India Sneaker Market Size, Share, Trends and Forecast by Product Type, Category, Price Point, Distribution Channel, End User, and Region, 2026-2034

India Sneaker Market Summary:

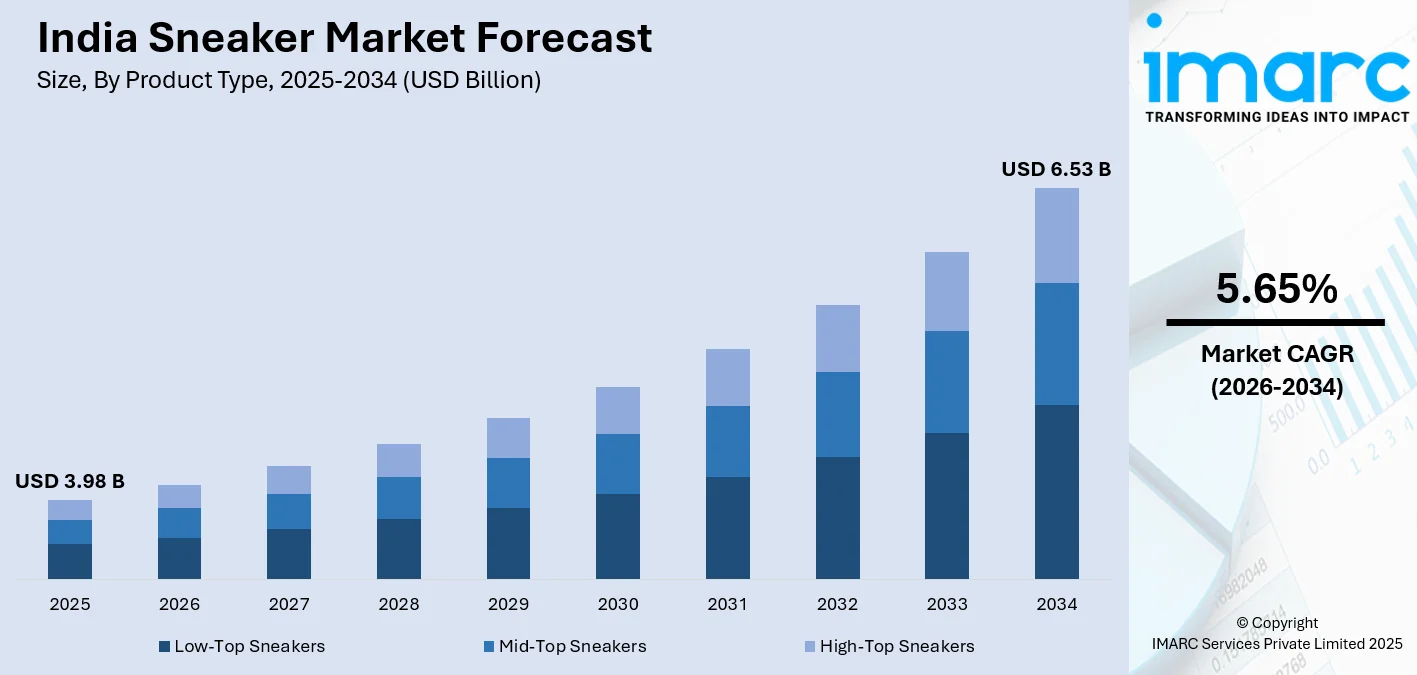

The India sneaker market size was valued at USD 3.98 Billion in 2025 and is projected to reach USD 6.53 Billion by 2034, growing at a compound annual growth rate of 5.65% from 2026-2034.

The market for sneakers in India is growing at a rapid pace due to reasons such as the young population, changing trends in the world of fashion, increasing health consciousness, and the urbanization and lifestyle changes taking place. Celebrity endorsement, the growing e-commerce business, and the need to buy quality and exclusive sneakers are adding to the market’s growth. Athleisure has made sneakers a part of daily attire, and digital and direct-to-consumer channels have increased reach even in semi-urban areas.

