India Smart Advertising Market Size, Share, Trends and Forecast by Component, Product, End Use, and Region, 2026-2034

India Smart Advertising Market Summary:

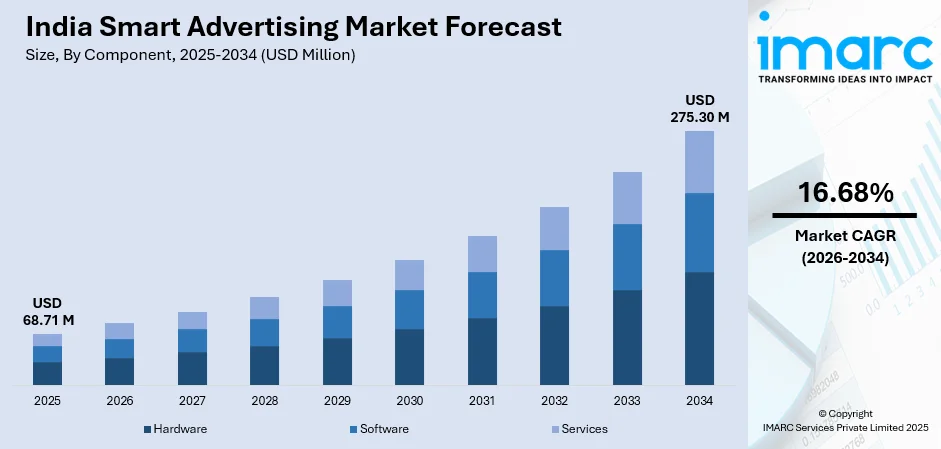

The India smart advertising market size was valued at USD 68.71 Million in 2025 and is projected to reach USD 275.30 Million by 2034, growing at a compound annual growth rate of 16.68% from 2026-2034.

The market is driven by rising urbanization and expanding digital infrastructure across major metropolitan areas and emerging smart cities. Increasing investments in advanced display technologies and data-driven advertising solutions are reshaping brand communication strategies. Growing adoption of programmatic advertising and real-time content management systems is enhancing campaign effectiveness. The integration of artificial intelligence and analytics capabilities is enabling precise audience targeting and improved return on investment, contributing to the expanding India smart advertising market share.

Key Takeaways and Insights:

-

By Component: Hardware dominates the market with a share of 52% in 2025, driven by high-resolution LED displays, digital screens, interactive kiosks, and growing demand for durable, energy-efficient installations.

-

By Product: Digital billboard leads the market with a share of 40% in 2025, owing to high visibility along highways, commercial zones, and transit corridors, offering dynamic, real-time content and multiple advertisements simultaneously.

-

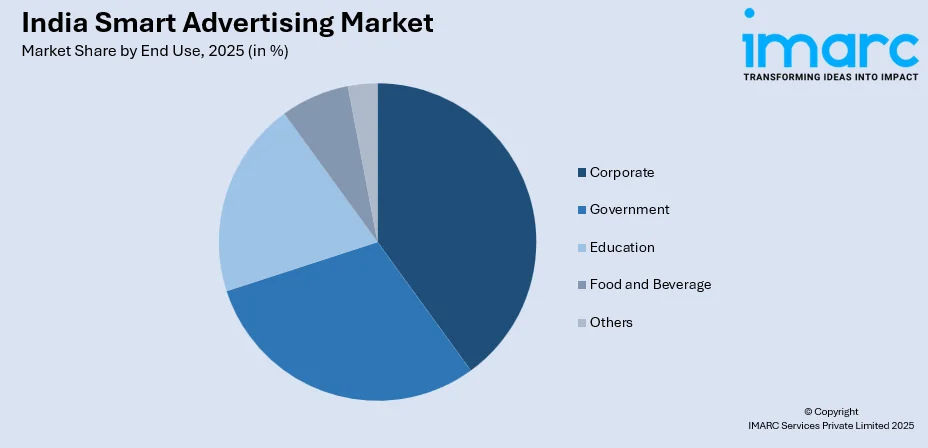

By End Use: Corporate represents the largest segment with a market share of 36% in 2025, driven by enterprises using smart advertising for brand building, promotions, and internal communication across offices, retail chains, and campuses.

