India Solar Energy Market Size, Share, Trends and Forecast by Deployment, Application, and Region, 2026-2034

India Solar Energy Market Summary:

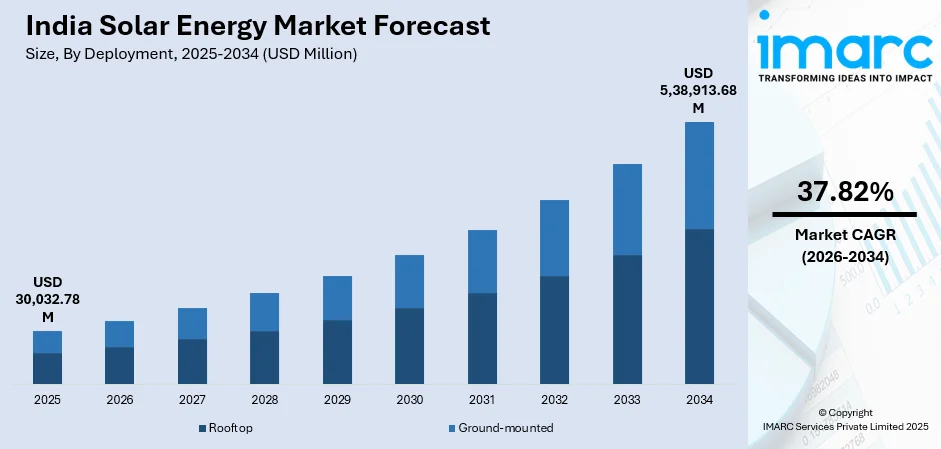

The India solar energy market size was valued at USD 30,032.78 Million in 2025 and is projected to reach USD 5,38,913.68 Million by 2034, growing at a compound annual growth rate of 37.82% from 2026-2034.

The market is driven by robust government policies and initiatives promoting renewable energy adoption, declining solar technology costs making installations economically viable, rising energy demand across residential and commercial sectors, increasing environmental consciousness among consumers and businesses, favorable geographical conditions providing abundant sunlight throughout the year, and growing private sector investments accelerating capacity expansions. Additionally, supportive regulatory frameworks, subsidies, and financial incentives are encouraging widespread deployment across various applications, contributing to India solar energy market share.

Key Takeaways and Insights:

-

By Deployment: Ground‑mounted dominates the market with a share of 58.05% in 2025, driven by extensive land availability in rural areas, utility-scale project economics, supportive regulatory frameworks, and enhanced operational efficiency for grid-connected installations.

-

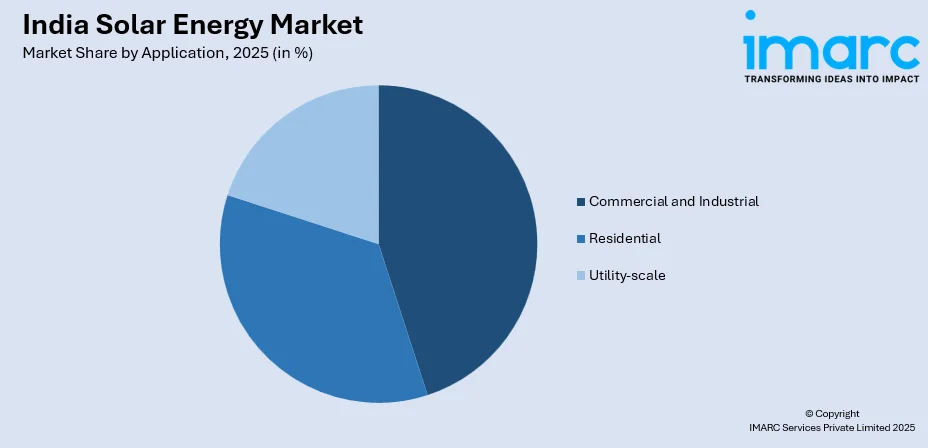

By Application: Commercial and industrial leads the market with a share of 36.1% in 2025, owing to corporate sustainability commitments, attractive return on investment, reduced operational electricity costs, and favorable net metering policies nationwide.

-

Key Players: The India solar energy market exhibits a dynamic competitive landscape, with domestic and international entities competing across utility-scale and distributed generation segments. Market participants differentiate through technological innovation, project execution capabilities, and strategic partnerships with government agencies and financial institutions.

