India Solar Panel Recycling Market Size, Share, Trends and Forecast by Process, Type, Material, Shelf Life, and Region, 2025-2033

India Solar Panel Recycling Market Overview:

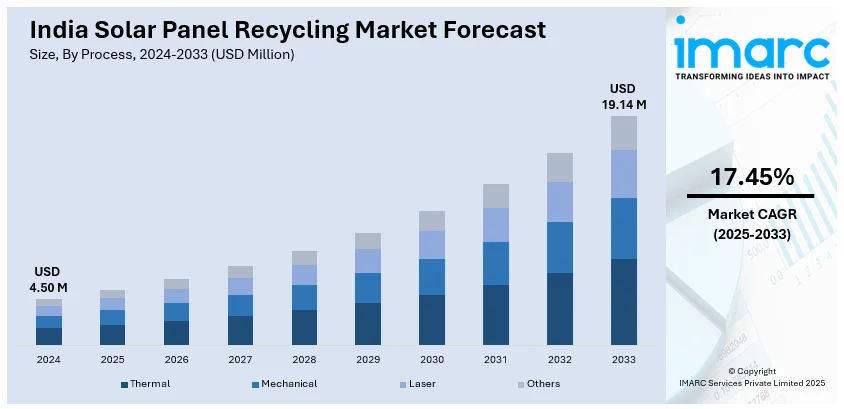

The India solar panel recycling market size reached USD 4.50 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 19.14 Million by 2033, exhibiting a growth rate (CAGR) of 17.45% during 2025-2033. The market is driven by the rapid growth of solar installations, leading to increased end-of-life panels. Government policies promoting sustainable waste management, rising environmental awareness, and the economic benefits of material recovery are key factors. Investments in recycling infrastructure and advanced technologies further propel India solar panel recycling market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.50 Million |

| Market Forecast in 2033 | USD 19.14 Million |

| Market Growth Rate (2025-2033) | 17.45% |

India Solar Panel Recycling Market Trends:

Growing Demand for Solar Panel Recycling Due to Increasing Solar Installations

The India solar panel recycling market share is expanding, driven by the rapid expansion of solar energy installations across the country. Data published by recent industry reports shows India made a remarkable achievement in 2024 when it added 24.5 GW of solar, the single biggest annual addition. This milestone was accompanied by 3.4 GW of wind capacity added nearly entirely from the utility-scale and rooftop solar units from the PM Surya Ghar scheme. According to the report, the total renewable energy capacity had reached a whopping 209.44 GW by the end of the last fiscal year, with solar energy constituting nearly half (47 percent) of that figure and reaffirming itself as the main renewable energy source. States such as Gujarat, Karnataka, and Tamil Nadu led the way in wind energy installations, and utility-scale solar growth skyrocketed 2.8 times, with 18.5 GW added. As India strives to achieve its renewable energy targets, the deployment of solar panels is escalating, leading to a corresponding increase in end-of-life solar panels. Solar panels typically have a lifespan of 25-30 years, and many early installations are now reaching their end-of-life phase, creating a pressing need for efficient recycling solutions. This trend is further amplified by government policies promoting sustainable waste management and circular economy practices. Companies are increasingly focusing on developing advanced recycling technologies to recover valuable materials including silicon, silver, and aluminum from decommissioned panels. The growing awareness about environmental sustainability and the economic benefits of material recovery are also driving the demand for solar panel recycling services in India.

To get more information on this market, Request Sample

Rising Investments in Recycling Infrastructure and Technology

The market is experiencing a rise in investments aimed at building robust recycling infrastructure and adopting innovative technologies. With the increasing volume of solar waste, both public and private stakeholders are recognizing the need for scalable and efficient recycling solutions. Startups and established companies are collaborating to develop cost-effective methods for dismantling and processing solar panels, ensuring minimal environmental impact. Thus, this further creating a positive India solar panel recycling market outlook. Additionally, government initiatives and incentives are encouraging the establishment of recycling facilities across the country. The focus is on creating a closed-loop system where recycled materials are reused in the production of new solar panels, reducing dependency on raw materials and lowering manufacturing costs. This trend is expected to accelerate as India positions itself as a leader in sustainable energy practices, making solar panel recycling a critical component of the renewable energy ecosystem. India has generated a total of 100,000 tonnes of solar waste in 2023, which is projected to increase to 600,000 tonnes in 2030. This increase is due to a rapid growth of solar capacity and its expected expansion up to 292 GW by 2030. A new study highlights the urgency of implementing effective recycling systems to tap into critical minerals such as silicon and silver — key for India's mineral security and circular economy goals. While impediments such as high recycling costs and the presence of the informal sector still exist, experts emphasize that investment in cutting-edge recycling technologies and infrastructure development is essential to achieving a sustainable approach to solar waste management.

