India Smart Energy Meters Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

India Smart Energy Meters Market Overview:

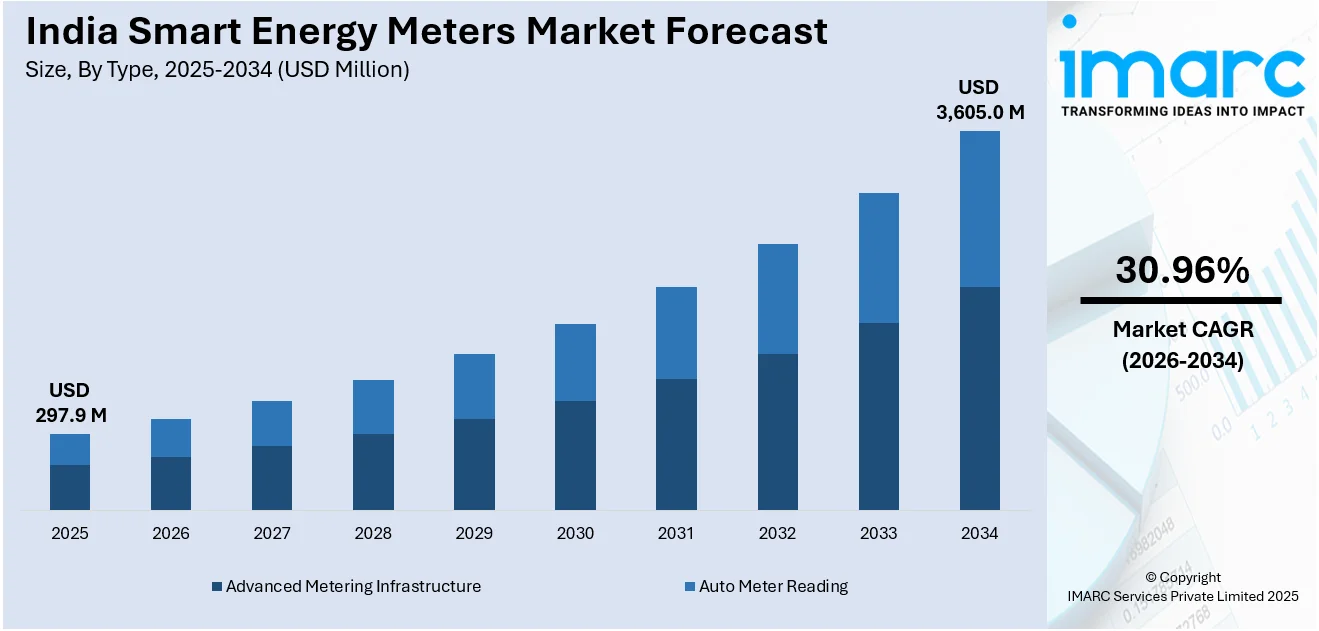

The India smart energy meters market size reached USD 297.9 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 3,605.0 Million by 2034, exhibiting a growth rate (CAGR) of 30.96% during 2026-2034. Government initiatives, rising electricity demand, grid modernization, reduction of power theft, growing smart grid deployment, increasing consumer awareness, and investments in advanced metering infrastructure for real-time energy monitoring and efficiency are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 297.9 Million |

| Market Forecast in 2034 | USD 3,605.0 Million |

| Market Growth Rate 2026-2034 | 30.96% |

India Smart Energy Meters Market Trends:

Advancing Smart Metering for Energy Efficiency

The adoption of advanced metering solutions is accelerating, transforming energy distribution and management. Large-scale deployments are enhancing operational efficiency, creating significant opportunities for modernization. Efforts are focused on reducing inefficiencies in power distribution, with smart meters playing a crucial role in optimizing grid performance. Strategic partnerships are driving the expansion of digital infrastructure, ensuring better energy management and financial stability for utilities. As smart technology integration progresses, it is strengthening grid resilience and streamlining power distribution. The emphasis on automation and real-time monitoring is improving transparency, minimizing losses, and supporting a more sustainable energy ecosystem. With continued investment and collaboration, digital metering is becoming a core component of energy infrastructure, paving the way for a more efficient future. For example, as of October 2024, approximately 117.7 million meters have been awarded, with 14.5 million already installed. This initiative presents a USD 20 Billion opportunity for the energy sector, aiming to reduce aggregate technical and commercial (AT&C) losses from 22% to an estimated 12-15%. In a significant development, EDF India and Actis have formed a joint venture to deploy smart metering infrastructure, enhancing energy efficiency and reducing losses in the power sector.

To get more information on this market Request Sample

Accelerating Smart Energy and Automation Solutions

Innovative energy management and automation technologies are gaining momentum, driving efficiency and sustainability in the power sector. The focus is shifting toward advanced solutions such as gas-free switchgear, intelligent automation, and AI-powered services that enhance operational control and reduce environmental impact. The push for electric mobility is also influencing developments, with integrated EV solutions becoming a key part of modern infrastructure. As digital transformation expands, automation is improving grid reliability, optimizing resource use, and supporting industrial self-sufficiency. These advancements align with broader sustainability goals, promoting cleaner, smarter, and more resilient energy networks. With increased investment in intelligent systems, energy distribution is becoming more adaptive, ensuring long-term efficiency while fostering a more connected and sustainable energy ecosystem. For instance, in February 2025, Schneider Electric showcased advanced energy management and automation technologies at ELECRAMA 2025, reinforcing its commitment to India's energy transition. Key innovations included gas-free switchgear, smart automation, EV solutions, and AI-driven services, supporting India's sustainability and industrial self-reliance goals.

