India Smart Factory Automation Market Size, Share, Trends and Forecast by Technology, Component, Deployment Mode, Industry Vertical, and Region, 2025-2033

India Smart Factory Automation Market Overview:

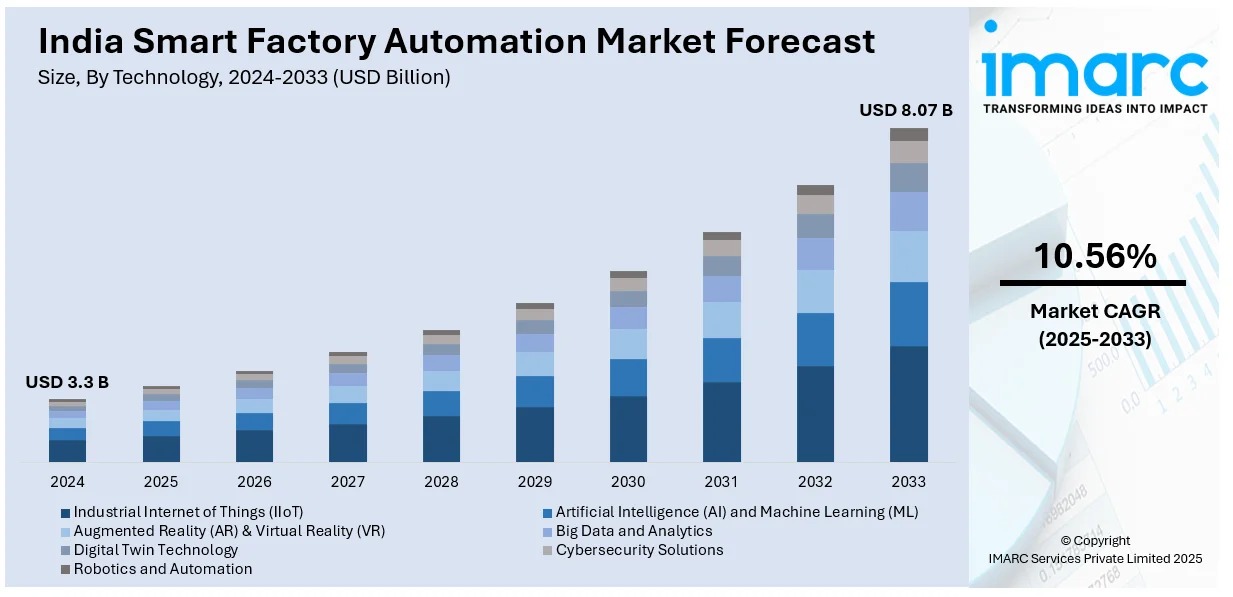

The India smart factory automation market size reached USD 3.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.07 Billion by 2033, exhibiting a growth rate (CAGR) of 10.56% during 2025-2033. Increasing adoption of Industry 4.0, demand for energy efficiency, rising labor costs, government initiatives, digital transformation in manufacturing, and integration of IoT, AI, and robotics for real-time monitoring and process optimization are some of the factors contributing to India smart factory automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.3 Billion |

| Market Forecast in 2033 | USD 8.07 Billion |

| Market Growth Rate 2025-2033 | 10.56% |

India Smart Factory Automation Market Trends:

Push for Zero-Defect and Intelligent Manufacturing

India is witnessing a growing focus on intelligent automation solutions that support zero-defect production goals. Key industries including automotive, aerospace, and electronics are rapidly integrating advanced assembly technologies such as automated tightening and dispensing systems. Alongside these, real-time data integration and software-driven quality checks are becoming essential components in modern production setups. The adoption of such solutions signals a shift toward more precise, traceable, and efficient manufacturing ecosystems aligned with Industry 4.0 principles. These factors are intensifying the India smart factory automation market growth. For example, in April 2025, Atlas Copco launched its first Smart Factory Innovation Centre in Pune, targeting India's smart manufacturing sector. The facility showcases automated tightening and dispensing technologies, error-proofing systems, and integrated software solutions for zero-defect production. It aims to support industries like automotive, aerospace, and electronics in adopting Industry 4.0 practices.

To get more information on this market, Request Sample

AIoT Integration in Industrial Automation

The domestic landscape for smart factory systems is shifting toward deeper integration of AIoT and edge computing solutions. Industrial units are increasingly exploring digital transformation services that combine automation hardware with intelligent software platforms. This shift is supported by favorable policies like the Production Linked Incentive (PLI) scheme and rising demand from sectors prioritizing connected, efficient, and scalable manufacturing. As adoption spreads, solutions offering real-time analytics, device interoperability, and modular automation are becoming central to next-generation factory environments across India. For instance, in March 2025, Foxconn's subsidiary Ennoconn announced its plans to enter the Indian market by registering a company in Tamil Nadu to deliver AIoT and industrial digital transformation solutions. This move strengthens India’s smart factory automation landscape, backed by growing demand and supportive government policies like the PLI scheme. Ennoconn aims to provide advanced industrial computing systems, enhancing automation capabilities across key sectors in line with India’s push for smart manufacturing.

India Smart Factory Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, component, deployment mode, and industry vertical.

