India Soybean Oil Market Size, Share, Trends and Forecast by Packaging Type, Packaging Material, Pack Size, Domestic Manufacturing/Imports, Application, Distribution Channel, and Region, 2026-2034

India Soybean Oil Market Summary

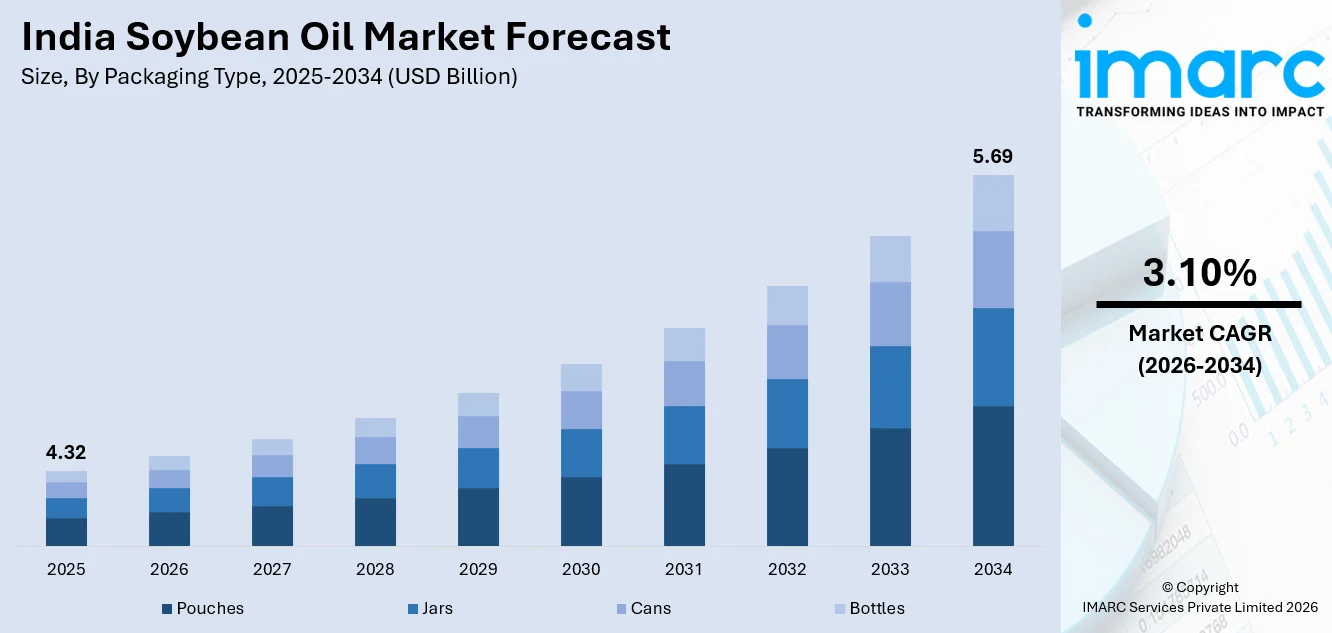

The India soybean oil market size was valued at USD 4.32 Billion in 2025 and is projected to reach USD 5.69 Billion by 2034, growing at a compound annual growth rate of 3.10% from 2026-2034.

The India soybean oil market is experiencing growth driven by evolving consumer dietary preferences toward healthier cooking oils, rapid urbanization, and expanding food processing activities. Increasing household demand, particularly in western and central regions where soybean cultivation is concentrated, alongside the proliferation of organized retail channels and e-commerce platforms, is reshaping distribution dynamics. Government initiatives promoting domestic oilseed production and rising health consciousness among consumers are further reinforcing positive market trajectories.

Key Takeaways and Insights:

- By Packaging Type: Pouches dominate the market with a share of 42% in 2025, driven by their affordability, lightweight portability, and widespread user preference across both urban and rural households for convenient, single-use packaging formats that minimize waste and offer easy storage.

