India Software Market Size, Share, Trends and Forecast by Type, Deployment Mode, Enterprise Size, Industry Vertical, and Region, 2026-2034

India Software Market Summary:

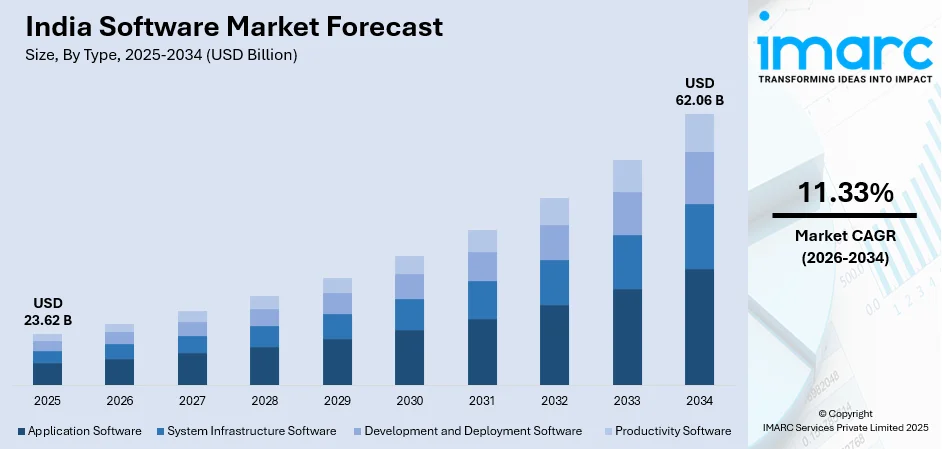

The India software market size was valued at USD 23.62 Billion in 2025 and is projected to reach USD 62.06 Billion by 2034, growing at a compound annual growth rate of 11.33% from 2026-2034.

The market is driven by rapid digital transformation across industries, widespread adoption of cloud computing solutions, and increasing internet and smartphone penetration nationwide. Government initiatives promoting digitalization, coupled with rising investments in artificial intelligence (AI) and cybersecurity technologies, are fueling expansion. The thriving startup ecosystem and robust IT export capabilities further accelerate growth, while enterprises increasingly implement software solutions to enhance operational efficiency and maintain competitive advantages in the evolving India software market.

Key Takeaways and Insights:

-

By Type: Application software dominates the market with a share of 46% in 2025, driven by increasing enterprise demand for business process automation, customer relationship management solutions, and enterprise resource planning systems enhancing organizational productivity.

-

By Deployment Mode: Cloud-based leads the market with a share of 64% in 2025, owing to its superior scalability, reduced infrastructure costs, enhanced accessibility enabling remote workforce operations, and flexibility in resource scaling.

-

By Enterprise Size: Large enterprises represent the largest segment with a market share of 52% in 2025, driven by substantial IT budgets enabling comprehensive digital transformation initiatives and complex operational requirements demanding integrated software ecosystems.

-

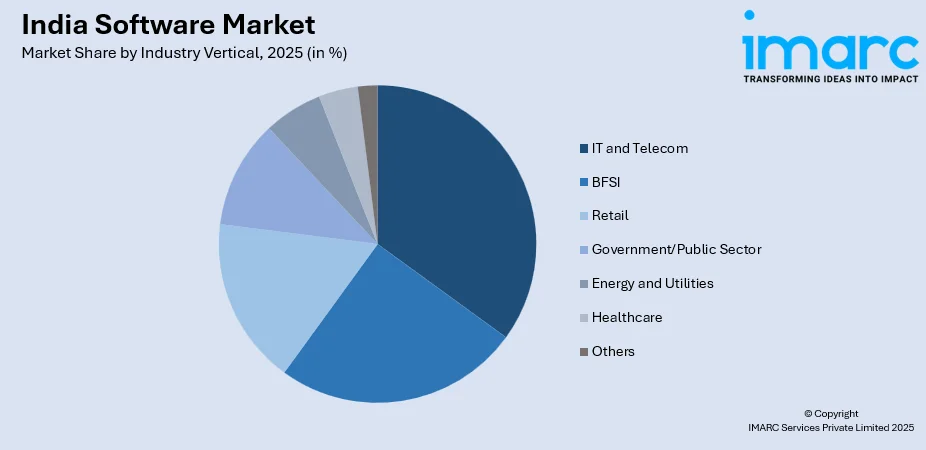

By Industry Vertical: IT and telecom dominate the market with a share of 28% in 2025, owing to to inherent technology-first operational models, continuous requirements for network management software, communication platforms, and billing systems.