To get more information on this market Request Sample

The India solar energy market is experiencing unprecedented growth fueled by a confluence of favorable factors. The government's ambitious renewable energy targets and supportive policy frameworks have created an investment-friendly ecosystem attracting both domestic and international players. According to sources, in 2025, PM Surya Ghar: Muft Bijli Yojana delivered zero electricity bills to over 7.7 Lakh households, supporting 19,45,758 rooftop solar installations through ₹13,926 Crore in government subsidies. Moreover, declining costs of solar photovoltaic modules and related components have significantly improved project economics, making solar power increasingly cost-competitive with conventional energy sources. Rising electricity demand from residential, commercial, and industrial consumers, coupled with growing environmental awareness, is accelerating the transition toward clean energy solutions. The country's exceptional solar irradiance levels and abundant land availability in key states provide ideal conditions for large-scale solar installations. Additionally, innovative financing mechanisms, public-private partnerships, and streamlined approval processes are facilitating rapid capacity additions across diverse deployment models and applications.

India Solar Energy Market Trends:

Integration of Battery Energy Storage Systems

The India solar energy market is witnessing a significant shift toward integrating battery energy storage solutions with solar installations to address intermittency challenges. Developers are increasingly incorporating storage capabilities to provide firm, dispatchable renewable electricity that can meet round-the-clock power requirements. As per sources, in November 2025, BC Jindal Group signed a 150 MW round-the-clock renewable energy PPA with SECI, deploying storage-backed hybrid systems to deliver firm, dispatchable green power and strengthen grid stability. Further, this trend is being driven by falling battery costs, evolving grid requirements, and growing demand from commercial and industrial consumers seeking reliable clean energy supply. Hybrid solar-storage projects are gaining prominence in government auctions, with procurement agencies prioritizing solutions that enhance grid stability.

Expansion of Rooftop Solar Across Urban Centers

The proliferation of rooftop solar installations across residential and commercial buildings represents a transformative trend reshaping India's energy landscape. Urban consumers are increasingly adopting distributed solar solutions driven by rising electricity tariffs, net metering policies, and desire for energy independence. Government subsidy programs are making rooftop installations financially attractive for homeowners while corporate sustainability mandates are driving commercial adoption. Furthermore, the growth of third-party ownership models, solar leasing arrangements, and innovative financing solutions is removing upfront cost barriers and accelerating market penetration.

Emergence of Floating and Agrivoltaic Solar Solutions

The India solar energy market is witnessing growing interest in innovative deployment models including floating solar installations and agrivoltaic systems that optimize land utilization. In November 2025, MNRE and the Ministry of Finance held discussions on launching a new renewable energy scheme supporting floating solar and agrivoltaic projects, prioritising land-efficient solar deployment across India. Additionally, floating solar projects on reservoirs, canals, and water bodies are gaining traction as they minimize land acquisition challenges while reducing water evaporation. Agrivoltaic installations that combine solar generation with agricultural activities are emerging as sustainable solutions addressing competing land-use priorities. These dual-use approaches enable farmers to generate additional income while maintaining crop cultivation, creating win-win outcomes for rural communities.

Market Outlook 2026-2034:

The India solar energy market revenue is positioned for exceptional growth over the forecast period, driven by the government's ambitious target of achieving substantial renewable energy capacity. The market is expected to witness sustained revenue expansion as utility-scale installations continue to dominate capacity additions while rooftop and distributed solar segments accelerate their growth trajectories. Favorable policy continuity, declining technology costs, and increasing private sector participation will fuel market revenue growth. The market generated a revenue of USD 30,032.78 Million in 2025 and is projected to reach a revenue of USD 5,38,913.68 Million by 2034, growing at a compound annual growth rate of 37.82% from 2026-2034.

India Solar Energy Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Deployment |

Ground‑mounted |

58.05% |

|

Application |

Commercial and Industrial |

36.1% |

Deployment Insights:

- Rooftop

- Ground-mounted

Ground‑mounted dominates with a market share of 58.05% of the total India solar energy market in 2025.

Ground-mounted solar installations dominate the India solar energy market, accounting for the largest deployment share. This segment's leadership stems from the development of large-scale solar parks across states with abundant land availability and favorable solar irradiance conditions. As per sources, in 2025, Mahindra Susten commissioned 560 MW of utility-scale solar capacity across Gujarat and Rajasthan, spanning 2,000 acres and connected to state grids through 220 kV substations. Moreover, utility-scale ground-mounted projects benefit from economies of scale, enabling developers to achieve lower levelized costs of electricity. The establishment of dedicated solar parks with pre-built infrastructure including transmission connectivity, land aggregation, and regulatory clearances has streamlined project development timelines.