- By Packaging Material: Plastic represents the largest segment with a market share of 51% in 2025, owing to its cost-effectiveness in manufacturing, superior barrier properties preserving oil freshness, and dominance in flexible pouch and bottle packaging formats preferred by price-sensitive Indian consumers.

- By Pack Size: 1 litres - 5 litres lead the market with a share of 35% in 2025, reflecting the purchasing behavior of middle-income Indian households that favor medium-sized packs balancing value-for-money considerations with manageable upfront expenditure.

- By Domestic Manufacturing/Imports: Domestic manufacturing dominates the market with a share of 74% in 2025, supported by India's robust soybean cultivation base concentrated in Madhya Pradesh and Maharashtra, along with government initiatives incentivizing local oilseed processing infrastructure.

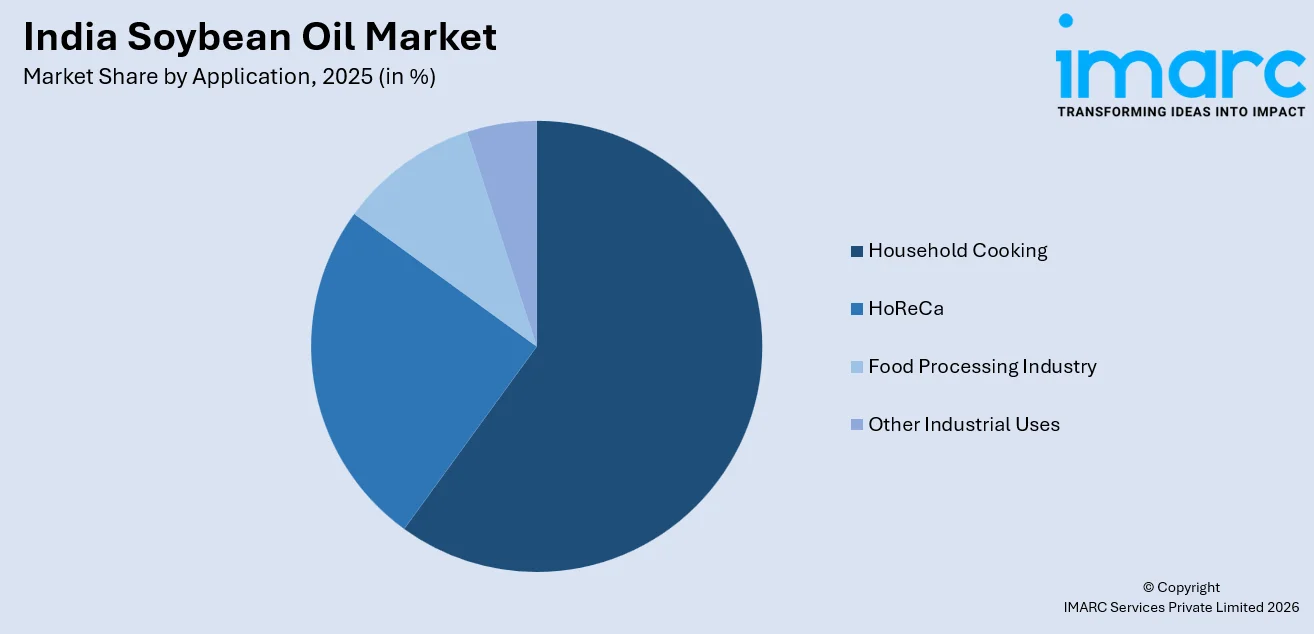

- By Application: Household cooking represents the largest segment with a market share of 60% in 2025. This dominance is because of soybean oil's neutral taste, high smoke point, and perceived health benefits that make it a preferred everyday cooking medium across Indian kitchens.

- By Distribution Channel: Supermarkets and hypermarkets lead the market with a share of 48% in 2025, due to the rapid expansion of organized retail infrastructure, superior product assortment, competitive pricing strategies, and branded oil merchandising initiatives.

- By Region: West and Central India dominate the market with a share of 35% in 2025, influenced by the concentration of soybean cultivation in Madhya Pradesh, Maharashtra, Gujarat, and Rajasthan, strong regional dietary preferences, and well-established processing infrastructure.