Key Takeaways and Insights:

- By Product Type: Low-top sneakers dominate the market with a share of 43% in 2025, driven by their versatility, lightweight design, and suitability for everyday wear across casual, semi-formal, and active lifestyle occasions, making them the preferred choice for fashion-conscious consumers.

- By Category: Branded leads the market with a share of 65% in 2025, attributed to increasing consumer preference for quality assurance, aspirational value, and the growing influence of international and domestic brands through strategic marketing, celebrity endorsements, and retail expansion.

- By Price Point: Economic dominates the market with a share of 68% in 2025, owing to the price-sensitive nature of Indian consumers, widespread demand from students and young professionals, and the availability of affordable options from both domestic and international brands.

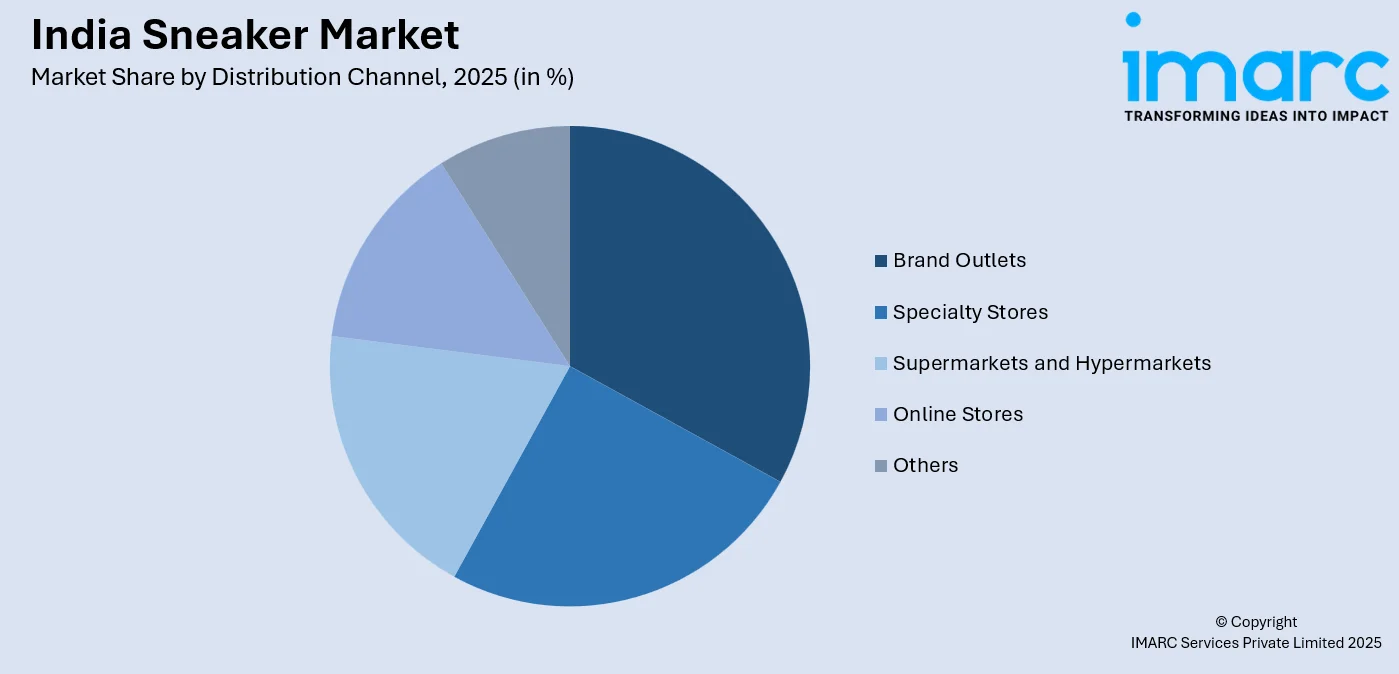

- By Distribution Channel: Brand outlets lead the market with a share of 31% in 2025, supported by exclusive product availability, authentic brand experience, personalized customer service, and the ability to try products before purchase, which builds consumer confidence and brand loyalty.

