India Specialty Clinics Market Size, Share, Trends and Forecast by Specialty Type, Service Type, Mode of Operation, Patient Demographics, and Region, 2025-2033

India Specialty Clinics Market Overview:

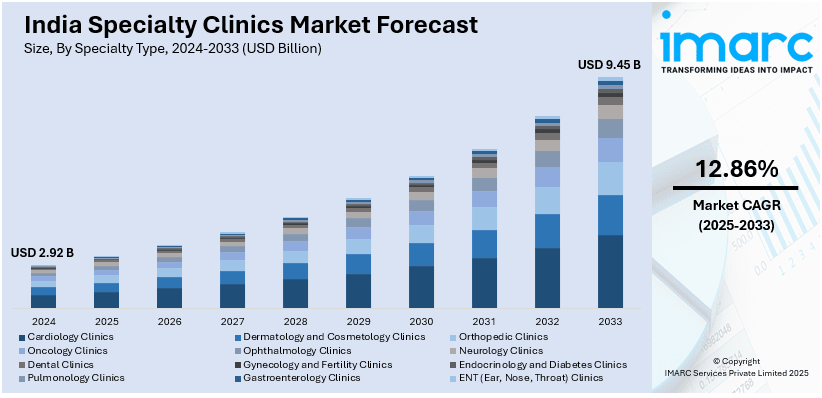

The India specialty clinics market size reached USD 2.92 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.45 Billion by 2033, exhibiting a growth rate (CAGR) of 12.86% during 2025-2033. The market is driven by rising medical tourism, increasing prevalence of chronic diseases, growing middle-class affordability, ongoing advancements in telemedicine, government healthcare initiatives, expanding insurance coverage, and a shift towards personalized treatments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.92 Billion |

| Market Forecast in 2033 | USD 9.45 Billion |

| Market Growth Rate 2025-2033 | 12.86% |

India Specialty Clinics Market Trends:

Rise of Multi-Specialty and Super-Specialty Clinics

India's specialty clinics sector is increasingly shifting toward multi-specialty and super-specialty facilities, driven by patient preference for comprehensive care under one roof. These clinics focus on treating specific medical conditions such as cardiology, oncology, neurology, dermatology, and orthopedics, responding to the rising prevalence of chronic and lifestyle diseases. This expansion gets additional fuel from corporate healthcare providers who team up with private equity firms making investments in specialty medical chains. For instance, in August 2024, Medanta unveiled plans to invest INR 1,200 crore in a new super-specialty hospital with over 500 beds, reflecting the growing demand for specialized medical care. Additionally, the combination of urban growth and increasing personal wealth enables the middle and upper economic groups to access premium specialized healthcare services. Specialty clinics also provide patients with faster service times as well as reduced waiting periods and state-of-the-art diagnostic capabilities to improve their experience. Due to patient preference for outpatient healthcare, these clinics continue to open new facilities in tier-2 and tier-3 urban areas to expand their service reach. As a result, the Ayushman Bharat program and health insurance penetration initiatives organized by the government reduce the cost of specialized treatments, thereby boosting the India specialty clinics market share.

To get more information on this market, Request Sample

Integration of Telemedicine and Digital Health Solutions

The rapid adoption of telemedicine and digital health solutions is transforming the India specialty clinics market outlook by improving accessibility and efficiency. In line with this, telehealth capabilities allow clinics to reach patients located in rural and semi-urban areas where specialized medical care is restricted to metro cities. Moreover, specialty clinics achieve better patient care quality through digital health services like artificial intelligence (AI) diagnostics, Electronic Health Records (EHRs), and remote monitoring which decrease operational expenses. For example, in September 2024, Delhi's Health Department launched free telemedicine services via e-Sanjeevani, enabling video consultations with specialists across 13 fields to reduce outpatient department burden and improve accessibility. This initiative highlights the growing role of government-backed digital health programs in enhancing healthcare reach. Besides this, various medical facilities have implemented mobile apps and digital portals to automate patient scheduling along with follow-up care and medication alert management, thus improving patient involvement in their treatment journey. With rising internet penetration and smartphone adoption, telemedicine platforms are becoming more user-friendly and accessible. Furthermore, wearable health technology and AI-powered chatbots are enhancing real-time patient monitoring and support. Apart from this, through the National Digital Health Mission (NDHM) program, government actions drive the digital healthcare transformation of specialty clinics in the country to build a modern efficient data-oriented patient-focused healthcare system nationwide, which is driving the India specialty clinics market growth.

India Specialty Clinics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on specialty type, service type, mode of operation, and patient demographics.

