India Smart Home Security Market Size, Share, Trends and Forecast by Product, Residence Type, and Region, 2026-2034

India Smart Home Security Market Overview:

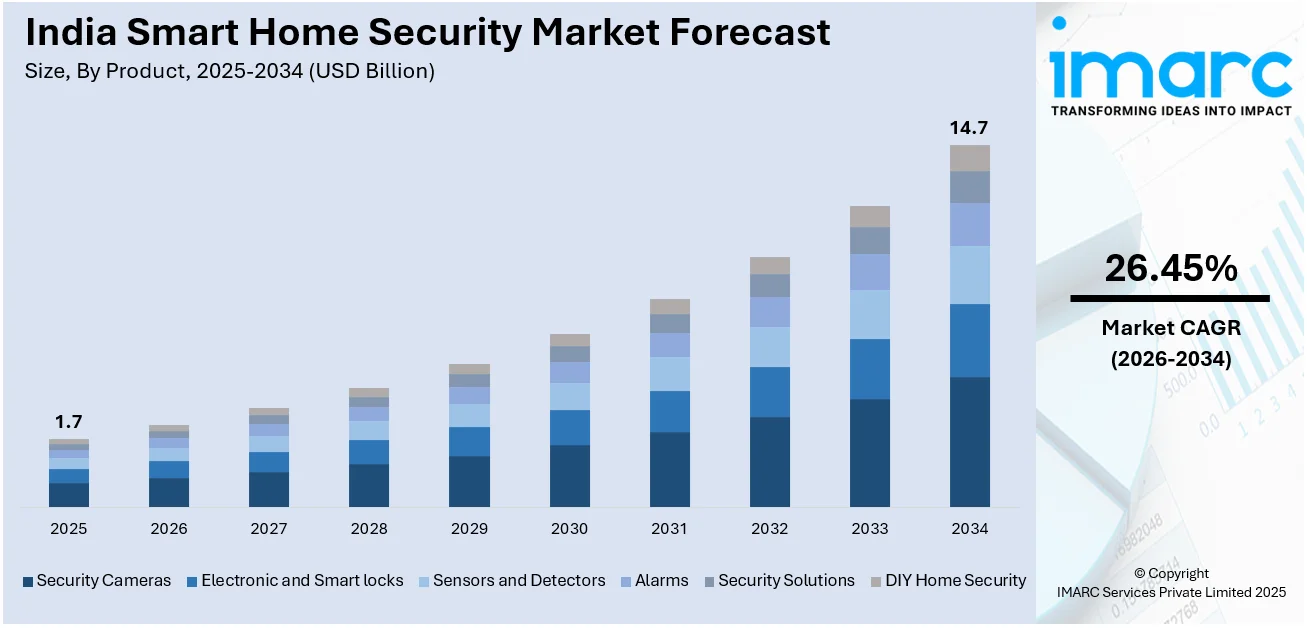

The India smart home security market size reached USD 1.7 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 14.7 Billion by 2034, exhibiting a growth rate (CAGR) of 26.45% during 2026-2034. Rising security concerns, increasing internet penetration, and technological advancements are driving the India smart home security market share. Additionally, artificial intelligence (AI)-powered innovations enhance surveillance, making security solutions more efficient and reliable.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.7 Billion |

| Market Forecast in 2034 | USD 14.7 Billion |

| Market Growth Rate (2026-2034) | 26.45% |

India Smart Home Security Market Trends:

Increasing internet penetration

Rising internet penetration is significantly driving the India smart home security market outlook by enabling seamless connectivity. With affordable data plans, customers are increasingly adopting smart security devices for real-time monitoring. The aggregate number of internet subscribers increased from 251.59 million in March 2014 to 954.40 million in March 2024, making smart security solutions more accessible. High-speed internet ensures smooth operation of IoT-enabled security cameras, smart locks, and motion detectors. Enhanced network coverage allows remote access to security systems through smartphones and cloud platforms. People can now receive instant alerts and live surveillance feeds from anywhere using internet connectivity. Reliable internet connections improve the efficiency of AI-driven security features like facial recognition and anomaly detection. The rise of 5G and fiber-optic networks is further enhancing the adoption of smart security solutions. Faster internet speeds enable uninterrupted communication between security devices and cloud storage for data backup. Expanding smart home ecosystems benefit from widespread internet access, bridging the gap between devices and users.

To get more information on this market Request Sample

Rising security concerns

Increasing security concerns are propelling the India smart home security market growth because of the escalating need for protection. Growing crime rates including burglaries and home invasions, are compelling homeowners to adopt smart security solutions. Urbanization is leading to nuclear families, making remote monitoring essential for ensuring household safety and security. Smart security devices like CCTV cameras, motion sensors, and smart locks provide real-time surveillance and instant alerts. People feel more secure with AI-powered threat detection, facial recognition, and automated alarms integrated into security systems. Concerns about unauthorized access and theft are prompting people to install IoT-enabled security solutions for better control. The demand for remote access security is rising as people travel frequently for work and personal reasons. Families with elderly members and children are increasingly relying on smart security for enhanced safety measures. For catering to the rising demand for better security solutions, MyGate launched MyGate Locks in September 2024, marking its entry into consumer electronics with smart door locks. Available in three variants, Lock SE, Lock Plus, and Lock Pro, these locks offer multiple unlocking options, remote access, and real-time notifications. Businesses and residential complexes are also implementing advanced security technologies to prevent potential threats and unauthorized entries.

