India Smart Water Meters Market Size, Share, Trends and Forecast by Product, Meter Type, Configuration Type, Component, Application, and Region, 2025-2033

India Smart Water Meters Market Overview:

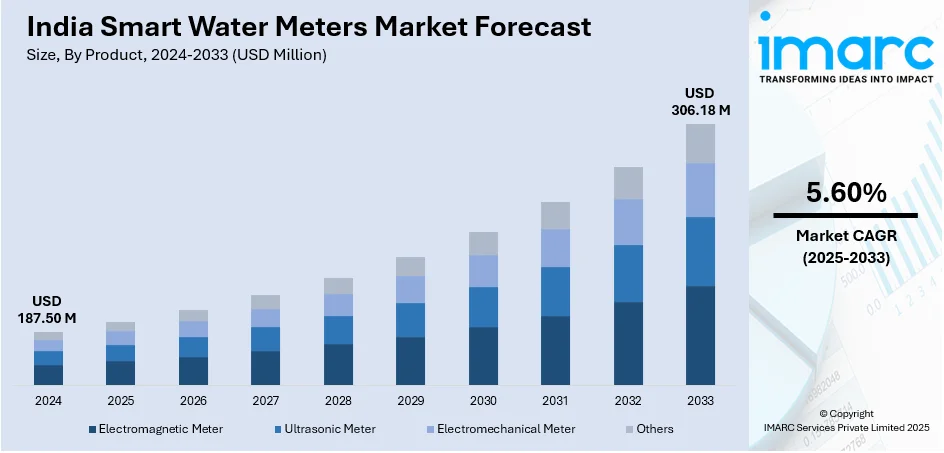

The India smart water meters market size reached USD 187.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 306.18 Million by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. The market is driven by increasing urbanization, supportive government initiatives for sustainable water management, rising demand for efficient water consumption monitoring, advanced Internet of Things (IoT)-enabled solutions, and integration of real-time data analytics for utilities and consumers.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 187.50 Million |

| Market Forecast in 2033 | USD 306.18 Million |

| Market Growth Rate 2025-2033 | 5.60% |

India Smart Water Meters Market Trends:

Government-Led Smart Water Infrastructure Initiatives

The India smart water meters market growth is primarily driven by government programs such as Atal Mission for Rejuvenation and Urban Transformation (AMRUT) and the Smart Cities Mission, as they support smart water infrastructure initiatives. These programs focus on implementing water conservation methods with efficient utility distribution and digital transformation of municipal services. In addition to this, municipal corporations in cities are actively implementing smart water meters to achieve accurate billing as well as decrease non-revenue water loss and distribute water equitably. For instance, Thane Municipal Corporation, in partnership with Thane Smart City Ltd and Palladium, installed 105,000 AMR-equipped smart water meters to reduce leakage, minimize non-revenue water, ensure accurate billing, and enhance water conservation and operational efficiency. Moreover, smart meter deployment rates have increased due to the mandate to install meters across all urban areas. Besides this, growth opportunities in the upcoming years will emerge due to government support through financial backing combined with policy structures and public-private partnership initiatives. Furthermore, the water infrastructure modernization process of the country relies on smart water meters to meet its sustainable water management needs when faced with increasing water scarcity problems, thereby impelling the market demand.

To get more information on this market, Request Sample

Rising Adoption of IoT and AMI-Based Solutions

The India smart water meters market share is boosting due to the ongoing transformations through the combination of IoT and Advanced Metering Infrastructure (AMI) technologies. The water utility sector now opts for modern smart meters instead of traditional mechanical meters because smart meters provide real-time measurement data and remote monitoring capabilities with automatic leak detection functions. In line with this, utilities can establish real-time exchanges with their customers, which strengthens operational processes along with improving transparency in utility operations. Concurrently, the rising market need for data-based water management approaches drives investments into IoT devices that help optimize water usage and discover irregularities. For example, in September 2024, Chennai Metrowater announced plans to install smart water meters in nearly 100,000 commercial, partly commercial, and high-rise buildings across the city. This initiative, part of the Chennai City Partnership programme, aims to encourage judicious water use and reduce non-revenue water, particularly among water-intensive consumers. Additionally, the integration of NB-IoT and LoRaWAN low-power communication networks reduces smart water meter prices while enabling their wider implementation particularly in urban and semi-urban areas. Apart from this, the integration of IoT technology with smart water meters stands as vital for India's water supply network digitalization process, which is enhancing the India smart water meters market outlook.

