India Solar Water Heater Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Solar Water Heater Market Overview:

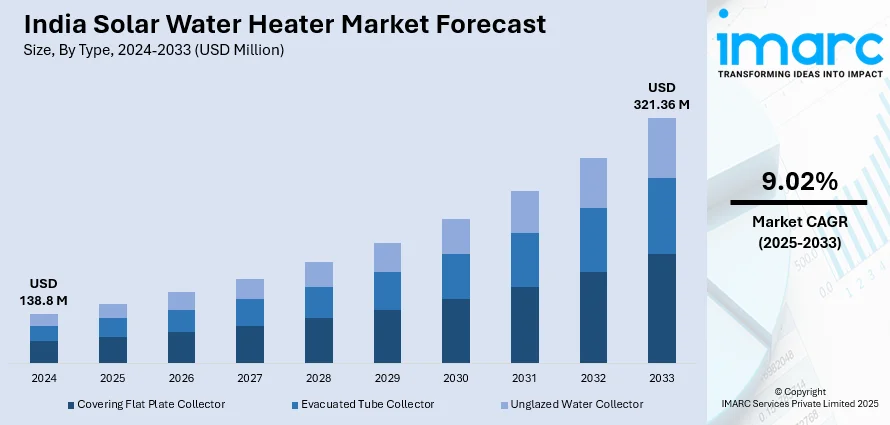

The India solar water heater market size reached USD 138.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 321.36 Million by 2033, exhibiting a growth rate (CAGR) of 9.02% during 2025-2033. The rising demand for energy-efficient heating solutions, government incentives promoting renewable energy adoption, increasing electricity costs, and growing environmental awareness are the factors propelling the growth of the market. Expanding residential and commercial construction, advancements in solar technology, and supportive policies further accelerate market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 138.8 Million |

| Market Forecast in 2033 | USD 321.36 Million |

| Market Growth Rate (2025-2033) | 9.02% |

India Solar Water Heater Market Trends:

Growing Adoption of High-Efficiency Solar Water Heating Solutions

India is witnessing a shift toward advanced solar water heating systems with enhanced efficiency and durability. Newer technologies incorporate copper heat pipe systems and glass-lined tanks, improving thermal performance and extending lifespan. Consumers are increasingly opting for sustainable and cost-effective alternatives, driven by rising energy costs and environmental concerns. Government initiatives supporting renewable energy adoption are further accelerating this shift. The preference for reliable and maintenance-free solutions is shaping product innovation, making solar water heaters a key component of energy-efficient households. As demand rises, manufacturers are focusing on improving heat retention, reducing heat loss, and ensuring long-term affordability. These developments signal a broader movement toward sustainable water heating in residential and commercial applications. For example, in January 2024, Sudarshan Saur unveiled an innovative advanced solar water heater technology featuring copper heat pipe systems and glass-lined tanks, enhancing efficiency and durability. This innovation aligns with India's increasing adoption of renewable energy solutions, offering consumers sustainable and cost-effective water heating options.

To get more information of this market, Request Sample

Expanding Solar Water Solutions for Rural Development

India is increasingly focusing on decentralized solar-powered water solutions to improve access in rural areas. Advanced solar-driven pumping systems are gaining traction for irrigation and household water supply, reducing reliance on conventional electricity and diesel-powered alternatives. Mobile demonstration programs are playing a crucial role in educating communities about efficient and sustainable water management. The adoption of these solutions is supported by government policies and international collaborations, accelerating deployment in remote locations. With growing awareness and improved affordability, more regions are integrating solar-based water supply systems, ensuring long-term energy savings and reduced environmental impact. This shift highlights a broader movement toward renewable-powered infrastructure, making solar water solutions a critical component of rural development and agricultural sustainability. For instance, in October 2023, Grundfos India launched the 'Jal Se Jeevan Yatra' initiative, featuring a mobile van equipped with advanced solar water supply solutions for rural communities and irrigation. Inaugurated by Danish Ambassador, this six-month program traversed 24 states in two phases, demonstrating Grundfos's solar-powered pumps and controls. This initiative underscores India's commitment to sustainable water access and the growing market for solar technologies in rural areas.

India Solar Water Heater Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Covering Flat Plate Collector

- Evacuated Tube Collector

- Unglazed Water Collector

The report has provided a detailed breakup and analysis of the market based on the type. This includes covering flat plate collector, evacuated tube collector, and unglazed water collector.

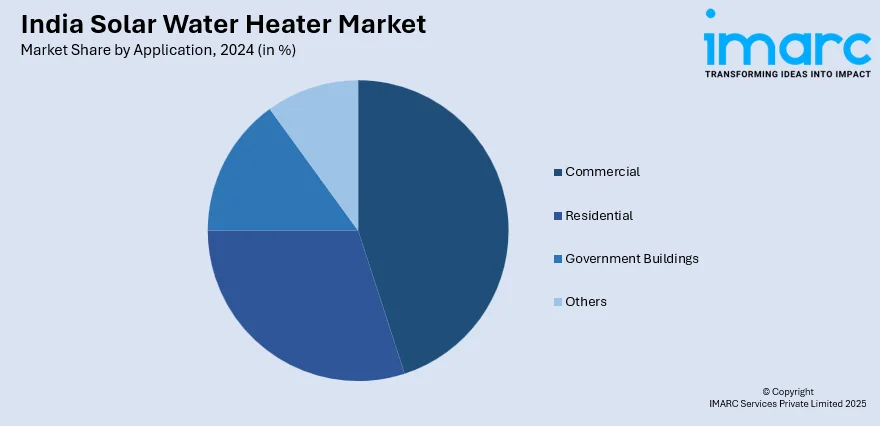

Application Insights:

- Commercial

- Residential

- Government Buildings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes commercial, residential, government buildings, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Solar Water Heater Market News:

- In June 2024, Karnataka's household solarizing initiative has received 10,000 applications, reflecting a strong public interest in renewable energy adoption. This surge aligns with India's broader push towards sustainable energy solutions, indicating a growing market for solar technologies, including solar water heaters in the region.

India Solar Water Heater Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Covering Flat Plate Collector, Evacuated Tube Collector, Unglazed Water Collector |

| Applications Covered | Commercial, Residential, Government Buildings, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar water heater market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solar water heater market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar water heater industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India solar water heater market was valued at USD 138.8 Million in 2024.

The India solar water heater market is projected to exhibit a CAGR of 9.02% during 2025-2033, reaching a value of USD 321.36 Million by 2033.

The India solar water heater market is driven by increasing energy costs, government subsidies, and growing environmental awareness. Rising demand for sustainable energy solutions, especially in residential and commercial sectors, also supports growth. Favorable climate conditions and urbanization further contribute, along with initiatives promoting renewable energy adoption across various regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)