India Social Commerce Market Size, Share, Trends and Forecast by Business Model, Device Type, Product Type, and Region, 2025-2033

India Social Commerce Market Size and Share:

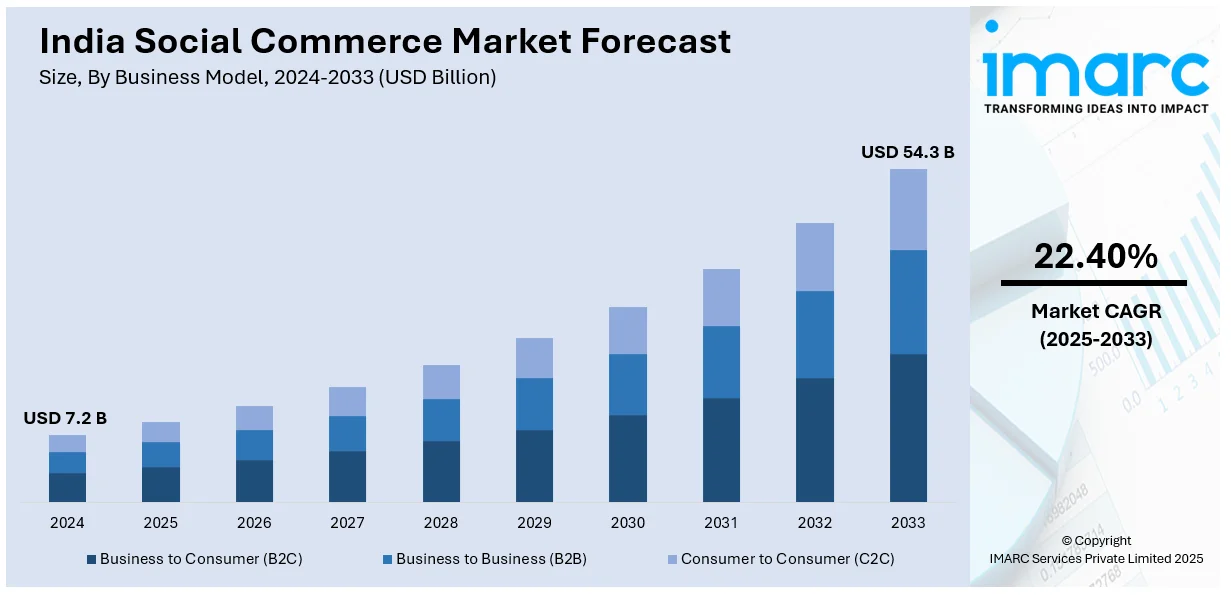

The India social commerce market size was valued at USD 7.2 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 54.3 Billion by 2033, exhibiting a CAGR of 22.40% during 2025-2033. West and Central India currently dominates the market. The market is growing due to widespread smartphone adoption, affordable internet, and the influence of platforms. Tier 2 and 3 cities are key growth areas, driven by trust in peer recommendations and vernacular content. Digital payments (UPI, BNPL) and localized solutions further enhance accessibility. Government initiatives support digital inclusion, while AI-driven personalization and gamification enhance user engagement, thus expanding the India social commerce market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 7.2 Billion |

|

Market Forecast in 2033

|

USD 54.3 Billion |

| Market Growth Rate 2025-2033 | 22.40% |

The market is primarily driven by the rapid adoption of smartphones and affordable internet access, fueled by competitive data plans and expanding 4G/5G networks. With million internet users, platforms have become key enablers for small businesses and individual sellers to reach customers directly. A report indicates that 84% of smartphone users in India examine their devices within 15 minutes of rising, dedicating 31% of their waking hours to smartphone usage. The duration of time spent on smartphones has increased significantly, rising from 2 hours in 2010 to 4.9 hours in 2023, with an average of 80 checks per day. Along with this, Tier 2 and Tier 3 cities are major growth contributors, as consumers increasingly trust peer recommendations and influencer-led purchases. Additionally, vernacular content and localized payment options, such as UPI and buy-now-pay-later (BNPL) services, are breaking barriers, making online shopping more accessible to non-English-speaking and cash-driven populations. Therefore, this is creating a positive India social commerce market outlook.

