India Siding Market Size, Share, Trends and Forecast by Material, Application, End Use, and Region, 2025-2033

India Siding Market Overview:

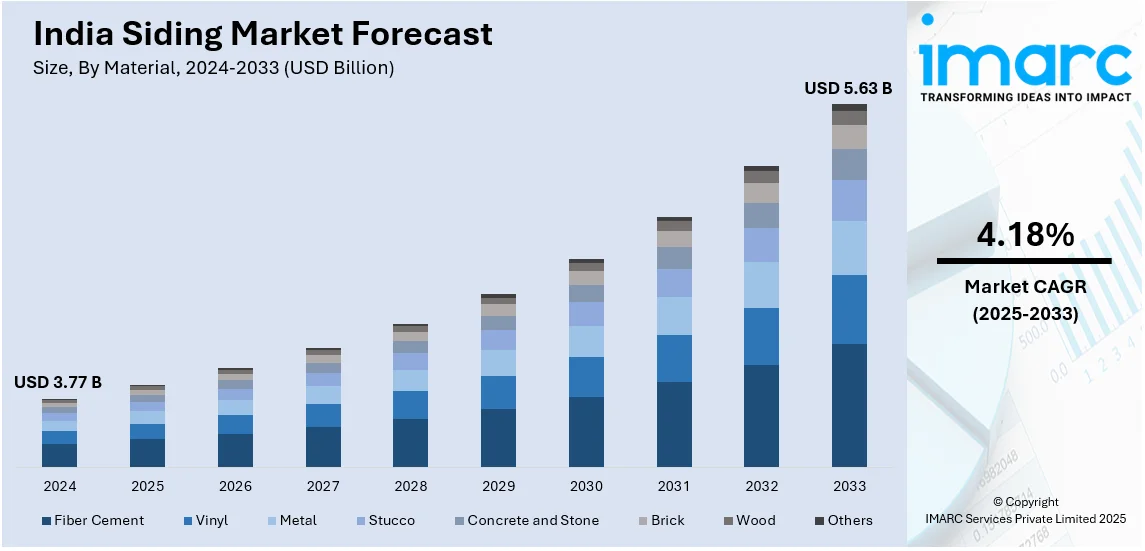

The India siding market size reached USD 3.77 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.63 Billion by 2033, exhibiting a growth rate (CAGR) of 4.18% during 2025-2033. The Indian siding market is primarily driven by rapid urbanization, leading to higher residential and commercial construction, and a growing emphasis on energy-efficient buildings, which boosts the demand for advanced siding materials.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.77 Billion |

| Market Forecast in 2033 | USD 5.63 Billion |

| Market Growth Rate (2025-2033) | 4.18% |

India Siding Market Trends:

Robust Growth in the Construction Industry

The construction industry in India has been the backbone of economic growth, recording impressive growth over recent decades. This growth impacts the demand for siding products, which are a necessary requirement for residential as well as non-residential construction. The Press Information Bureau estimated that the building industry was to record a double-digit growth rate of 10.7% in the financial year 2023-24. This growth is due to more infrastructure projects, urbanization, and residential developments. The government's emphasis on infrastructure development, such as the Smart Cities Mission and Housing for All, has also contributed to this growth. These initiatives are aimed at developing 100 smart cities and building millions of affordable houses, respectively, thus driving the construction industry. Increased population in urban cities has created demand for residential and commercial properties, which has brought about the use of long-lasting and attractive siding materials. Moreover, the focus on green buildings with energy efficiency has also contributed to the use of new siding materials that provide efficient insulation and help in environmental sustainability. This is a trend supporting world sustainability and appealing to the green consumer market. The development of the construction industry has a chain reaction on support industries, with the siding business not being exempted. When there are rising structures built or rehabilitated, siding materials' demand escalates as well, with potential for siding makers and vendors to innovate and respond to the variety of tastes among consumers. The harmonious interdependence supports the continuation of the siding market with the developing construction sector.

To get more information on this market, Request Sample

Favorable Government Policies and Economic Indicators

Government policies and favorable economic performance have been critical in supporting the Indian siding market. Favorable policies encouraging infrastructure growth, complemented by positive economic growth, have fostered an enabling environment for market growth. The Government of India has taken proactive measures in upgrading infrastructure, with sizeable investments in several projects. For example, the Press Information Bureau stated that the nominal GDP at current prices for 2022-23 was put at INR 269.50 lakh crore, an upsurge of 14.2% over the last year. This economic growth has facilitated higher expenditure on infrastructure, which has a direct impact on the siding market. Foreign Direct Investment (FDI) policies have been liberal too, driving investment within the construction sector. Relaxation of allowing 100% FDI under the automatic route for housing, built-up infrastructure, construction-development projects, and townships has promoted higher foreign involvement. Such inflows of capital have encouraged the launch of new projects, thus creating a greater demand for siding materials. Besides, the government's emphasis on 'Make in India' and indigenous demand has prompted indigenous production of building materials, including siding. Such a focus not only lessens reliance on imports but also develops local industries, generating employment opportunities leading to a propelling market. The mutual complementarity of supportive policies and economic indices results in a solid foundation for a boost in the siding market.

