India Smart Infrastructure Market Size, Share, Trends and Forecast by Type, End User, and Region, 2025-2033

India Smart Infrastructure Market Overview:

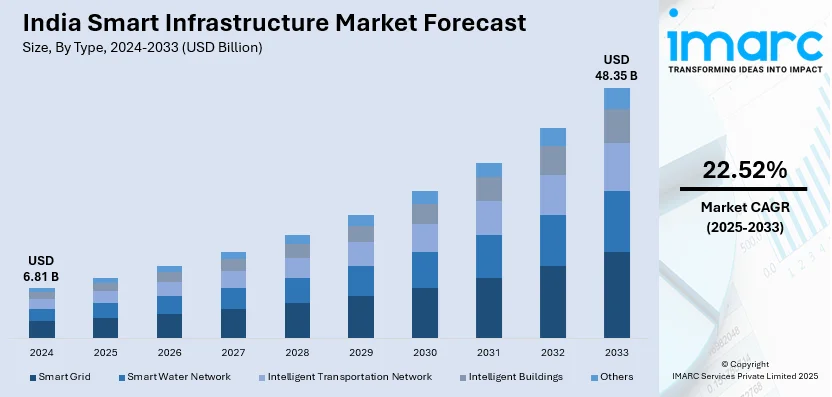

The India smart infrastructure market size reached USD 6.81 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.35 Billion by 2033, exhibiting a growth rate (CAGR) of 22.52% during 2025-2033. Supportive government initiatives like Smart Cities Mission, increasing Internet of Things (IoT) and artificial intelligence (AI) adoption, a strong push for energy efficiency and sustainability, and rising investments in digital infrastructure and intelligent transportation systems, are propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.81 Billion |

| Market Forecast in 2033 | USD 48.35 Billion |

| Market Growth Rate (2025-2033) | 22.52% |

India Smart Infrastructure Market Trends:

Expansion of Data Center Infrastructure

India’s smart infrastructure sector is experiencing rapid expansion, particularly in the development of data centers. This growth is fueled by increasing digital adoption, higher internet usage, and supportive government initiatives. The surge in smartphone penetration, e-commerce, and digital services has significantly boosted data consumption, which is projected to exceed 25 exabytes per month by 2025. Additionally, substantial investments from both domestic and global companies are strengthening India's data infrastructure. Leading technology giants such as Amazon Web Services, Microsoft, and Google have collectively committed over $2 billion to expand their data center operations in the country. The Indian government is playing a pivotal role in this transformation by introducing investor-friendly policies and incentives, including the Digital India initiative and data localization regulations. These localization policies alone are anticipated to drive the establishment of more than a hundred new data centers by 2025. Moreover, sustainability is becoming a key focus, with data centers increasingly adopting eco-friendly technologies to minimize their environmental footprint. By 2030, it is estimated that at least half of India's data centers will be powered by renewable energy sources, further accelerating market growth.

To get more information on this market, Request Sample

Integration of Satellite Internet Services

Another emerging trend in India's smart infrastructure market is the integration of satellite internet services, aiming to bridge the digital divide and enhance connectivity, especially in remote regions. Elon Musk's Starlink has entered into agreements with India's leading telecom operators, Bharti Airtel and Reliance Jio, to bring satellite internet services to India. This collaboration aims to provide high-speed internet access to millions in remote areas, contingent upon government approval. Moreover, despite India's significant user base, approximately 40% of the population lacks internet access, particularly in remote and mountainous regions. The integration of satellite internet services is poised to address this gap, offering low-latency broadband and enhancing coverage in underserved areas. Besides this, the Indian government's support for space and technology innovation is also facilitating these developments. Discussions between Indian Prime Minister Narendra Modi and Elon Musk have emphasized the importance of such collaborations. By leveraging the telecom operators' existing infrastructure, the integration of satellite internet services aims to enhance coverage and provide better connectivity in areas currently underserved.

India Smart Infrastructure Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, and end user.

Type Insights:

- Smart Grid

- Smart Water Network

- Intelligent Transportation Network

- Intelligent Buildings

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes smart grid, smart water network, intelligent transportation network, intelligent buildings, and others.

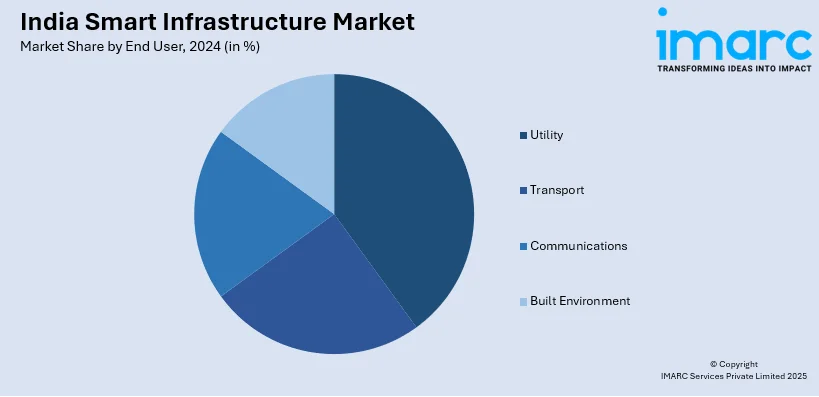

End User Insights:

- Utility

- Transport

- Communications

- Built Environment

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes utility, transport, communications, and built environment.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Infrastructure Market News:

- March 2025: India's Computer Emergency Response Team (CERT-In) launched a set of cybersecurity guidelines designed to improve the security of Smart City infrastructure across the country. Named "Cyber Security Guidelines for Smart City Infrastructure," these directives outline essential strategies, best practices, and protective measures to safeguard urban digital systems against evolving cyber threats.

- September 2024: India announced 12 new greenfield industrial smart cities to enhance global competitiveness. The $3.4 billion project, approved by Prime Minister Narendra Modi's Cabinet Committee on Economic Affairs, aims to attract $18.1 billion in investments and create 4 million jobs. The cities will be strategically located along India's six major industrial corridors and pass through 10 states, focusing on ahead-of-demand, plug-and-play, and walk-to-work concepts.

India Smart Infrastructure Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Smart Grid, Smart Water Network, Intelligent Transportation Network, Intelligent Buildings, Others |

| End Users Covered | Utility, Transport, Communications, Built Environment |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart infrastructure market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart infrastructure market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart infrastructure industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart infrastructure market in India was valued at USD 6.81 Billion in 2024.

The India smart infrastructure market is projected to exhibit a CAGR of 22.52% during 2025-2033, reaching a value of USD 48.35 Billion by 2033.

The India smart infrastructure market is driven by rapid urbanization, government initiatives like Smart Cities Mission, rising demand for energy efficiency, and integration of digital technologies such as IoT and AI. Growing investments in sustainable infrastructure, public-private partnerships, and increasing need for better mobility, safety, and resource management further propel growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)