The ground-mounted continues to attract substantial capacity additions as developers leverage India's vast expanses of barren and uncultivable land suitable for solar installations. States in western and northern regions have emerged as preferred destinations for utility-scale projects due to superior solar resources and supportive state policies. The segment benefits from mature project development practices, established supply chains, and competitive financing terms from domestic and international lenders. Technological advancements including bifacial modules and single axis tracking systems are improving generation yields and project returns.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial and Industrial

- Utility-scale

Commercial and industrial leads with a share of 36.1% of the total India solar energy market in 2025.

The commercial and industrial commands a leading share of the India solar energy market, driven by businesses seeking to reduce electricity costs and meet sustainability objectives. Corporate consumers are increasingly adopting solar solutions through rooftop installations, open-access procurement, and captive power arrangements. As per sources, Tata Power Renewable Energy signs an 80 MW rooftop and dispatchable solar PPA with Tata Power Mumbai Distribution in 2025, supplying 315 Million Units annually and reducing 0.25 Million Tons CO₂. Moreover, favorable regulatory frameworks enabling direct power purchase from solar generators without distribution company intermediation have accelerated commercial adoption. The segment benefits from strong demand drivers including rising grid electricity tariffs, renewable purchase obligations mandating clean energy sourcing, and corporate environmental commitments aligned with global sustainability standards.

Commercial and industrial consumers are emerging as anchor demand drivers for the solar energy market as businesses recognize the economic and reputational benefits of renewable energy adoption. Manufacturing facilities, data centers, commercial complexes, and retail establishments are deploying solar installations to optimize operational costs and demonstrate environmental responsibility. The growth of third-party power purchase agreements and solar leasing models is enabling businesses to access clean energy without significant capital expenditure. Industrial clusters and special economic zones are increasingly incorporating solar infrastructure into their development plans.

Regional Insights:

- North India

- South India

- East India

- West India

North India represents a significant market for solar energy installations, led by the state of Rajasthan which has emerged as the country's leading solar power producer. The region benefits from excellent solar irradiance levels, vast expanses of desert and barren land suitable for utility-scale installations, and supportive state policies promoting renewable energy development. Major solar parks and manufacturing facilities are concentrated in this region.

South India has an important share of the solar power industry with the contribution of the states of Tamil Nadu, Karnataka, Andhra Pradesh, and Telangana. Favorable irradiance levels throughout the year, high industry demand, well-developed transmission networks, and supportive state policies are some of the advantages that South India has as a location for the setting up of solar power plants. Roof-top installations at the commercial sector make an important contribution to the solar installations.

East India presents emerging opportunities for solar energy market expansion as states focus on increasing renewable capacity to meet growing electricity demand. The region includes states such as Odisha, West Bengal, Jharkhand, and Bihar where solar installations are gaining momentum through government-sponsored programs and private investments. Growing awareness of solar benefits and improving policy frameworks are supporting capacity additions in this underserved region.

West India dominates the solar energy market with Gujarat and Maharashtra leading capacity installations across utility-scale and distributed segments. The region hosts world-class renewable energy parks, benefits from superior solar resources, and features well-established industrial demand driving commercial solar adoption. Gujarat's progressive policies and vast land availability have attracted significant investments, while Maharashtra's strong manufacturing base supports rooftop solar deployment across industrial consumers.

Market Dynamics:

Growth Drivers:

Why is the India Solar Energy Market Growing?

Ambitious Government Policies and Regulatory Support

The India solar energy market is experiencing robust growth underpinned by comprehensive government policies and regulatory frameworks promoting renewable energy adoption. The government has established ambitious targets for solar capacity installation, creating a predictable long-term demand outlook that attracts sustained investments from domestic and international players. According to reports, the Union Budget allocated INR 10,000 Crore for solar infrastructure, supporting large-scale parks, rooftop systems, and off-grid solutions, boosting private investment and strengthening India’s renewable energy push. Further, national-level initiatives have established standardized auction mechanisms, transparent bidding processes, and reliable power purchase agreements providing revenue visibility to project developers. State-level policies complement central schemes through additional incentives, land allocation support, and streamlined approval processes accelerating project implementation.

