India Solar Generator Market Size, Share, Trends and Forecast by Grid Connectivity, End-User, and Region, 2025-2033

India Solar Generator Market Overview:

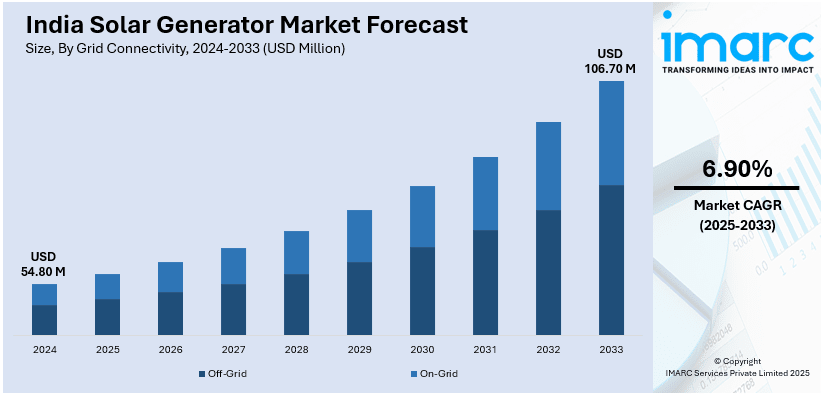

The India solar generator market size reached USD 54.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 106.70 Million by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. The India solar generator market share is expanding, driven by increasing investments in renewable energy projects, which is encouraging the installation of solar farms and residential solar systems, along with the growing implementation of rural electrification initiatives.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 54.80 Million |

| Market Forecast in 2033 | USD 106.70 Million |

| Market Growth Rate 2025-2033 | 6.90% |

India Solar Generator Market Trends:

Increasing adoption of renewable energy

The rising adoption of renewable energy is impelling the India solar generator market growth. With the high demand for renewable energy, government agencies, private companies, and energy firms are funding solar power projects. In December 2024, Reliance Industries unveiled a 20 GW solar facility in Jamnagar, Gujarat. The firm dedicated INR 75,000 Crore to renewable energy initiatives. The initial phase was set to debut in early 2025. These investments are supporting the installation of solar farms, residential solar systems, and backup power solutions that rely on solar generators for energy storage and distribution. Additionally, solar generators are gaining popularity in construction sites, outdoor events, and temporary workspaces that require portable and eco-friendly power sources. Expenditure on solar technologies is also encouraging advancements in battery efficiency, enhancing the storage capacity and performance of solar generators. With the increasing environmental concerns and stringent carbon reduction goals, stakeholders are wagering on solar energy solutions, motivating the employment of solar generators for reliable and sustainable power supply in various industries.

To get more information on this market, Request Sample

Expansion of off-grid and remote area electrification projects

The expansion of off-grid and remote area electrification projects is offering a favorable India solar generator market outlook. Many remote areas in India struggle with unstable or no connection to the traditional power grid, making solar generators an ideal solution to meet electricity demands. The Indian Government is actively promoting rural electrification through initiatives like the Integrated Power Development Scheme (IPDS), Saubhagya Scheme, and the Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY), which is encouraging the installation of solar generators to provide sustainable energy. According to the Ministry of Power, under the DDUGJY/IPDS/SAUBHAGYA schemes, the accessibility of electricity in rural regions improved from 12.5 hours in 2015 to 21.9 hours in 2024. These projects are particularly effective in regions where extending the traditional grid is expensive or challenging. Solar generators are being employed to power homes, schools, healthcare facilities, and community centers in these areas, improving living standards and supporting local businesses. Additionally, renewable energy companies are partnering with non-government organizations to broaden solar generator installations in villages, enhancing access to clean and affordable energy. As the demand for reliable off-grid power solutions grows, innovations in battery storage and panel efficiency are refining solar generator performance, making them more durable and effective for extended usage. With increasing investments in rural electrification, the adoption of solar generators continues to expand across India's off-grid and remote regions.

India Solar Generator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on grid connectivity and end-user.

Grid Connectivity Insights:

- Off-Grid

- On-Grid

The report has provided a detailed breakup and analysis of the market based on the grid connectivity. This includes off-grid and on-grid.

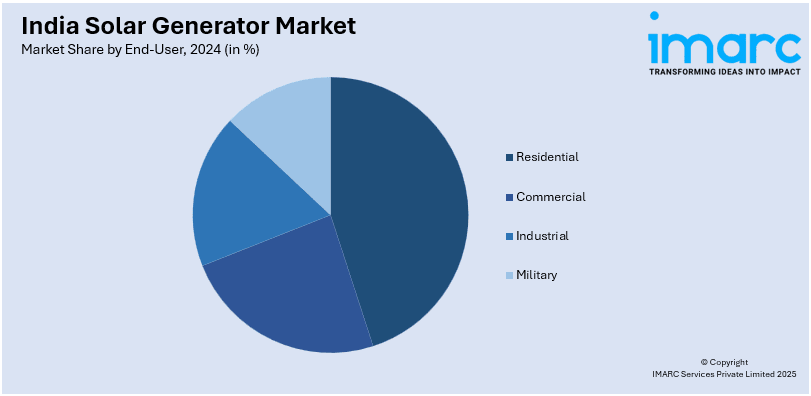

End-User Insights:

- Residential

- Commercial

- Industrial

- Military

A detailed breakup and analysis of the market based on the end-users have also been provided in the report. This includes residential, commercial, industrial, and military.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Solar Generator Market News:

- In January 2025, Solis introduced its Solarator series of hybrid inverters for both residential and commercial use in India. The Series featured solar inverter models compatible with generators, each designed for distinct energy needs. These inverters could accommodate single- or three-phase setups.

- In October 2023, Madhya Pradesh Urja Awas Nigam (MPUVNL) called for bids to establish 300 MW of grid-enjoined solar power projects under Component C of the Pradhan Mantri Kisan Urja Suraksha evam Utthan Mahabhiyan (KUSUM) initiative at different sites in the state. In all contract years, except for the first operational year, the renewable energy generator was required to achieve a minimum CUF of 19% annually for the entire length of the PPA. The solar generator was designed to manage the land and associated infrastructure to push the project forward and connect to the 33/11 kV sub-station to facilitate power evacuation by the scheduled commissioning date or the start of commercial operations, depending on which occurred first.

India Solar Generator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Grid Connectivities Covered | Off-Grid, On-Grid |

| End-Users Covered | Residential, Commercial, Industrial, Military |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar generator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solar generator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar generator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar generator market in India was valued at USD 54.80 Million in 2024.

The India solar generator market is projected to exhibit a CAGR of 6.90% during 2025-2033, reaching a value of USD 106.70 Million by 2033.

The expansion of the solar generator market in India is driven by increasing demand for sustainable energy, frequent power shortages in rural areas, and government support for solar initiatives. Additionally, growing environmental consciousness and falling costs of solar technology are significant factors contributing to this market's growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)