-

By Region: Northern India leads the largest segment with a market share of 32% in 2025, driven by the concentration of major technology hubs including Delhi-NCR, presence of government institutions, and significant business process outsourcing operations.

-

Key Players: The India software market exhibits a moderately fragmented competitive landscape, characterized by the presence of established multinational technology corporations alongside domestic IT service providers and emerging software startups offering specialized solutions across various industry verticals.

To get more information on this market Request Sample

The India software market is experiencing robust expansion, propelled by accelerating digital transformation initiatives undertaken by organizations across all sectors. The proliferation of cloud computing technologies has revolutionized how businesses deploy and manage software applications, offering unprecedented scalability and cost optimization. As per sources, in November 2025, Tata Consultancy Services (TCS) and SAP signed a five-year agreement to drive enterprise-wide cloud and generative AI transformation, strengthening AI-led IT operations, accelerating innovation, and improving efficiency across SAP’s global business landscape. Moreover, government programs promoting digitalization, including initiatives focused on electronic governance and digital payments, have created substantial demand for software solutions throughout public and private sectors. The expanding internet infrastructure and increasing smartphone adoption have established a foundation for software-based services to reach broader populations. Furthermore, enterprises are prioritizing investments in productivity enhancement tools, cybersecurity solutions, and business intelligence platforms to maintain competitive positioning in evolving market conditions. The growing emphasis on automation and AI integration is further accelerating software adoption, as organizations seek operational efficiency improvements and enhanced decision-making capabilities across diverse industry verticals.

India Software Market Trends:

Growing Integration of Artificial Intelligence and Machine Learning

The India software market is witnessing accelerated integration of AI and machine learning (ML) capabilities into business applications. According to sources, in October 2025, Under the India AI Mission, the Government allocated over ₹10,300 crore and deployed 38,000 GPUs to strengthen national AI infrastructure and accelerate inclusive AI-driven innovation across sectors. Furthermore, organizations are increasingly adopting AI-powered software solutions to automate complex decision-making processes, enhance customer engagement through intelligent chatbots, and derive actionable insights from vast data repositories. This technological evolution is transforming traditional software offerings into intelligent systems capable of predictive analytics and autonomous operations. Software vendors are embedding ML algorithms into enterprise applications, enabling adaptive learning and continuous improvement in functionality across customer relationship management, supply chain optimization, and financial management domains.

Expansion of Low-Code and No-Code Development Platforms

The emergence of low-code and no-code development platforms is democratizing software creation capabilities across Indian enterprises. As per sources, in November 2025, Zoho unveiled AI-powered Zoho One, enhancing contextual collaboration across 50+ integrated applications, enabling businesses to build, automate, and manage workflows with minimal coding through unified AI, UX, and integrations. Further, these platforms enable business users without extensive programming expertise to develop functional applications addressing specific organizational requirements. This trend is accelerating digital transformation timelines by reducing dependency on traditional software development cycles. Organizations are leveraging visual development interfaces to rapidly prototype, deploy, and iterate applications supporting diverse operational workflows. The approach significantly reduces development costs while empowering domain experts to create customized solutions addressing unique business challenges without requiring extensive technical resources or prolonged implementation schedules.

Rising Adoption of Software-as-a-Service Delivery Models

Indian enterprises are increasingly transitioning from traditional perpetual licensing models toward subscription-based software-as-a-service consumption patterns. According to sources, in June 2025 stat reflects shifting investment patterns within India’s software ecosystem, showing how AI-native and SaaS-AI hybrid models are reshaping software development, monetization, and growth strategies across Indian enterprises and startups. Moreover, this shift enables organizations to access sophisticated software capabilities without substantial upfront capital investments while ensuring continuous access to latest features and security updates. The subscription model provides enhanced flexibility in scaling software utilization according to business requirements, supporting seasonal fluctuations and growth trajectories. Vendors are restructuring product offerings around recurring revenue models, providing comprehensive service packages encompassing maintenance, support, and periodic enhancements, thereby establishing long-term customer relationships and predictable revenue streams.

Market Outlook 2026-2034:

The India software market is projected to exhibit substantial revenue growth throughout the forecast period, reflecting the country's accelerating digital transformation journey and increasing technology adoption across traditional industries. Growing sophistication of enterprise software requirements continues driving expansion. The market revenue growth will be sustained by expanding cloud services adoption, AI integration, cybersecurity investments, and the continuous emergence of specialized software solutions addressing diverse industry-specific operational needs nationwide. The market generated a revenue of USD 23.62 Billion in 2025 and is projected to reach a revenue of USD 62.06 Billion by 2034, growing at a compound annual growth rate of 11.33% from 2026-2034.