Technology Insights:

- Industrial Internet of Things (IIoT)

- Artificial Intelligence (AI) and Machine Learning (ML)

- Augmented Reality (AR) & Virtual Reality (VR)

- Big Data and Analytics

- Digital Twin Technology

- Cybersecurity Solutions

- Robotics and Automation

The report has provided a detailed breakup and analysis of the market based on the technology. This includes Industrial Internet of Things (IIoT), artificial intelligence (AI) and machine learning (ML), augmented reality (AR) & virtual reality (VR), big data and analytics, digital twin technology, cybersecurity solutions, and robotics and automation.

Component Insights:

- Sensors and Actuators

- Industrial Robots

- Human-Machine Interface (HMI)

- Industrial Control Systems (SCADA, PLC, DCS)

- Networking and Communication Systems

- Software and Cloud Solutions

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes sensors and actuators, industrial robots, human-machine interface (HMI), industrial control systems (SCADA, PLC, DCS), networking and communication systems, and software and cloud solutions.

Deployment Mode Insights:

- On-Premise

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premise and cloud-based.

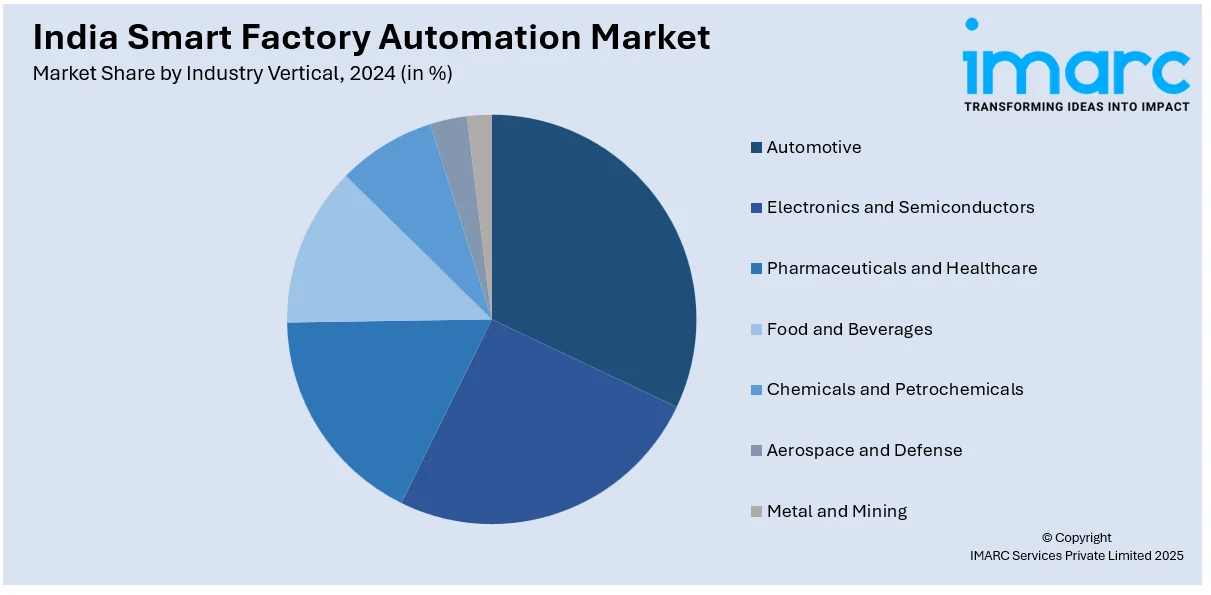

Industry Vertical Insights:

- Automotive

- Electronics and Semiconductors

- Pharmaceuticals and Healthcare

- Food and Beverages

- Chemicals and Petrochemicals

- Aerospace and Defense

- Metal and Mining

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes automotive, electronics and semiconductors, pharmaceuticals and healthcare, food and beverages, chemicals and petrochemicals, aerospace and defense, and metal and mining.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Factory Automation Market News:

- In April 2025, Daifuku inaugurated a new smart factory in Hyderabad, focused on manufacturing material handling systems with advanced automation. The facility integrates Industry 4.0 technologies to boost production efficiency and meet growing demand in India’s industrial and warehousing sectors. This investment marks Daifuku’s strategic expansion in India’s automation landscape, aiming to serve sectors like manufacturing, logistics, and automotive with locally produced automation solutions.

India Smart Factory Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Industrial Internet of Things (IIoT), Artificial Intelligence (AI) and Machine Learning (ML), Augmented Reality (AR) & Virtual Reality (VR), Big Data and Analytics, Digital Twin Technology, Cybersecurity Solutions, Robotics and Automation |

| Components Covered | Sensors and Actuators, Industrial Robots, Human-Machine Interface (HMI), Industrial Control Systems (SCADA, PLC, DCS), Networking and Communication Systems, Software and Cloud Solutions |

| Deployment Modes Covered | On-Premise, Cloud-Based |

| Industry Verticals Covered | Automotive, Electronics and Semiconductors, Pharmaceuticals and Healthcare, Food and Beverages, Chemicals and Petrochemicals, Aerospace and Defense, Metal and Mining |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart factory automation market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart factory automation market on the basis of technology?

- What is the breakup of the India smart factory automation market on the basis of component?

- What is the breakup of the India smart factory automation market on the basis of deployment mode?

- What is the breakup of the India smart factory automation market on the basis of industry vertical?

- What is the breakup of the India smart factory automation market on the basis of region?

- What are the various stages in the value chain of the India smart factory automation market?

- What are the key driving factors and challenges in the India smart factory automation market?

- What is the structure of the India smart factory automation market and who are the key players?

- What is the degree of competition in the India smart factory automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart factory automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart factory automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart factory automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)