India Smart Conveyor Belt Systems Market Size, Share, Trends and Forecast by Product, Application, and Region, 2026-2034

India Smart Conveyor Belt Systems Market Overview:

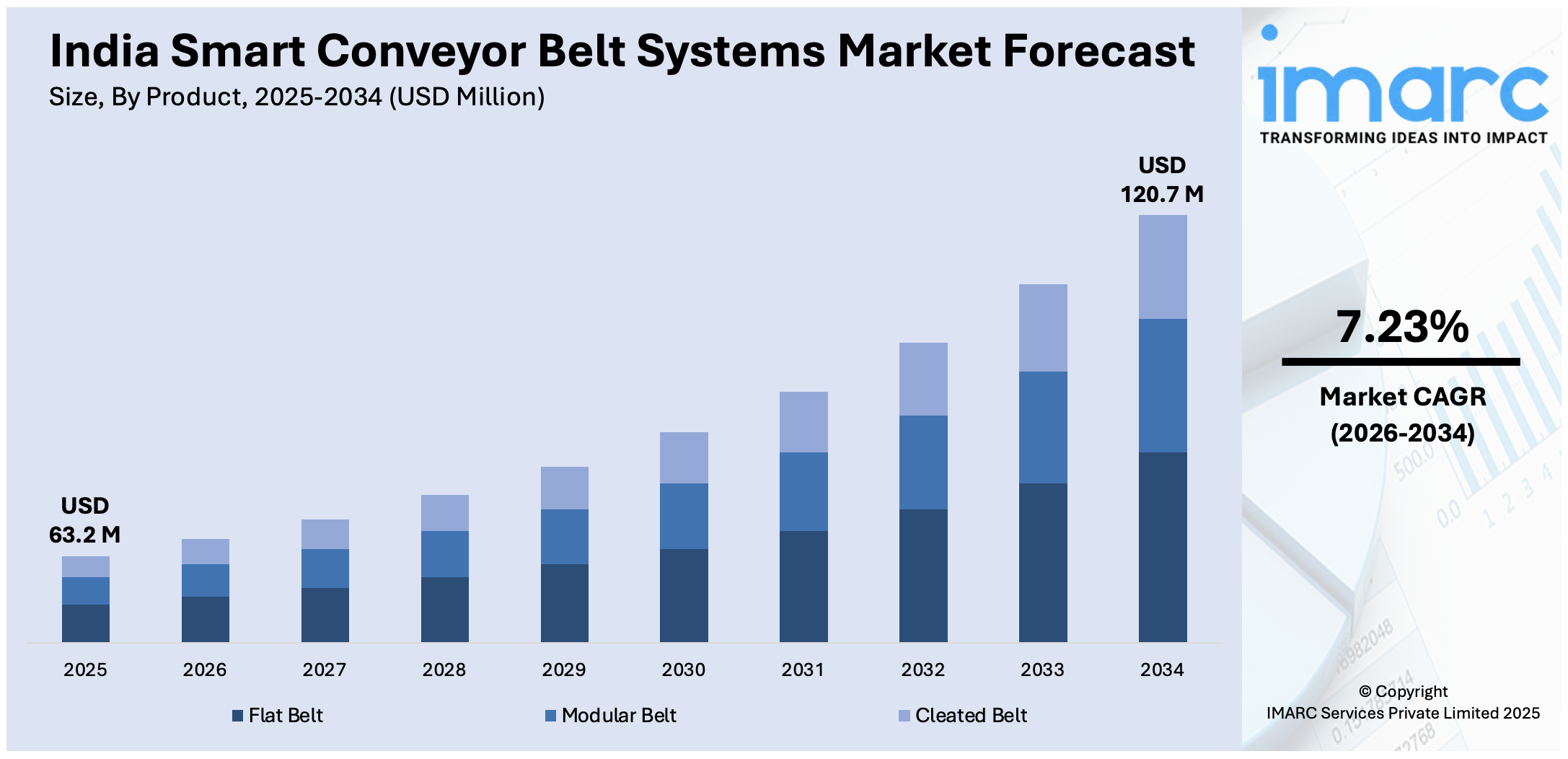

The India smart conveyor belt systems market size reached USD 63.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 120.7 Million by 2034, exhibiting a growth rate (CAGR) of 7.23% during 2026-2034. Rising industrial automation, rapid growth in manufacturing and logistics sectors, and increased focus on operational efficiency are key drivers of India’s smart conveyor belt systems market. Demand for real-time tracking, reduced labor costs, and integration of Internet of Things (IoT) and artificial intelligence (AI) technologies further propel adoption across automotive, food processing, and e-commerce industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 63.2 Million |

| Market Forecast in 2034 | USD 120.7 Million |

| Market Growth Rate 2026-2034 | 7.23% |

India Smart Conveyor Belt Systems Market Trends:

Integration of IoT and Predictive Maintenance

One of the prominent trends in India’s smart conveyor belt systems market is the growing integration of Internet of Things (IoT) and predictive maintenance solutions. Manufacturers are increasingly adopting sensor-based technologies to enable real-time monitoring of system performance, allowing early detection of wear, tear, or mechanical faults. According to studies, predictive maintenance can reduce unplanned downtime by 30–50% and increase equipment life by 20–40%, making it highly attractive to Indian industries. Powered by artificial intelligence (AI) and machine learning (ML), predictive analytics supports timely maintenance planning and optimizes conveyor throughput. This trend is gaining momentum in sectors like automotive, pharmaceuticals, and food processing, where uninterrupted production is critical. Data-driven decision-making is reshaping conveyor systems into intelligent, self-regulating networks.

To get more information on this market Request Sample

Rising Adoption of Modular and Flexible Conveyor Designs

The market in India is witnessing a growing inclination toward modular and flexible smart conveyor systems, driven by the need for scalability and adaptability in dynamic production environments. Industries are increasingly preferring systems that can be quickly reconfigured, extended, or relocated with minimal downtime and capital investment. These module-based solutions enable the manufacturers to react quickly to evolving product lines, packaging modes, and process needs. In industries where rapid customization and shorter product lifecycles are the norm, such as electronics, FMCG, and e-commerce, the trend is especially prevalent. Flexible conveyor designs also make it possible to integrate automation and robotics systems, facilitating the efficient processing of a wide range of product shapes and sizes. This pattern is a continuation of India's broader shift towards agile supply chain management and lean manufacturing.

Emphasis on Energy Efficiency and Sustainability

Energy-efficient conveyor belt systems are proving to be a prominent trend in the Indian market, coinciding with the increased focus on environmentally friendly industrial operations. Intelligent conveyors with energy-saving motors, regenerative braking systems, and low-friction parts are becoming increasingly popular among manufacturers looking to minimize operational expenses and carbon footprints. Moreover, eco-friendly material usage in belt fabrication and recyclable system parts are also in harmony with green manufacturing guidelines. Energy monitoring software within such systems allows for real-time monitoring of power usage, enabling more effective energy management practices. The trend is also supported by regulatory policies and corporate sustainability objectives that compel industries to use cleaner technologies. Consequently, energy-efficient smart conveyor systems are becoming the hallmark of sustainable and cost-saving industrial automation in India.

India Smart Conveyor Belt Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and application.

Product Insights:

- Flat Belt

- Modular Belt

- Cleated Belt

The report has provided a detailed breakup and analysis of the market based on the product. This includes flat belt, modular belt, and cleated belt.

