India Smart Conveyor Systems Market Size, Share, Trends and Forecast by Component, Product Type, Technology, Automation Level, Industry Vertical, and Region, 2025-2033

India Smart Conveyor Systems Market Overview:

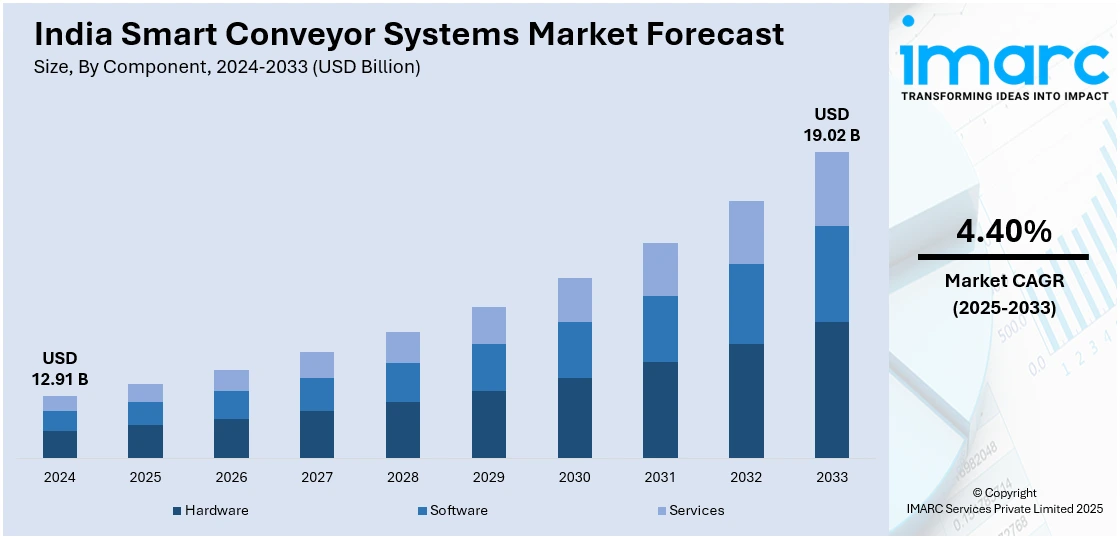

The India smart conveyor systems market size reached USD 12.91 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 19.02 Billion by 2033, exhibiting a growth rate (CAGR) of 4.40% during 2025-2033. The market is propelled by IoT integration, AI-driven automation, and amplified demand for complete automation solutions in industries, such as e-commerce and manufacturing. These technologies increase efficiency, minimize downtime, and facilitate large-scale operations. As industries continue to become more modernized and incorporate intelligent logistics solutions, the market is set for long-term growth. The heightened focus on automation has significantly grown the India smart conveyor systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.91 Billion |

| Market Forecast in 2033 | USD 19.02 Billion |

| Market Growth Rate 2025-2033 | 4.40% |

India Smart Conveyor Systems Market Trends:

Expansion of IoT-Powered Intelligent Conveyor Systems in India

India's smart conveyor system market has witnessed significant growth with the integration of Internet of Things (IoT) technologies. IoT-based conveyor systems provide real-time monitoring, predictive maintenance, and enhanced operational efficiency. As industries in India aim to automate, demand for such advanced systems has risen. For instance, in February 2024, Martin Engineering launched the Martin® Tracker™ HD belt conveyor alignment system that automatically tracks belts to reduce downtime, maintenance, and operating costs, boosting productivity with minimal interference. In addition, the ability to gather and process data along each section of the conveyor system enables companies to streamline their operations, reduce downtime, and maximize overall productivity. This technology, aside from enhancing system reliability, also contributes to lowering costs and ensuring enhanced operational responsiveness. As industries like e-commerce, logistics, and manufacturing witness growing momentum with the world experiencing a rapidly rising growth rate, the adoption of IoT in conveyor systems is poised to increase even more, leading India smart conveyor systems market growth to be positive. The future of the India smart conveyor systems market is looking bright, with accelerating investments being made in digital technologies and automation.

To get more information on this market, Request Sample

Growing Adoption of AI-Powered Conveyor Systems

Artificial Intelligence (AI) is developing most, acting as the driver for India smart conveyor systems market growth. AI-powered conveyor systems make use of machine learning (ML) algorithms to automate processes that are sophisticated, optimize material handling processes, and improve decision-making. Defect detection, predicting failure, and real-time adjustments of operations depending on environmental conditions and operating needs are made possible by these types of conveyor systems. With changing AI technology, they have spread extensively and are now affordable for companies of all sizes, becoming a valued asset for various industries. Manufacturing, e-commerce, and food processing sectors in India are rapidly implementing AI to streamline processes and boost productivity. The proportion of India smart conveyor systems in AI-based technologies is growing extremely quickly, and the future for these systems is bright with increasing companies investing in AI-based automation solutions, which will be a critical part of meeting the requirements of an expanding industrial landscape.

Increasing Demand for Fully Automated Conveyor Systems in E-commerce

Indian logistics and e-commerce sector is witnessing a boom with the rise in demand for completely automated conveyor systems skyrocketing. Conveyer systems allow for high-speed, efficient, and precise material handling, from picking order to packing to shipping. Automation takes precedence when e-commerce business managers initiate operations, and large volumes of products have to be managed well within timely delivery schedules as well as reaching precision. Demand for flexibility, scalability, and reducing human intervention in warehouse management is increasing the use of fully automated conveyor systems. Due to the continuous rise in the Indian online retail market, demand for fully automated conveyor systems will keep on rising, and encouraging amounts of e-commerce entities will be investing in high-tech conveyor solutions. For example, in May 2023, Bastian Solutions formally opened its first conveyor manufacturing plant in Bangalore, India, a major expansion of its technology capabilities and facilitating the relocation of manufacturing under the "Make in India" initiative by localized production for retail, e-commerce, and manufacturing industries. Also, the India smart conveyor system market is anticipated to significantly increase with this rise in the adoption of automation, thus pushing India towards emerging as a technologically evolved supply chain system.

