India Soluble Dietary Fibers Market Size, Share, Trends and Forecast by Type, Source, Application, and Region, 2025-2033

India Soluble Dietary Fibers Market Overview:

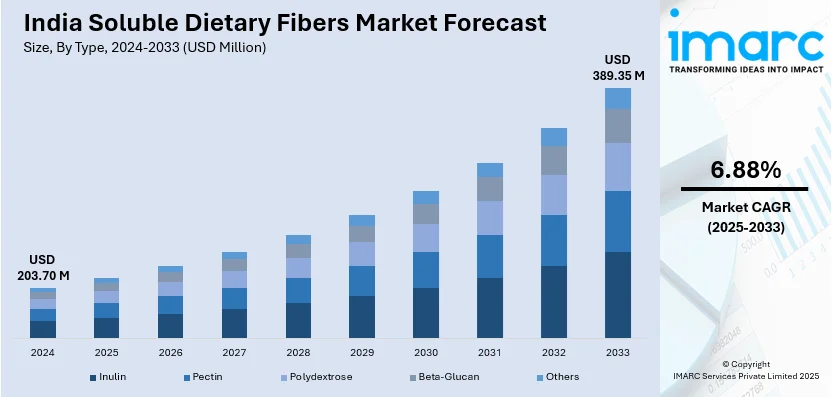

The India soluble dietary fibers market size reached USD 203.70 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 389.35 Million by 2033, exhibiting a growth rate (CAGR) of 6.88% during 2025-2033. The market is driven by rising health consciousness, increasing demand for functional foods, and the growing prevalence of lifestyle diseases including diabetes and obesity. Additionally, the popularity of plant-based, clean-label products and government initiatives promoting healthy eating habits are key factors augmenting the India soluble dietary fibers market share and innovation in this sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 203.70 Million |

| Market Forecast in 2033 | USD 389.35 Million |

| Market Growth Rate (2025-2033) | 6.88% |

India Soluble Dietary Fibers Market Trends:

Increasing Demand for Functional Foods and Beverages

The rising demand for functional foods and beverages is majorly driving the India soluble dietary fibers market growth. As consumers become more health-conscious, there is a growing preference for products that offer additional health benefits, such as improved digestion, weight management, and blood sugar control. Soluble dietary fibers, such as inulin, pectin, and beta-glucan, are increasingly being incorporated into a variety of food and beverage products, including cereals, dairy, and snacks. This trend is further fueled by the increasing prevalence of lifestyle-related diseases including diabetes and obesity, prompting consumers to seek healthier dietary options. On World Diabetes Day 2024, India reiterated the urgent need to further strengthen diabetes prevention, management, and equitable access to healthcare services, with this chronic non-communicable disease (NCD) affecting 10.1 crore (approximately 101 million) individuals, as revealed by the ICMR-INDAIB study. Government initiatives under the NP-NCD program include 6,237 community clinics and free essential medicines for the promotion of care for diabetes. Due to a rise in diabetes-related complications, the demand for functional dietary food products in India is witnessing a significant increase. Manufacturers are responding by launching innovative products fortified with soluble fibers, catering to the changing preferences of health-aware consumers. Additionally, government initiatives promoting healthy eating habits and the growing influence of Western dietary patterns are contributing to the market's expansion.

To get more information on this market, Request Sample

Rising Popularity of Plant-Based and Clean Label Products

The growing popularity of plant-based and clean label products is creating a positive India soluble dietary fibers market outlook. Consumers are increasingly seeking natural and minimally processed ingredients, driving demand for soluble fibers derived from plant sources such as fruits, vegetables, and grains. This shift is aligned with the broader clean label movement, where transparency and simplicity in ingredient lists are prioritized. Soluble dietary fibers, being naturally occurring and beneficial for gut health, fit well into this trend. Furthermore, the rise of veganism and vegetarianism in India has spurred the demand for plant-based dietary fibers as alternatives to animal-derived ingredients. According to a research report by IMARC Group, the India vegan food market size was valued at USD 1,468.3 Million in 2024. The market is expected to reach USD 3,822.3 Million by 2033, with a growing CAGR of 10% from 2025 to 2033. Food manufacturers are leveraging this trend by highlighting the natural origins and health benefits of soluble fibers in their marketing strategies. As a result, the market is experiencing a rise in product innovations that cater to the demand for clean, plant-based, and sustainable dietary options.

India Soluble Dietary Fibers Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, source, and application.

Type Insights:

- Inulin

- Pectin

- Polydextrose

- Beta-Glucan

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes inulin, pectin, polydextrose, beta-glucan, and others.

Source Insights:

- Cereals and Grains

- Nuts and Seeds

- Fruits and Vegetables

- Others

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes cereals and grains, nuts and seeds, fruits and vegetables, and others.

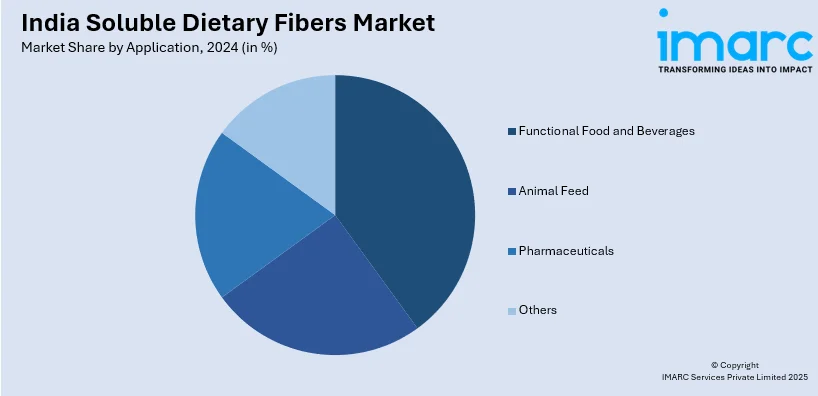

Application Insights:

- Functional Food and Beverages

- Animal Feed

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes functional food and beverages, animal feed, pharmaceuticals, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Soluble Dietary Fibers Market News:

- September 23, 2024: Marine Hydrocolloids announced showcasing its broad portfolio of hydrocolloids, such as pectin, and 100 percent plant-based soluble dietary fibers, such as Sealife, during Fi India 2024, Bengaluru. With 40-plus years of experience, the Kerala-based company operates in 50-plus countries, offering clean-label, vegan products for the food, pharmaceutical, and nutraceutical industries. These innovative products cater to the rising need for soluble dietary fibers in India, providing functional and gut-friendly ingredients for health-focused formulations.

India Soluble Dietary Fibers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Inulin, Pectin, Polydextrose, Beta-Glucan, Others |

| Sources Covered | Cereals and Grains, Nuts and Seeds, Fruits and Vegetables, Others |

| Applications Covered | Functional Food and Beverages, Animal Feed, Pharmaceuticals, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India soluble dietary fibers market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India soluble dietary fibers market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India soluble dietary fibers industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India soluble dietary fibers market was valued at USD 203.70 Million in 2024.

The India soluble dietary fibers market is projected to exhibit a CAGR of 6.88% during 2025-2033, reaching a value of USD 389.35 Million by 2033.

Key drivers of the India soluble dietary fibers market include rising health consciousness and preventive wellness awareness, as consumers seek digestive support and blood sugar management solutions. The popularity of functional and clean-label foods also boosts demand. Growth in plant-based diets and better disposable incomes further drive adoption of fiber-enriched products.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)