India Solar PV Inverter Market Size, Share, Trends and Forecast by Technology, Voltage, Application, and Region, 2025-2033

India Solar PV Inverter Market Overview:

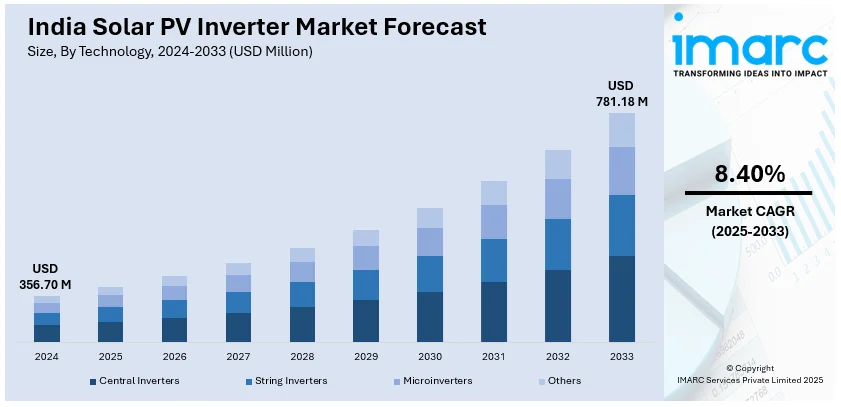

The India solar PV inverter market size reached USD 356.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 781.18 Million by 2033, exhibiting a growth rate (CAGR) of 8.40% during 2025-2033. The market is driven by growing solar installations, increasing government incentives, decreasing inverter costs, rising demand for energy storage solutions, and surging demand for energy storage and grid stability.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 356.70 Million |

| Market Forecast in 2033 | USD 781.18 Million |

| Market Growth Rate (2025-2033) | 8.40% |

India Solar PV Inverter Market Trends:

Shift Towards String Inverters and Smart Inverter Technology

The India solar PV inverter market growth is transitioning toward string inverters as a substitute for central inverters because they better serve commercial, industrial, and utility-scale projects. For instance, in May 2024, Sineng Electric supplied 2,887 units of its 275 kW string inverters for a 641 MW solar project at the Khavda Solar Park in Gujarat, developed by Adani. These inverters feature 12 maximum power point trackers (MPPTs) and compatibility with bifacial PV modules, enhancing energy yield and optimizing the levelized cost of electricity (LCOE). String inverters provide developers and installers with their modular design and superior efficiency and performance tracking capabilities. In addition to this, the market asks for more string inverters to address the fast-growing distributed solar projects and rooftop systems. Moreover, smart inverters continue to appeal to the market because of their expanded features, which include advanced remote monitoring, artificial intelligence (AI) diagnostics and grid-intelligent capabilities. Besides this, the improvement of system reliability and maximum energy output results from these inverters, which optimize their power conversion efficiency. Furthermore, the acceptance of smart inverters receives a boost from government initiatives that strengthen renewable energy (RE) connection to the grid and support power system stability. Apart from this, research and development (R&D) investments from manufacturers in mature solar markets allow them to create high-efficiency inverters with digital features, which collect real-time data and implement predictive maintenance for lowering the operational costs of solar asset owners.

To get more information on this market, Request Sample

Rising Demand for Hybrid and Energy Storage-Integrated Inverters

The India solar PV inverter market share is boosting as hybrid and energy storage-integrated inverters are rapidly gaining popularity. In line with this, the rise of RE has led to increased stability challenges in the power grid which necessitates solar PV with battery storage hybrid inverters to combine solar PV and battery support capabilities. Additionally, hybrid inverters deliver backup power storage capabilities together with peak demand control functions which perfectly suit residential and commercial users who need to address power grid stability issues. Moreover, the Indian government's motivational drive for energy storage deployment combined with battery-based solution incentives has significantly increased this trend. For example, in December 2024, India's MNRE mandated battery storage for new solar and wind projects, requiring 10% storage capacity to enhance grid stability and ensure a reliable, continuous RE supply. This policy is expected to accelerate the adoption of hybrid inverters as they enable better integration of storage with solar systems. Concurrently, the rising adoption of hybrid inverters by commercial institutions and industries serves two purposes by minimizing their usage of diesel backup systems while cutting down expenses. Furthermore, manufacturers now produce cost-effective high-efficiency hybrid inverters with intelligent energy management systems for the market. Apart from this, the market demand for hybrid inverters is increasing significantly because energy storage costs continue to decrease, while policy backing strengthens, thus enabling India to build a decentralized resilient energy system, thereby enhancing the India solar PV inverter market outlook.