-

By Region: North India leads the market with a share of 30% in 2025, owing to commercial infrastructure in Delhi-NCR, expanding smart city initiatives, and metro rail networks offering prime locations for digital advertising.

-

Key Players: The India smart advertising market exhibits a moderately fragmented competitive landscape, with established technology providers and specialized digital signage firms operating across various segments. Market participants are focusing on technological innovation, strategic partnerships, and geographic expansion to strengthen their positioning.

To get more information on this market Request Sample

The India smart advertising market is witnessing significant growth, driven by digital transformation and infrastructure modernization across metropolitan and tier-two cities. The surge in smart city projects is enabling extensive deployment of high-resolution LED displays, digital billboards, and interactive kiosks in public spaces, transit hubs, and commercial centers. According to reports, in 2025, Smartags announced the expansion of its Digital Out-of-Home network to over 1,000+ high-traffic locations across India, projecting a monthly reach of 40 Million consumers. Moreover, rising smartphone penetration and internet adoption are facilitating advanced audience analytics, programmatic advertising, and precise campaign targeting. Corporates leverage smart advertising for brand building, promotions, and internal communications, while experiential marketing encourages interactive consumer engagement. Expanding retail spaces, shopping malls, and entertainment venues provide new opportunities for dynamic content delivery. Technological innovation, strategic partnerships, and integrated hardware-software solutions are reshaping competitive dynamics, with hardware, digital billboards, corporate users, and North India leading market growth.

India Smart Advertising Market Trends:

Integration of Artificial Intelligence and Machine Learning

The adoption of artificial intelligence (AI) and machine learning (ML) technologies is transforming smart advertising capabilities across the Indian market. These advanced technologies enable real-time audience recognition, demographic profiling, and behavioural analysis to deliver highly personalized content. Advertisers are leveraging AI-powered systems to automatically optimize content scheduling based on footfall patterns, weather conditions, and local events. As per sources, in July 2025, Google expanded its AI-driven advertising tools in India, with early adopters like Cashify reporting a 15 percent increase in conversions, demonstrating AI’s impact on campaign optimization. Further, the integration of computer vision and facial recognition technologies allows for anonymous audience measurement and engagement tracking without compromising privacy. Machine learning algorithms continuously improve campaign performance by analyzing viewer responses and adjusting creative elements dynamically.

Expansion of Programmatic Advertising Platforms

Programmatic advertising is gaining significant traction in India's smart advertising ecosystem, enabling automated and data-driven media buying and selling processes. This technology allows advertisers to purchase digital out-of-home inventory in real time based on specific audience parameters and contextual triggers. The emergence of demand-side platforms and supply-side platforms specifically designed for digital signage is streamlining campaign execution and optimization. As per sources, in August 2025, JCDecaux India partnered with VIOOH to provide programmatic access to 64 premium digital screens at Bengaluru’s Kempegowda International Airport, generating over 41 Million monthly impressions. Moreover, advertisers benefit from enhanced targeting precision, reduced operational complexity, and improved cost efficiency through programmatic capabilities. The growing availability of standardized measurement metrics and third-party verification services is increasing advertiser confidence in programmatic outdoor investments.

Rise of Interactive and Immersive Display Technologies

Interactive and immersive display technologies are emerging as powerful tools for creating memorable brand experiences in Indian urban environments. Touchscreen kiosks, gesture-recognition displays, and augmented reality installations are enabling two-way consumer engagement beyond traditional passive advertising. Brands are deploying interactive displays in retail environments, transit stations, and public spaces to facilitate product exploration, wayfinding assistance, and promotional campaigns. According to sources, in April 2025, the 54th Media Expo Mumbai showcased over 135 exhibitors presenting innovations in digital advertising, interactive signage, and immersive display technologies, highlighting India’s growing focus on experiential smart advertising. Further, the integration of near-field communication and QR code technologies enables seamless transitions between physical displays and mobile experiences. These interactive formats generate valuable consumer interaction data while enhancing brand recall and purchase intent among engaged audiences.

