India Silica Market Size, Share, Trends and Forecast by Product, End Use, and Region, 2025-2033

India Silica Market Overview:

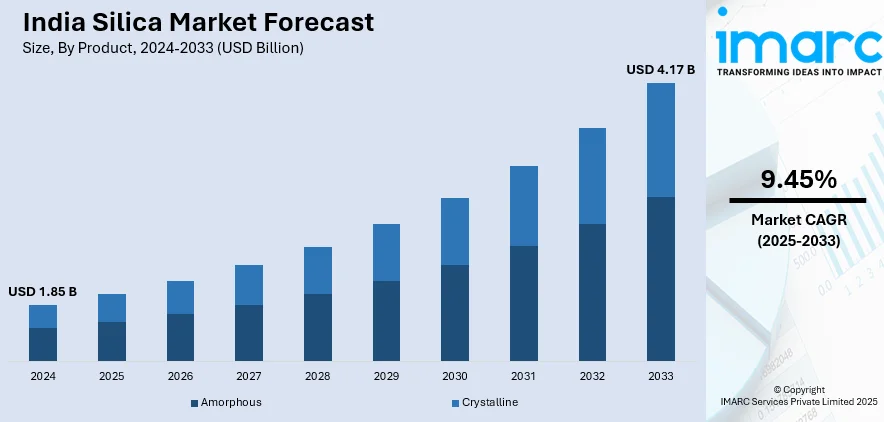

The India silica market size reached USD 1.85 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 4.17 Billion by 2033, exhibiting a growth rate (CAGR) of 9.45% during 2025-2033. The rising product demand in the construction, automotive, and electronics industries, the growing utilization of silica in glass manufacturing, rubber reinforcement, and semiconductor production, and the increasing adoption of precipitated silica in the pharmaceutical and personal care sectors are among the key factors driving the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.85 Billion |

| Market Forecast in 2033 | USD 4.17 Billion |

| Market Growth Rate 2025-2033 | 9.45% |

India Silica Market Trends:

Expansion of the Automotive Industry

India’s rapidly expanding automotive sector is a key driver of the rising demand for silica, particularly precipitated silica, which is widely used as a reinforcing filler in tire manufacturing. By enhancing traction, grip, and wear resistance, silica plays a crucial role in improving tire performance to meet modern vehicle standards. The Indian automotive industry has witnessed remarkable growth, with passenger vehicle production reaching 4,578,639 units in 2022-23, a 25.41% increase from the previous year, whereas commercial vehicle sales surged by 28.56% to 1,035,626 units. This production boom has directly propelled tire demand, with tire exports rising by 50% in FY22. To support this growth, the tire industry has invested over INR 35,000 crore (USD 4.26 billion) in capacity expansion and debottlenecking over the past three years. Additionally, initiatives like NE-MITRA (North East Mission of Tire Industry for Rubber Augmentation), with an INR 1,110 crore (USD 0.14 billion) investment, aim to develop 200,000 hectares of rubber plantations, ensuring a stable raw material supply. This interlinked growth of the automotive and tire industries underscores the sustained demand for high-performance tires and silica in India.

To get more information on this market, Request Sample

Growth in the Electronics Industry

India’s rapidly expanding electronics sector is a key driver of the silica market, with precipitated silica playing a crucial role in moisture absorption for display devices, watches, semiconductors, and cameras. It also acts as a reinforcing filler in adhesives and sealants, improving durability and resistance to environmental stresses. The industry has experienced significant expansion, reaching USD 155 billion in FY23. Production has nearly doubled, growing from USD 48 billion in FY17 to USD 101 billion in FY23. Mobile phones now contribute 43% of total electronics manufacturing, highlighting the sector’s rapid progress. Rising demand for consumer electronics, telecommunications equipment, and automotive electronics has also driven an increase in silica consumption. Government initiatives, such as ‘Digital India’ and ‘Make in India’, along with supportive FDI policies, have attracted both domestic and foreign investments. In the Union Budget 2023-24, the Ministry of Electronics and Information Technology received an allocation of INR 16,549 crore (USD 2 billion), marking a 40% annual increase to strengthen the sector's growth. As the industry advances, the demand for high-quality materials, such as precipitated silica, is expected to grow further.

India Silica Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product and end use.

Product Insights:

- Amorphous

- Crystalline

The report has provided a detailed breakup and analysis of the market based on the product. This includes amorphous and crystalline.

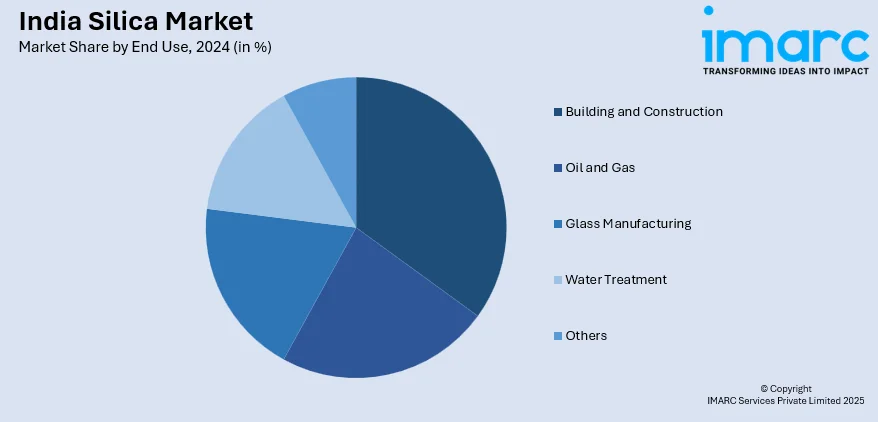

End Use Insights:

- Building and Construction

- Oil and Gas

- Glass Manufacturing

- Water Treatment

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes building and construction, oil and gas, glass manufacturing, water treatment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Silica Market News:

- January 2025: Evonik introduced Smart Effects, which combines its Silica and Silanes business lines. The firm will be part of "Advanced Technologies" and will focus on major areas such as automotive, electronics, consumer health and nutrition, and building protection. Smart Effects will provide high purity silica, metal oxides, and silanes for lithium-ion batteries and semiconductors.

- December 2024: Mitsubishi Chemical Group announced intentions to enhance the production capacity of Mitsubishi Synthetic Silica, which is used in semiconductor fabrication. The ultra-high purity product serves as a raw material for quartz crucibles and high-purity quartz components in semiconductor fabrication equipment.

- September 2024: RIR Power Electronics Ltd. initiated the construction of India's first silicon carbide (SiC) manufacturing facility at EMC Park in Infovalley, Bhubaneswar. With an investment of INR 620 crore over three years, the project is expected to generate over 500 jobs and bolster Odisha's position in the power electronics industry.

India Silica Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Amorphous, Crystalline |

| End Uses Covered | Building and Construction, Oil and Gas, Glass Manufacturing, Water Treatment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India silica market performed so far and how will it perform in the coming years?

- What is the breakup of the India silica market on the basis of product?

- What is the breakup of the India silica market on the basis of end use?

- What are the various stages in the value chain of the India silica market?

- What are the key driving factors and challenges in the India silica market?

- What is the structure of the India silica market and who are the key players?

- What is the degree of competition in the India silica market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India silica market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India silica market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India silica industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)