India Shelf Labeling Systems Market Size, Share, Trends and Forecast by Product Type, Technology, Display Type, Component, End User, and Region, 2026-2034

India Shelf Labeling Systems Market Overview:

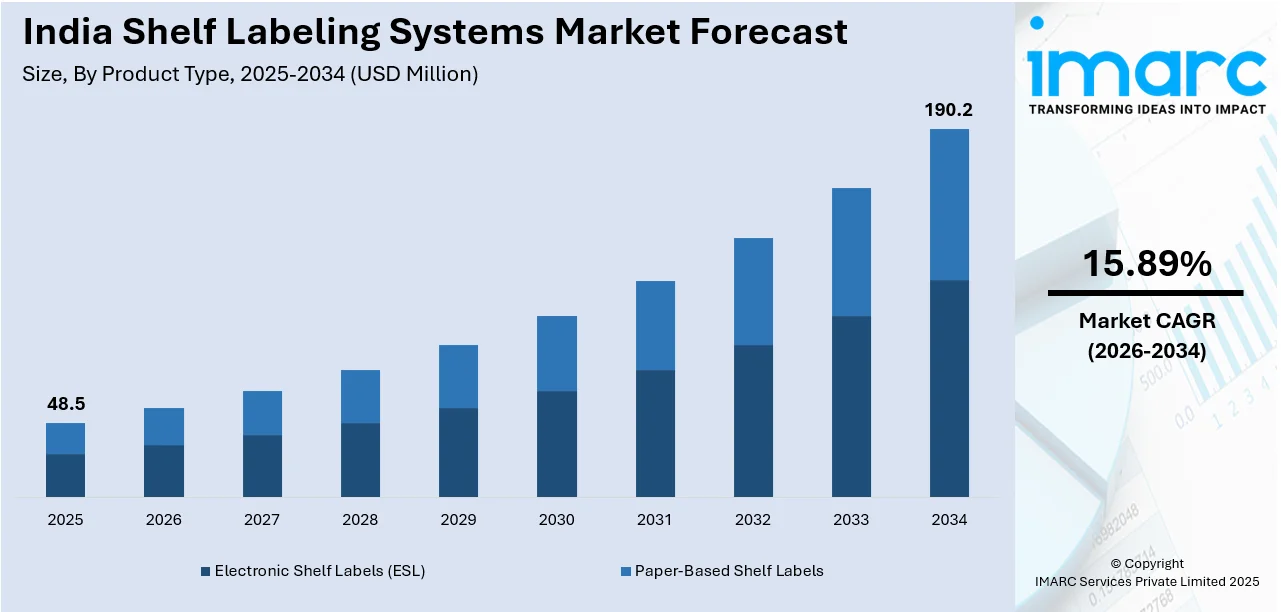

The India shelf labeling systems market size reached USD 48.5 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 190.2 Million by 2034, exhibiting a growth rate (CAGR) of 15.89% during 2026-2034. The increasing adoption of electronic shelf labels, advancements in RF and NFC-based labeling technologies, rising demand for automation in retail, sustainability initiatives, and dynamic pricing strategies are some of the major factors augmenting the India shelf labelling systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 48.5 Million |

| Market Forecast in 2034 | USD 190.2 Million |

| Market Growth Rate 2026-2034 | 15.89% |

India Shelf Labeling Systems Market Trends:

Rising Adoption of Digital Pricing Solutions in Retail

The increasing shift towards automation and digital transformation in the retail sector is significantly driving the adoption of self-labeling systems in India. With the growing presence of supermarkets, hypermarkets, and convenience stores, retailers are actively seeking efficient pricing solutions that reduce manual labor and enhance accuracy. For instance, on March 5, 2024, 7-Eleven opened its 50th shop in India at the World Trade Centre in Kharadi, Pune, marking a significant milestone. Within the next two years, the company intends to double its footprint to 100 stores with the goal of entering other cities. Almost one-third of 7-Eleven's income comes from Asian markets, and the company runs roughly 85,000 outlets in 20 countries, bringing in about USD 81 Billion annually. This expansion is expected further to accelerate the demand for automated shelf labeling systems as large-scale retail chains increasingly prioritize streamlined operations and accurate pricing management. Besides this, electronic shelf labels (ESL) reduce pricing errors, enable real-time price adjustments, and increase operational efficiency. Furthermore, the need for dynamic pricing methods is allowing merchants to modify prices in response to changes in demand and rival pricing, which is driving India shelf labeling system market growth. As e-commerce and omnichannel retailing gain traction, physical establishments are also being urged to invest in digital shelf labeling to enhance consumer interaction and streamline inventory control. In the upcoming years, the Indian market for self-labeling systems is anticipated to continue expanding due to developments in wireless communication technologies like NFC and RF-based labels.

To get more information on this market Request Sample

Government Initiatives and Sustainability Trends Fuel Market Expansion

Sustainability concerns and government initiatives promoting digitalization are key drivers accelerating the adoption of self-labeling systems in India. The push for paperless operations and reduced environmental impact has encouraged businesses to transition from traditional paper-based shelf labels to electronic alternatives. Regulatory policies aimed at improving retail efficiency and consumer transparency are further supporting this shift. Additionally, retailers are increasingly focusing on energy-efficient and eco-friendly solutions, with electronic shelf labels emerging as a viable option due to their long lifespan and minimal paper waste. These labels not only facilitate real-time price updates but also support seamless inventory management, making them a practical choice for modern retail environments. For instance, on June 25, 2024, Panasonic Life Solutions India introduced the eSignCard, an innovative electronic display designed to replace traditional table-top paper placards. This eco-friendly solution utilizes E Ink's ePaper technology, providing a paper-like display that is free from blue light and consumes minimal power. Such advancements underscore the expanding application of electronic labeling solutions across the retail sector. The Indian government's initiatives to promote smart retail infrastructure and digital payment solutions is positively impacting India shelf labeling systems market outlook. Retailers are also leveraging these systems to meet compliance requirements regarding accurate pricing and consumer protection. As sustainability remains a priority for businesses, the adoption of digital shelf labeling systems is expected to surge, contributing to an efficient, technology-driven retail ecosystem in India.