- By End User: Men dominate the market with a share of 43% in 2025, driven by higher spending on footwear, growing interest in sports and fitness activities, strong influence of streetwear culture, and the increasing adoption of sneakers for both casual and semi-formal occasions.

- By Region: North India leads the market with a share of 34% in 2025, supported by high urbanization rates, presence of major metropolitan centers including the National Capital Region, substantial youth population, and well-developed retail infrastructure facilitating sneaker accessibility.

- Key Players: The Indian sneaker market is highly competitive, led by international brands in premium segments, while domestic players dominate mass and mid-priced categories. Growing D2C entrants and private labels are intensifying competition through affordability, localization, and online-first distribution strategies.

To get more information on this market Request Sample

The Indian sneaker industry is undergoing a significant shift as consumers increasingly perceive footwear as a fashion and lifestyle product rather than only athletic wear. Homegrown brands are gaining strong momentum, supported by rising interest in limited-edition and design-led offerings. According to reports, in November 2025, Bengaluru-based sneaker brand Comet sold out 200 pairs of its Comet X Naru limited-edition drop within an hour, with customers lining up before store opening. Social media platforms, fashion influencers, and celebrity endorsements have played a major role in positioning sneakers as expressions of individuality and status. Gen Z and millennial consumers are particularly drawn to exclusive launches, collaborations, and culturally inspired designs. Direct-to-consumer Indian brands are successfully blending local aesthetics with global quality standards. Meanwhile, the expansion of organized retail and e-commerce is improving accessibility, helping sneaker culture extend beyond metro cities into tier-

India Sneaker Market Trends:

Rise of Athleisure and Lifestyle Integration

The Indian sneaker market is undergoing a notable shift as athleisure fashion merges sportswear with everyday wear, making sneakers a common wardrobe choice across age groups. This trend is reflected in ASICS opening its first company-owned and company-operated store in India at DLF Mall of India, Noida, highlighting rising demand for both performance and lifestyle footwear. Consumers increasingly prefer versatile sneakers suitable for fitness, work, and social settings. Growing participation in running, yoga, and sports is driving demand for comfort-focused designs that combine advanced cushioning, breathable materials, and contemporary aesthetics.

Emergence of Homegrown Direct-to-Consumer Brands

A new generation of Indian sneaker brands is transforming the market by combining cultural identity with modern design. In June 2025,homegrown label Gully Labs recently raised ₹8.7 crore in a seed funding round led by Zeropearl VC to expand its product portfolio and retail presence, reflecting growing investor confidence in design-led Indian footwear. These brands rely on digital-first strategies, influencer marketing, and direct-to-consumer models to build strong youth communities. By integrating local motifs, storytelling, and competitive pricing, Indian sneaker brands are appealing to consumers seeking authenticity, value, and self-expression beyond global brand premiums.

Growing Influence of Sneaker Culture and Resale Market

Sneaker culture has become a prominent cultural force in India, influenced by celebrity endorsements, brand collaborations, and the global streetwear movement. Platforms such as InsoleCrew have emerged as key community hubs, curating rare and authentic sneakers from global brands including Nike, Adidas, Jordan, and ASICS while hosting community-led events and content. Limited-edition drops fuel excitement and active resale markets, where collectors trade sought-after pairs. The growth of authentication and resale platforms has formalized sneaker collecting, while social media continues to strengthen engagement, visibility, and community building among Indian sneaker enthusiasts.

