India Solar Thermal Systems Market Size, Share, Trends and Forecast by Technology, Application, End User, and Region, 2025-2033

India Solar Thermal Systems Market Overview:

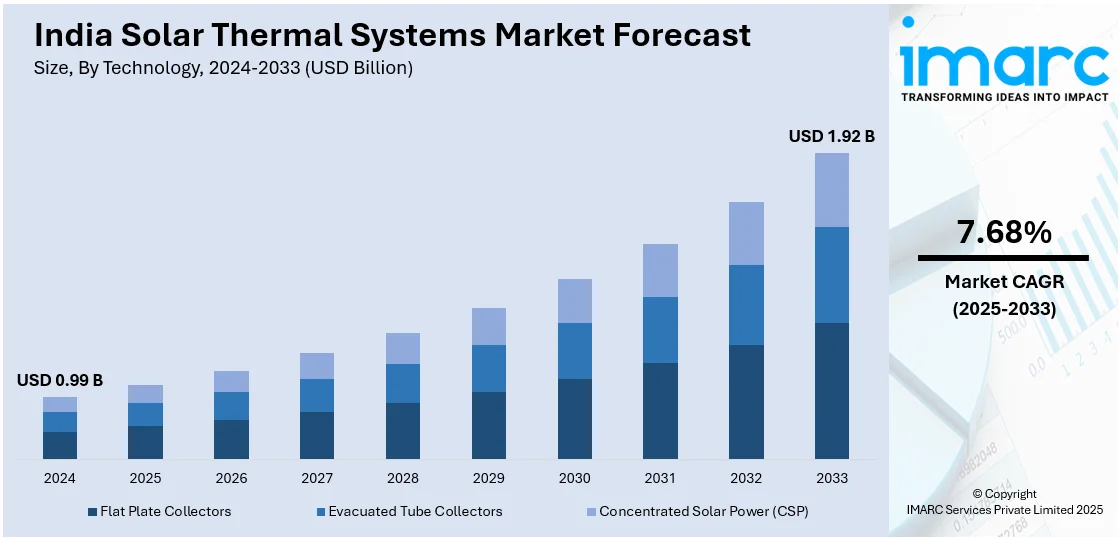

The India solar thermal systems market size reached USD 0.99 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.92 Billion by 2033, exhibiting a growth rate (CAGR) of 7.68% during 2025-2033. The market is driven by rising industrial demand for cost-effective and eco-friendly heating solutions, supported by government incentives including subsidies and tax benefits. Increasing energy costs, stringent environmental regulations, and the need for sustainable alternatives further enhance adoption. Technological advancements, hybrid system integration, and growing awareness of energy efficiency are further expanding the India solar thermal systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 0.99 Billion |

| Market Forecast in 2033 | USD 1.92 Billion |

| Market Growth Rate 2025-2033 | 7.68% |

India Solar Thermal Systems Market Trends:

Rising Demand for Solar Thermal Systems in Industrial Applications

The market is witnessing significant growth due to increasing adoption in the industrial sector. Industries such as textiles, food processing, and chemical manufacturing are shifting toward solar thermal solutions to reduce reliance on fossil fuels and cut operational costs. Solar water heating and steam generation systems are particularly in demand, as they offer sustainable alternatives to conventional boilers powered by coal or gas. The Union Ministry of New and Renewable Energy appointed the Bureau of Indian Standards (BIS) to put in place quality control provisions for solar water heaters in India, effective October 14, 2024. The purpose is to check the entry of low-quality, low-cost products and support the thriving Indian market, which sees yearly sales of solar water heaters totaling INR 700 crore (approximately USD 82.67 Million), with Karnataka responsible for over 42% of the sales. This order makes India a world leader in solar water heater quality assurance, along with the European Union and Australia. In addition to this, government initiatives, such as subsidies under the National Solar Mission and state-level incentives, further encourage industrial users to adopt these systems. Additionally, rising energy costs and stringent environmental regulations are pushing companies to invest in renewable energy solutions. With advancements in solar thermal technology, including high-efficiency collectors and thermal storage systems, industries can achieve better performance and reliability. As a result, the industrial segment is expected to drive substantial market growth in the coming years, supported by both economic and environmental benefits.

To get more information on this market, Request Sample

Growth of Hybrid Solar Thermal Systems for Residential and Commercial Use

The increasing popularity of hybrid systems that combine solar thermal technology with other energy sources, such as electric or gas-based heating, is propelling the India solar thermal systems market growth. These systems are gaining traction in residential and commercial buildings, where consistent hot water supply is essential. Hybrid systems ensure uninterrupted performance even during cloudy days or peak demand periods, enhancing user convenience. The real estate sector is also integrating solar thermal solutions into green building projects to meet sustainability standards and reduce energy consumption. Furthermore, rising awareness about energy efficiency and government-backed schemes promoting solar water heaters are accelerating adoption. Chandigarh is set to open India's biggest floating solar power plant facility with a capacity of 4 MW in Sector 39, under a INR 24 Crore (approximately USD 2.83 Million) Crest initiative. This facility will improve the city's total solar capacity to 89.689 MWp in government and private buildings, further strengthening Chandigarh's position as a rooftop solar implementation leader. The scheme aligns with the Union Territory's vision to advance renewable energy, which involves further research on solar installations in parks and along cycling routes. Manufacturers are focusing on compact, cost-effective designs to cater to urban households and hospitality sectors. As urbanization and energy demand grow, hybrid solar thermal systems are expected to play a crucial role in India’s transition toward cleaner and more efficient energy solutions.

