India Smart Tires Market Size, Share, Trends and Forecast by Vehicle Type, Product Type, Sensor Type, Technology, Vehicle Propulsion, Distribution Channel, and Region, 2025-2033

India Smart Tires Market Overview:

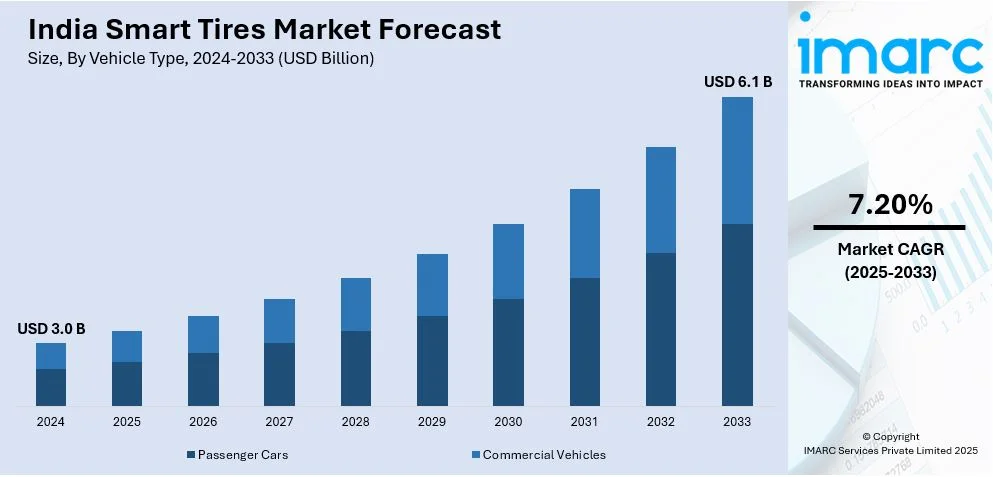

The India smart tires market size reached USD 3.0 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.1 Billion by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. The growing emergence of specialized research and development (R&D) centers to create smart tire solutions designed for Indian roadways, climatic conditions, and vehicle categories and the escalating demand for improved efficiency and cost reductions in commercial transport are bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.0 Billion |

| Market Forecast in 2033 | USD 6.1 Billion |

| Market Growth Rate 2025-2033 | 7.20% |

India Smart Tires Market Trends:

Growing Investments in Smart Tire Manufacturing

Leading international and local tire producers are ramping up investments in smart tire research and manufacturing plants in India. Firms are establishing specialized research and development (R&D) centers to create smart tire solutions designed for Indian roadways, climatic conditions, and vehicle categories. Partnerships among tire manufacturers, automotive original equipment manufacturers (OEMs), and technology companies are speeding up the market launch of tires with sensors. Furthermore, government incentives for local manufacturing through programs such as "Make in India" are motivating tire manufacturers to set up domestic production facilities, lowering expenses and making smart tires cheaper for buyers. Startups and research organizations are also developing innovations in tire monitoring technologies, predictive analytics, and artificial intelligence (AI)-powered performance improvements. The rise of domestic production and ongoing technological progress are guaranteeing a reliable availability of affordable and high-performing smart tires for different vehicle categories. In line with this trend, Continental Tires India launched "Intelligent Tyres" (I-tyres) for the commercial vehicle segment in early 2023, equipped with sensors for enhanced safety. These I-tyres aimed to improve safety features, especially for tubeless tires in commercial vehicles, a segment with significant growth potential. The company also planned to expand its product range and production capacity in India.

To get more information on this market, Request Sample

Rising Demand for Fleet Efficiency and Cost Optimization

The drive for improved efficiency and cost reductions in commercial transport is speeding up the use of smart tires in India. Fleet operators are focusing on solutions that reduce downtime, enhance fuel efficiency, and prolong tire longevity. Smart tires fitted with real-time monitoring systems deliver essential information on pressure, temperature, and wear, facilitating proactive maintenance and minimizing unexpected breakdowns. Sustaining ideal inflation levels improves fuel efficiency and reduces operating expenses in the long run. Features for preventing theft and predictive analytics enhance fleet security and resource management. As logistics networks grow to address increasing e-commerce and industrial needs, businesses are implementing advanced tire technologies to guarantee smoother operations and adherence to changing safety regulations. The growing focus on cutting carbon emissions and enhancing road safety is encouraging commercial vehicle operators to adopt smart tire solutions that boost overall efficiency while decreasing environmental effects. In 2024, JK Tyre announced plans to launch sensor-based smart tires for trucks. These tires featured a tire pressure monitoring system that sent alerts to drivers' smartphones for temperature and inflation violations. The smart tires promised to increase tire life by 10%, reduce fuel costs, and prevent tire thefts.