Market Outlook 2026-2034:

The India sneaker market is well-placed for sustained growth throughout the forecast period, supported by favorable demographic trends, rising disposable incomes, and evolving consumer lifestyle preferences. With a youth population of over four hundred million people below twenty-five years, this forms a significant consumer base that looks at sneakers as cultural markers and fashion essentials. Further urbanization and penetration of organized retail and e-commerce platforms will improve product access across different geographic locations and consumer segments. Innovation in product design, material, and manufacturing technologies will remain key for market players looking to differentiate their products and capture consumer preferences that keep changing. The presence of both international brands and emerging homegrown players makes the competitive environment dynamic, which works in consumers' favor through product variety, competitive pricing, and innovation. The market generated a revenue of USD 3.98 Billion in 2025 and is projected to reach a revenue of USD 6.53 Billion by 2034, growing at a compound annual growth rate of 5.65% from 2026-2034.

India Sneaker Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Low-Top Sneakers |

43% |

|

Category |

Branded |

65% |

|

Price Point |

Economic |

68% |

|

Distribution Channel |

Brand Outlets |

31% |

|

End User |

Men |

43% |

|

Region |

North India |

34% |

Product Type Insights:

- Low-Top Sneakers

- Mid-Top Sneakers

- High-Top Sneakers

The low-top sneakers dominate with a market share of 43% of the total India sneaker market in 2025.

The low-top sneaker continues to be the most popular option within the Indian market, as it offers versatility, is lightweight, and provides a comfortable fit, giving it the functionality to wear to casual, semi-formal, and other events throughout the day. The reason it has received favorable responses and acceptance is its ability to sustain and complement the climate and fashion within India.

The segment provides for significant product offering ranging from minimalist designs, retro designs, and fashionable designs. Brands have continuously entered the market with innovative products in terms of material and design. Low-top sneakers are easily affordable by all segments of the market ranging from economy to premium. This contributes to the dominance in the market by virtue of penetration. Moreover, there exist satisfying product features across all segments.

Category Insights:

- Branded

- Private Label

The branded leads with a share of 65% of the total India sneaker market in 2025.

Branded sneakers dominate the Indian market as consumers increasingly link established brands with quality, design innovation, and aspirational value. Global sportswear companies like ASICS are expanding locally, raising production from 30% to 40% and opening brand-owned stores in cities such as Delhi and Mumbai, reflecting strong demand. Rising disposable incomes among the growing middle class support purchases of recognized brands that offer durability, premium quality, after-sales service, and strong marketing presence through celebrity endorsements and retail partnerships.

Long-term credibility and trust, accumulated over time through the quality of their products, are supporting this segment of branded sneakers. For many consumers, this is an investment since the quality makes them long-lasting, and their appeal may be enduring. Apart from this, branded sneakers have some social meaning: they are status symbols and permit a teen to express his or her identity in groups of friends and online communities, confirming his or her fashion sense and social recognition.

Price Point Insights:

- Luxury

- Economic

The economic dominates with a market share of 68% of the total India sneaker market in 2025.

The economic price range leads the Indian market for sneakers, with affordability being an essential purchase criterion for the masses. Students, young working professionals, and budget-conscious customers form a major consumer base who look for good sport shoes with affordable price tags. Both domestic and multinational companies have identified this considerable market potential and have developed sport shoes with a blend of quality, comfort, and affordability through the economic price range.

The type is benefited by widespread distribution networks of value brands in both organized and unorganized sectors. The rise in e-commerce websites and online market spaces also supports the growth of the type as it provides consumers with lucrative prices and easy comparisons of products. Certainly, the product has to be offered at lucrative prices; however, it also has to possess functionality and modern design.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Specialty Stores

- Supermarkets and Hypermarkets

- Brand Outlets

- Online Stores

- Others

The brand outlets lead with a share of 31% of the total India sneaker market in 2025.

Brand outlets are a key retail channel for sneakers in India, offering exclusive products, authentic brand experiences, and comprehensive collections under one roof. For example, in July 2025, global retailer Foot Locker partnered with Metro Brands to open a new store in Noida, combining curated sneakers with immersive shopping experiences. These outlets allow brands to showcase full collections, tell their stories, provide personalized service, and let consumers try products, which is crucial for evaluating fit, comfort, and style before purchase.