India Siding Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on material, application, and end use.

Material Insights:

- Fiber Cement

- Vinyl

- Metal

- Stucco

- Concrete and Stone

- Brick

- Wood

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes fiber cement, vinyl, metal, stucco, concrete and stone, brick, wood, and others.

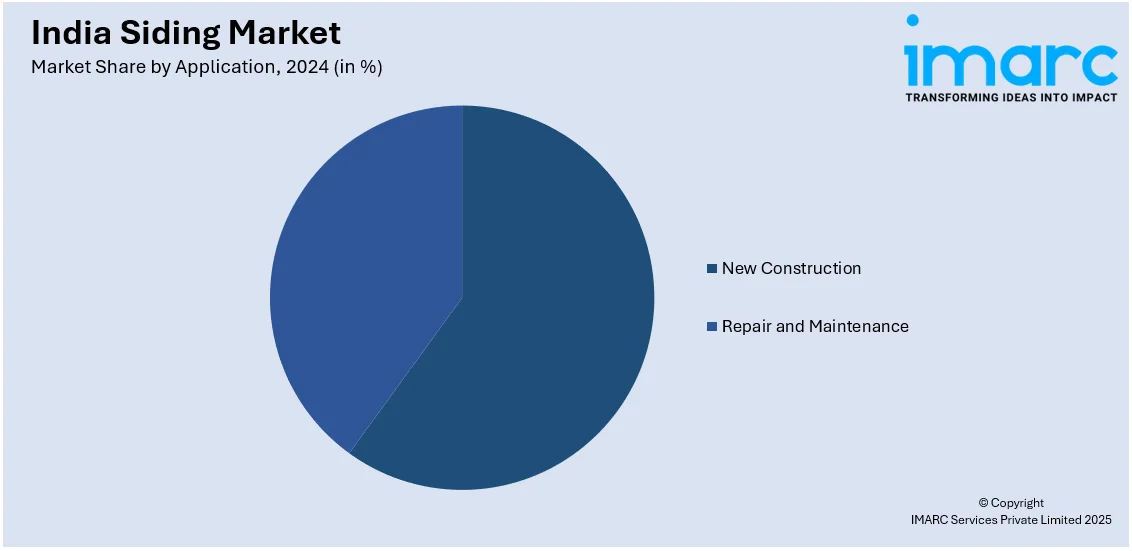

Application Insights:

- New Construction

- Repair and Maintenance

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes new construction and repair and maintenance.

End Use Insights:

- Residential

- Non-Residential

- Healthcare

- Education

- Hospitality

- Retail

- Offices

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes residential and non-residential (healthcare, education, hospitality, retail, offices, and others).

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Siding Market News:

- March 2025: The Government of Andhra Pradesh declared that the construction activity in Amaravati will start by March 2025, primarily on the development of infrastructure and residential projects. This massive construction activity is putting additional pressure on building material demand, such as siding products. The growth is propelling the expansion of the India siding market by enhancing the demand for aesthetically pleasing and durable exterior cladding solutions.

- December 2024: Greaves Retail launched a new range of electric light construction equipment at bauma CONEXPO India 2024. This launch speeds up the use of green machinery in the construction industry, increasing efficiency and sustainability. As a result, the Indian siding market enjoys enhanced installation procedures and lower environmental footprints.

India Siding Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Fiber Cement, Vinyl, Metal, Stucco, Concrete and Stone, Brick, Wood, Others |

| Applications Covered | New Construction, Repair and Maintenance |

| End Uses Covered |

|

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India siding market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India siding market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India siding industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The siding market in India was valued at USD 3.77 Billion in 2024.

The India siding market is projected to exhibit a (CAGR) of 4.18% during 2025-2033, reaching a value of USD 5.63 Billion by 2033.

Infrastructure development, energy efficiency demand, and aesthetic appeal of buildings drive demand for the siding market. Siding products enhance insulation, add weather resistance, and lower maintenance. Residential, commercial, and industrial construction growth supports implementation. Initiatives such as Pradhan Mantri Awas Yojana (PMAY) and growing green building code awareness drive usage of sustainable siding options within climatic zones.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)