India Solar Water Pump Market Size, Share, Trends and Forecast by Type, Operation, Capacity, Application and Region, 2025-2033

India Solar Water Pump Market Size and Share:

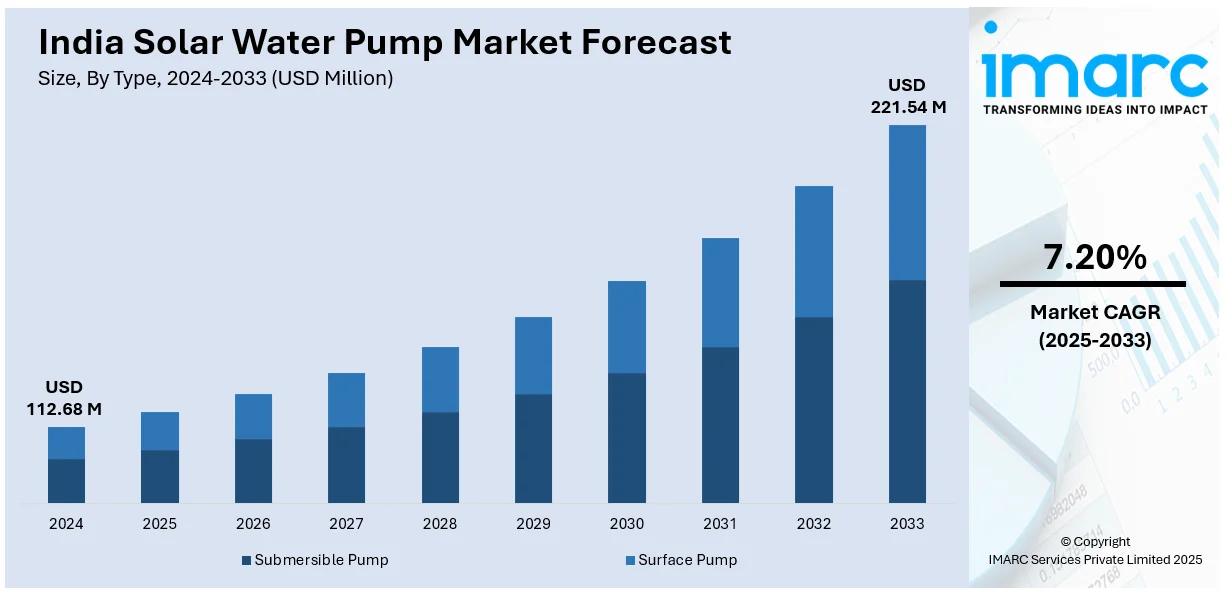

The India solar water pump market size reached USD 112.68 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 221.54 Million by 2033, exhibiting a growth rate (CAGR) of 7.20% during 2025-2033. Rising government support through subsidies and initiatives like PM-KUSUM, coupled with increasing awareness of sustainable irrigation, is driving the market. The shift toward renewable energy sources and the need for cost-effective, eco-friendly agricultural solutions further boost the adoption of solar-powered pumping systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 112.68 Million |

| Market Forecast in 2033 | USD 221.54 Million |

| Market Growth Rate 2025-2033 | 7.20% |

India Solar Water Pump Market Trends:

Growing Adoption of PM-KUSUM Scheme:

One of the most significant trends in the Indian solar water pump market is the growing traction of the Pradhan Mantri Kisan Urja Suraksha evam Utthaan Mahabhiyan (PM-KUSUM) scheme. This government initiative aims to install 20 lakh standalone solar pumps and 15 lakh grid-connected solar pumps across India, driving the widespread adoption of solar-powered irrigation. By providing an up to 60% subsidization support and promoting grid-connected solarization, the scheme saves diesel and grid-based electricity dependency. It further allows farmers to generate extra revenues by selling unused power to the grid. Both public and private sector investments are being drawn into the initiative by it, thereby promoting large-scale production and application. Maharashtra, Rajasthan, and Uttar Pradesh states are seeing an increased adoption that is changing agrarian practices.

To get more information on this market, Request Sample

Technological Advancements in Solar Pump Systems:

Technological innovation is shaping the future of solar water pumping in India, with the government aiming to deploy 30 million solar water pumps by 2030. This reflects a strong push toward integrating advanced technologies to meet agricultural energy demands. The use of high-efficiency photovoltaic modules, brushless DC motors, and intelligent controllers is improving the performance and reliability of pump sets. These technologies allow efficient operation even under low sunlight and minimize maintenance needs. IoT-based systems with remote monitoring and fault detection further enhance user convenience for farmers. Hybrid solar pumps that can run on both solar and grid power are also becoming increasingly popular for their flexibility. With falling costs, such technologies are quickly spreading over rural and semi-rural agricultural lands.

Increased Private Sector Participation and Financing Models:

The Indian solar water pump market is seeing increased participation from private sector players, fueled by prospects of accessing the large rural customer base. The companies are entering into partnerships with financial institutions to introduce innovative financing schemes like pay-as-you-go (PAYG), lease-based models, and microfinancing, bringing solar pumps within the reach of marginal and small farmers. These systems lower the upfront cost by 40–60%, overcoming one of the main adoption hurdles. Private companies are also investing in strong distribution networks and after-sales support to increase their rural footprint. Through such measures, private players have helped boost solar pump installations by 30–35% in some areas, essentially filling in the gaps of government programmes like PM-KUSUM and enabling a fast-tracking of scalability of solar irrigation in India.