India Solar Panel Recycling Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on process, type, material, and shelf life.

Process Insights:

- Thermal

- Mechanical

- Laser

- Others

The report has provided a detailed breakup and analysis of the market based on the process. This includes thermal, mechanical, laser, and others.

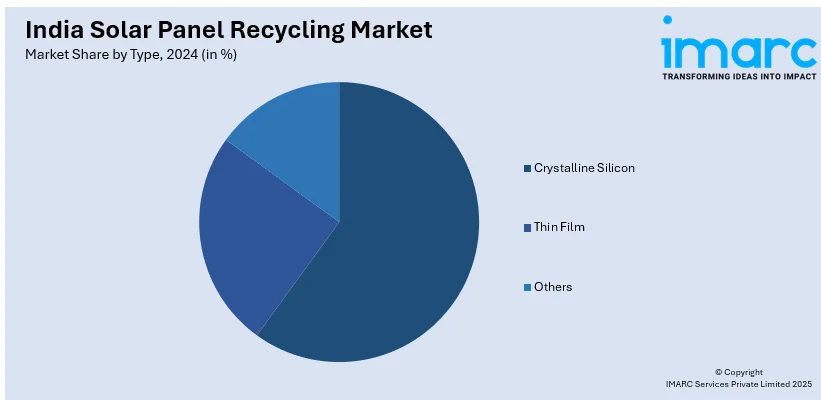

Type Insights:

- Crystalline Silicon

- Thin Film

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes crystalline silicon, thin film, and others.

Material Insights:

- Metal

- Glass

- Aluminum

- Silicon

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes metal, glass, aluminum, silicon, and others.

Shelf Life Insights:

- Normal Loss

- Early Loss

A detailed breakup and analysis of the market based on the shelf life have also been provided in the report. This includes normal loss and early loss.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Solar Panel Recycling Market News:

- November 26, 2024: Dynamic Industry Corporation launched its monosilicon cell solar panel recycling solutions in India, aimed at eliminating the expected 595,000 tonnes of solar waste by 2050 using its patented, carbon-neutral technology. In order to recover these valuable materials while reducing CO2 emissions by 4.77 tonnes for every ton of panels recycled, the company plans to set up two recycling facilities in northern and southern India. This is in line with India's sustainability goals and its transition towards a low-carbon economy.

- March 12, 2024: Recyclekaro announced plans to unveil India’s very first Plasma Furnace, which would enhance the eWaste recycling capacity to 75,000 metric tonnes in the country per year. This facility will also enable the reclaiming of rare earth metals from electronic waste and lithium-ion batteries here. By making use of system advanced plasma furnace technology operating between 5000 and 1000°C, the initiative is meant to reduce over-dependence on imports and improve resource recovery, recovering 1 to 1.5 million tonnes (MT) of rare earth elements annually. While the focus of these collaborative efforts is primarily on e-waste, this innovation has the potential to develop scalable solutions for solar panel recycling. It can be scaled to solve the rising problem of solar waste generated in the country.

India Solar Panel Recycling Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Processes Covered | Thermal, Mechanical, Laser, Others |

| Types Covered | Crystalline Silicon, Thin Film, Others |

| Materials Covered | Metal, Glass, Aluminum, Silicon, Others |

| Shelf Lives Covered | Normal Loss, Early Loss |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the India solar panel recycling market performed so far and how will it perform in the coming years?

- What is the breakup of the India solar panel recycling market on the basis of process?

- What is the breakup of the India solar panel recycling market on the basis of type?

- What is the breakup of the India solar panel recycling market on the basis of material?

- What is the breakup of the India solar panel recycling market on the basis of shelf life?

- What is the breakup of the India solar panel recycling market on the basis of region?

- What are the various stages in the value chain of the India solar panel recycling market?

- What are the key driving factors and challenges in the India solar panel recycling market?

- What is the structure of the India solar panel recycling market and who are the key players?

- What is the degree of competition in the India solar panel recycling market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar panel recycling market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solar panel recycling market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar panel recycling industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)