India Sodium Chlorate Market Size, Share, Trends and Forecast by Form, Application, and Region, 2025-2033

India Sodium Chlorate Market Overview:

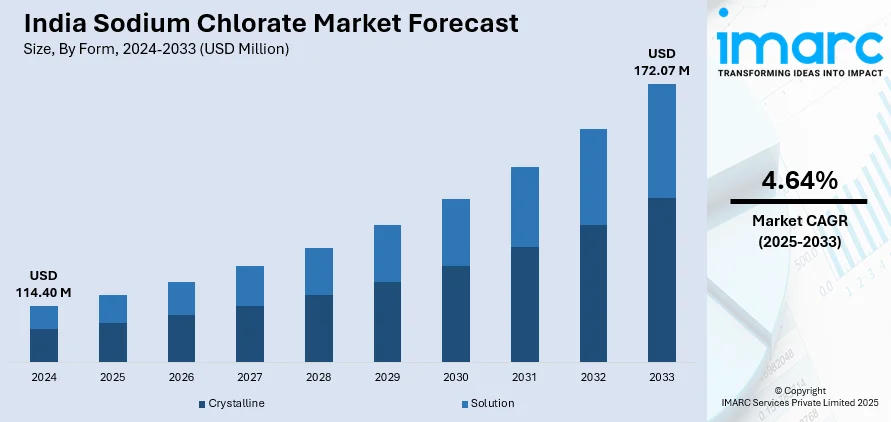

The India sodium chlorate market size reached USD 114.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 172.07 Million by 2033, exhibiting a growth rate (CAGR) of 4.64% during 2025-2033. The market is primarily driven by its essential role in the pulp and paper industry, where it serves as a key bleaching agent. Moreover, technological advancements in manufacturing processes have enhanced efficiency and environmental sustainability and are further catalyzing the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 114.40 Million |

| Market Forecast in 2033 | USD 172.07 Million |

| Market Growth Rate 2025-2033 | 4.64% |

India Sodium Chlorate Market Trends:

Rising Demand from the Pulp and Paper Industry

The burgeoning demand from India's pulp and paper industry is a significant driver of the country's sodium chlorate market. Sodium chlorate (NaClO₃) is indispensable in producing chlorine dioxide (ClO₂), a key bleaching agent in Elemental Chlorine-Free (ECF) processes. This method effectively removes lignin from wood pulp, yielding high-quality, bright, and durable paper products while minimizing environmental impact. As India's paper production capacity expands to meet the needs of sectors like packaging, education, and communication, the consumption of sodium chlorate correspondingly increases. For instance, the shift towards eco-friendly bleaching practices has led many Indian paper mills to adopt ECF bleaching, relying heavily on sodium chlorate. This transition not only enhances product quality but also ensures compliance with stringent environmental regulations, further fueling sodium chlorate demand.

To get more information on this market, Request Sample

Expansion in the Chemical and Industrial Sectors

India’s rapid industrialization and expanding infrastructure are driving demand for sodium chlorate across various sectors, including chemical synthesis, herbicides, explosives, and water treatment. The India specialty chemicals industry, projected to grow at a CAGR of 3.8% from 2023 to 2025, is fueling the need for high-performance oxidizers like sodium chlorate. Additionally, with precision agriculture gaining traction, sodium chlorate's application as a desiccant and herbicide in crop production is increasing, contributing to the Indian agrochemical market’s expected growth to USD 23.3 billion by 2033 at a 4.28% CAGR (2025-2033). Beyond agriculture, the water treatment industry in India is experiencing rapid expansion due to stricter industrial waste regulations, further boosting sodium chlorate demand as a disinfectant and oxidizer. The chemical sector’s shift toward sustainable and efficient oxidizing agents has also expanded sodium chlorate’s role in industrial applications such as dye manufacturing and wastewater treatment, reinforcing its critical position in India’s evolving industrial landscape.

India Sodium Chlorate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on form and application.

Form Insights:

- Crystalline

- Solution

The report has provided a detailed breakup and analysis of the market based on the form. This includes crystalline and solution.

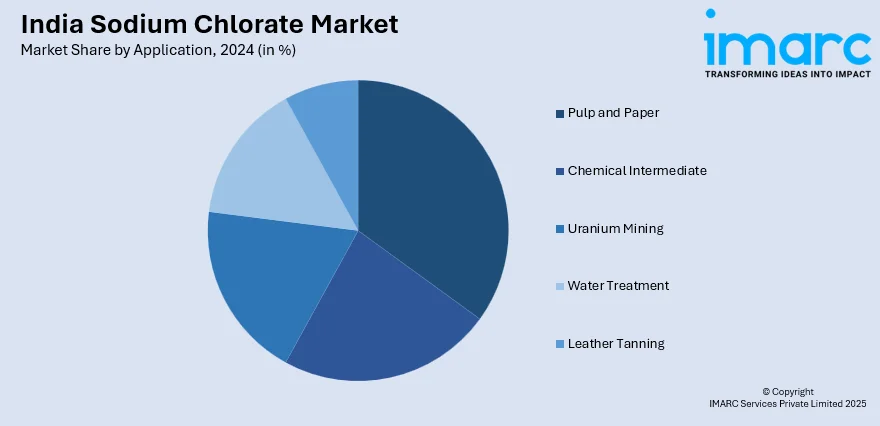

Application Insights:

- Pulp and Paper

- Chemical Intermediate

- Uranium Mining

- Water Treatment

- Leather Tanning

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes pulp and paper, chemical intermediate, uranium mining, water treatment, and leather tanning.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Sodium Chlorate Market News:

- April 2025: ITC Limited agreed to acquire Century Pulp & Paper (CPP) from Aditya Birla Real Estate Limited. Established in 1984 in Lalkuan, Uttarakhand, CPP has an annual production capacity of 480,000 metric tons. This acquisition is set to enhance ITC's Paperboards & Specialty Papers Business by increasing production capacity, improving customer service efficiency, and diversifying operations across multiple sites.

- March 2025: Gujarat Alkalies and Chemicals Limited (GACL), an Indian sodium chlorate production company, launched the country's largest chlorotoluene factory in Dahej. The project, costing INR 350 crore, would employ chlorine to produce value-added chlorine-based goods. The facility is planned to employ over 1,000 people and produce approximately INR 130 crore in foreign cash through chemical exports to Europe, America, and South Asia. GACL.

India Sodium Chlorate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Forms Covered | Crystalline, Solution |

| Applications Covered | Pulp and Paper, Chemical Intermediate, Uranium Mining, Water Treatment, Leather Tanning |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India sodium chlorate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India sodium chlorate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India sodium chlorate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The sodium chlorate market in India was valued at USD 114.40 Million in 2024.

The India sodium chlorate market is projected to exhibit a CAGR of 4.64% during 2025-2033, reaching a value of USD 172.07 Million by 2033.

The India sodium chlorate market is propelled by rising demand from the pulp and paper industry for bleaching processes, along with its applications in herbicides and specialty chemicals. Increasing industrialization, growth in agricultural chemicals, and expanding exports are further supporting the market’s steady consumption across multiple end-use sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)