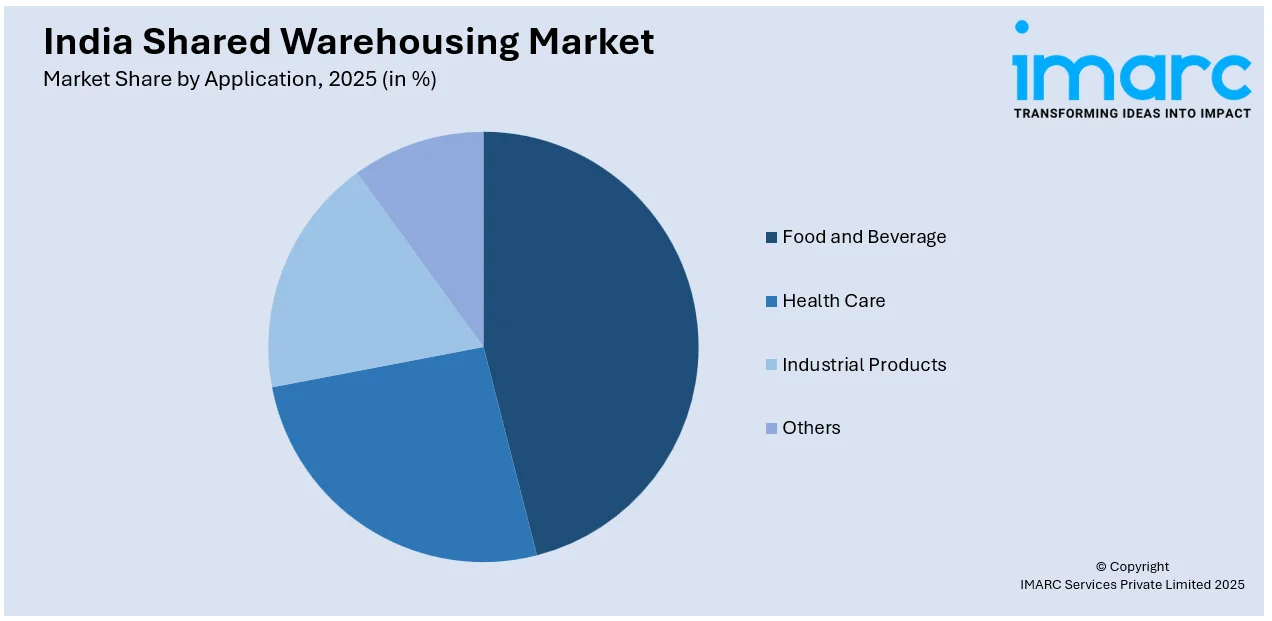

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverage

- Health Care

- Industrial Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverage, health care, industrial products, and others.

Region Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Shared Warehousing Market News

- December 2024: KSH Integrated Logistics launched a 15,000 sq. ft. multi-client warehouse in Jaipur’s Vishwakarma Industrial Area. This advanced facility, equipped with a Warehouse Management System (WMS), strengthens shared warehousing by enhancing scalability, compliance, and operational efficiency, catering to FMCG, automotive, and consumer durables sectors.

- December 2024: Sumadhura Group launched a 1.8 lakh sq. ft. premium warehousing facility at Sumadhura Logistics Park for Zepto and NX Logistics India. This Grade-A+ infrastructure enhances shared warehousing in Bengaluru, improving supply chain efficiency and strengthening India's quick commerce and logistics ecosystem.

India Shared Warehousing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Long Term Warehousing, Short Term Warehousing |

| Applications Covered | Food and Beverage, Health Care, Industrial Products, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India shared warehousing market performed so far and how will it perform in the coming years?

- What is the breakup of the India shared warehousing market on the basis of type?

- What is the breakup of the India shared warehousing market on the basis of application?

- What are the various stages in the value chain of the India shared warehousing market?

- What are the key driving factors and challenges in the India shared warehousing market?

- What is the structure of the India shared warehousing market and who are the key players?

- What is the degree of competition in the India shared warehousing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India shared warehousing market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India shared warehousing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India shared warehousing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)