The leading brands are increasingly adding to their direct-to-consumer retail presence in major cities as well as in new tier-two cities. The brand stores have become prominent platforms for new product launches as well as other consumer engagement events. The controlled environment of the retail setting allows for a regulated consumption experience of the brand. This creates a solid brand positioning among target groups of consumers.

End User Insights:

- Men

- Women

- Kids

The men dominate with a market share of 43% of the total India sneaker market in 2025.

The largest consumer in the sneaker market in India is males. This is due to enhanced spending trends, an active lifestyle, and wearing sneakers not only for sports activities. The rising trend in Indian males wearing sneakers for casual outings, relaxed work environments, or social gatherings has been for both comfort and fashion. Emerging trends from sports, street wear, and fashion influencers have turned sneakers from just sneakers to fashion statements, increasing their popularity in the market among males.

The category leverages strong product lines with a wide range of sports performance shoes, lifestyle lines, and limited editions targeting the male consumer with varied preferences. Brands also focus on reaching the target consumer through sports sponsorships, gaming collaborations, or joint ventures with iconic properties aligned with the interests of males. Increasing health-consciousness among the males and engaging with sporting pursuits increases the demand for sports or lifestyle sneakers to fulfill the needs.

Regional Insights:

- North India

- West and Central India

- South India

- East and Northeast India

North India exhibits a clear dominance with a 34% share of the total India sneaker market in 2025.

North India maintains its position as the leading regional market for sneakers, supported by high urbanization rates, substantial youth population concentrations, and the presence of major metropolitan centers including the National Capital Region. The region benefits from relatively higher disposable incomes in urban areas, well-developed retail infrastructure including premium shopping destinations, and strong consumer awareness of fashion trends. North Indian consumers demonstrate high receptivity to new product launches, brand collaborations, and exclusive releases that drive sneaker culture adoption.

The region demonstrates strong adoption of both organized retail formats and e-commerce platforms that enhance consumer access to diverse sneaker collections across multiple price segments and brand offerings. The concentration of educational institutions, corporate offices, and entertainment venues creates diverse usage occasions that support sneaker demand across consumer segments. Additionally, the presence of brand flagship stores, exclusive retail experiences, and sneaker-focused events in northern metropolitan centers positions the region as a trendsetting market that influences broader national consumer preferences.

Market Dynamics:

Growth Drivers:

Why is the India Sneaker Market Growing?

Expanding Youth Population and Changing Fashion Preferences

India’s large youth population is a key growth driver for the sneaker market, with Gen Z and millennials increasingly viewing footwear as a fashion statement and form of self-expression. Consumers favor uniquely designed sneakers priced between ₹3,000–₹5,500, boosting homegrown brands like Comet, Gully Labs, Thaely, and Neeman’s through social media and storytelling-led design. Exposure to global trends, celebrity styles, and influencer recommendations shapes preferences, while young Indians integrate sneakers into daily wardrobes, valuing both style and comfort across casual, social, and lifestyle occasions.

Rising Health Consciousness and Fitness Participation

Rising health and wellness awareness in India has boosted participation in running, gym workouts, yoga, and recreational sports. The Government of India’s Fit India Movement encourages daily physical activity, promoting walking, cycling, and sports, fostering a fitness culture across age groups. This growing health consciousness drives demand for performance-oriented sneakers that offer comfort, support, and functionality. Expanding fitness centers, running clubs, and sports communities in metros and tier-two cities further increase the market for quality athletic footwear that enhances performance and reduces injury risk.

E-commerce Expansion and Digital Retail Transformation

The rapid growth of e‑commerce and digital retail has broadened access to sneaker collections across India. Flipkart-owned Myntra leads India’s online fashion category, including footwear, with over 50% active user share, highlighting its role in online sneaker sales. Digital marketplaces offer wide variety, competitive pricing, reviews, and convenient delivery, attracting tech-savvy consumers. Direct-to-consumer brands use these channels to reach buyers directly with personalized experiences. Rising smartphone adoption, digital payments, and improved logistics enable e‑commerce to penetrate tier-two and tier-three cities, expanding sneaker accessibility to previously underserved markets.