India Solar Thermal Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, application, and end user.

Technology Insights:

- Flat Plate Collectors

- Evacuated Tube Collectors

- Concentrated Solar Power (CSP)

- Parabolic Trough

- Solar Tower

- Fresnel Reflectors

- Dish Stirling

The report has provided a detailed breakup and analysis of the market based on the technology. This includes flat plate collectors, evacuated tube collectors, and concentrated solar power (CSP) (parabolic trough, solar tower, fresnel reflectors, and dish stirling).

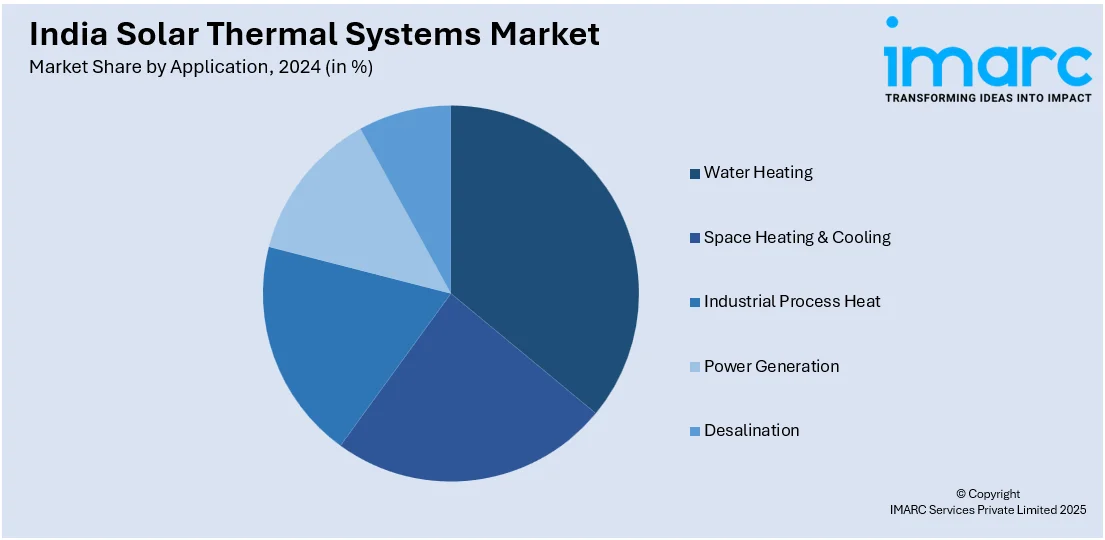

Application Insights:

- Water Heating

- Space Heating & Cooling

- Industrial Process Heat

- Power Generation

- Desalination

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes water heating, space heating & cooling, industrial process heat, power generation, and desalination.

End User Insights:

- Residential

- Commercial

- Industrial

- Agricultural

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, industrial, and agricultural.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Solar Thermal Systems Market News:

- November 23, 2024: Suntek Solar launched TRUZON SOLAR, an innovative new brand with a mission to push the adoption of renewable energy in India, with a goal of achieving ten times growth within five years. Suntek Solar has already successfully implemented over 200,000 solar installations, including rooftop solar systems and solar water heaters. Supported by Mahesh Babu, TRUZON SOLAR aims to grow nationally and apply cutting-edge innovations to further enhance solar adoption across India.

- July 05, 2024: The Solar Energy Corporation of India (SECI) announced plans to float a tender for a 500 MW concentrated solar thermal power storage project by the end of the current financial year. This project aims to provide round-the-clock energy with the use of concentrated solar technology, thus ensuring grid stability and optimal utilization of renewable energy. The project aligns with India's long-term goal to enhance energy storage capacity and ensure sustainable, reliable energy for the future.

India Solar Thermal Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered |

|

| Applications Covered | Water Heating, Space Heating & Cooling, Industrial Process Heat, Power Generation, Desalination |

| End Users Covered | Residential, Commercial, Industrial, Agricultural |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar thermal systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solar thermal systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar thermal systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India solar thermal systems market was valued at USD 0.99 Billion in 2024.

The India solar thermal systems market is projected to exhibit a CAGR of 7.68% during 2025-2033, reaching a value of USD 1.92 Billion by 2033.

The India solar thermal systems market is driven by rising energy costs, increasing industrial heat demand, and government incentives supporting renewable integration. Growing adoption in sectors like textiles, food processing, and pharmaceuticals, alongside strong solar irradiance across regions, enhances system viability. Additionally, corporate sustainability goals and favorable financing schemes propel market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)