India Solar PV Inverter Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on technology, voltage, and application.

Technology Insights:

- Central Inverters

- String Inverters

- Microinverters

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes central inverters, string inverters, microinverters, and others.

Voltage Insights:

- <1,000 V

- 1,000 – 1,499 V

- >1,500 V

A detailed breakup and analysis of the market based on the voltage have also been provided in the report. This includes <1,000 V, 1,000 – 1,499 V, and >1,500 V.

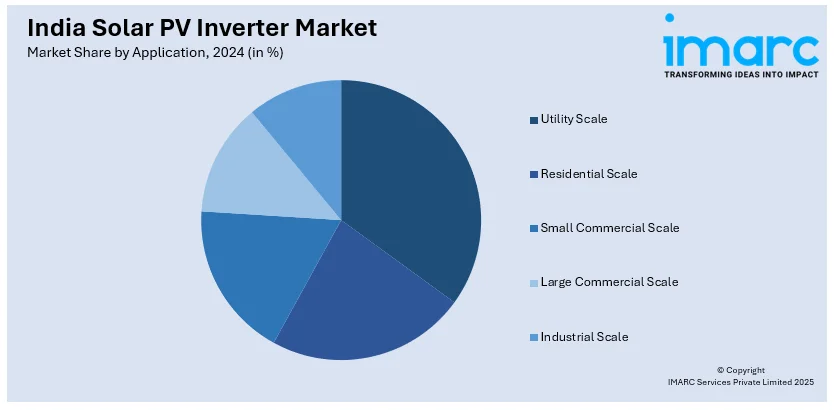

Application Insights:

- Utility Scale

- Residential Scale

- Small Commercial Scale

- Large Commercial Scale

- Industrial Scale

The report has provided a detailed breakup and analysis of the market based on the application. This includes utility scale, residential scale, small commercial scale, large commercial scale, and industrial scale.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Solar PV Inverter Market News:

- In July 2024, Sungrow, a global leader in PV inverter and energy storage systems, signed a strategic agreement to supply 850 MW of inverters to Hero Future Energies (HFE), the RE arm of the Hero Group. This collaboration involves delivering advanced 1500V inverter solutions for multiple HFE projects across India, aiming to optimize Levelized Cost of Energy (LCOE) and ensure robust performance even in harsh environmental conditions.

- In May 2024, Vikram Solar secured a significant order to supply 250 MW of high-efficiency, bifacial solar PV modules to Gujarat Industries Power Company Limited (GIPCL). These modules, ranging from 540Wp to 570Wp, are slated for deployment at the MW RE Park in Khavda, located in the Great Rann of Kutch, Gujarat. This agreement enhances the development of solar energy infrastructure in Gujarat, contributing to the state's RE capacity and supporting India's broader solar energy objectives.

India Solar PV Inverter Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Central Inverters, String Inverters, Microinverters, Others |

| Voltages Covered | <1,000 V, 1,000 – 1,499 V, >1,500 V |

| Applications Covered | Utility Scale, Residential Scale, Small Commercial Scale, Large Commercial Scale, Industrial Scale |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar PV inverter market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solar PV inverter market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar PV inverter industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The solar PV inverter market in India was valued at USD 356.70 Million in 2024.

The solar PV inverter market in India is projected to exhibit a CAGR of 8.40% during 2025-2033, reaching a value of USD 781.18 Million by 2033.

The growth of the India solar PV inverter market is driven by rising solar power installations, greater demand for energy independence, and improved grid infrastructure. Supportive government policies, increased investment in utility-scale and rooftop solar projects, and growing environmental awareness are pushing adoption. Advances in inverter efficiency, reliability, and remote monitoring features are also supporting market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)