India Soap Dispensers Market Size, Share, Trends and Forecast by Product Type, Application, Sales Channel, and Region, 2025-2033

India Soap Dispensers Market Overview:

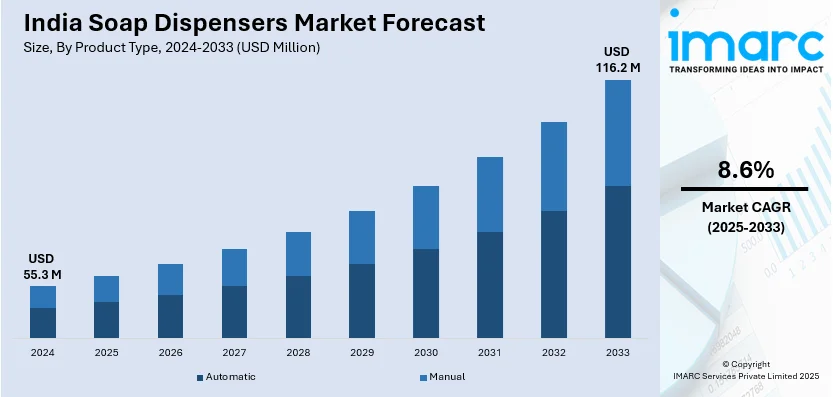

The India soap dispensers market size reached USD 55.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 116.2 Million by 2033, exhibiting a growth rate (CAGR) of 8.6% during 2025-2033. The rising hygiene awareness, government initiatives promoting sanitation, increasing adoption in commercial spaces, and urbanization are the factors propelling the growth of the market. Growth in the hospitality, healthcare, and foodservice industries, along with demand for touchless dispensers, further accelerates market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 55.3 Million |

| Market Forecast in 2033 | USD 116.2 Million |

| Market Growth Rate 2025-2033 | 8.6% |

India Soap Dispensers Market Trends:

Rising Demand for Home Hygiene Solutions

The increasing rate of homeownership among millennials in India is driving the need for modern hygiene solutions. As more individuals invest in their own residences, there is a growing emphasis on creating cleaner, more efficient living spaces. This shift is fueling interest in innovative bathroom and kitchen accessories, including touchless soap dispensers that enhance convenience and sanitation. The preference for sleek, automated, and refillable hygiene products is becoming more prominent, aligning with changing lifestyle choices. Additionally, urbanization and higher disposable incomes are influencing purchasing decisions, encouraging homeowners to adopt smart and aesthetically appealing solutions. The rise in housing ownership also means more demand for durable and long-lasting hygiene products that integrate seamlessly into contemporary home designs. With increasing awareness of health-conscious living, the market for hands-free and sensor-based soap dispensers is witnessing significant momentum, reflecting evolving consumer preferences toward improved hygiene standards in residential spaces. Apartment List's 2021 Ownership Study reported a 7.9% increase in millennial homeownership in 2020, from 40% to 47.9%, a trend projected to expand further in the housing market.

To get more information on this market, Request Sample

Growing Preference for Touchless Hygiene Solutions

The increasing focus on hygiene and convenience is driving the demand for advanced, touch-free solutions in India. Consumers are prioritizing products that reduce physical contact and enhance cleanliness in public and residential spaces. Automatic soap dispensers with infrared sensors are becoming more common, particularly in commercial establishments, hotels, and modern homes. The emphasis on aesthetics is also influencing purchasing decisions, with sleek, minimalistic designs gaining popularity. Alongside functionality, these products integrate well with sensor-based washroom accessories such as automated taps and hand dryers, creating a seamless and hygienic user experience. Businesses and homeowners are investing in smart sanitation products that combine hygiene with contemporary design. The shift toward contactless solutions reflects a broader movement toward enhanced safety standards, particularly in high-traffic environments. As awareness of cross-contamination risks increases, the adoption of automated soap dispensers is expanding, contributing to a more sanitary and efficient approach to handwashing. For instance, in April 2022, Euronics introduced the NERO series in India, featuring a black matte automatic soap dispenser. This touchless device enhances washroom hygiene by minimizing cross-contamination. The NERO series also includes sensor taps and hand dryers, combining functionality with sophisticated design to elevate bathroom aesthetics.

India Soap Dispensers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, application, and sales channel

Product Type Insights:

- Automatic

- Manual

The report has provided a detailed breakup and analysis of the market based on the product type. This includes automatic and manual.

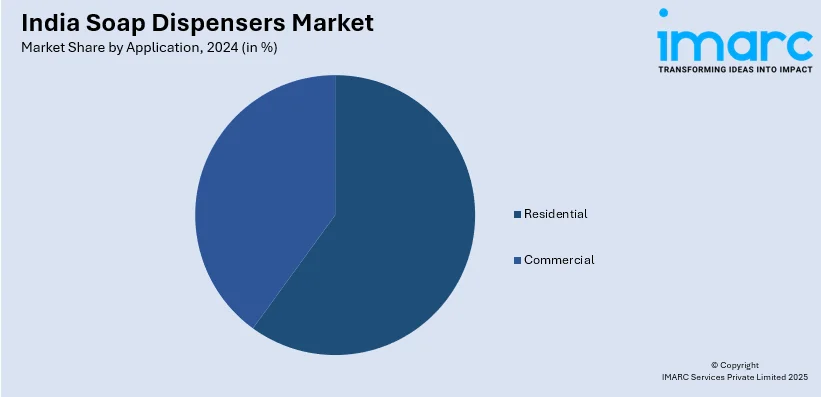

Application Insights:

- Residential

- Commercial

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes residential and commercial.

Sales Channel Insights:

- Supermarket/Hypermarket

- E-commerce Stores

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes supermarket/hypermarket and e-commerce stores.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Soap Dispensers Market News:

- In April 2022, Kent RO Systems Ltd., based in Noida, Uttar Pradesh, launched the Kent Touchless Soap Dispenser. Equipped with an infrared sensor, this automatic dispenser ensures a hygienic, contact-free handwashing experience, reflecting Kent's commitment to innovative health solutions in India.

India Soap Dispensers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Automatic, Manual |

| Applications Covered | Residential, Commercial |

| Sales Channels Covered | Supermarket/Hypermarket, E-commerce Stores |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India soap dispensers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India soap dispensers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India soap dispensers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The soap dispensers market in India was valued at USD 55.3 Million in 2024.

The India soap dispensers market is projected to exhibit a CAGR of 8.6% during 2025-2033, reaching a value of USD 116.2 Million by 2033.

Key factors driving the India soap dispensers market include increasing hygiene awareness, changing lifestyle habits, and the adoption of touchless technology in public and commercial spaces. Additionally, government initiatives promoting sanitation and the growth of the hospitality sector further drive the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)