To get more information on this market, Request Sample

In addition, the shift toward community-based shopping, where group buying and live commerce enhance engagement, is propelling the market. Platforms leverage social networks to facilitate reselling and bulk purchases, appealing to price-sensitive consumers. India is estimated to have over 900 million social media users by the year 2025. The average time spent by individuals in India on social media is 2 hours and 30 minutes a day, making it one of the most sought-after channels for increasing awareness about a particular product among consumers. The rise of micro-entrepreneurs, particularly women and rural sellers, further accelerates the India social commerce market growth by fostering hyperlocal commerce. Government initiatives including Digital India and ONDC (Open Network for Digital Commerce) also play a role by supporting small vendors in transitioning online. Additionally, gamification, personalized recommendations, and AI-driven chatbots are improving user experience, enhancing retention, and driving higher conversion rates in India’s fast-changing social commerce ecosystem. These efforts are helping bridge the digital divide, particularly in rural areas, allowing small businesses to access a wider audience. Furthermore, as digital payment systems become more secure and accessible, the ease of transactions is fueling consumer confidence and market growth.

India Social Commerce Market Trends:

Digitization and Digital Transformation

The increasing digitization in India is a primary driver of market expansion. Social commerce allows businesses to operate without the need for a cutting infrastructure, physical presence, communication, and overhead costs. According to the Ministry of Electronics & IT, industries such as ICT services and electronic manufacturing accounted for 7.83% of Gross Value Added (GVA), with digital platforms and intermediaries contributing an additional 2%. This highlights the far-reaching impact of digital transformation in the economy. With the rise of internet penetration and growing use of smartphones, laptops, and tablets for social media access, the market is expected to continue its upward trajectory, fueled by the widespread digital shift.

Rise in Smartphone Shipments Drives Social Commerce Adoption

Smartphone usage is increasingly central to India’s social commerce landscape. As per the India Brand Equity Foundation, smartphone shipments in India increased by 3% year-on-year in Q3 2024, with their total value growing by 12%, marking a record quarterly high. The growing number of smartphone users presents a significant opportunity for social commerce platforms to tap into a larger customer base. With consumers increasingly using smartphones to access social media and engage in online shopping, this trend is contributing directly to India social commerce market demand, indicating a shift toward mobile-first commerce solutions in India. This mobile-driven behavior is reshaping how brands interact with consumers, pushing businesses to optimize content and services for smartphone users.

Technological Advancements Enhance User Experience

Technological innovations, particularly artificial intelligence (AI) integrations, are propelling social commerce in India. The use of AI-powered chatbots and voice assistants is optimizing customer interactions by predicting behavior and enhancing user experiences. According to the International Journal of Management, Economics, and Commerce, AI-enabled chatbots improve product selection accuracy by 48% per unit of implementation. These advancements are enabling businesses to deliver personalized and efficient services, driving higher engagement and conversion rates. According to the India social commerce marker forecast, this technological advancement is expected to accelerate the growth of social commerce platforms across India, helping them cater to a more data-driven and customer-focused audience.

India Social Commerce Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India social commerce market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on business model, device type, and product type.

Analysis by Business Model:

- Business to Consumer (B2C)

- Business to Business (B2B)

- Consumer to Consumer (C2C)

Business to consumer (B2C) stands as the largest component in 2024, driven by the increasing preference for direct online purchases through social media platforms. Brands and retailers leverage Facebook, Instagram, and WhatsApp to engage customers with personalized promotions, influencer collaborations, and seamless checkout experiences. The convenience of discovering products via social feeds, coupled with secure digital payments including UPI and BNPL, has accelerated B2C adoption. Additionally, rising smartphone penetration and internet accessibility enable businesses to target both urban and rural consumers effectively. E-commerce giants, along with D2C brands, utilize social commerce to enhance reach and conversions. The segment’s growth is further fueled by AI-driven recommendations, live commerce, and targeted ads, making B2C the preferred choice for businesses aiming to capitalize on India’s rapidly expanding digital shopper base.