India Smart Energy Meters Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on type and application.

Type Insights:

- Advanced Metering Infrastructure

- Auto Meter Reading

The report has provided a detailed breakup and analysis of the market based on the type. This includes advanced metering infrastructure and auto meter reading.

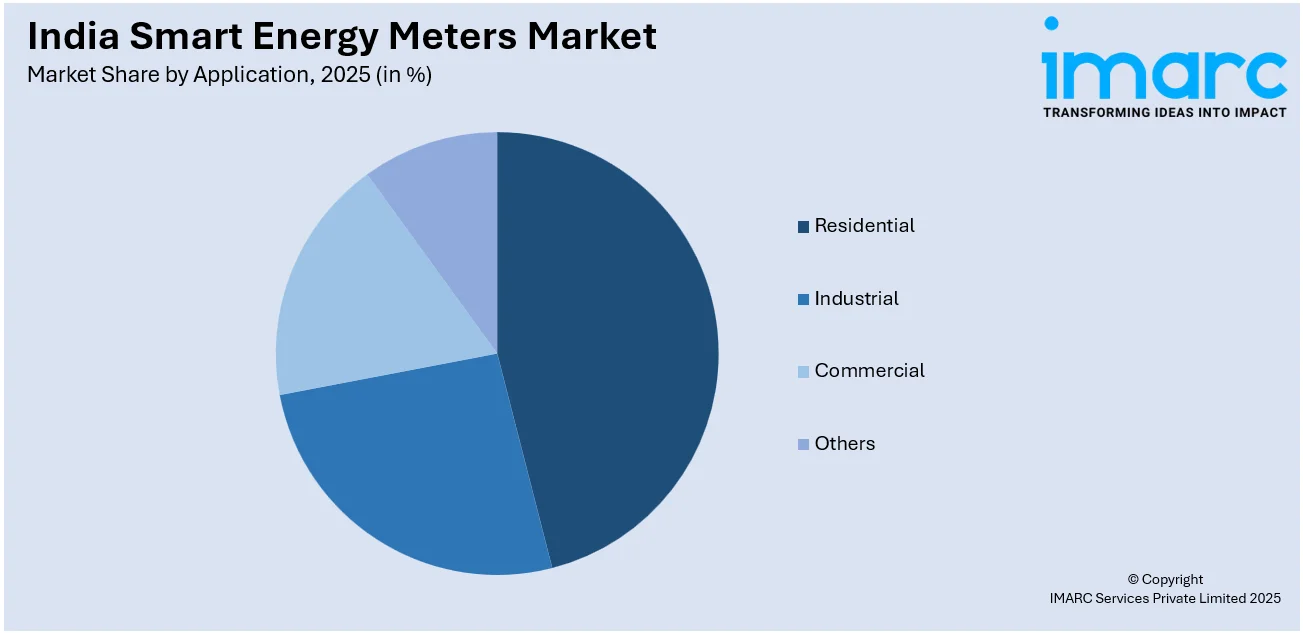

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Industrial

- Commercial

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential, industrial, commercial, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Energy Meters Market News:

- In February 2025, Wirepas achieved a significant milestone by deploying over 5 million smart electricity meters across India. Leveraging Wirepas Mesh technology, these meters enhance operational efficiency and enable real-time energy management. The deployment boasts a 99.9% reliability rate and spans multiple states, including Assam, Bihar, Gujarat, Jammu & Kashmir, Ladakh, Madhya Pradesh, Maharashtra, Uttar Pradesh, and West Bengal. This initiative aligns with India's goal to install 250 million smart meters by 2025.

- In December 2024, Silicon Labs shipped 4 million FG23 system-on-chip (SoC) devices integrated with Wirepas Mesh connectivity for India's advanced metering infrastructure. This collaboration enhances the scalability and reliability of smart meter deployments, ensuring 99.9% data delivery accuracy. The solution's cost efficiency and resilience in dense urban and expansive rural settings align with India's Revamped Distribution Sector Scheme (RDSS) standards, aiming to modernize the nation's energy infrastructure.

India Smart Energy Meters Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Advanced Metering Infrastructure, Auto Meter Reading |

| Applications Covered | Residential, Industrial, Commercial, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart energy meters market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart energy meters market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart energy meters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India smart energy meters market was valued at USD 297.9 Million in 2025.

The India smart energy meters market is projected to exhibit a CAGR of 30.96% during 2026-2034, reaching a value of USD 3,605.0 Million by 2034.

The India smart energy meters market is driven by government mandates for smart grid rollout, increasing energy efficiency goals, and rising electricity demand. Utility companies adopt advanced metering to reduce losses and enhance billing accuracy. Growing renewable energy integration and consumer awareness of usage data further accelerate deployment across urban and rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)