India Software Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Type |

Application Software |

46% |

|

Deployment Mode |

Cloud-based |

64% |

|

Enterprise Size |

Large Enterprises |

52% |

|

Industry Vertical |

IT and Telecom |

28% |

|

Region |

Northern India |

32% |

Type Insights:

- Application Software

- Enterprise Resource Planning (ERP)

- Customer Relationship Management (CRM)

- Supply Chain Management (SCM)

- Enterprise Collaboration Software

- Enterprise Content Management (ECM) Software

- Education Software

- Others

- System Infrastructure Software

- Network Management Systems (NMS)

- Storage Software

- Security Software

- Development and Deployment Software

- Enterprise Data Management (EDM)

- Business Analytics and Reporting Tools

- Application Servers

- Integration and Orchestration Middleware

- Data Quality Tools

- Productivity Software

- Office Software

- Creative Software

- Others

The application software dominates with a market share of 46% of the total India software market in 2025.

Application software maintains its position as the dominant segment within the India software market, commanding substantial revenue contribution through diverse solution categories. Enterprise resource planning systems enable organizations to integrate core business processes including finance, human resources, supply chain, and manufacturing operations within unified platforms. Customer relationship management applications facilitate enhanced customer engagement, sales automation, and service management capabilities. As per sources, in September 2025, Haptik launched “AI for All,” enabling over 50,000 Indian SMBs to deploy enterprise-grade AI Agents, automating customer interactions and boosting CRM efficiency. Moreover, these solutions are experiencing heightened adoption as businesses prioritize operational efficiency, customer satisfaction enhancement, and data-driven decision-making processes.

The application software continues evolving through incorporation of advanced technologies including AI, analytics, and automation capabilities. Educational software solutions are gaining traction with increasing emphasis on digital learning platforms across academic institutions and corporate training environments. Supply chain management applications address growing complexity in logistics operations, while collaboration software supports distributed workforce models. The segment benefits from continuous innovation in user experience design, mobile accessibility, and integration capabilities enabling seamless connectivity across organizational technology ecosystems.

Deployment Mode Insights:

- On-premises

- Cloud-based

Cloud-based leads with a share of 64% of the total India software market in 2025.

Cloud-based has emerged as the predominant model for software delivery within the Indian market, driven by compelling advantages in scalability, accessibility, and cost optimization. According to sources, in October 2025, Bharti Airtel partnered with IBM to expand its cloud services (Airtel Cloud), establishing Multizone Regions to support Indian enterprises with secure, resilient cloud infrastructure. Moreover, organizations increasingly prefer cloud deployment to eliminate capital expenditure on infrastructure while gaining flexibility to scale resources according to fluctuating operational demands. The model enables geographically dispersed workforces to access applications seamlessly, supporting evolving workplace paradigms emphasizing remote and hybrid operational arrangements.

Cloud-based offers inherent advantages in maintenance reduction, automatic updates, and enhanced disaster recovery capabilities that traditional on-premises installations cannot match economically. Security improvements in cloud infrastructure, combined with compliance certifications addressing industry-specific regulatory requirements, have addressed historical concerns regarding data protection. The subscription-based pricing structure associated with cloud deployments provides financial predictability while enabling access to sophisticated software capabilities previously accessible only to large enterprises with substantial IT budgets. Integration capabilities supporting multi-cloud and hybrid architectures further enhance deployment flexibility.

Enterprise Size Insights:

- Small and Medium-sized Enterprises

- Large Enterprises

Large enterprises exhibit a clear dominance with a 52% share of the total India software market in 2025.

Large enterprises constitute the dominant customer segment for software solutions in India, leveraging substantial technology budgets to implement comprehensive digital transformation initiatives. These organizations require sophisticated, integrated software ecosystems capable of supporting complex operational workflows across multiple departments, geographic locations, and business units. Enterprise-grade requirements encompassing advanced security, regulatory compliance, customization capabilities, and extensive integration with existing technology infrastructure drive preference for comprehensive software platforms.

Large enterprises demonstrate greater propensity for adopting emerging technologies including AI, ML, and advanced analytics within their software investments. According to sources, in November 2025, EY-CII reported that 47% of Indian enterprises have multiple Generative AI use cases live in production, marking a clear shift from pilots to performance. Further, these organizations possess dedicated IT teams capable of managing complex implementations and deriving maximum value from sophisticated software capabilities. The segment drives significant market revenue through enterprise-wide license agreements, extensive customization requirements, and comprehensive support service engagements. Digital transformation imperatives motivate continuous technology investments as large enterprises seek competitive advantages through operational excellence and innovation.