India Smart Conveyor Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, product type, technology, automation level, and industry vertical.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Product Type Insights:

- Belt Conveyors

- Roller Conveyors

- Overhead Conveyors

- Pallet Conveyors

- Sortation Systems

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes belt conveyors, roller conveyors, overhead conveyors, pallet conveyors, and sortation systems.

Technology Insights:

- IoT-Enabled Conveyors

- AI-Driven Systems

- Robotic Integration

- RFID and Barcode Scanning

The report has provided a detailed breakup and analysis of the market based on the technology. This includes IoT-enabled conveyors, AI-driven systems, robotic integration, and RFID and barcode scanning.

Automation Level Insights:

- Semi-Automated Conveyor Systems

- Fully Automated Conveyor Systems

A detailed breakup and analysis of the market based on the automation level have also been provided in the report. This includes semi-automated conveyor systems and fully automated conveyor systems.

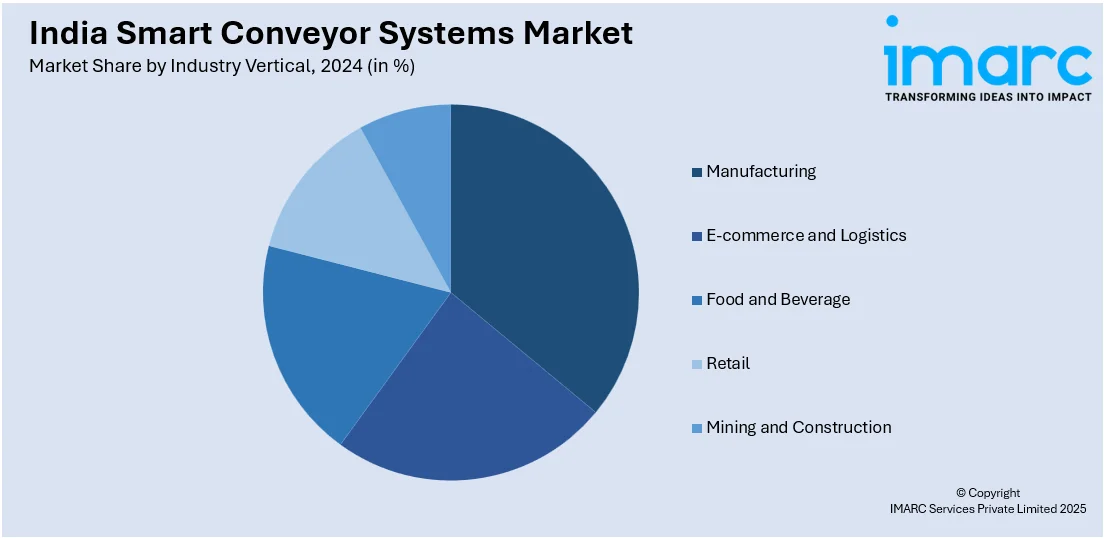

Industry Vertical Insights:

- Manufacturing

- E-commerce and Logistics

- Food and Beverage

- Retail

- Mining and Construction

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes manufacturing, e-commerce and logistics, food and beverage, retail, and mining and construction.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Conveyor Systems Market News:

- In November 2024, NMDC inaugurated its "Transformation and Innovation" vertical to spearhead technological innovation in India's mining industry. As part of the initiative, NMDC plans to install smart technologies such as RopeCon Conveyor System, improve efficiency, sustainability, and automation of operations. The move is part of NMDC's focus on cutting-edge, forward-looking technology in mining and logistics.

- In November 2024, Siemens launched the SIMATIC ET 200SP e-Starter with semiconductor technology for conveyor systems. With ultra-short-circuit protection, 1,000 times faster than conventional solutions as it reduces downtime, wear, and maintenance. Fully integrated with TIA Portal, it enhances efficiency, reliability, and sustainability in industries like food processing and intralogistics

India Smart Conveyor Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Product Types Covered | Belt Conveyors, Roller Conveyors, Overhead Conveyors, Pallet Conveyors, Sortation Systems |

| Technologies Covered | IoT-Enabled Conveyors, AI-Driven Systems, Robotic Integration, RFID and Barcode Scanning |

| Automation Levels Covered | Semi-Automated Conveyor Systems, Fully Automated Conveyor Systems |

| Industry Verticals Covered | Manufacturing, E-commerce and Logistics, Food and Beverage, Retail, Mining and Construction |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart conveyor systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart conveyor systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart conveyor systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India smart conveyor systems market was valued at USD 12.91 Billion in 2024.

The India smart conveyor systems market is projected to exhibit a CAGR of 4.40% during 2025-2033, reaching a value of USD 19.02 Billion by 2033.

The India smart conveyor systems market is driven by rapid industrial automation, growth in e-commerce and warehousing, and increasing focus on manufacturing efficiency. Rising adoption of Industry 4.0 technologies, along with government initiatives like “Make in India,” further fuels demand for intelligent, sensor-based conveyor systems across logistics, automotive, and food processing sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)