India Ship Repairing Market Size, Share, Trends and Forecast by Vessel Type, Application, End User, and Region, 2025-2033

India Ship Repairing Market Overview:

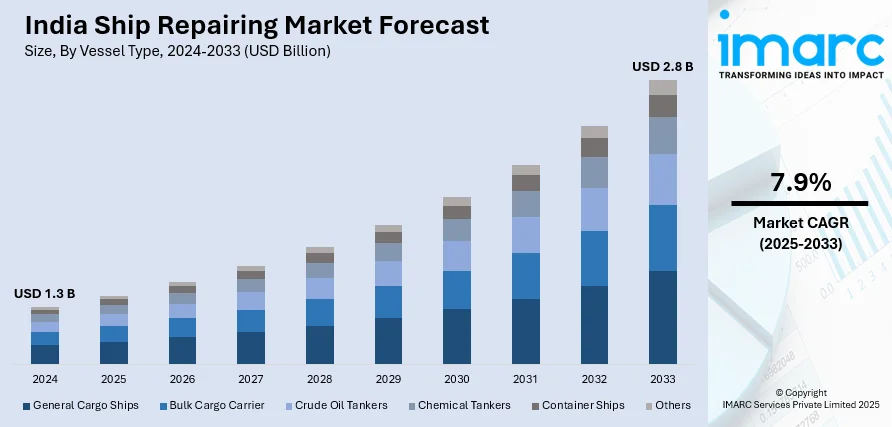

The India ship repairing market size reached USD 1.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.8 Billion by 2033, exhibiting a growth rate (CAGR) of 7.9% during 2025-2033. The market is growing extremely fast with India’s strategic coastal location on key international shipping lanes and strong government backing through plans such as the Maritime India Vision 2030. Investments aimed at upgrading shipyards and improving infrastructure, including the Maritime Development Fund, reinforce the nation's ability to meet world repair demand. India also has an increasing, qualified seafaring labor force and more compliance with global maritime safety and environmental regulations that necessitate ongoing vessel maintenance, which further increases the India ship repairing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.3 Billion |

| Market Forecast in 2033 | USD 2.8 Billion |

| Market Growth Rate 2025-2033 | 7.9% |

India Ship Repairing Market Trends:

Increasing Strategic Significance of India in International Maritime Services

India's strategic position on major international shipping routes, especially off the Arabian Sea, Bay of Bengal, and Indian Ocean, continues to increase its significance in the international ship repairing industry. With growing maritime trade, the demand for effective and convenient repair centers has increased, and India is being seen more and more as a workable solution. Its large coastline and proximity to prime ports such as Mumbai, Chennai, and Cochin provide significant geographical benefits. While this natural location allows for faster turnarounds of ships, it also minimizes detours for foreign shipping lines. With shipping lines looking to minimize costs and time, they tend to look more toward Indian shipyards for routine maintenance and emergency repairs. Simultaneously, India's increasing economic relations with different nations are generating greater maritime traffic, further increasing the need for domestic repair facilities. These new trade patterns contribute to India's increasing role in the ship repairing part of the international maritime market.

To get more information of this market, Request Sample

Infrastructure Enlargement and Technological Upgrade

One significant trend influencing the Indian ship repairing industry is the ongoing enlargement and modernization of infrastructure. In the last few years, a number of public and private shipyards have expanded their facilities to accommodate larger ships and more complex repairs. The deployment of sophisticated diagnostic equipment, dry docks, and modular repair systems is making Indian shipyards comparable to international standards. Concurrently, there is a noticeable shift toward digitalization in ship repair operations, with technologies such as predictive maintenance, automation, and remote inspection gaining popularity. These advances are enhancing operational efficiency, safety, and service quality. Moreover, the cooperation among Indian shipyards and international marine technology companies is hastening the implementation of best practices and technical expertise. The urge for cleaner and compliant ship repair services is also affecting the market, as customers look for partners who are compliant with international environmental standards. This technological and infrastructural development is fueling the India ship repairing market growth.

