India Smart Safety Helmets Market Size, Share, Trends and Forecast by Technology Type, Connectivity Type, Material Type, Safety Features, End-Use Industry, and Region, 2025-2033

India Smart Safety Helmets Market Overview:

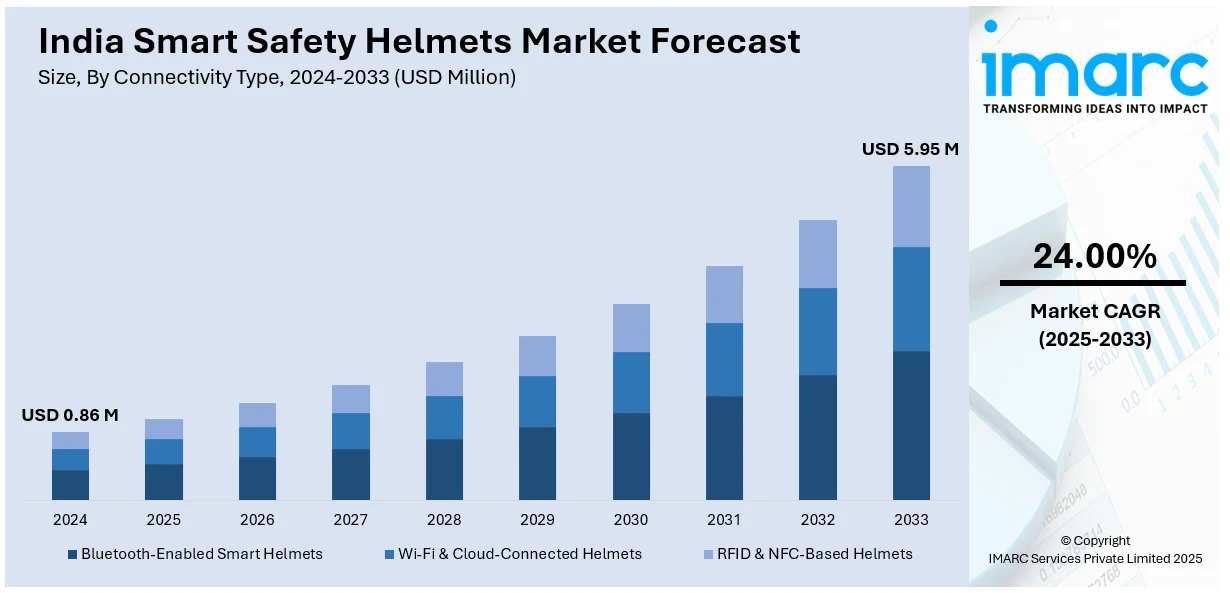

The India smart safety helmets market size reached USD 0.86 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5.95 Million by 2033, exhibiting a growth rate (CAGR) of 24.00% during 2025-2033. The market is driven by developments in technology, greater emphasis on labour safety, and growing adoption in industrial segments. Incorporation of elements like IoT, AR, and healthcare monitoring is changing conventional head gear into smart protective devices. Such development aligns with India's overall digital and infrastructure ambitions, improving compliance with safety standards and operational effectiveness. These developments are all contributing to the growth in India smart safety helmets market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.86 Million |

| Market Forecast in 2033 | USD 5.95 Million |

| Market Growth Rate 2025-2033 | 24.00% |

India Smart Safety Helmets Market Trends:

Integration of Futuristic Technologies in Helmet Design

India is experiencing a quick transition to adopting intelligent safety helmets with incorporation of futuristic technologies like Internet of Things (IoT), artificial intelligence (AI), and augmented reality (AR). These innovative features improve user safety by enhancing real-time hazard detection, health monitoring, and navigation assistance. Smart helmets with AR and HUD features are being increasingly investigated in key industries for delivering situational awareness. IoT connectivity enables wireless data transmission to centralized units, enhancing response times and decision-making in hostile environments. For instance, in April 2025, an innovator from Mangaluru received international acclaim for developing a smart helmet with patented audio technology, which was subsequently implemented in headphones and car seats. Moreover, priority on worker safety and government regulations in industries such as infrastructure, oil & gas, and manufacturing are driving this trend even faster. India smart safety helmets market prospect continues to look good because of this technological advancement, which is likely to have a significant impact on market trends and end-user demand, ultimately leading to greater adoption and innovation in protective equipment throughout the nation.