- Key Players: The India soybean oil market exhibits moderate competitive intensity, with multinational edible oil corporations competing alongside established domestic manufacturers and regional brands across price segments and distribution channels.

To get more information on this market Request Sample

The India soybean oil market is primarily driven by shifting dietary preferences and the rapid expansion of the middle-class consumer base. As health awareness rises, urban and semi-urban households are increasingly transitioning from traditional fats to refined, fortified vegetable oils, favoring soybean oil for its nutritional profile and versatility. This shift aligns with national income projections, as the State Bank of India has indicated that the country is expected to transition into the upper-middle-income category by the end of the decade, with per capita income projected to approach $4,000 by 2030. This rise in disposable income allows families to opt for branded, packaged oils that ensure better hygiene and quality standards. Furthermore, government initiatives, such as the National Mission on Edible Oils and Oilseeds (NMEO-OS) are strengthening the supply chain by boosting domestic production. When combined with the growing footprint of e-commerce and organized retail, these economic and structural factors offers a favorable market outlook.

India Soybean Oil Market Trends

Policies and Import Dynamics

Government policies related to edible oil imports, tariffs, and domestic oilseed production significantly influence the soybean oil market. India’s efforts to enhance oilseed cultivation and reduce import dependency impact supply dynamics and pricing structures. Furthermore, incentives for oilseed farmers and support for domestic crushing industries contribute to supply stability. For instance, in 2025, India launched the National Mission on Edible Oils and Oilseeds (NMEO-OS) with a budget of Rs 10,103.38 crore, aiming to raise domestic oilseed production to 70 million tons by 2030–31. The mission targeted major oilseeds like rapeseed-mustard, peanuts, soybeans, sunflower, and sesame. These policy interventions collectively play a crucial role in shaping production, pricing, and long-term growth prospects of the soybean oil sector.

Growing Awareness of Nutritional Attributes

Increasing consumer focus on nutritional balance and healthier cooking habits is bolstering the demand for soybean oil in India. Soybean oil, rich in polyunsaturated fatty acids, is perceived as beneficial for maintaining a balanced dietary fat intake when used appropriately. Health-conscious urban consumers are becoming attentive to product labeling and nutritional content, encouraging manufacturers to innovate. In line with this, in 2025, KRBL Ltd entered the blended edible oil segment with its “India Gate Uplife” variants, including Gut Pro and Lite, which combined rice bran, soybean, and sunflower oils. This strategic move targets Rs 200–300 crore revenue in three years and aligns with the rising preference for heart-friendly and wellness-oriented cooking oils.

Expanding Retail and Distribution Networks

The growth of organized retail, supermarkets, and e-commerce platforms is enhancing the accessibility of soybean oil across India. Improved logistics infrastructure and deeper penetration into tier-II and tier-III cities are broadening the consumer base. Branded soybean oil products benefit from better shelf visibility, promotional strategies, and diverse packaging options, encouraging trial and repeat purchases. Additionally, online grocery platforms provide convenience, subscription models, and price comparisons, influencing buying decisions. This was exemplified in 2024, when Louis Dreyfus Company (LDC) relaunched its Vibhor edible oil brand, featuring soybean, palm olein, cottonseed, mustard oils, and premium vanaspati enriched with vitamins A and D. The company aimed to expand Vibhor nationwide through retail, supermarkets, and online channels by 2026, catering to health-conscious consumers and strengthening distribution networks.

Market Outlook 2026-2034:

The India soybean oil market demonstrates promising revenue growth potential throughout the forecast period, underpinned by structural demographic shifts, evolving dietary habits, and strengthening domestic production capabilities. The market generated a revenue of USD 4.32 Billion in 2025 and is projected to reach a revenue of USD 5.69 Billion by 2034, growing at a compound annual growth rate of 3.10% from 2026-2034. The continued proliferation of organized retail channels, deepening e-commerce penetration, and government-backed initiatives to enhance domestic oilseed production are expected to sustain positive revenue momentum across the forecast period.