Government Support and Private Sector Engagement

The Indian government has been at the forefront of developing the ship repairing market with good policies and long-term vision plans. Plans for maritime development are designed to make the maritime sector self-reliant and globally competitive. Recently, the government declared that the shipping ministry will shortly introduce a new policy for shipbuilding and repair as part of the 100-day action agenda. Maritime India Vision 2030 (MIV 2030) seeks to elevate India’s ship repair and shipbuilding position within the top ten worldwide, while the Amrit Kaal Vision 2047 establishes a bolder target of achieving the top 5. Hence, shipyard modernization incentives, ease of doing business reforms, and coastal economic zones are attracting greater investment in this sector. In addition, the public-private partnership (PPP) model is used more and more to construct and operate maritime infrastructure, promoting increasing private sector participation. Indian industrial groups and international investors are also interested in ship repair businesses as they see the potential of the market. Education and skill training programs to prepare a more specialist maritime workforce help fuel the development of the industry. The collaboration between government support and entrepreneurship is driving innovation and enhancing service provision. Consequently, India is slowly shifting from being a regional service provider to a strategic competitor in the international ship repair value chain.

India Ship Repairing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on vessel type, application, and end user.

Vessel Type Insights:

- General Cargo Ships

- Bulk Cargo Carrier

- Crude Oil Tankers

- Chemical Tankers

- Container Ships

- Others

The report has provided a detailed breakup and analysis of the market based on the vessel type. This includes general cargo ships, bulk cargo carrier, crude oil tankers, chemical tankers, container ships, and others.

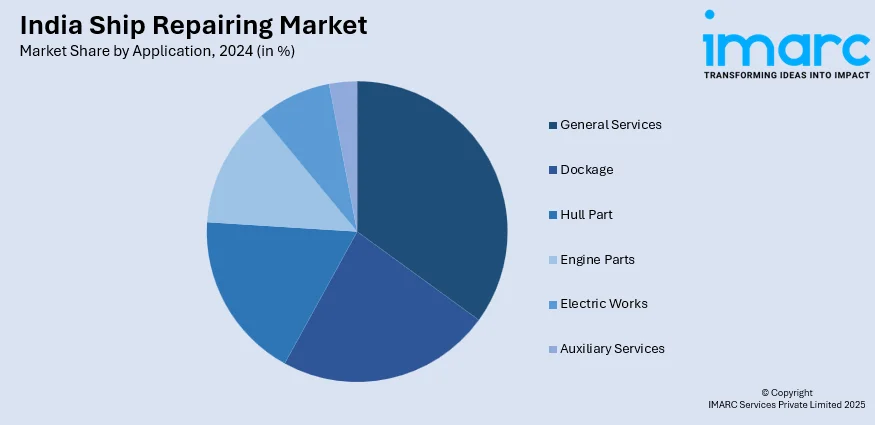

Application Insights:

- General Services

- Dockage

- Hull Part

- Engine Parts

- Electric Works

- Auxiliary Services

The report has provided a detailed breakup and analysis of the market based on the application. This includes general services, dockage, hull part, engine parts, electric works, and auxiliary services.

End User Insights:

- Transport Companies

- Military

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes transport companies, military, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Ship Repairing Market News:

- In April 2025, Cochin Shipyard Ltd (CSL) entered into a memorandum of understanding (MOU) with a prominent service provider for the international maritime, gas, offshore oil and renewable energy sectors, known as Drydocks World, in order to enhance ship repair clusters.

- In February 2025, A.P. Moller - Maersk (Maersk) and Cochin Shipyard Limited (CSL) revealed they had signed a Memorandum of Understanding (MoU) to investigate partnership possibilities in ship repair, maintenance, and construction in India. This strategic alliance corresponds with the Government of India's Vision 2047 maritime goals and recent announcements in the Union Budget 2025-26 aimed at positioning India as one of the top five global maritime centers.

- In December 2024, Kongsberg Maritime entered into a contract with Hindustan Shipbuilding Limited to provide its electric replenishment-at-sea systems for the Fleet Support Ships initiative. The Fleet Support Ships (FSS) of the Indian Navy are a new category of five sizable replenishment vessels aimed at improving the operational effectiveness of the Indian Navy.

India Ship Repairing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vessel Types Covered | General Cargo Ships, Bulk Cargo Carrier, Crude Oil Tankers, Chemical Tankers, Container Ships, Others |

| Applications Covered | General Services, Dockage, Hull Part, Engine Parts, Electric Works, Auxiliary Services |

| End Users Covered | Transport Companies, Military, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India ship repairing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India ship repairing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India ship repairing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The ship repairing market in India was valued at USD 1.3 Billion in 2024.

The India ship repairing market is projected to exhibit a CAGR of 7.9% during 2025-2033, reaching a value of USD 2.8 Billion by 2033.

The India ship repairing market is driven by the country’s strategic coastline, increasing maritime trade, and rising demand for maintenance of aging fleets. Government initiatives to boost domestic shipbuilding and repair infrastructure, along with growing investments in port modernization, are further supporting market expansion across key coastal regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)