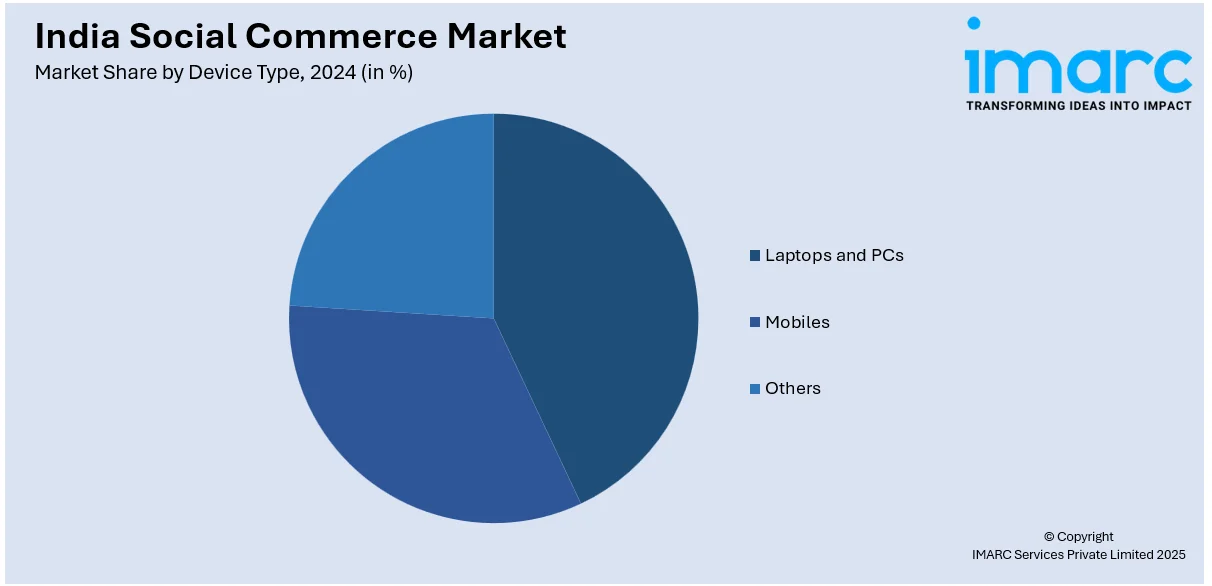

Analysis by Device Type:

- Laptops and PCs

- Mobiles

- Others

Mobiles lead the market in 2024, driven by widespread smartphone adoption and affordable internet access. With over 700 million users, mobile phones serve as the primary gateway for online shopping, particularly in Tier 2 and 3 cities where affordability and convenience play a key role. Social commerce platforms leverage mobile-friendly interfaces, enabling seamless browsing, transactions, and peer-to-peer recommendations. The rise of short-video platforms further increases mobile-driven purchases through engaging, visual content. Additionally, mobile-exclusive features such as UPI payments, one-click checkouts, and app-based loyalty programs enhance user experience, driving higher conversions. As 5G expands and budget smartphones become more accessible, mobiles will continue to fuel India’s social commerce growth, making them the preferred choice for both consumers and sellers.

Analysis by Product Type:

- Personal and Beauty Care

- Apparels

- Accessories

- Home Products

- Health Supplements

- Food and Beverages

- Others

Apparels lead the market in 2024, fueled by rising fashion consciousness, affordability, and the influence of social media trends. Platforms cater to demand for trendy, budget-friendly clothing, particularly among young and aspirational buyers in Tier 2 and 3 cities. The segment thrives on influencer endorsements, live commerce demonstrations, and peer recommendations, which drive impulse purchases. Seasonal discounts, easy return policies, and vernacular content further enhance accessibility for diverse demographics. Additionally, the proliferation of local and global fast-fashion brands on social platforms ensures a steady supply of stylish options. With India’s growing youth population and increasing disposable income, apparel remains the most sought-after category, solidifying the social commerce market in India.