India Soybean Oil Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Packaging Type |

Pouches |

42% |

|

Packaging Material |

Plastic |

51% |

|

Pack Size |

1 Litres - 5 Litres |

35% |

|

Domestic Manufacturing/Imports |

Domestic Manufacturing |

74% |

|

Application |

Household Cooking |

60% |

|

Distribution Channel |

Supermarkets and Hypermarkets |

48% |

|

Region |

West and Central India |

35% |

Packaging Type Insights:

- Pouches

- Jars

- Cans

- Bottles

Pouches dominate with a market share of 42% of the total India soybean oil market in 2025.

Pouches have established clear market leadership in the packaging landscape, due to their affordability, convenience, and widespread acceptance among middle and lower-income households. Lightweight and easy to store, pouches reduce transportation and handling costs for manufacturers and retailers. They are commonly available across local stores, supermarkets, and rural distribution networks, making them the preferred choice for everyday cooking oil purchases. Additionally, flexible packaging allows consumers to buy smaller quantities, supporting frequent purchases and better budget management. This practicality continues to strengthen pouch dominance in the market.

Pouches also remain popular because they support high-volume consumption patterns and offer better value compared to rigid containers. Oil brands often use pouches for promotional pricing and larger distribution reach, ensuring strong visibility in both urban and semi-urban markets. Their compact design minimizes packaging waste and improves shelf efficiency for retailers. Moreover, advances in multilayer packaging technology are enhancing durability and leak resistance, increasing consumer confidence. As demand for cost-effective and easily accessible edible oil packaging grows, pouches are expected to maintain leadership in the market.

Packaging Material Insights:

- Metal

- Plastic

- Paper

- Others

Plastic leads with a market share of 51% of the total India soybean oil market in 2025.

Plastic holds the biggest market share owing to its durability, cost efficiency, and ease of handling across the supply chain. Plastic bottles and containers provide strong resistance to leakage and contamination, preserving oil quality during storage and transport. Manufacturers prefer plastic because it supports mass production at lower costs compared to metal or glass alternatives. The material is lightweight, reducing logistics expenses and improving distribution efficiency across urban and rural markets. Its compatibility with different pack sizes, ranging from small household bottles to bulk containers, further strengthens its dominant position in the market.

Plastic also offers high consumer convenience, with features like resealable caps, ergonomic grip designs, and transparent bodies that allow visibility of product quantity and clarity. Retailers favor plastic container due to its stackability and reduced breakage risk compared to glass packaging. Advances in food-grade plastic technology are improving safety standards and extended shelf life, reinforcing user trust. Additionally, plastic supports branding through labeling and printing flexibility, enabling manufacturers to enhance shelf appeal. As demand for practical, safe, and cost-effective edible oil packaging grows, plastic continues to maintain leadership in the market.

Pack Size Insights:

- Less than 1 Litres

- 1 Litres

- 1 Litres - 5 Litres

- 5 Litres - 10 Litres

- 10 Litres and Above

1 litres - 5 litres exhibit a clear dominance with a 35% share of the total India soybean oil market in 2025.

The 1 liter to 5 liters dominates the market because of its suitability for regular household consumption. This range aligns well with the purchasing patterns of middle-income families who prefer stocking essential cooking oils in moderate quantities. This segment offers a balance between affordability and convenience, avoiding the higher upfront cost of bulk packs while reducing the frequency of repurchase compared to smaller sachets. Retailers also prioritize this pack size as it ensures steady turnover and optimal shelf utilization. Its widespread availability across supermarkets, local stores, and e-commerce platforms further strengthens its dominant market position nationwide.

Additionally, the 1 liter to 5 liters pack size caters effectively to both urban and semi-urban consumers, where soybean oil is commonly used for daily cooking needs. These packs are easy to handle, store, and pour, making them practical for household kitchens. Manufacturers benefit from efficient production and packaging processes within this standardized size range, supporting cost control and consistent supply. Promotional pricing and bundled offers are frequently applied to this segment, enhancing consumer appeal. As households continue to seek value-oriented, manageable quantities, the 1 liter to 5 liters category remains the preferred and leading pack size in the market.