India Smart Water Meters Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, meter type, configuration type, component, and application.

Product Insights:

- Electromagnetic Meter

- Ultrasonic Meter

- Electromechanical Meter

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes electromagnetic meter, ultrasonic meter, electromechanical meter, and others.

Meter Type Insights:

- Smart Hot-Water Meter

- Smart Cold-Water Meter

A detailed breakup and analysis of the market based on the meter type have also been provided in the report. This includes smart hot-water meter and smart cold-water meter.

Configuration Type Insights:

- Automated Meter Reading (AMR)

- Advanced Metering Infrastructure (AMI)

The report has provided a detailed breakup and analysis of the market based on the configuration type. This includes automated meter reading (AMR) and advanced metering infrastructure (AMI).

Component Insights:

- Meters and Accessories

- IT Solutions

- Communication System

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes meters and accessories, IT solutions, and communication system.

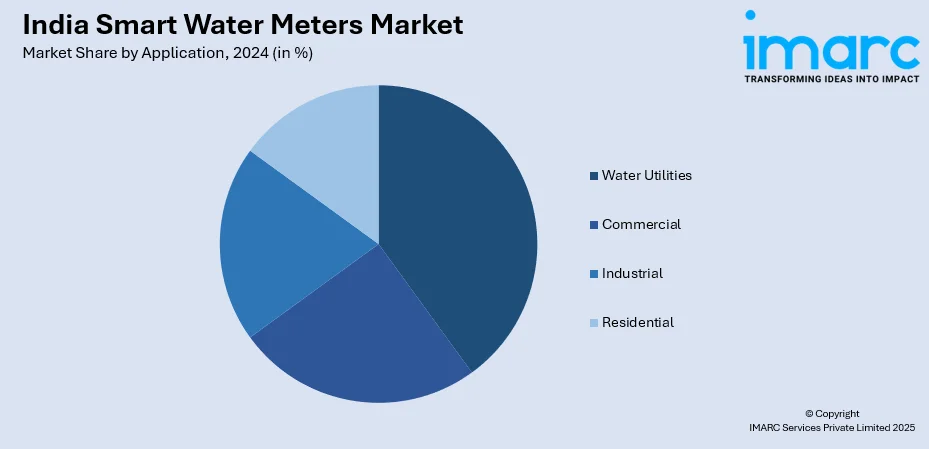

Application Insights:

- Water Utilities

- Commercial

- Industrial

- Residential

The report has provided a detailed breakup and analysis of the market based on the application. This includes water utilities, commercial, industrial, and residential.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Smart Water Meters Market News:

- In May 2024, Polaris secured contracts worth ₹2,452 crore to install 2.2 million smart meters in West Bengal and over 160,000 meters in Manipur. These projects aim to reduce distribution losses and empower consumers with smart prepaid meters, enhancing energy monitoring and grid management capabilities.

- In September 2023, GMR Smart Electricity Distribution Private Ltd received a ₹2,470 crore contract to install, integrate, and maintain 2.552 million smart meters in Uttar Pradesh's Agra and Aligarh zones. This project is expected to enhance billing accuracy and reduce losses for distribution companies, contributing to the state's energy efficiency goals.

India Smart Water Meters Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Electromagnetic Meter, Ultrasonic Meter, Electromechanical Meter, Others |

| Meter Types Covered | Smart Hot-Water Meter, Smart Cold-Water Meter |

| Configuration Types Covered | Automated Meter Reading (AMR), Advanced Metering Infrastructure (AMI) |

| Components Covered | Meters and Accessories, IT Solutions, Communication System |

| Applications Covered | Water Utilities, Commercial, Industrial, Residential |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India smart water meters market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India smart water meters market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India smart water meters industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The smart water meters market in the India was valued at USD 187.50 Million in 2024.

The India smart water meters market is projected to exhibit a CAGR of 5.60% during 2025-2033, reaching a value of USD 306.18 Million by 2033.

Key factors driving the India smart water meters market include heightened water scarcity, government initiatives endorsing water conservation, the requirement for efficient water management, and advancements in IoT technology. Additionally, the rising demand for automation in water distribution systems and real-time data analytics contribute to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)