Regional Analysis:

- North India

- West and Central India

- South India

- East India

In 2024, West and Central India accounted for the largest market share, driven by rapid urbanization, robust digital infrastructure, and strong consumer purchasing power. States including Maharashtra, Gujarat, and Madhya Pradesh boast a tech-savvy population that actively engages with platforms. Mumbai and Ahmedabad serve as key hubs for e-commerce and D2C brands, leveraging social media for targeted promotions and influencer collaborations. The region’s widespread smartphone penetration, coupled with seamless UPI adoption, further accelerates transaction volumes. Additionally, the presence of manufacturing clusters and local artisans in these states ensures a steady supply of trendy apparel, handicrafts, and electronics—key drivers of social commerce sales. With a blend of metropolitan demand and Tier 2 market growth, West and Central India remain pivotal to the sector’s expansion.

Competitive Landscape:

The competitive landscape of the market is characterized by aggressive expansion strategies, technological innovation, and localized approaches to capture diverse consumer segments. According to the India social commerce market analysis, key players are leveraging AI-driven recommendations, vernacular interfaces, and hyperlocal supply chains to enhance user engagement and retention. Many are integrating live commerce features and gamification to enhance interactive shopping experiences, while others focus on empowering small sellers through reseller networks and zero-commission models. Strategic partnerships with payment gateways and logistics providers are streamlining transactions and delivery, particularly in Tier 2 and 3 cities. Additionally, brands are investing in influencer collaborations and short-video commerce to tap into younger demographics. With intensifying competition, companies are also prioritizing customer trust through easy returns, cashless payments, and community-driven validation, ensuring sustainable growth in this rapidly transforming sector.

The report provides a comprehensive analysis of the competitive landscape in the India social commerce market with detailed profiles of all major companies.

Latest News and Developments:

- February 2025: Yotta Data Services launched myShakti, a B2C generative AI chatbot. Built on the open-source DeepSeek model and powered by 128 Nvidia H100 GPUs, myShakti was designed to support numerous applications, including customer support, healthcare, education, and legal research. Its capabilities in automating customer interactions and handling queries are expected to support online retail experiences.

- February 2025: DTDC launched 2-4 hour and same-day delivery services, expanding into rapid commerce with a new dark store in Bengaluru. This initiative aimed to improve last-mile delivery and support D2C and social commerce sellers. DTDC also announced that it intends to extend these services nationwide, tapping into the growing demand for faster e-commerce deliveries.

- November 2024: Amazon introduced Creator Central, an in-app platform that empowers influencers by streamlining content creation, monetization, and customer engagement. Features included tools for designing, reviewing, and publishing content, accessing earnings analytics, and managing dedicated storefronts.

- September 2024: AnyMind Group unveiled its GenAI-powered live commerce platform, AnyLive, to enhance cross-border e-commerce. The platform used AI-generated virtual streamers and large-language models to create multi-language live streams.

- August 2024: Worldline launched an Omnichannel Payments Platform, 'One Commerce'. The platform integrated in-store and online payments, offering features such as WhatsApp In-App integration, Instagram QR, and subscription payments. It aimed to streamline transactions, providing businesses with a unified and seamless customer experience.

India Social Commerce Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Business Models Covered | Business to Consumer (B2C), Business to Business (B2B), Consumer to Consumer (C2C) |

| Device Types Covered | Laptops and PCs, Mobiles, Others |

| Product Types Covered | Personal and Beauty Care, Apparels, Accessories, Home Products, Health Supplements, Food and Beverages, Others |

| Regions Covered | North India, West and Central India, South India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India social commerce market from 2019-2033.

- The India social commerce market research report provides the latest information on the market drivers, challenges, and opportunities in the regional market.

- The study maps the leading, as well as the fastest-growing, regional markets.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India social commerce industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India social commerce market was valued at USD 7.2 Billion in 2024.

The widespread adoption of smartphones and affordable internet access is propelling market growth. The rise of digital payments, including UPI and BNPL services, along with localized solutions, enhances accessibility. Government initiatives such as Digital India and ONDC support the transition of small businesses to online platforms. AI-driven personalization and gamification improve user engagement and retention.

The India social commerce market is projected to exhibit a CAGR of 22.40% during 2025-2033, reaching a value of USD 54.3 Billion by 2033.

Mobiles dominate the market in 2024, driven by widespread smartphone adoption, affordable internet, and mobile-first features like UPI payments and short-video content that enhance accessibility and user engagement across urban and rural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)