Specialty Type Insights:

- Cardiology Clinics

- Dermatology and Cosmetology Clinics

- Orthopedic Clinics

- Oncology Clinics

- Ophthalmology Clinics

- Neurology Clinics

- Dental Clinics

- Gynecology and Fertility Clinics

- Endocrinology and Diabetes Clinics

- Pulmonology Clinics

- Gastroenterology Clinics

- ENT (Ear, Nose, Throat) Clinics

The report has provided a detailed breakup and analysis of the market based on the specialty type. This includes cardiology clinics, dermatology and cosmetology clinics, orthopedic clinics, oncology clinics, ophthalmology clinics, neurology clinics, dental clinics, gynecology and fertility clinics, endocrinology and diabetes clinics, pulmonology clinics, gastroenterology clinics, and ENT (ear, nose, throat) clinics.

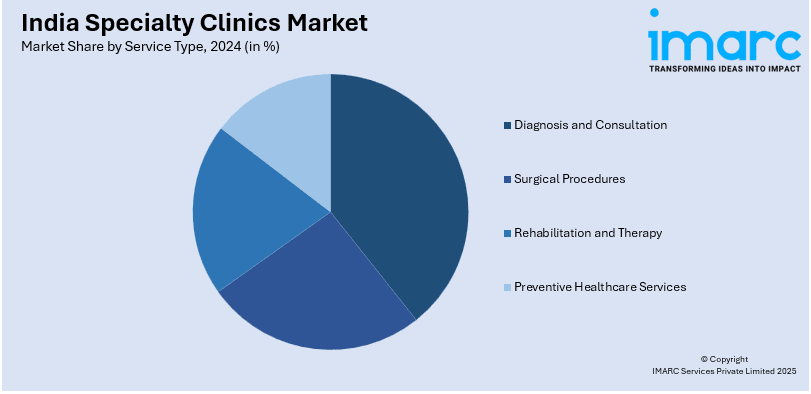

Service Type Insights:

- Diagnosis and Consultation

- Surgical Procedures

- Rehabilitation and Therapy

- Preventive Healthcare Services

A detailed breakup and analysis of the market based on the service type have also been provided in the report. This includes diagnosis and consultation, surgical procedures, rehabilitation and therapy, and preventive healthcare services.

Mode of Operation Insights:

- Standalone Clinics

- Hospital-Affiliated Clinics

- Chain/Franchise-Based Clinics

The report has provided a detailed breakup and analysis of the market based on the mode of operation. This includes standalone clinics, hospital-affiliated clinics, and chain/franchise-based clinics.

Patient Demographics Insights:

- Pediatric Patients

- Adult Patients

- Geriatric Patients

A detailed breakup and analysis of the market based on the patient demographics have also been provided in the report. This includes pediatric patients, adult patients, and geriatric patients.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North, South, East and west India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Specialty Clinics Market News:

- In November 2024, Yatharth Hospital & Trauma Care Services acquired a renowned super-specialty hospital in Model Town, New Delhi. This move strengthens Yatharth's footprint in North India, enhancing its capacity to deliver specialized healthcare services and meeting the growing demand for quality care.

- In September 2024, Centre for Sight announced a strategic collaboration with Laxmi Eye Hospital, increasing its presence in Maharashtra to nine centers. This partnership aims to provide advanced ophthalmic care, contributing to the growth and accessibility of specialized eye care services in the region.

India Specialty Clinics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Specialty Types Covered | Cardiology Clinics, Dermatology and Cosmetology Clinics, Orthopedic Clinics, Oncology Clinics, Ophthalmology Clinics, Neurology Clinics, Dental Clinics, Gynecology and Fertility Clinics, Endocrinology and Diabetes Clinics, Pulmonology Clinics, Gastroenterology Clinics, ENT (Ear, Nose, Throat) Clinics |

| Service Types Covered | Diagnosis and Consultation, Surgical Procedures, Rehabilitation and Therapy, Preventive Healthcare Services |

| Mode of Operations Covered | Standalone Clinics, Hospital-Affiliated Clinics, Chain/Franchise-Based Clinics |

| Patient Demographics Covered | Pediatric Patients, Adult Patients, Geriatric Patients |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India specialty clinics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India specialty clinics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India specialty clinics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India specialty clinics market size reached USD 2.92 Billion in 2024.

The India specialty clinics market is expected to reach USD 9.45 Billion by 2033, exhibiting a CAGR of 12.86% during 2025-2033.

The market growth is driven by rising healthcare awareness, increasing prevalence of chronic diseases, and growing demand for specialized medical services. Expansion of healthcare infrastructure, advancements in medical technology, and increasing disposable incomes further boost market development. Additionally, the shift toward outpatient care and preference for personalized treatment options contribute to the growing adoption of specialty clinics across India.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)