To get more information on this market, Request Sample

Growing Adoption in Industrial and Infrastructure Industries

Growing focus on occupational safety in India's fast-growing industrial and infrastructure industries is fueling growing demand for smart safety helmets. With increasing growth in infrastructure construction and industrial process complexity, smart protective equipment requirements become highly indispensable. Smart helmets with features such as fall indication, environmental health monitoring, and real-time fitness tracking are also being seen as critical components to maintaining worker welfare and production productivity. For example, in April 2025, Vedanta launched smart helmets with real-time audio-visual connectivity to lead employees in real-time, improving workplace safety and workflow efficiency throughout its operations. The new technology minimizes hazards and enhances safety mechanisms. Furthermore, construction, mining, and heavy manufacturing segments stand out uniquely with increasing use of wearable security technologies. Moreover, regulatory incentives and digitalization plans are also prompting companies to go beyond traditional safeguards. India smart safety helmets market growth is hence highly driven by the nation's infrastructure goals and the emphasis placed on workplace safety, making way for the mass adoption of smart protective gear designed according to specific requirements of various industrial settings.

Growth of Connected Safety Ecosystems

India is slowly adopting the idea of connected safety ecosystems with smart safety helmets as an essential element of an integrated workplace environment. These helmets, when equipped with Bluetooth, Wi-Fi, GPS, and RFID technology, offer smooth integration with enterprise systems, allowing real-time tracking, predictive maintenance, and remote monitoring of staff. This degree of connectivity not only enhances workplace safety but also leads to amplified productivity and adherence to safety protocols. The shift towards digital safety ecosystems is part of larger smart city and Industry 4.0 initiatives in the making in India. Organizations are increasingly realizing the potential of using data from wearables for predictive analytics and strategic planning. As this ecosystem evolves, India smart safety helmets' contribution to the personal protective equipment (PPE) market is likely to increase, emphasizing the shift in the mindset of both public and private sectors from reactive to proactive safety management.

India Smart Safety Helmets Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology type, connectivity type, material type, safety features, and end-use industry.

Technology Type Insights:

- IoT-Enabled Smart Helmets

- Augmented Reality (AR) & Heads-Up Display (HUD) Helmets

- AI-Powered Safety Helmets

- Sensor-Based Smart Helmets

- GPS-Enabled Helmets

- Communication-Integrated Helmets

The report has provided a detailed breakup and analysis of the market based on the technology type. This includes IoT-enabled smart helmets, augmented reality (AR) & heads-up display (HUD) helmets, ai-powered safety helmets, sensor-based smart helmets, GPS-enabled helmets, and communication-integrated helmets.

Connectivity Type Insights:

- Bluetooth-Enabled Smart Helmets

- Wi-Fi & Cloud-Connected Helmets

- RFID & NFC-Based Helmets

A detailed breakup and analysis of the market based on the connectivity type have also been provided in the report. This includes Bluetooth-enabled smart helmets, WI-FI & cloud-connected helmets, and RFID & NFC-based helmets.

Material Type Insights:

- Polycarbonate Helmets

- Fiberglass & Composite Helmets

- ABS Plastic Helmets

- Carbon Fiber Helmets

The report has provided a detailed breakup and analysis of the market based on the material type. This includes polycarbonate helmets, fiberglass & composite helmets, abs plastic helmets, and carbon fiber helmets.

Safety Features Insights:

- Real-Time Health Monitoring

- Fall & Impact Detection

- Noise Cancellation & Communication Enhancement

- Fire & Hazard Detection

- Environmental Monitoring

- Smart Lighting & Alerts

A detailed breakup and analysis of the market based on the safety features have also been provided in the report. This includes real-time health monitoring, fall & impact detection, noise cancellation & communication enhancement, fire & hazard detection, environmental monitoring, and smart lighting & alerts.

