India Soup Market Size, Share, Trends and Forecast by Type, Category, Packaging, Distribution Channel, and Region, 2026-2034

Market Overview:

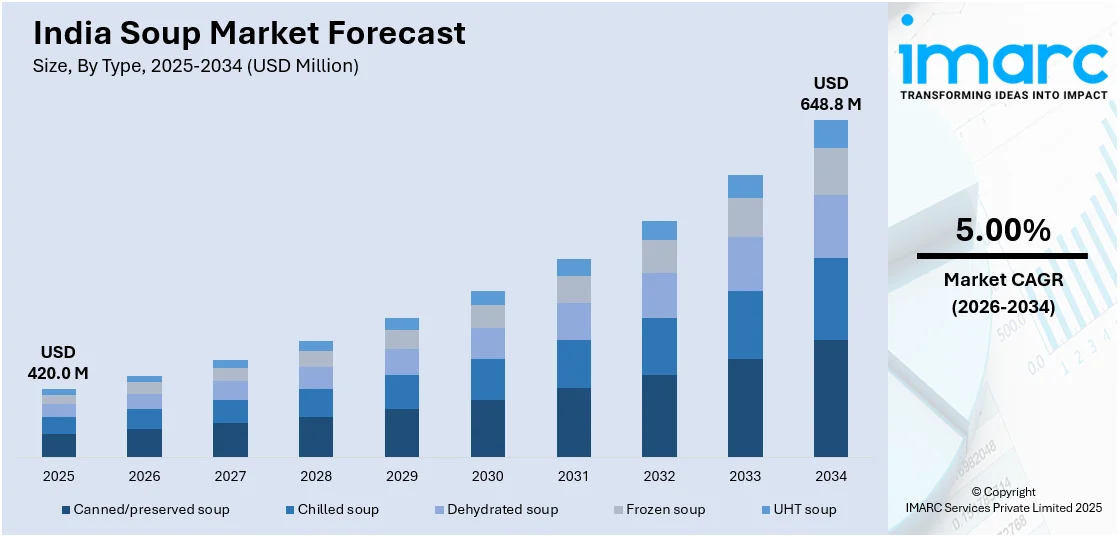

The India soup market size reached USD 420.0 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 648.8 Million by 2034, exhibiting a growth rate (CAGR) of 5.00% during 2026-2034. The changing lifestyles, increasing health consciousness, rising disposable income, growing Western cultural influences, and the expansion of organized retail, offering convenient, healthy, and diverse options to consumers seeking quick and nutritious meals represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 420.0 Million |

| Market Forecast in 2034 | USD 648.8 Million |

| Market Growth Rate (2026-2034) | 5.00% |

A soup is a liquid-based dish typically made by combining various ingredients such as vegetables, meat, seafood, herbs, and spices in a flavorful broth or stock. It is a versatile and comforting culinary creation that has been enjoyed by cultures worldwide for centuries. With endless variations, soups can be thick or thin, chunky or smooth, hot or cold, and can cater to diverse tastes and dietary preferences. The ingredients are often simmered together over a gentle heat, allowing the flavors to meld and develop, resulting in a rich and satisfying meal. Soups can be simple or complex, from a humble chicken noodle soup to an elaborate French bouillabaisse or an aromatic Indian curry soup. Aside from its taste and versatility, soup also offers numerous health benefits. It is an excellent way to incorporate a wide variety of vegetables, legumes, and whole grains into one's diet, providing essential nutrients and fiber. Soups can be a wholesome and nourishing option for those seeking a balanced and nutritious meal. Moreover, soup has a comforting and soothing effect, making it a popular choice during colder months or when one is feeling under the weather. It warms the body and soul, providing a sense of comfort and well-being.

To get more information on this market Request Sample

India Soup Market Trends:

