India Smart Home Energy Management Device Market Size, Share, Trends and Forecast by Component, Communication Technology, and Region, 2026-2034

India Smart Home Energy Management Device Market Overview:

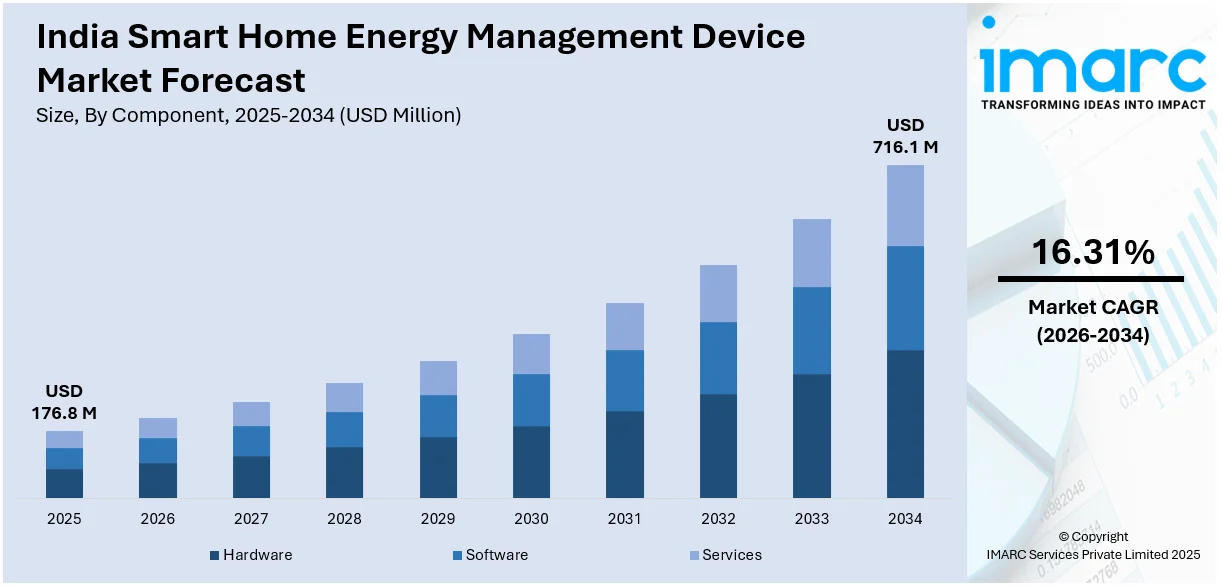

The India smart home energy management device market size reached USD 176.8 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 716.1 Million by 2034, exhibiting a growth rate (CAGR) of 16.31% during 2026-2034. The market is growing due to rising demand for energy-efficient appliances, real-time monitoring, automation, and air quality control. Local manufacturing, smart meter adoption, and IoT integration are further driving residential digital energy solutions across urban households and new constructions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 176.8 Million |

| Market Forecast in 2034 | USD 716.1 Million |

| Market Growth Rate 2026-2034 | 16.31% |

India Smart Home Energy Management Device Market Trends:

Real-Time Monitoring Accelerating Smart Adoption

The growing preference for intelligent electricity consumption tracking is shaping the Indian smart home energy management device market. Consumers are now prioritizing real-time data visibility, tamper alerts, outage notifications, and seamless connectivity. This has led to increased demand for advanced metering solutions that reduce manual intervention and human errors. Utilities are also favoring automated systems that support efficient billing, fault detection, and energy optimization. These preferences are creating opportunities for companies to introduce smart, digitally integrated solutions with mobile accessibility and high accuracy. In May 2024, Oakter launched OAKMETER, a smart energy meter equipped with Advanced Metering Infrastructure (AMI), IoT integration, and 4G connectivity. Designed to transmit consumption data every 15 or 30 minutes, it supports tamper detection and mobile visibility, improving utility communication and customer engagement. The product's impact is visible across households and distribution systems, where automated monitoring helps improve transparency, operational efficiency, and power savings. Oakter's manufacturing expansion, aimed at producing one million meters per month, reflects rising demand and aligns with India's digital energy reforms. As the market shifts towards smarter homes, such innovations are setting new benchmarks for precision, reliability, and integration in everyday energy usage.

To get more information on this market Request Sample

Automation and Design Driving Market Growth

Digital home infrastructure in India is rapidly evolving, driven by the dual demand for energy-efficient automation and elegant design. Consumers are seeking devices that blend into modern interiors while delivering high-performance energy control and monitoring. There's also growing awareness around air quality and hygiene, encouraging the adoption of smart switches and home automation systems that go beyond traditional functionality. This trend is supported by the rising construction of smart homes and increased developer interest in integrated digital ecosystems. In July 2024, Schneider Electric introduced Wiser 2.0 and Miluz Lara at BuildCon Goa. Wiser 2.0 enables easy automation and energy monitoring, while Miluz Lara switches offer air quality indicators and SmartThings integration, all locally manufactured to serve India's evolving needs. This development has helped redefine how Indian households manage comfort, safety, and energy use. The ability to automate appliances, track power consumption, and receive maintenance alerts has strengthened adoption among residential users and builders. With Wi-Fi-enabled control and customizable designs, Schneider's solutions appeal to both homeowners and professionals. The market is witnessing a steady shift from manual systems to responsive digital platforms, further boosting the smart home energy management ecosystem in India.