Market Outlook 2026-2034:

The India smart advertising market is positioned for robust revenue growth through the forecast period driven by accelerating urbanization and expanding digital infrastructure investments. The market revenue is projected to experience strong expansion as advertisers increasingly allocate budgets toward data-driven outdoor formats offering measurable performance. Continued government initiatives supporting smart city development and public infrastructure modernization will establish new advertising inventory across transportation networks and public spaces. The convergence of digital signage with mobile technologies and connected devices is expected to unlock innovative advertising formats and enhanced audience engagement opportunities, sustaining positive market momentum. The market generated a revenue of USD 68.71 Million in 2025 and is projected to reach a revenue of USD 275.30 Million by 2034, growing at a compound annual growth rate of 16.68% from 2026-2034.

India Smart Advertising Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Component | Hardware | 52% |

| Product | Digital Billboard | 40% |

| End Use | Corporate | 36% |

| Region | North India | 30% |

Component Insights:

- Hardware

- Software

- Services

Hardware dominates with a market share of 52% of the total India smart advertising market in 2025.

The hardware commands the largest share of the India smart advertising market, encompassing display screens, digital billboards, interactive kiosks, media players, and mounting infrastructure. The segment's dominance reflects the capital-intensive nature of smart advertising deployments requiring substantial investments in high-quality display technologies. LED and LCD displays constitute the primary hardware categories, with increasing adoption of ultra-high-definition and outdoor-rated panels designed for continuous operation in diverse environmental conditions across metropolitan and emerging urban centers. In November 2025, AdBot launched Rewa’s first organised DOOH LED network, deploying large-format LED screens across five high-traffic locations, positioning itself as Central India’s fastest-growing digital advertising brand.

The growing preference for larger format displays and video wall configurations in premium advertising locations is driving hardware revenue growth across the country. Technological advancements in display brightness, energy efficiency, and remote management capabilities are enhancing the value proposition for hardware investments significantly. The expansion of digital out-of-home networks across retail, transportation, and hospitality sectors is generating sustained demand for commercial-grade display hardware and supporting infrastructure components throughout Indian cities.

Product Insights:

- Interactive Kiosk

- Digital Billboard

- Digital Poster

- Others

Digital billboard leads with a share of 40% of the total India smart advertising market in 2025.

Digital billboard represents the leading product category in India's smart advertising market, strategically positioned along highways, major intersections, and high-traffic urban corridors nationwide. These large-format LED displays offer unparalleled visibility and the flexibility to rotate multiple advertisements, maximizing revenue potential from premium locations effectively. In January 2025, Bright Outdoor Media unveiled 30 feet by 25 feet digital LED billboard at Wadi Bunder Junction, Mumbai, engaging thousands of commuters daily and enhancing city-level brand visibility. Moreover, the ability to update content remotely and schedule campaigns based on time-of-day or audience demographics provides significant advantages over traditional static billboards for advertisers seeking dynamic engagement.

The segment continues to expand as media owners invest in upgrading prime outdoor locations with digital capabilities and municipal authorities incorporate digital signage into urban beautification initiatives. Digital billboards are increasingly integrated with audience measurement technologies providing advertisers with impression data and engagement metrics previously unavailable in outdoor advertising formats. The scalability and operational efficiency of this format are attracting substantial investments from established outdoor media companies and new entrants.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Corporate

- Government

- Education

- Food and Beverage

- Others

Corporate exhibits a clear dominance with a 36% share of the total India smart advertising market in 2025.

