India Smart HVAC System Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Smart HVAC System Market Overview:

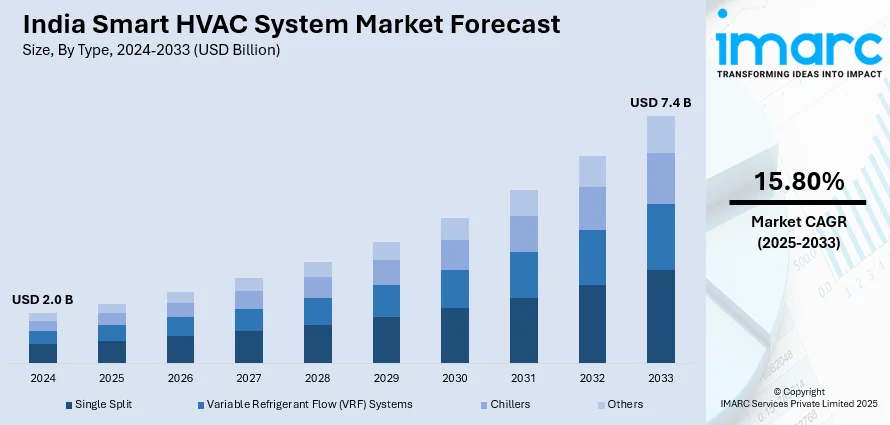

The India smart HVAC system market size reached USD 2.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 7.4 Billion by 2033, exhibiting a growth rate (CAGR) of 15.80% during 2025-2033. The market is driven by rising energy efficiency mandates, increasing urbanization, smart building adoption, and heightened awareness of indoor air quality. Government initiatives promoting green infrastructure, growth in commercial real estate, and consumer demand for automated climate control solutions are also accelerating market penetration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.0 Billion |

| Market Forecast in 2033 | USD 7.4 Billion |

| Market Growth Rate (2025-2033) | 15.80% |

India Smart HVAC System Market Trends:

Integration of HVAC Systems with Building Management Platforms

A key trend in India’s smart HVAC market is the integration of HVAC systems with centralized building management systems (BMS). Commercial facilities, particularly in metros, are increasingly adopting BMS-enabled HVAC units to enable real-time monitoring, predictive maintenance, and performance optimization. This integration helps facility managers regulate energy usage, automate ventilation cycles, and reduce operational costs. The BMS compatibility also allows data sharing between HVAC and other systems like lighting, access control, and fire safety, ensuring coordinated infrastructure management. For instance, Danfoss promotes HVAC 4.0 as a smart building solution combining digitalization, energy efficiency, and sustainability. Their systems use smart sensors, digital actuators, and cloud-connected components to enable real-time monitoring, predictive maintenance, and intelligent energy management via Building Management Systems (BMS). Core technologies include pressure-independent control valves (PICVs), hydronic balancing, and remote commissioning tools. Applications span fan coil units, air handling units, and domestic hot water systems. HVAC 4.0 reduces costs, enhances comfort, and supports decarbonization and green building goals. In sectors like IT parks, retail complexes, and airports, where HVAC accounts for significant energy consumption, BMS-linked solutions are becoming essential. As smart infrastructure policies expand across India, demand for such integrated and interoperable systems is projected to accelerate across new and retrofitted buildings.

To get more information on this market, Request Sample

Growth of IoT and Cloud-Connected HVAC Devices

The widespread adoption of IoT in India is fueling the deployment of cloud-connected smart HVAC devices. These systems use embedded sensors and wireless connectivity to continuously monitor air quality, temperature, humidity, and occupancy patterns. The data collected is analyzed via cloud platforms, enabling remote control, diagnostics, and energy usage analytics. Such features are increasingly sought by residential developers, commercial landlords, and facility management firms aiming to improve occupant comfort while cutting energy bills. The rise in smartphone penetration and availability of app-based controls further boosts consumer interest. With 5G rollout and increasing smart home awareness, the demand for intelligent, connected HVAC units that offer personalized climate control and automation is anticipated to rise sharply in India. For instance, as per industry reports, the Indian HVAC sector is set for rapid growth, driven by the government’s ₹11.11 lakh crore infrastructure investment announced in Budget 2024–25. The market is projected to reach USD 30 Billion by 2030. With over 50% of buildings expected to be constructed in the next two decades and cities with populations over one million increasing from 42 to 68, demand is surging. Technologies like variable refrigerant flow systems, machine learning-based predictive maintenance, and IoT integration are transforming energy efficiency and sustainability.