India Smart Home Energy Management Device Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2026-2034. Our report has categorized the market based on component and communication technology.

Component Insights:

- Hardware

- Smart Meters

- Energy Monitors

- Smart Plugs

- Others

- Software

- Energy Analytics Software

- Home Energy Management Platforms

- Others

- Services

- Consulting and Energy Audits

- Installation and Integration Services

- Maintenance and Support Services

- Others

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware (smart meters, energy monitors, smart plugs, and others), software (energy analytics software, home energy management platforms, and others), services (consulting and energy audits, installation and integration services, maintenance and support services, and others).

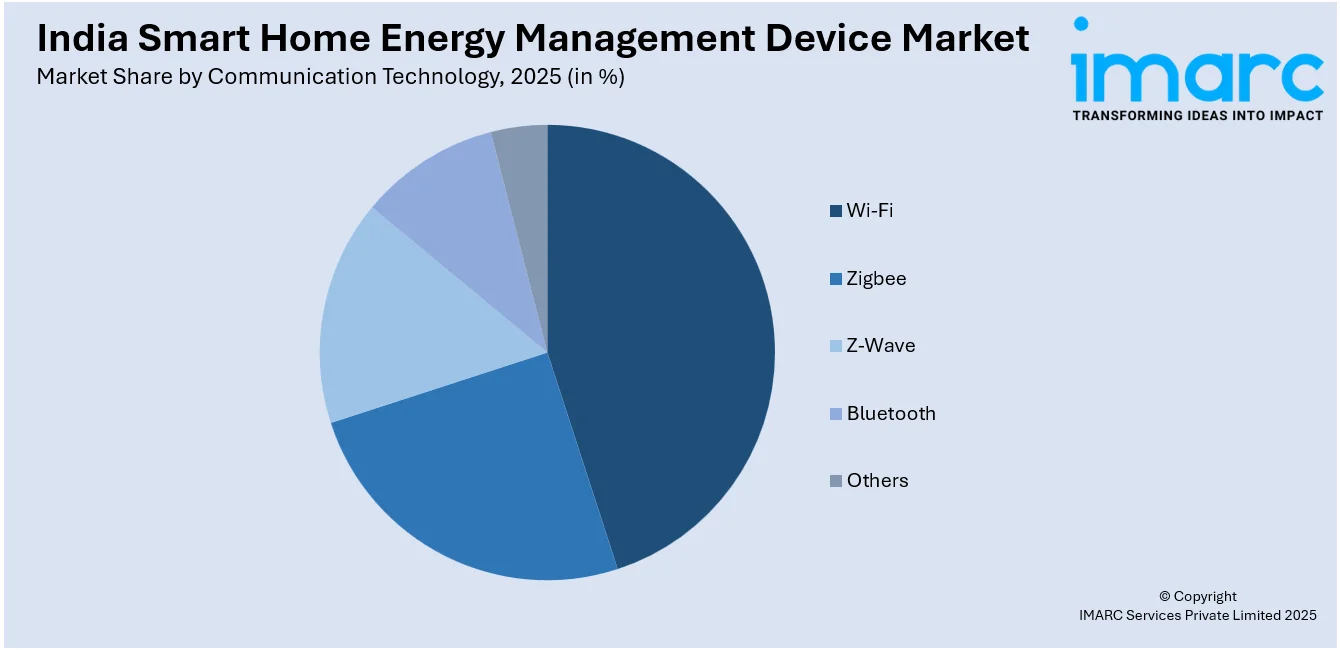

Communication Technology Insights:

Access the comprehensive market breakdown Request Sample

- Wi-Fi

- Zigbee

- Z-Wave

- Bluetooth

- Others

A detailed breakup and analysis of the market based on the communication technology have also been provided in the report. This includes wi-fi, ZigBee, Z-Wave, Bluetooth, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Home Energy Management Device Market News:

- February 2025: Lauritz Knudsen launched smart-ready electrical solutions at ELECRAMA 2025, including digital MCCBs with modular trip units. The launch strengthened India’s smart home energy management device industry by supporting system automation, efficient load control, and renewable energy integration across connected home environments.

- February 2025: Samsung launched its Bespoke AI Refrigerator series in India, featuring AI Energy Mode, SmartThings integration, and Twin Cooling Plus. This advanced smart home energy management device enhanced user control, enabled energy savings, and supported sustainable, connected living for modern Indian households.

India Smart Home Energy Management Device Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered |

|

| Types Covered | Wi-Fi, Zigbee, Z-Wave, Bluetooth, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart home energy management device market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart home energy management device market on the basis of component?

- What is the breakup of the India smart home energy management device market on the basis of communication technology?

- What are the various stages in the value chain of the India smart home energy management device market?

- What are the key driving factors and challenges in the India smart home energy management device market?

- What is the structure of the India smart home energy management device market and who are the key players?

- What is the degree of competition in the India smart home energy management device market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart home energy management device market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart home energy management device market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart home energy management device industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)