Industry Vertical Insights:

Access the comprehensive market breakdown Request Sample

- IT and Telecom

- BFSI

- Retail

- Government/Public Sector

- Energy and Utilities

- Healthcare

- Others

IT and telecom lead with a market share of 28% of the total India software market in 2025.

IT and telecom represent the leading industry vertical for software consumption within the Indian market. This sector's inherent technology-centric operational model creates continuous requirements for sophisticated software solutions supporting service delivery, network management, and customer operations. Telecommunications operators require extensive billing systems, customer management platforms, and network optimization tools enabling efficient service provision to millions of subscribers across diverse communication technologies.

IT and telecom organizations consume substantial software resources supporting their client service delivery operations, internal productivity requirements, and business management functions. The sector demonstrates early adoption patterns for emerging software technologies, often serving as proving grounds for innovative solutions before broader market penetration. In April 2025, Bharti Airtel partnered with Google and Jio Platforms with Nvidia to co-develop locally relevant AI use cases across retail, healthcare, agriculture, and education in India. Moreover, cloud services providers, data center operators, and technology startups within this vertical contribute significantly to software consumption. The sector's competitive dynamics drive continuous technology investment as organizations seek differentiation through superior service capabilities and operational efficiency.

Regional Insights:

- Northern India

- West and Central India

- South India

- East and Northeast India

Northern India dominates with a market share of 32% of the total India software market in 2025.

Northern India has established itself as the dominant regional market for software solutions, anchored by the extensive technology ecosystem concentrated within the Delhi-National Capital Region. The region hosts numerous multinational technology operations, major government institutions, and substantial business process outsourcing establishments collectively driving significant software consumption. Established IT infrastructure, robust connectivity, and concentration of skilled technology professionals support vibrant software market activity.

The region benefits from proximity to central government operations requiring extensive software implementations across administrative, defense, and public service domains. Industrial corridors extending throughout Northern India encompass manufacturing, automotive, and pharmaceutical operations increasingly adopting digital transformation initiatives. Educational institutions concentrated within the region contribute to software consumption while simultaneously developing technology talent supporting industry requirements. Financial services, retail, and healthcare sectors operating across major Northern Indian metropolitan areas demonstrate growing software adoption patterns, further strengthening regional market contribution.

Market Dynamics:

Growth Drivers:

Why is the India Software Market Growing?

Accelerating Digital Transformation Across Industry Verticals

Digital transformation has emerged as a strategic imperative for Indian organizations seeking competitive advantage in evolving market conditions. Enterprises across manufacturing, healthcare, financial services, and retail sectors are implementing comprehensive software solutions to modernize legacy operations and enhance customer engagement capabilities. As per sources, in August 2025, Tata Projects adopted SAP’s cloud-first ERP solutions, unifying project planning, procurement, finance, HR, and analytics to enhance operational efficiency and enable real-time data-driven decisions. Further, this transformation encompasses adoption of cloud platforms, business intelligence tools, and automation technologies enabling data-driven decision-making processes. Organizations recognize that digital capabilities directly influence market positioning, customer satisfaction, and operational resilience. The transformation journey requires substantial software investments spanning enterprise applications, integration platforms, and specialized industry solutions, driving consistent market expansion as organizations progress through successive digital maturity stages.

Government Initiatives Promoting Digital Economy Development

Government programs focused on digital infrastructure development and electronic governance have created substantial demand for software solutions across public and private sectors. Initiatives promoting digital payments, electronic documentation, and online service delivery require extensive software implementations supporting citizen-facing applications and backend administrative systems. According to sources, in 2025, India’s National e-Governance Division (NeGD) integrated nearly 2,000 e-Government services on DigiLocker and e-District platforms, enabling citizens nationwide seamless access to certificates, welfare schemes, and utility services. Moreover, the emphasis on digital identity systems, taxation platforms, and public service automation generates requirements for specialized software development and deployment. These programs create multiplier effects as digitally enabled government services necessitate corresponding capabilities within private sector organizations interacting with public systems. Infrastructure investments supporting connectivity expansion enable software adoption in previously underserved geographic regions, broadening addressable market scope.