Domestic Manufacturing/Imports Insights:

- Domestic Manufacturing

- Imports

Domestic manufacturing dominates with a market share of 74% of the total India soybean oil market in 2025.

Domestic manufacturing leads the market owing to the country’s strong edible oil processing infrastructure and expanding refining capacity. India has developed a wide network of oilseed crushing units and refineries that support local production and reduce reliance on external suppliers. Domestic manufacturers can respond more quickly to fluctuations in demand, ensuring consistent availability across regions. Local production also helps control transportation and import-related costs, making soybean oil more competitively priced for consumers. Government initiatives supporting oilseed cultivation and self-reliance in edible oils further encourage growth in domestic manufacturing.

Domestic manufacturing also benefits from better supply chain integration, with closer access to raw materials, packaging units, and distribution networks. Indian producers can adapt product offerings to local taste preferences, packaging requirements, and pricing expectations more effectively than imported brands. Additionally, locally manufactured soybean oil is often perceived as fresher and more aligned with domestic quality standards. Import dependency exposes markets to global price volatility, currency fluctuations, and trade restrictions, which domestic production helps minimize. As India continues to strengthen its edible oil sector, domestic manufacturing remains the leading contributor to the soybean oil market.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Household Cooking

- HoReCa

- Food Processing Industry

- Other Industrial Uses

Household cooking leads with a market share of 60% of the total India soybean oil market in 2025.

Household represents the largest segment driven by its widespread use in daily cooking across urban and rural homes. Soybean oil is commonly used for frying and preparing traditional Indian dishes, making it a staple in household kitchens. Its neutral flavor and high smoke point suit diverse regional cuisines, increasing its acceptance among families. The growing population and rising preference for packaged edible oils over loose variants further support household demand. Affordable pricing compared to premium oils also strengthens its position among middle-income consumers seeking value without compromising on quality and cooking performance.

Additionally, increasing awareness about hygiene and branded food products is shifting consumers toward packaged soybean oil for home consumption. Smaller pack sizes and convenient packaging formats are designed specifically to cater to household needs, reinforcing dominance in this segment. Marketing campaigns by leading brands target families by highlighting purity, fortification, and health benefits, further driving adoption. The expansion of modern retail and e-commerce platforms further enhances accessibility, particularly in tier-II and tier-III cities. For instance, India’s e-commerce industry, valued at INR 10,82,875 Crore in 2024, provides extensive distribution channels, making packaged soybean oil widely available. This trend reinforces the household segment’s dominance in the soybean oil market.

Distribution Channel Insights

- Direct/Institutional Sales

- Supermarkets and Hypermarkets

- Convenience Stores

- Online

- Others

Supermarkets and hypermarkets exhibit a clear dominance with a 48% share of the total India soybean oil market in 2025.

Supermarkets and hypermarkets account for the majority of the market share because of their wide product assortment, strong brand presence, and convenient shopping experience. These outlets offer consumers access to multiple soybean oil brands, pack sizes, and price ranges under one roof, enabling easy comparison and informed purchasing decisions. Promotional discounts, bundled offers, and in-store visibility further encourage higher sales volumes. With increasing urbanization and rising disposable incomes, more people prefer organized retail formats for grocery shopping. The availability of trusted packaged edible oils in hygienic conditions also supports the dominance of supermarkets and hypermarkets.

Moreover, supermarkets and hypermarkets play a key role in driving consumer awareness through product placement and marketing campaigns. They cater to bulk household demand as well as smaller packs, ensuring steady sales across income groups. The expansion of retail chains into tier II and tier III cities is strengthening their reach beyond metros, boosting distribution efficiency. These stores also maintain reliable supply chains and consistent stock availability, reducing dependence on traditional local shops. As consumers increasingly shift toward modern retail for quality assurance and convenience, supermarkets and hypermarkets remain the leading distribution channel in the market.