The corporate leads smart advertising adoption in India, utilizing digital displays for external brand communications, customer engagement, and internal information dissemination across organizations. As per sources, in September 2025, SHARP Business Systems India showcased Direct-View LED walls, large format displays, and interactive signage at InfoComm India 2025, highlighting solutions for corporate offices, retail spaces, and employee engagement. Further, large enterprises deploy smart advertising solutions across their retail networks, office lobbies, manufacturing facilities, and customer service centers to reinforce brand identity effectively. Corporate cafeterias, waiting areas, and employee common spaces increasingly feature digital signage for internal communications and wellness initiatives aimed at enhancing workplace engagement and productivity.

The banking, financial services, and insurance sector represents a significant corporate adopter, utilizing digital displays in branches and customer touchpoints for product promotions and queue management solutions. Retail corporations leverage smart advertising for point-of-sale promotions, wayfinding assistance, and enhanced shopping experiences that drive foot traffic and sales conversions effectively. The hospitality and real estate sectors are also deploying sophisticated digital signage networks to showcase the properties, amenities, and promotional offers.

Regional Insights:

- North India

- West and Central India

- South India

- East India

North India dominates with a market share of 30% of the total India smart advertising market in 2025.

North India commands the largest regional share of the smart advertising market, anchored by extensive commercial infrastructure and advertising expenditure concentrated in the Delhi-National Capital Region. The region benefits from a dense network of shopping malls, office complexes, and entertainment venues that provide premium locations for digital advertising installations throughout urban areas. Delhi's expanding metro rail network offers substantial advertising inventory across stations and transit corridors reaching millions of daily commuters seeking information.

Smart city initiatives across north states including Uttar Pradesh, Rajasthan, and Punjab are creating new opportunities for digital signage deployments in public spaces and transportation infrastructure. The region's robust presence of multinational corporations, national headquarters, and thriving startup ecosystem generates substantial corporate demand for smart advertising solutions continuously. Tier-two cities such as Jaipur, Lucknow, and Chandigarh are witnessing accelerated adoption as retail and commercial development expands beyond boundaries.

Market Dynamics:

Growth Drivers:

Why is the India Smart Advertising Market Growing?

Accelerating Smart City Development and Urban Infrastructure Modernization

India's ambitious smart city mission is creating unprecedented opportunities for smart advertising deployments across urban landscapes. Government investments in modernizing public infrastructure including transportation systems, civic facilities, and urban spaces are establishing new platforms for digital signage installations. The integration of digital displays into bus shelters, railway stations, airports, and metro networks enable advertisers to reach captive audiences during daily commutes. In November 2025, DMRC announced a co-branding initiative across 141 metro stations, allowing advertisers to integrate digital and static branding while ensuring design compliance, safety, and operational suitability. Moreover, municipal beautification projects increasingly incorporate digital kiosks providing wayfinding information, public announcements, and advertising content. The convergence of urban planning initiatives with digital infrastructure development is accelerating the transformation of Indian cities into connected advertising ecosystems.

Rising Demand for Data-Driven and Measurable Advertising Solutions

Advertisers are increasingly demanding measurable outcomes and transparent performance metrics from their outdoor advertising investments, driving adoption of smart advertising technologies. Digital displays integrated with audience analytics capabilities provide impression counts, demographic insights, and engagement measurements previously unavailable in traditional outdoor formats. The ability to track campaign performance in real time and optimize creative content based on audience responses enhances return on advertising expenditure. According to sources, in August 2025, a survey of Mumbai Metro Aqua Line 3 commuters showed 88% spend 11 to 20 minutes per trip, offering brands extended engagement windows for impactful train wrap and station advertising campaigns. Further, brands operating under performance marketing frameworks are attracted to smart advertising's measurability and attribution capabilities. The growing sophistication of data collection and analysis tools is transforming outdoor advertising from a brand awareness medium into a performance-oriented channel.