Market Restraints:

What Challenges the India Sneaker Market is Facing?

Price Sensitivity and Competition from Counterfeit Products

The Indian consumer market remains highly price-sensitive, with the majority of consumers prioritizing affordability in their purchase decisions. This price consciousness limits premium segment growth and creates pressure on branded manufacturers to compete with lower-priced alternatives. The prevalence of counterfeit products in unorganized retail markets poses significant challenges, as consumers seeking brand aesthetics at lower prices often opt for imitation products that erode legitimate brand sales and consumer trust.

Low Brand Loyalty and Fragmented Consumer Preferences

Indian sneaker consumers, particularly younger segments, demonstrate relatively low brand loyalty, frequently switching between brands based on trending styles, promotional offers, and peer influences. This preference volatility requires brands to continuously invest in marketing, product innovation, and consumer engagement to maintain market relevance. The fragmented consumer preference landscape, with diverse requirements across price segments, style preferences, and usage occasions, complicates brand positioning and product portfolio management for market participants.

Limited Penetration in Rural and Semi-Urban Markets

Despite overall market growth, branded sneaker adoption remains concentrated in urban and metropolitan areas, with limited penetration in rural and smaller town markets. Lower awareness about branded footwear benefits, restricted distribution infrastructure, and affordability constraints limit market expansion beyond established urban centers. Traditional footwear preferences and limited exposure to fashion trends in rural areas further constrain potential market growth in these underserved geographic segments.

Competitive Landscape:

The India sneaker market features a dynamic competitive landscape with established international brands competing alongside emerging homegrown players and private label offerings. Leading global brands maintain strong market positions through extensive marketing investments, celebrity endorsements, strategic retail partnerships, and continuous product innovation. Domestic brands compete by offering value-focused products tailored to Indian consumer preferences, leveraging local market understanding and cost advantages. The competitive environment is characterized by brand collaborations with artists, designers, and cultural icons that generate consumer excitement and differentiate product offerings. Emerging direct-to-consumer brands are disrupting traditional market structures by leveraging digital channels, social media marketing, and community-building strategies to establish direct consumer relationships and capture market share from established players.

Recent Developments:

- In July 2025, Homegrown sneaker brand CHK was launched in India by founders including a Myntra co-founder, aiming to bridge the gap between budget and premium footwear. The brand targets Gen-Z consumers with design-led, made-in-India sneakers, reflecting rising demand for affordable yet stylish domestic sneaker labels.

India Sneaker Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Low-Top Sneakers, Mid-Top Sneakers, High-Top Sneakers |

| Categories Covered | Branded, Private Label |

| Price Points Covered | Luxury, Economic |

| Distribution Channels Covered | Specialty Stores, Supermarkets and Hypermarkets, Brand Outlets, Online Stores, Others |

| End Users Covered | Men, Women, Kids |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India sneaker market size was valued at USD 3.98 Billion in 2025.

The India sneaker market is expected to grow at a compound annual growth rate of 5.65% from 2026-2034 to reach USD 6.53 Billion by 2034.

Low-top sneakers dominated the India sneaker market with a share of 43%, driven by their versatility, lightweight design, and suitability for everyday wear across casual, semi-formal, and active lifestyle occasions.

Key factors driving the India sneaker market include the expanding youth population and changing fashion preferences, rising health consciousness and fitness participation, growing influence of athleisure trends and sneaker culture, e-commerce expansion and digital retail transformation, and increasing celebrity endorsements and brand collaborations.

Major challenges include price sensitivity among consumers, competition from counterfeit products in unorganized markets, low brand loyalty among younger consumer segments, fragmented consumer preferences, and limited penetration in rural and semi-urban markets where branded sneaker awareness and distribution remain underdeveloped.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)