India Smart Home Security Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2026-2034. Our report has categorized the market based on product and residence type.

Product Insights:

- Security Cameras

- Electronic and Smart locks

- Sensors and Detectors

- Alarms

- Security Solutions

- DIY Home Security

The report has provided a detailed breakup and analysis of the market based on the product. This includes security cameras, electronic and smart locks, sensors and detectors, alarms, security solutions, and DIY home security.

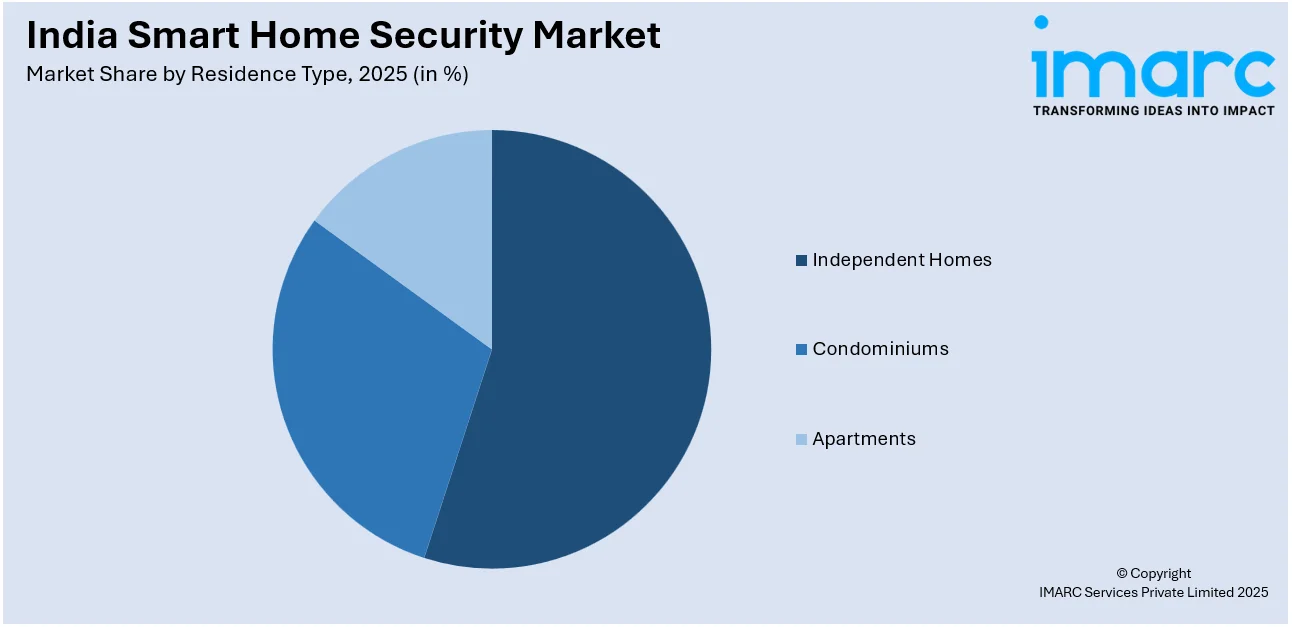

Residence Type Insights:

Access the comprehensive market breakdown Request Sample

- Independent Homes

- Condominiums

- Apartments

A detailed breakup and analysis of the market based on the residence type have also been provided in the report. This includes independent homes, condominiums, and apartments.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Home Security Market News:

- In September 2024, ABB India introduced ABB-free@home®, a smart wireless home automation system that enhances security, comfort, and energy efficiency. It integrates various devices, including appliances and EV chargers, into a single interface. Supporting Apple HomeKit, Google Home, Amazon Alexa, and Samsung SmartThings, it ensures seamless connectivity with third-party brands. The Matter Bridge Add-on enhances interoperability, while the ABB-free@home® Next app enables remote control.

- In April 2024, Godrej Locks introduced a new range of budget-friendly products, aiming to expand its market share from 30% to 50% within three years. The latest locks are over 50% more affordable than existing models, with a 7-8% price reduction on current products. This initiative focuses on tier-2, 3, and 4 cities, ensuring nationwide access to quality security solutions.

India Smart Home Security Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Security Cameras, Electronic and Smart locks, Sensors and Detectors, Alarms, Security Solutions, DIY Home Security |

| Residence Types Covered | Independent Homes, Condominiums, Apartments |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart home security market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart home security market on the basis of product?

- What is the breakup of the India smart home security market on the basis of residence type?

- What are the various stages in the value chain of the India smart home security market?

- What are the key driving factors and challenges in the India smart home security?

- What is the structure of the India smart home security market and who are the key players?

- What is the degree of competition in the India smart home security market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart home security market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart home security market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart home security industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)