India Smart Charging Station Market Size, Share, Trends and Forecast by Charging Technology, Connectivity, Battery Technology, Application, and Region, 2026-2034

India Smart Charging Station Market Overview:

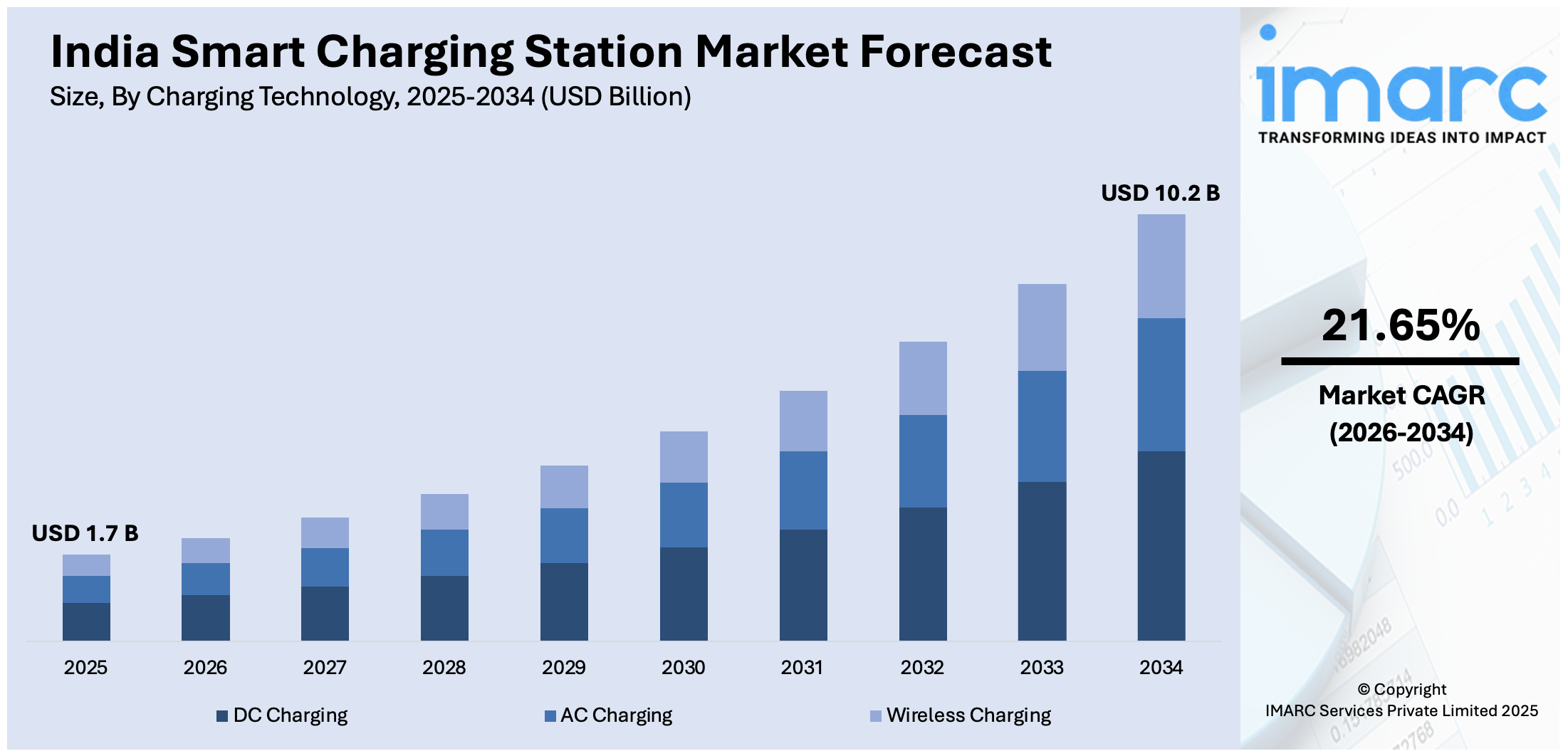

The India smart charging station market size reached USD 1.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 10.2 Billion by 2034, exhibiting a growth rate (CAGR) of 21.65% during 2026-2034. The market is led by the growth in electric vehicle (EV) adoption, government incentives such as the FAME scheme, and pro-infrastructure policies. Growing fuel prices and green concerns are motivating consumers to adopt EVs, which is triggering demand for affordable, effective charging networks. Public-private collaborations and urban planning are speeding up the installation along highways and cities. Intelligent technologies, such as IoT integration and real-time monitoring, also support improved user experience and operational effectiveness, which further increases the India smart charging station market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.7 Billion |

| Market Forecast in 2034 | USD 10.2 Billion |

| Market Growth Rate 2026-2034 | 21.65% |

India Smart Charging Station Market Trends:

Expansion of Charging Infrastructure Across India

The charging infrastructure for electric vehicles (EVs) in India is rapidly growing, while both public and private sectors are contributing to installing charging stations throughout the nation. Car manufacturers such as Tata Motors and Maruti Suzuki are increasingly engaged in developing charging networks so that EV charging points become easily accessible. For example, Tata Motors is looking to increase the charging points manifold, while Maruti Suzuki is eyeing the fitment of fast charging points across key cities. Moreover, agreements between state-owned fuel retailers and private players are further strengthening the charging network. These initiatives play a vital role in overcoming the range anxiety factor among prospective buyers of EVs and encouraging electric vehicle adoption in India.

To get more information on this market Request Sample

Adoption of Smart Charging Technologies

The inclusion of intelligent technologies in EV charging stations is revolutionizing the charging experience in India. Smart charging solutions, with Internet of Things (IoT) embedded in them, facilitate real-time monitoring, remote diagnosis, and effective energy management. They support users in finding accessible charging stations, checking charging status, and even making payments via mobile apps, thereby improving convenience and user experience. In addition, smart charging systems enable load management, lessening the burden on the power grid during peak times. As the popularity of electric vehicles increases, the implementation of smart charging technologies is becoming crucial to maintain a secure and efficient charging system, further impelling the India smart charging station market growth.

Government Policies and Incentives

Government policies and incentives from the Indian government are crucial in promoting the development of the EV charging market. Initiatives like that of the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme support the installation of charging infrastructure with funding, which makes the country commercially attractive for companies to invest in EV charging systems. Initiated in 2015, the program has experienced two stages, with Phase II lasting until March 2024. It offers financial incentives for electric vehicles, intending to assist in acquiring 55,000 electric passenger cars, more than 500,000 electric three-wheelers, and one million electric two-wheelers. The program also encourages the expansion of charging infrastructure nationwide. State governments have also brought in their own measures to enhance adoption, with state government subsidies and incentives available for both consumers who buy EVs and also for charging infrastructure developers. These policies help simplify the permit process, lower electricity tariffs for charging EVs, and improve the number of public charging stations available. The proactive initiative by the government plays a major role in establishing a facilitative environment for the development of the EV charging sector in India.

India Smart Charging Station Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on charging technology, connectivity, battery technology, and application.

Charging Technology Insights:

- DC Charging

- AC Charging

- Wireless Charging

The report has provided a detailed breakup and analysis of the market based on the charging technology. This includes DC charging, AC charging, and wireless charging.

Connectivity Insights:

- Wi-Fi

- Cellular

- LAN

The report has provided a detailed breakup and analysis of the market based on the connectivity. This includes wi-fi, cellular, and LAN.

Battery Technology Insights:

- Lithium-Ion

- Solid-state Batteries

The report has provided a detailed breakup and analysis of the market based on the battery technology. This includes lithium-ion and solid-state batteries.