India Smart Tires Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on vehicle type, product type, sensor type, technology, vehicle propulsion, and distribution channel.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes passenger cars and commercial vehicles.

Product Type Insights:

- Connected Tire

- Intelligent Tire/TPMS

A detailed breakup and analysis of the market based on the product type have also been provided in the report. This includes connected tire and intelligent tire/TPMS.

Sensor Type Insights:

- TPMS

- Accelerometer Sensor

- Strain Gauge Sensor

- RFID Chip

- Others

The report has provided a detailed breakup and analysis of the market based on the sensor type. This includes TPMS, accelerometer sensor, strain gauge sensor, RFID chip, and others.

Technology Insights:

- Pneumatic Tire

- Run-Flat Tire

- Non-Pneumatic Tire

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes pneumatic tire, run-flat tire, and non-pneumatic tire.

Vehicle Propulsion Insights:

- Conventional Vehicles

- Electric Vehicles

The report has provided a detailed breakup and analysis of the market based on the vehicle propulsion. This includes conventional vehicles and electric vehicles.

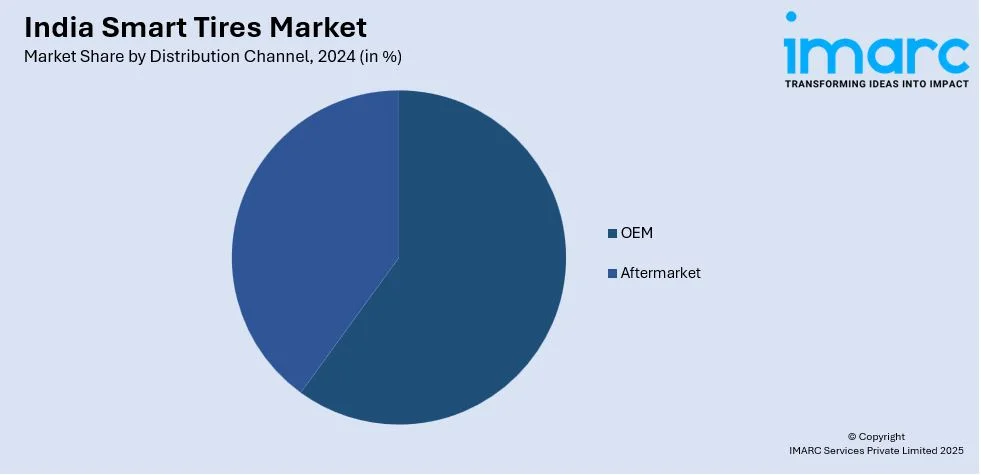

Distribution Channel Insights:

- OEM

- Aftermarket

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes OEM and aftermarket.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, West India, East India, Soth India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Tires Market News:

- In January 2025, Continental Tires launched the PC6 and Gen3 radial tires at the Continental Track Day in Chennai. The PC6 tires are designed for Indian roads, featuring Macroblock Technology for stability and ContiSeal for enhanced safety. The Gen3 truck radial tires are aimed at medium and heavy commercial vehicles, offering new sizes for diverse applications.

- In June 2024, JK Tyre introduced advanced smart tires featuring embedded sensors that monitored tire pressure and temperature in real time. This technology aimed to enhance safety, performance, and driving efficiency for both commercial and passenger vehicles. The smart tires offered benefits like improved fuel efficiency, extended tire lifespan, and reduced environmental impact.

India Smart Tires Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles |

| Product Types Covered | Connected Tire, Intelligent Tire/TPMS |

| Sensor Types Covered | TPMS, Accelerometer Sensor, Strain Gauge Sensor, RFID Chip, Others |

| Technologies Covered | Pneumatic Tire, Run-Flat Tire, Non-Pneumatic Tire |

| Vehicle Propulsions Covered | Conventional Vehicles, Electric Vehicles |

| Distribution Channels Covered | OEM, Aftermarket |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India smart tires market performed so far and how will it perform in the coming years?

- What is the breakup of the India smart tires market on the basis of vehicle type?

- What is the breakup of the India smart tires market on the basis of product type?

- What is the breakup of the India smart tires market on the basis of sensor type?

- What is the breakup of the India smart tires market on the basis of technology?

- What is the breakup of the India smart tires market on the basis of vehicle propulsion?

- What is the breakup of the India smart tires market on the basis of distribution channel?

- What is the breakup of the India smart tires market on the basis of region?

- What are the various stages in the value chain of the India smart tires market?

- What are the key driving factors and challenges in the India smart tires market?

- What is the structure of the India smart tires market and who are the key players?

- What is the degree of competition in the India smart tires market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart tires market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart tires market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart tires industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)