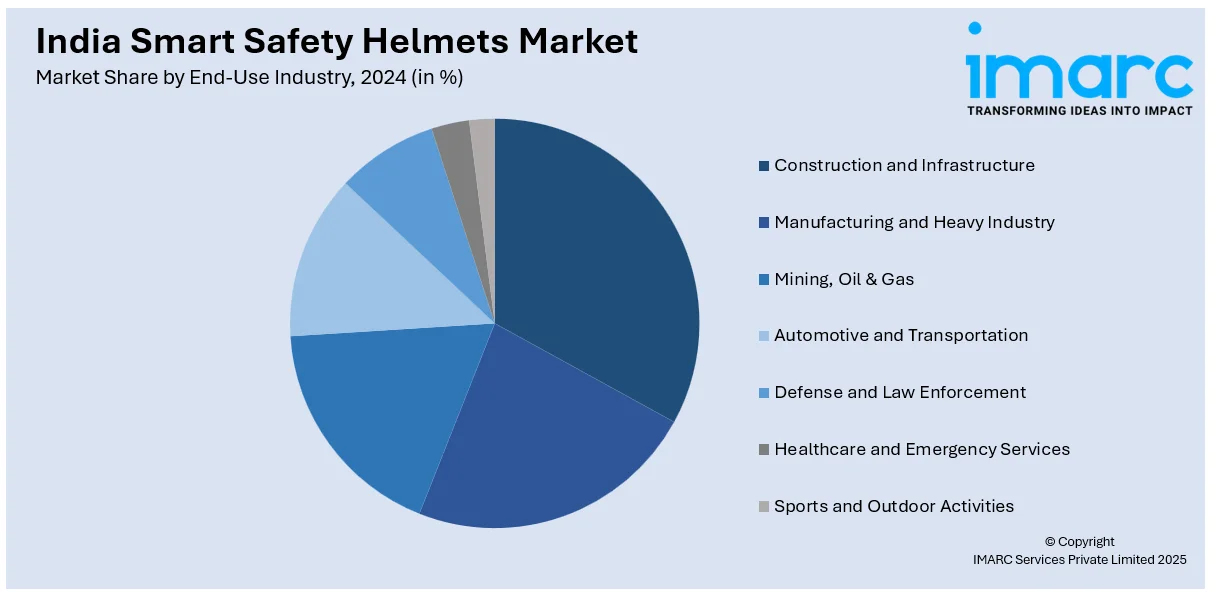

End-Use Industry Insights:

- Construction and Infrastructure

- Manufacturing and Heavy Industry

- Mining, Oil & Gas

- Automotive and Transportation

- Defense and Law Enforcement

- Healthcare and Emergency Services

- Sports and Outdoor Activities

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes construction and infrastructure, manufacturing and heavy industry, mining, oil & gas, automotive and transportation, defense and law enforcement, healthcare and emergency services, and sports and outdoor activities.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Safety Helmets Market News:

- In March 2025, Jarsh Safety has introduced its flagship product, the ActivCooling Helmet, a smart helmet for industrial workers that leverages AI. The helmet manages temperature to avoid heat stress under harsh conditions. The zero-maintenance, rechargeable helmet is a breakthrough for hot working environments, boosting worker comfort and protection.

- In January 2025, Proxgy introduced the Hat+ Band and ProHat Band, which converted regular industrial helmets into AC and Smart Helmets. The Hat+ Band provides cooling for employees working in hot conditions, and the ProHat Band enhances protection with features such as real-time communication and hazard recognition. Both devices are designed to make workers more comfortable and productive.

- In March 2024, Steelbird Hi-Tech India introduced the SBA-17 RDX open-face helmet, with a thermoplastic shell, removable cheek pads, high-density EPS for crash protection, and scratch-resistant polycarbonate visor with a built-in sun shield. This product introduction is just a part of the overall plans of the company to introduce 70 new helmets.

India Smart Safety Helmets Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technology Types | IoT-Enabled Smart Helmets, Augmented Reality (AR) & Heads-Up Display (HUD) Helmets, AI-Powered Safety Helmets, Sensor-Based Smart Helmets, GPS-Enabled Helmets, Communication-Integrated Helmets |

| Connectivity Types | Bluetooth-Enabled Smart Helmets, Wi-Fi & Cloud-Connected Helmets, RFID & NFC-Based Helmets |

| Material Types | Polycarbonate Helmets, Fiberglass & Composite Helmets, ABS Plastic Helmets, Carbon Fiber Helmets |

| Safety Features | Real-Time Health Monitoring, Fall & Impact Detection, Noise Cancellation & Communication Enhancement, Fire & Hazard Detection, Environmental Monitoring, Smart Lighting & Alerts |

| End-Use Industries | Construction and Infrastructure, Manufacturing and Heavy Industry, Mining, Oil & Gas, Automotive and Transportation, Defense and Law Enforcement, Healthcare and Emergency Services, Sports and Outdoor Activities |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart safety helmets market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart safety helmets market on the basis of technology type?

- What is the breakup of the India smart safety helmets market on the basis of connectivity type?

- What is the breakup of the India smart safety helmets market on the basis of material type?

- What is the breakup of the India smart safety helmets market on the basis of safety features?

- What is the breakup of the India smart safety helmets market on the basis of end-use industry?

- What is the breakup of the India smart safety helmets market on the basis of region?

- What are the various stages in the value chain of the India smart safety helmets market?

- What are the key driving factors and challenges in the India smart safety helmets?

- What is the structure of the India smart safety helmets market and who are the key players?

- What is the degree of competition in the India smart safety helmets market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart safety helmets market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart safety helmets market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart safety helmets industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)