Regional Insights:

- North India

- West and Central India

- East India

- South India

West and Central India dominate with a market share of 35% of the total India soybean oil market in 2025.

West and Central India is the leading segment in the market attributed to the strong presence of soybean cultivation, processing hubs, and a well-established edible oil supply chain. States, such as Madhya Pradesh, Maharashtra, and Rajasthan, contribute significantly to soybean production, ensuring easy availability of raw materials for oil extraction. The region also hosts several large oil mills and refining units, supporting high output and efficient distribution. With soybean oil being widely used for daily cooking, demand remains consistently strong across households and foodservice sectors.

Additionally, West and Central India benefits from better logistics connectivity, allowing soybean oil manufacturers to supply both local and national markets effectively. The region’s large population base, combined with rising awareness about healthier cooking oils, supports sustained market growth. Consumers in these areas increasingly prefer refined soybean oil due to its affordability and versatility in Indian cuisine. The presence of organized retail networks and wholesale markets also strengthens product accessibility. Food processing industries, restaurants, and snack manufacturers in the region further drive bulk demand, making West and Central India the leading regional contributor to India’s soybean oil market.

Market Dynamics

Growth Drivers

Why is the India Soybean Oil Market Growing?

Technological Advancements in Refining and Processing

Advancements in oil refining technologies are improving the quality, stability, and shelf life of soybean oil, thereby enhancing its market appeal. Modern refining techniques reduce impurities, improve color and odor, and optimize fatty acid composition to meet consumer preferences. Automation and quality control systems ensure consistent production standards and operational efficiency. Technological upgrades also support the development of specialized variants tailored for frying, baking, and industrial applications. As processors adopt more efficient extraction and refining methods, product performance improves, strengthening competitiveness in the edible oil segment. These technological improvements contribute to higher consumer acceptance and sustained market growth.

Rising Domestic Consumption of Edible Oils

The growing population and changing dietary habits in India are significantly catalyzing the demand for soybean oil. According to the Asian Palm Oil Alliance in 2024, India consumes 24–25 million tons of edible oil annually. As household consumption of edible oils increases across urban and rural areas, soybean oil remains a widely preferred choice due to its affordability and versatility in cooking applications. The growing use of processed and packaged foods further drives the demand, as soybean oil is commonly utilized in food manufacturing, frying, and bakery products. With rising per capita edible oil consumption and evolving culinary preferences, soybean oil continues to hold a substantial share in the overall edible oil basket, thereby supporting the market growth nationwide.

Growing Demand in Processed Food Industry

The rapid expansion of India’s processed food and quick-service restaurant sectors is catalyzing the demand for soybean oil. Food manufacturers prefer soybean oil due to its neutral flavor, stable frying characteristics, and suitability for a wide range of food applications. Increasing urbanization, busy lifestyles, and rising disposable incomes are encouraging higher consumption of packaged snacks, ready-to-eat (RTE) meals, and fried products. These segments require consistent and large volumes of edible oils, strengthening soybean oil’s industrial demand. As the food processing sector continues to modernize and scale operations, soybean oil remains an integral ingredient supporting sustained industry growth.

Market Restraints

What Challenges the India Soybean Oil Market is Facing?

Intense Competition from Alternative Cooking Oils Constraining Market Expansion

The India soybean oil market faces persistent competitive pressure from a diverse range of alternative cooking oils, including palm oil, mustard oil, sunflower oil, groundnut oil, and coconut oil, that command strong regional loyalties and price competitiveness. Regional dietary traditions create deeply entrenched user preferences for specific oil types across different geographic markets, limiting soybean oil's ability to achieve uniform nationwide penetration despite its favorable nutritional attributes and competitive pricing.

Price Volatility Linked to International Commodity Market Fluctuations

Soybean oil pricing in India remains significantly influenced by global commodity market dynamics, international soybean harvest outcomes, and currency exchange rate movements that create uncertainty for both manufacturers and individuals. The inherent volatility in raw material costs complicates pricing strategies for domestic manufacturers, potentially eroding user loyalty during periods of sharp price escalation while simultaneously compressing producer margins during price corrections, thereby destabilizing the market's value chain economics.