India Shelf Labeling Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, technology, display type, component, and end user.

Product Type Insights:

- Electronic Shelf Labels (ESL)

- Paper-Based Shelf Labels

The report has provided a detailed breakup and analysis of the market based on the product type. This includes Electronic Shelf Labels (ESL) and paper-based shelf labels.

Technology Insights:

- Radio Frequency (RF) Based Labels

- Infrared (IR) Based Labels

- Near Field Communication (NFC) Labels

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes Radio Frequency (RF) Based Labels, Infrared (IR) Based Labels, Near Field Communication (NFC) Labels, others.

Display Type Insights:

- LCD Labels

- E-Paper Labels

The report has provided a detailed breakup and analysis of the market based on the display type. This includes LCD labels and E-Paper labels.

Component Insights:

- Hardware

- Labels

- Displays

- Transmitters

- Software

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware (labels, displays, and transmitters), software, and services.

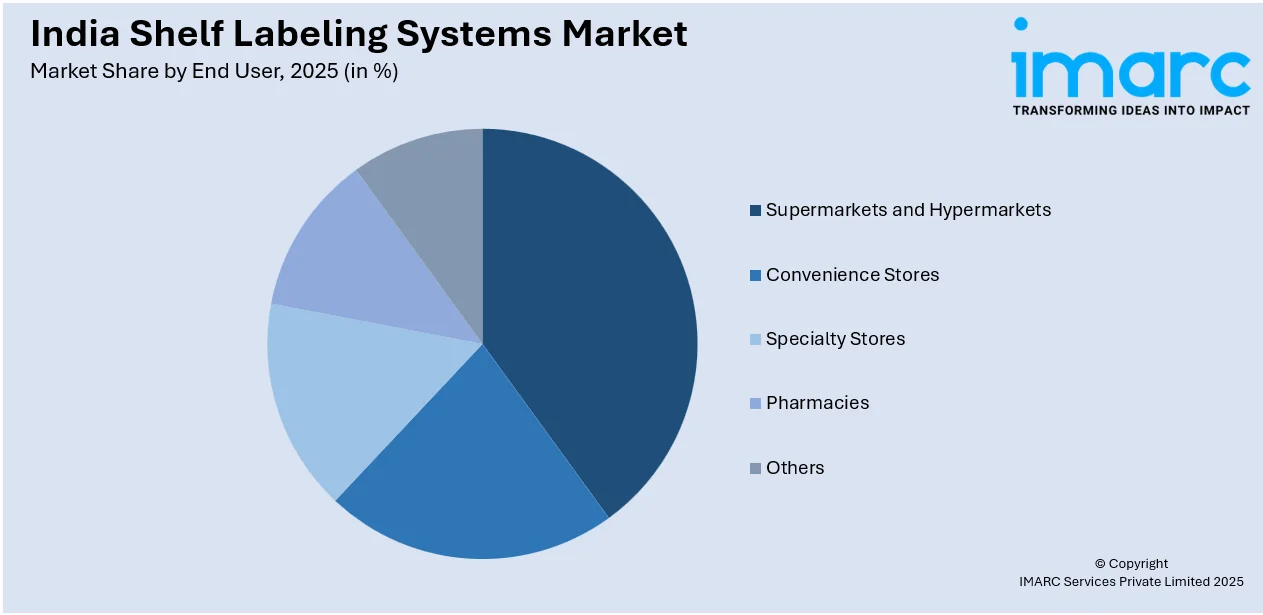

End User Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Pharmacies

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes supermarkets and hypermarkets, convenience stores, specialty stores, pharmacies, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Shelf Labeling Systems Market News:

- On October 17, 2024, SuperUs obtained pre-seed funding from Venture Catalysts with the goal of transforming the display technology industry with innovative and sustainable solutions. With eight hybrid production lines at its 30,000 square foot facilities in Vapi, Gujarat, the investment will increase SuperUs's production capacity. Through the provision of cutting-edge goods like ePaper displays and electronic shelf labels (ESL), SuperUs hopes to take advantage of the growing digital signage market.

India Shelf Labeling Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Electronic Shelf Labels (ESL), Paper-Based Shelf Labels |

| Technologies Covered | Radio Frequency (RF) Based Labels, Infrared (IR) Based Labels, Near Field Communication (NFC) Labels, Others |

| Display Types Covered | LCD labels, E-Paper Labels |

| Components Covered |

|

| End Users Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Pharmacies, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India shelf labeling systems market performed so far and how will it perform in the coming years?

- What is the breakup of the India shelf labeling systems market on the basis of product type?

- What is the breakup of the India shelf labeling systems market on the basis of technology?

- What is the breakup of the India shelf labeling systems market on the basis of display type?

- What is the breakup of the India shelf labeling systems market on the basis of component?

- What is the breakup of the India shelf labeling systems market on the basis of end user?

- What is the breakup of the India shelf labeling systems market on the basis of region?

- What are the various stages in the value chain of the India shelf labeling systems market?

- What are the key driving factors and challenges in the India shelf labeling systems market?

- What is the structure of the India shelf labeling systems market and who are the key players?

- What is the degree of competition in the India shelf labeling systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India shelf labeling systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India shelf labeling systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India shelf labeling systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)