Expanding Retail and Commercial Real Estate Development

The rapid expansion of organized retail, shopping centers, and commercial office developments across Indian cities is generating substantial demand for smart advertising solutions. Retail environments are increasingly incorporating digital signage for product promotions, brand communications, and enhanced customer experiences that differentiate shopping destinations. Commercial developers recognize the revenue potential of integrating advertising infrastructure into building facades, lobbies, and common areas. The growth of quick-service restaurants, entertainment venues, and hospitality establishments creates additional installation opportunities for digital displays. Mixed-use developments combining retail, office, and residential components offer diverse advertising touchpoints reaching varied demographic segments throughout their daily routines.

Market Restraints:

What Challenges the India Smart Advertising Market is Facing?

High Initial Investment and Total Cost of Ownership

The substantial capital investment required for deploying smart advertising infrastructure presents a significant barrier for market expansion, particularly for smaller media owners and advertisers. Hardware costs including commercial-grade displays, mounting structures, and network connectivity represent considerable upfront expenditure. Ongoing operational expenses encompassing content management, maintenance, energy consumption, and software licensing add to the total cost of ownership.

Regulatory Complexity and Permit Requirements

The fragmented regulatory landscape governing outdoor advertising across Indian states and municipalities creates compliance challenges for smart advertising deployments. Varying permit requirements, zoning restrictions, and content regulations across jurisdictions complicate network expansion and standardization efforts. Regulatory uncertainty regarding digital displays including brightness limitations, animation restrictions, and placement guidelines can delay project implementations.

Infrastructure and Connectivity Limitations in Emerging Markets

Inadequate power supply reliability and internet connectivity in tier-two and tier-three cities constrain smart advertising expansion beyond major metropolitan areas. Network-dependent digital signage systems require stable connectivity for content updates, real-time campaign management, and audience analytics capabilities. Power fluctuations and outages can disrupt display operations and damage sensitive electronic equipment, increasing maintenance costs.

Competitive Landscape:

The India smart advertising market features a diverse competitive landscape comprising global technology providers, regional media companies, and specialized digital signage solution providers. Market participants are differentiating through technological innovation, content management capabilities, and geographic network coverage. Strategic partnerships between hardware manufacturers, software developers, and media owners are creating integrated solution offerings that address advertisers' evolving requirements. The market is witnessing consolidation activity as larger players acquire regional operators to expand network footprint and achieve operational efficiencies. Investment in proprietary audience measurement technologies and programmatic platforms is becoming a competitive differentiator as advertisers demand performance accountability. Emerging players are focusing on niche applications including retail digital signage, transit media, and corporate communications to establish market presence before pursuing broader expansion strategies.

Recent Developments:

-

In January 2025, India’s Out-of-Home (OOH) advertising industry is projected to grow 15–16%, reaching Rs 5,500 Crore. The IOAA will complete a nationwide hoarding census, while agencies test RoadStar, a GPS-based measurement system, enhancing transparency, ad placement, and accountability across legal OOH sites, supporting sustainable and data-driven industry growth.

India Smart Advertising Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Products Covered | Interactive Kiosk, Digital Billboard, Digital Poster, Others |

| End Uses Covered | Corporate, Government, Education, Food and Beverage, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India smart advertising market size was valued at USD 68.71 Million in 2025.

The India smart advertising market is expected to grow at a compound annual growth rate of 16.68% from 2026-2034 to reach USD 275.30 Million by 2034.

The hardware held the largest share in the India smart advertising market, driven by widespread deployment of high-resolution LED displays, digital screens, and interactive kiosks. Strong demand for durable, energy-efficient installations across public, corporate, and commercial spaces fueled its dominant position.

Key factors driving the India smart advertising market include accelerating smart city initiatives, expanding retail and commercial infrastructure, rising demand for data-driven advertising solutions, integration of AI technologies, and growing programmatic advertising adoption.

Major challenges include high initial investment requirements, fragmented regulatory frameworks across states, infrastructure limitations in tier-two and tier-three cities, power supply reliability concerns, and the need for standardized measurement metrics across the industry.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)