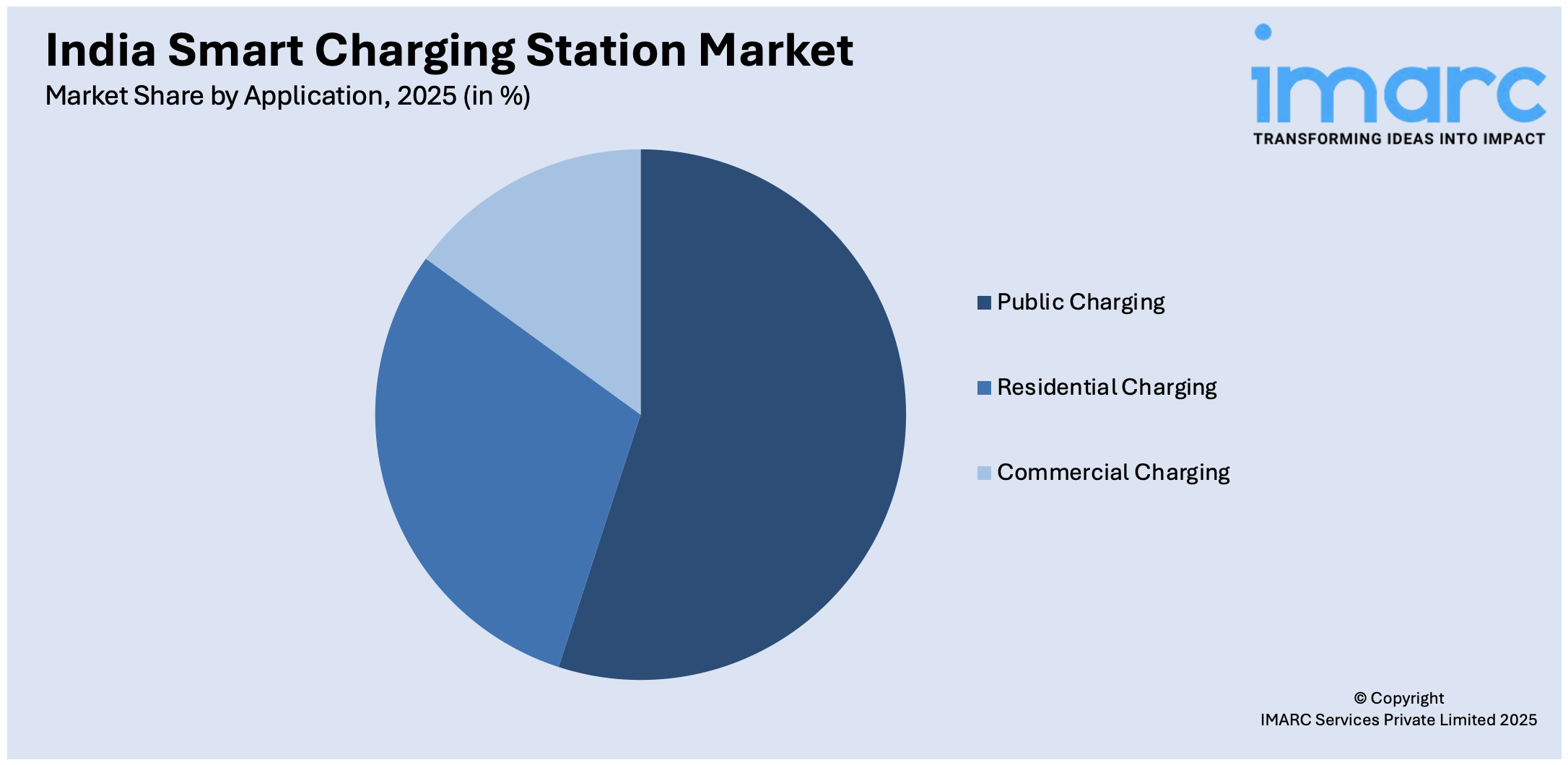

Application Insights:

Access the comprehensive market breakdown Request Sample

- Public Charging

- Residential Charging

- Commercial Charging

The report has provided a detailed breakup and analysis of the market based on the application. This includes public charging, residential charging , and commercial charging.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Charging Station Market News:

- In February 2025, TATA.ev revealed its 'Open Collaboration 2.0' initiative designed to enhance the local electric vehicle charging infrastructure, with goals to increase the number of charging stations to exceed 400,000 within the following 2 years. Additionally, by enhancing its collaboration with charging point operators (CPOs), it aims to install 30,000 public charging points that will be able to serve nationwide EV users.

- In February 2025, electric commercial vehicle manufacturer Euler Motors announced a partnership with Tata Power Renewables for rapid chargers. According to the long-term Memorandum of Understanding (MoU), Tata Power Renewables will supply rapid chargers for Euler Motors' customers, the company stated. As a result, Euler Motors customers will gain access to rapid chargers at key high-traffic spots along their usual routes.

- In February 2025, Ather Energy joined forces with ChargeMOD to enhance its electric vehicle (EV) charging network in Kerala. This partnership will allow EV users who are utilizing the LECCS (Light Electric Combined Charging System) type connector to access 121 additional charging sites throughout the state.

- In April 2025, Charge Zone achieved a significant milestone by growing its network to more than 13,500 charging stations, establishing it as the largest electric vehicle charging platform in the nation.

India Smart Charging Station Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Charging Technologies Covered | DC Charging, AC Charging, Wireless Charging |

| Connectivities Covered | Wi-Fi, Cellular, LAN |

| Battery Technologies Covered | Lithium-Ion, Solid-state Batteries |

| Applications Covered | Public Charging, Commercial Charging, Residential Charging |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart charging station market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart charging station market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart charging station industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India smart charging station market was valued at USD 1.7 Billion in 2025.

The India smart charging station market is projected to exhibit a CAGR of 21.65% during 2026-2034, reaching a value of USD 10.2 Billion by 2034.

The India smart charging station market is driven by accelerating EV adoption, supportive government policies including subsidies and the FAME scheme, and partnerships between automakers and energy providers. Urban infrastructure development, 5G connectivity for advanced management, and rising consumer demand for fast and convenient charging are also propelling market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)