As lifestyles become more hectic, consumers are increasingly seeking convenient and quick meal options. Ready-to-eat soups provide a convenient solution as they require minimal preparation time and offer a ready-to-consume meal or snack option. The rise in urbanization and the growing number of working individuals have further fueled the demand for convenient food options like soups. Additionally, there is a growing awareness among Indian consumers about health and wellness. Soups are perceived as a healthy choice due to their high vegetable content, which provides essential nutrients. Additionally, the demand for low-calorie, gluten-free, and organic soups has increased, catering to the health-conscious segment of the population. Manufacturers are introducing healthier variants, such as soups with no added preservatives or artificial flavors, to meet this demand. Other than this, the influence of Western culture, particularly through exposure to international cuisines and the media, has played a significant role in shaping consumer preferences in India. Soups, traditionally not a staple in Indian cuisine, have gained popularity due to their association with Western culinary traditions. This influence has led to an increased acceptance and consumption of soups in Indian households. Besides this, the growth of organized retail, including supermarkets, hypermarkets, and online grocery platforms, has made a wide range of soup products easily accessible to consumers. This has increased the availability of different soup brands and flavors and also enhanced consumer awareness and product visibility. Moreover, India has witnessed a steady increase in disposable income, leading to a shift in consumer spending patterns. As consumers have more discretionary income, they are willing to explore new food options and experiment with different flavors and cuisines. This has led to a growing demand for international and gourmet soups, which offer unique flavors and ingredients

India Soup Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the India soup market report, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on type, category, packaging, distribution channel.

Type Insights:

- Canned/preserved soup

- Chilled soup

- Dehydrated soup

- Frozen soup

- UHT soup

The report has provided a detailed breakup and analysis of the market based on the type. This includes canned/preserved soup, chilled soup, dehydrated soup, frozen soup, and UHT soup.

Category Insights:

- Vegetarian soup

- Non-vegetarian soup

A detailed breakup and analysis of the market based on the category has also been provided in the report. This includes vegetarian soup and non-vegetarian soup.

Packaging Insights:

- Canned

- Pouched

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes canned, pouched, and others.

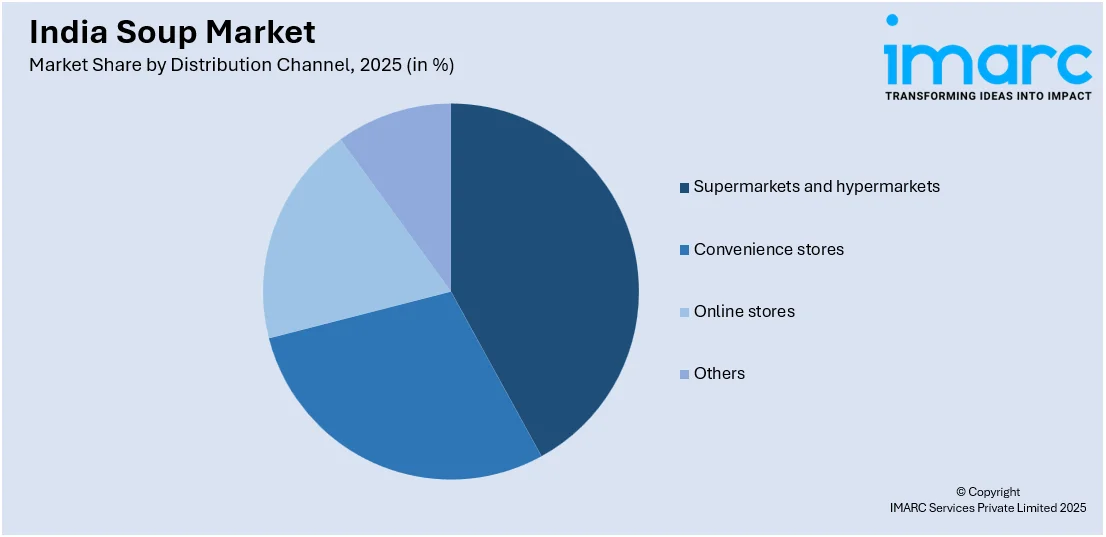

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and hypermarkets

- Convenience stores

- Online stores

- Others

A detailed breakup and analysis of the market based on the distribution channel has also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- South India

- North India

- West & Central India

- East India

The report has also provided a comprehensive analysis of all the major regional markets, which include South India, North India, West & Central India, and East India.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the India soup market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Soup Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Types Covered | Canned/Preserved Soup, Chilled Soup, Dehydrated Soup, Frozen Soup, UHT Soup |

| Categories Covered | Vegetarian Soup, Non-Vegetarian Soup |

| Packagings Covered | Canned, Pouched, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | South India, North India, West & Central India, East India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India soup market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the India soup market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India soup industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The soup market in India was valued at USD 420.0 Million in 2025.

The India soup market is projected to exhibit a CAGR of 5.00% during 2026-2034, reaching a value of USD 648.8 Million by 2034.

The India soup market is primarily driven by increasing health consciousness, busy lifestyles leading to demand for convenient ready-to-eat options, rising disposable incomes, and the growing influence of Western culinary trends. Product innovation and e-commerce expansion also play significant roles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)