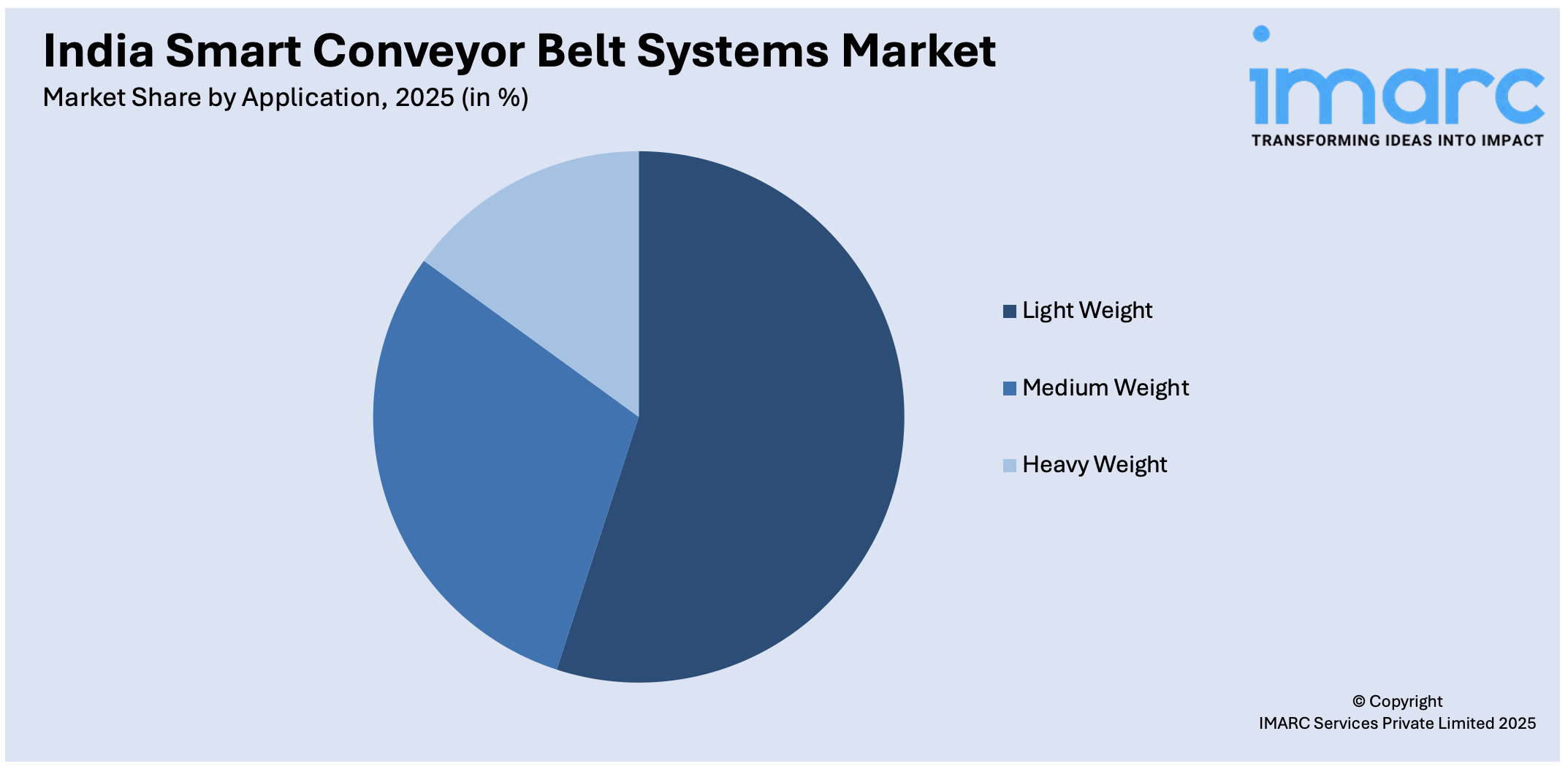

Application Insights:

Access the comprehensive market breakdown Request Sample

- Light Weight

- Medium Weight

- Heavy Weight

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes light weight, medium weight, and heavy weight.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Conveyor Belt Systems Market News:

- In September 2024, International Conveyors Ltd. acquired equity shares worth ₹6.89 crore in Sterling and Wilson Renewable Energy, a leading solar EPC solutions provider. This move follows the company’s earlier investment in Bajaj Finance. While ICL primarily manufactures and markets FRAS PVC Conveyor Belting for hazardous underground mining applications, this strategic investment diversifies its portfolio, aligning with the growing renewable energy sector and enhancing its business expansion initiatives.

- In April 2023, Omtech Food Engineering, a leading conveyor system manufacturer based in Rajkot, Gujarat, launched its next-generation Conveyor Belt System for enhanced food processing operations. The new range includes customized solutions across four key categories: manufacturing, food application, parcel, and packaging conveyors. Featuring advanced systems like modular belts, telescopic conveyors, spiral systems, and zero-pressure accumulation conveyors, Omtech aims to streamline food, pharma, and warehouse operations with innovative, tailored conveying solutions.

India Smart Conveyor Belt Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Flat Belt, Modular Belt, Cleated Belt |

| Applications Covered | Light Weight, Medium Weight, Heavy Weight |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart conveyor belt systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart conveyor belt systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart conveyor belt systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart conveyor belt systems market in India was valued at USD 63.2 Million in 2025.

The India smart conveyor belt systems market is projected to exhibit a CAGR of 7.23% during 2026-2034, reaching a value of USD 120.7 Million by 2034.

Rising automation in manufacturing, logistics, and mining is propelling India’s smart conveyor belt systems market. Demand for efficient material handling, reduced labor costs, and real-time monitoring drives adoption. Integration with IoT, AI, and sensors enhances operational efficiency, predictive maintenance, and supply chain optimization, supporting industrial growth and improving workflow automation across multiple sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)