Rising Enterprise Focus on Operational Efficiency Enhancement

Indian enterprises are increasingly prioritizing operational efficiency improvements through software-enabled process optimization and automation. Organizations recognize that traditional manual processes cannot scale economically while maintaining quality standards required in competitive markets. Software solutions enabling workflow automation, resource optimization, and productivity enhancement directly address these requirements. Enterprise resource planning implementations provide integrated visibility across business operations, while specialized applications address function-specific optimization requirements. As per sources, in September 2025, Nilons Enterprises adopted RISE with SAP cloud-ERP, enhancing operational efficiency, supply chain visibility, and data-driven decision-making across its food processing operations in India. Moreover, the efficiency imperative extends across supply chain management, financial operations, human resources administration, and customer service domains. Organizations achieving efficiency gains through software adoption establish competitive advantages motivating broader industry adoption, sustaining market growth momentum.

Market Restraints:

What Challenges the India Software Market is Facing?

Cybersecurity Vulnerabilities and Data Protection Concerns

Organizations contemplating software implementations face substantial concerns regarding cybersecurity vulnerabilities and data protection requirements. The increasing sophistication of cyber threats targeting software systems creates hesitancy among organizations managing sensitive information. Data breach incidents generate significant reputational damage and regulatory penalties, motivating cautious evaluation of software solutions and deployment approaches. Compliance requirements addressing data protection regulations impose additional implementation complexity and ongoing operational overhead, potentially slowing adoption timelines.

Skilled Workforce Availability Constraints

The India software market faces constraints related to availability of appropriately skilled technology professionals capable of implementing and managing sophisticated software systems. While the country produces substantial numbers of technology graduates, demand for specialized expertise in emerging technologies often exceeds supply. Organizations encounter difficulties recruiting professionals with expertise in advanced analytics, AI, and cloud architecture.

Integration Complexity with Legacy Systems

Organizations operating established technology environments face significant integration challenges when implementing new software solutions alongside legacy systems. Many Indian enterprises maintain substantial investments in older technology platforms that cannot be rapidly replaced despite limitations. Achieving seamless data flow and process integration between modern software applications and legacy infrastructure requires extensive customization and specialized expertise.

Competitive Landscape:

The India software market presents a dynamic competitive environment characterized by diverse participant categories competing across solution segments and customer tiers. Established multinational technology corporations leverage global product portfolios, substantial research capabilities, and extensive partner ecosystems to address enterprise customer requirements. These organizations compete through comprehensive solution breadth, advanced technology integration, and established brand recognition supporting complex implementation engagements. Domestic IT service providers leverage deep market understanding, competitive pricing structures, and localized support capabilities to serve customers across enterprise and mid-market segments. Emerging software startups introduce innovative solutions addressing specific industry requirements or technology domains, often challenging established providers through specialized functionality and agile development approaches. Competition intensifies as cloud deployment models reduce traditional barriers associated with infrastructure requirements, enabling broader market participation.

Recent Developments:

-

In December 2025, Nucleus Software convened Nucleus for India | Synapse 2025 in Mumbai, unveiling India’s AI-defined banking framework and globally launching FinnOne Neo® GA 8.5. The platform enhances digital lending, compliance, automation, and ecosystem integration, enabling financial institutions across India and international markets to scale efficiently in an AI-driven environment.

-

In August 2024, Bengaluru-based startup Sarvam AI launched its GenAI platform for India, unveiling enterprise subscription products, Indic language models, and AI tools for sectors including financial services, legal, consumer goods, and technology, aiming to democratize AI access and foster innovation across Indian enterprises.

India Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Enterprise Sizes Covered | Small and Medium-sized Enterprises, Large Enterprises |

| Industry Verticals Covered | IT and Telecom, BFSI, Retail, Government/Public Sector, Energy and Utilities, Healthcare, Others |

| Regions Covered | North India, West and Central India, South India, East and Northeast India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India software market size was valued at USD 23.62 Billion in 2025.

The India software market is expected to grow at a compound annual growth rate of 11.33% from 2026-2034 to reach USD 62.06 Billion by 2034.

Application software held the largest market share, driven by increasing enterprise adoption of business process automation, customer relationship management, and enterprise resource planning solutions that enhance organizational productivity, streamline operational workflows, and support data-driven decision-making across diverse industry verticals.

Key factors driving the India software market include accelerating digital transformation initiatives across industries, expanding cloud computing adoption, government digitalization programs, rising enterprise focus on operational efficiency, and increasing investments in emerging technologies.

Major challenges include cybersecurity vulnerabilities and data protection concerns, skilled technology workforce availability constraints, integration complexity with legacy systems, pricing pressures affecting vendor profitability, and regional infrastructure disparities limiting market penetration.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)