Shift Toward Energy-Efficient Inverter and VRF Technologies

The Indian market is witnessing a marked shift from traditional fixed-speed systems to energy-efficient technologies like inverter-based units and Variable Refrigerant Flow (VRF) systems. These smart HVAC systems adjust compressor speed in real-time, significantly lowering energy consumption during partial load conditions. Commercial spaces such as hospitals, hotels, and educational institutions are prioritizing VRF installations for their zonal cooling capabilities and space-saving configurations. Inverter technology is also gaining popularity in the residential segment, especially in Tier-1 and Tier-2 cities, supported by rising electricity costs and environmental awareness. The Bureau of Energy Efficiency’s star rating system and the growing focus on green building certifications are reinforcing the shift towards advanced, sustainable HVAC technologies across sectors. For instance, in February 2024, ACREX India 2024 commenced at India Expo Mart, Greater Noida, drawing over 30,000 visitors and 500+ exhibitors from 40+ countries. Organized by ISHRAE and Informa Markets, the event spotlighted India’s HVAC sector, expected to hit USD 30 Billion by 2030 at a 15.8% CAGR. Companies including Daikin, Carrier, Voltas, and Danfoss showcased smart, sustainable HVAC technologies. Key sessions addressed net-zero goals, policy reforms, local manufacturing, and skill-building, underscoring India’s growing prominence in global HVAC innovation and decarbonization efforts.

India Smart HVAC System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Single Split

- Variable Refrigerant Flow (VRF) Systems

- Chillers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes single split, variable refrigerant flow (VRF) systems, chillers, and others.

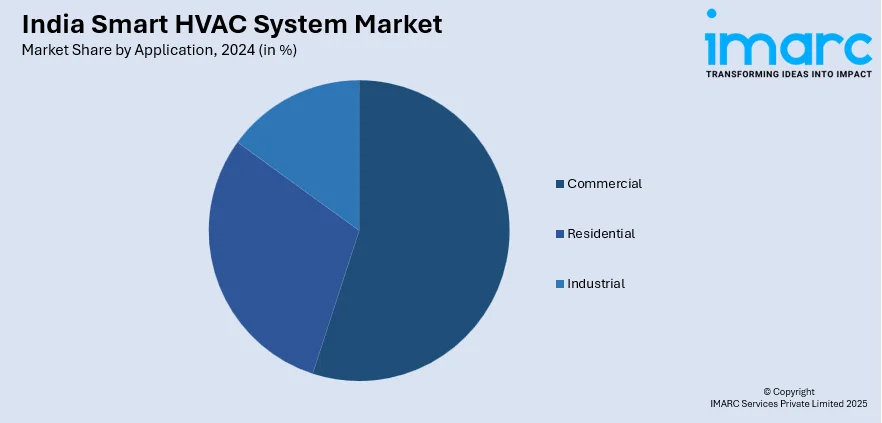

Application Insights:

- Commercial

- Residential

- Industrial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, residential, and industrial.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart HVAC System Market News:

- In February 2024, Hisense HVAC, a subsidiary of Qingdao Hisense Hitachi Air-conditioning Systems, launched operations in India. The company specializes in smart, energy-efficient HVAC solutions for commercial and residential applications. Hisense aims to establish a strong presence in India's growing air-conditioning market through advanced technology and strategic leadership.

- In January 2024, Carrier expanded its India-made HVAC portfolio by introducing locally manufactured air handling units (AHUs) and fan coil units (FCUs), aligning with the 'Make in India' initiative. Designed for commercial, healthcare, and infrastructure projects, the units offer high efficiency, low maintenance, and Eurovent-certified performance. This expansion enhances Carrier’s service capabilities and reinforces its commitment to energy-efficient, sustainable HVAC solutions tailored for the Indian market.

- In March 2025, SHARP India re-entered the Indian AC market with the launch of three new series—Reiryou, Seiryo, and Plasma Chill—offering energy-efficient, feature-rich air conditioners. Key features include 7-stage filtration, self-cleaning, i-FEEL sensors, high ambient cooling, and smart diagnosis.

- In February 2025, Blue Star Limited launched 150 new room AC models for 2025. The lineup includes 40 Smart WiFi ACs, Heavy Duty models (cooling up to 56°C), Hot & Cold variants (working down to -10°C), and ACs with anti-virus filtration. Production capacity stands at 1.4 million units, with plans to scale to 1.8 million.

- In February 2024, ABB India launched the ACH180, a next-generation compact drive tailored for HVACR systems. Designed for use in commercial spaces like data centers, malls, and hotels, it supports IE5 motors, enables energy savings, and integrates with building automation systems via BACnet and Modbus. Features include fireman’s override, operation in up to 60°C ambient temperature, and compatibility with fan arrays, compressors, pumps, and more. It helps reduce CO₂ emissions and lowers installation costs with built-in filters.

India Smart HVAC System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Single Split, Variable Refrigerant Flow (VRF) Systems, Chillers, Others |

| Applications Covered | Commercial, Residential, Industrial |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart HVAC system market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart HVAC system market on the basis of type?

- What is the breakup of the India smart HVAC system market on the basis of application?

- What are the various stages in the value chain of the India smart HVAC system market?

- What are the key driving factors and challenges in the India smart HVAC system market?

- What is the structure of the India smart HVAC system market and who are the key players?

- What is the degree of competition in the India smart HVAC system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart HVAC system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart HVAC system market.

- Porter's Five Forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart HVAC system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)