Declining Technology Costs and Improving Economics

The continuous decline in solar photovoltaic module prices and balance-of-system costs has dramatically improved project economics, making solar power increasingly cost-competitive with conventional generation sources. Technological advancements in cell efficiency, manufacturing processes, and installation techniques have reduced the levelized cost of electricity from solar installations to historically low levels. According to reports, in December 2025, GST reductions on rooftop solar components lowered system costs by 7-10%, shortening payback periods and boosting adoption under schemes like PM Surya Ghar: Muft Bijli Yojana. Moreover, this cost competitiveness is driving organic demand from consumers seeking affordable electricity alternatives. The falling cost trajectory has expanded the addressable market for solar installations across residential, commercial, industrial, and utility segments.

Rising Energy Demand and Environmental Consciousness

The India solar energy market benefits from the country's rapidly growing electricity demand driven by economic development, urbanization, and rising living standards. Industrial expansion, infrastructure development, and increasing household appliance penetration are creating sustained demand for additional power generation capacity. Solar energy is well-positioned to capture this incremental demand given its cost advantages, scalability, and distributed deployment potential. As per sources, in 2025, India added 44.5 GW of renewable capacity, with solar contributing nearly 35 GW, raising total non-fossil capacity to 262.74 GW, surpassing Paris Agreement targets five years early. Simultaneously, rising environmental consciousness among consumers, businesses, and policymakers is accelerating the transition toward clean energy solutions. Corporate sustainability commitments aligned with global environmental frameworks are driving solar adoption among large industrial consumers.

Market Restraints:

What Challenges the India Solar Energy Market is Facing?

Land Acquisition and Availability Challenges

The India solar energy market faces constraints related to land acquisition and availability for large-scale solar installations. Competing land-use priorities including agriculture, residential development, and industrial expansion create challenges in securing suitable parcels for utility-scale projects. Fragmented land ownership patterns and complex title documentation requirements extend project development timelines. Environmental clearances for projects near ecologically sensitive areas and protected zones introduce additional approval uncertainties.

Transmission Infrastructure and Grid Integration Constraints

The India solar energy market encounters restraints related to transmission infrastructure limitations and grid integration challenges in certain regions. High solar resource areas in western and northern states have witnessed capacity concentration outpacing transmission network expansion. This infrastructure mismatch creates evacuation constraints limiting project commissioning and causing generation curtailment. Grid stability concerns from variable solar generation require additional investments in ancillary services and balancing mechanisms.

Policy and Regulatory Uncertainty Across States

The India solar energy market experiences restraints from policy variations and regulatory inconsistencies across different states. Divergent state-level policies regarding open-access charges, banking provisions, and wheeling arrangements create complexity for interstate project development and power supply. Changes in regulatory frameworks including retrospective modifications to existing agreements have occasionally impacted investor confidence. Variations in renewable purchase obligation enforcement across states create uneven demand patterns.

Competitive Landscape:

The India solar energy market features a dynamic competitive landscape characterized by the presence of large domestic conglomerates, international project developers, equipment manufacturers, and specialized engineering procurement construction contractors. Market participants are pursuing diverse strategies including vertical integration across manufacturing and project development, capacity expansion through organic growth and acquisitions, and geographic diversification across high-potential states. The competitive environment is witnessing consolidation as larger players acquire project portfolios and manufacturing assets to achieve scale advantages. Strategic partnerships between developers, financial institutions, and corporate off-takers are reshaping market dynamics. Players are differentiating through technology adoption, project execution capabilities, and relationship management with key stakeholders.

Recent Developments:

-

In March 2025, Waaree Energies launched India’s largest 5.4 GW solar cell facility at Chikhli, Gujarat. Spread over 150 acres, the gigafactory reinforces India’s standing in global renewable energy manufacturing, advancing clean energy adoption, supporting technological self-reliance, and contributing significantly to the country’s vision of energy independence and sustainable growth in the solar sector.

India Solar Energy Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployments Covered | Rooftop, Ground-mounted |

| Applications Covered | Residential, Commercial and Industrial, Utility-scale |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India solar energy market size was valued at USD 30,032.78 Million in 2025.

The India solar energy market is expected to grow at a compound annual growth rate of 37.82% from 2026-2034 to reach USD 5,38,913.68 Million by 2034.

Ground-mounted held the largest India solar energy market share, driven by the establishment of large-scale utility solar parks across states with abundant land availability, economies of scale, and government initiatives supporting mega solar installations.

Key factors driving the India solar energy market include ambitious government renewable energy targets and supportive policies, declining solar technology costs improving project economics, rising electricity demand, growing environmental consciousness, and increasing private sector investments.

Major challenges include land acquisition complexities, transmission infrastructure constraints, policy variations across states, grid integration requirements, financing accessibility for smaller developers, and supply chain dependencies for the key equipment components.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)