India Solar Water Pump Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, operation, capacity and application.

Type Insights:

- Submersible Pump

- Surface Pump

The report has provided a detailed breakup and analysis of the market based on the type. This includes submersible pump, and surface pump.

Operation Insights:

- AC Pump

- DC Pump

A detailed breakup and analysis of the market based on the operation have also been provided in the report. This includes AC pump, and DC pump.

Capacity Insights:

- Up to 5 HP

- 5 HP to 10 HP

- 10 HP to 20 HP

- More Than 20 HP

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes Up to 5 HP, 5 HP to 10 HP, 10 HP to 20 HP, and more than 20 HP.

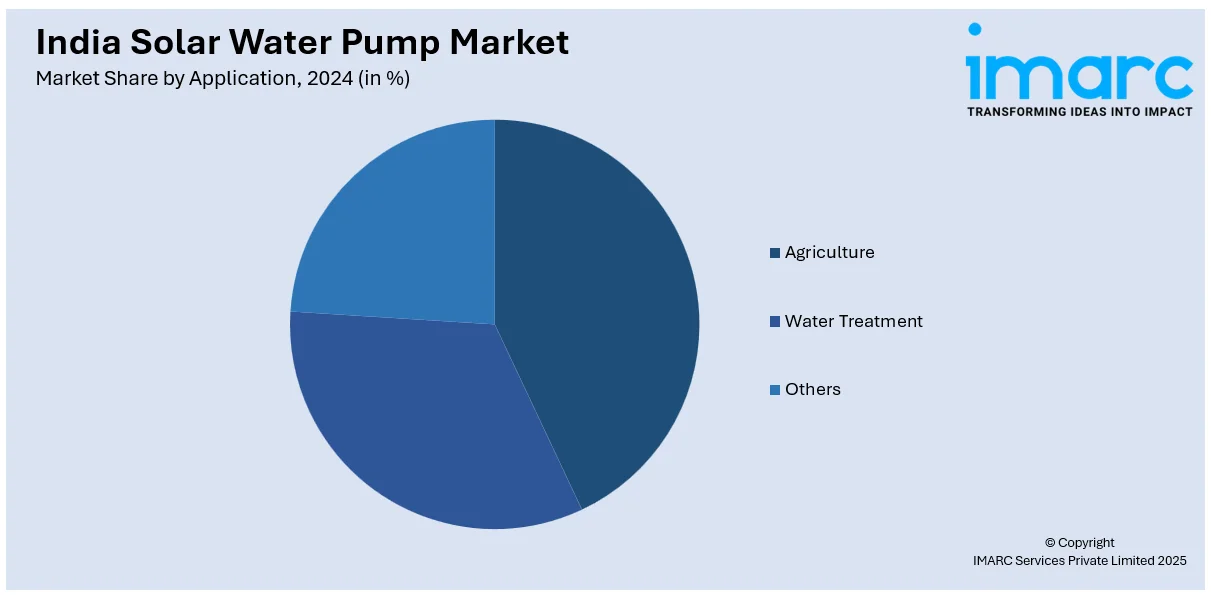

Application Insights:

- Agriculture

- Water Treatment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes agriculture, water treatment, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Solar Water Pump Market News:

- In February 2024, IndiGrid, India’s leading power sector infrastructure investment trust (InvIT), acquired a 300 MW solar power project for Rs 1,550 crore. With this acquisition, IndiGrid’s portfolio now includes 19 solar projects across eight states, totaling 1.1 GWp generation capacity. The move boosts IndiGrid’s total Assets Under Management to Rs 28,200 crore, reinforcing its position in the renewable energy sector and aligning with its expansion strategy in clean power infrastructure.

- In February 2025, Alpex Solar secured a work order from Maharashtra State Electricity Distribution Company Limited (MSEDCL) to supply 2,000 solar water pumps under the Magel Tyala Saur Krushi Pump Scheme. Valued at Rs 450 million, the project supports renewable energy adoption in agriculture by providing solar-powered pumps to farmers. The initiative aims to reduce reliance on grid electricity and curb carbon emissions, promoting sustainable and energy-efficient farming practices in Maharashtra.

India Solar Water Pump Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Submersible Pump, Surface Pump |

| Operations Covered | AC Pump, DC Pump |

| Capacities Covered | 5 HP, 5 HP to 10 HP, 10 HP to 20 HP, More Than 20 HP |

| Applications Covered | Agriculture, Water Treatment, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India solar water pump market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India solar water pump market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India solar water pump industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India solar water pump market was valued at USD 112.68 Million in 2024.

The India solar water pump market is projected to exhibit a CAGR of 7.20% during 2025-2033, reaching a value of USD 221.54 Million by 2033.

Rising demand for sustainable agriculture, government subsidies, and rural electrification drive India’s solar water pump market. Growing awareness about renewable energy, reduced operational costs, and environmental benefits delight farmers. Technological advancements, improved pump efficiency, and expanding financing options further accelerate adoption, especially in off-grid and remote agricultural regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)