Import Dependency Creating Supply Chain Vulnerability and Policy Uncertainty

Despite substantial domestic production capabilities, India continues to depend on imported soybean oil to bridge the gap between domestic supply and the growing consumption demand, exposing the market to geopolitical disruptions, trade policy uncertainties, and logistics chain vulnerabilities. Frequent adjustments to import duty structures create regulatory uncertainty for market participants, complicating long-term investment planning and inventory management decisions for processors, refiners, and distributors across the supply chain.

Competitive Landscape

The India soybean oil market exhibits moderate competitive intensity characterized by the coexistence of multinational agricultural commodity processors, established domestic edible oil conglomerates, and regional manufacturers competing across price segments and distribution tiers. Market dynamics reflect strategic positioning, ranging from premium, brand-driven offerings emphasizing health attributes, fortification, and quality certifications to value-oriented products targeting price-sensitive buyers in mass-market segments. The competitive landscape is increasingly shaped by distribution network scale and penetration depth, brand marketing effectiveness in communicating nutritional benefits, packaging innovation, and supply chain integration spanning from oilseed procurement through processing to consumer-facing retail distribution.

Recent Developments

- November 2025: Fortune Refined Soybean Oil launched a new campaign featuring Akshay Kumar, celebrating India’s tradition of greeting others by asking about their health first. The ad positioned the brand as a “silent caretaker” in homes, linking good health to everyday kitchen choices. It also highlighted the oil’s Nutri 5 benefits, supporting overall family well-being and healthy cooking habits.

- October 2025: Fortune launched its ‘Bhojan Bahini’ campaign to celebrate the heritage of its mustard and soybean oils, strengthening its presence in West Bengal. The regional campaign featured Sourav Ganguly and Abir Chatterjee in a cinematic TV commercial highlighting Bengal’s rich food culture. It reinforced Fortune’s leadership in the edible oil segment while promoting quality and authentic regional flavors.

India Soybean Oil Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical and Forecast Trends, Industry Catalysts and Challenges, Segment-Wise Historical and Predictive Market Assessment:

|

| Packaging Types Covered | Pouches, Jars, Cans, Bottles |

| Packaging Materials Covered | Metal, Plastic, Paper, Others |

| Pack Sizes Covered | Less than 1 Litres, 1 Litres, 1 Litres - 5 Litres, 5 Litres - 10 Litres, 10 Litres and Above |

| Domestic Manufacturing/Imports Covered | Domestic Manufacturing, Imports |

| Applications Covered | Household Cooking, HoReCa, Food Processing Industry, Other Industrial Uses |

| Distribution Channels Covered | Direct/Institutional Sales, Supermarkets and Hypermarkets , Convenience Stores , Online , Others |

| Region Covered | North India, West and Central India, East India, South India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The India soybean oil market size was valued at USD 4.32 Billion in 2025.

The India soybean oil market is expected to grow at a compound annual growth rate of 3.10% from 2026-2034 to reach USD 5.69 Billion by 2034.

Pouches account for the largest revenue share of 42% in 2025 due to their affordability, lightweight portability, and widespread individual preference for convenient packaging formats across both urban and rural households.

Key factors driving the India soybean oil market include government initiatives, import regulations, and incentives for domestic oilseed production, which are stabilizing supply and prices. For instance, in 2025, India launched the National Mission on Edible Oils and Oilseeds (NMEO-OS) with a Rs 10,103.38 crore budget to increase production to 70 million tons by 2030–31, targeting key oilseeds, including soybeans, enhancing long-term market growth.

Major challenges include intense competition from alternative cooking oils with strong regional loyalties, price volatility linked to international commodity market fluctuations and currency exchange movements, import dependency creating supply chain vulnerability, frequent policy adjustments affecting import duty structures, and uneven distribution infrastructure in rural and remote areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)