India Specialty Fats & Oils Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

India Specialty Fats & Oils Market Overview:

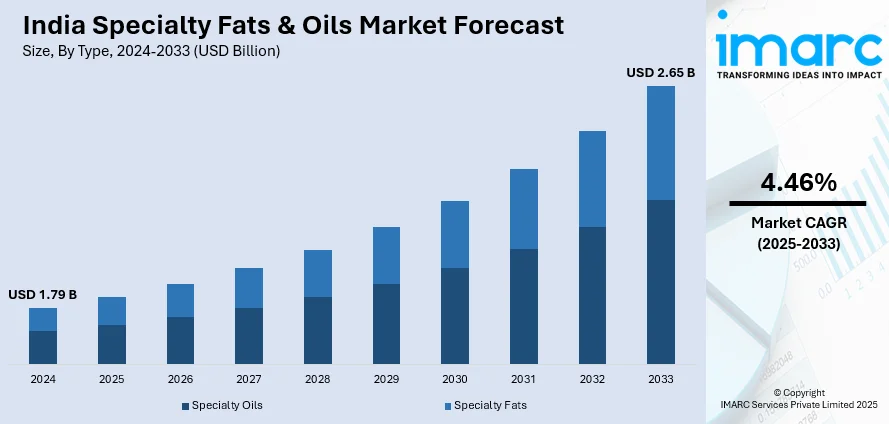

The India specialty fats & oils market size reached USD 1.79 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.65 Billion by 2033, exhibiting a growth rate (CAGR) of 4.46% during 2025-2033. The market is driven by increasing health awareness, which is prompting demand for healthier alternatives, the expansion in food processing and bakery sectors, and the rising product usage in the personal care and cosmetics industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.79 Billion |

| Market Forecast in 2033 | USD 2.65 Billion |

| Market Growth Rate 2025-2033 | 4.46% |

India Specialty Fats & Oils Market Trends:

Rising Demand for Plant-Based and Sustainable Products

Consumer tastes in India are progressively evolving towards healthier and more ecologically sustainable food alternatives, owing to rising health awareness and environmental concerns. As a result, there is an increased demand for specialized fats and oils, particularly those derived from plants. The growth of vegetarian and vegan diets has increased the demand for plant-based foods. For example, Cargill's launch of the Gemini Plus Trans Fat-Free Vanaspati in Kerala appeals to health-conscious consumers looking for traditional tastes without trans fats. Additionally, Indian consumers are prioritizing sustainable sourcing, with the global market for sustainably sourced palm oil projected to reach 8 million metric tons. As a response, Indian manufacturers are adopting sustainable practices, such as sourcing certified sustainable palm oil and exploring alternatives like sunflower and soybean oils. Supporting this shift, the Indian government approved a USD 1.2 billion program in October 2024 to boost domestic edible oil production, aiming to increase output from 12.7 million metric tons to 25.45 million metric tons by 2030-31. This growing demand for plant-based and sustainable products is among the key factors driving the market growth.

To get more information on this market, Request Sample

Technological Advancements in Food Processing

Technological advancements in food processing are revolutionizing the market by enabling the production of customized fats and oils with unique functions adapted to the different demands of the food sector. Innovations such as enzymatic interesterification, fractionation, and hydrogenation have enabled the production of specialized fats and oils with enhanced stability, texture, and nutritional profiles. These improvements cater to the evolving demands of the food industry for healthier and more functional ingredients. A pertinent example is the introduction of enzymatic interesterification, which allows for the modification of fat molecules to produce trans-fat-free alternatives with desirable melting points and textures. This technology has been instrumental in developing specialty fats used in confectionery and bakery products, meeting consumer preferences for healthier options without compromising on quality. Furthermore, the adoption of advanced extraction and refining techniques has facilitated the production of high-quality specialty oils, such as palm and coconut oils, which are extensively utilized in processed foods. These technological strides not only improve product quality but also expand the application scope of specialty fats and oils, thereby driving market growth in India.

India Specialty Fats & Oils Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Specialty Oils

- Specialty Fats

The report has provided a detailed breakup and analysis of the market based on the type. This includes specialty oils and specialty fats.

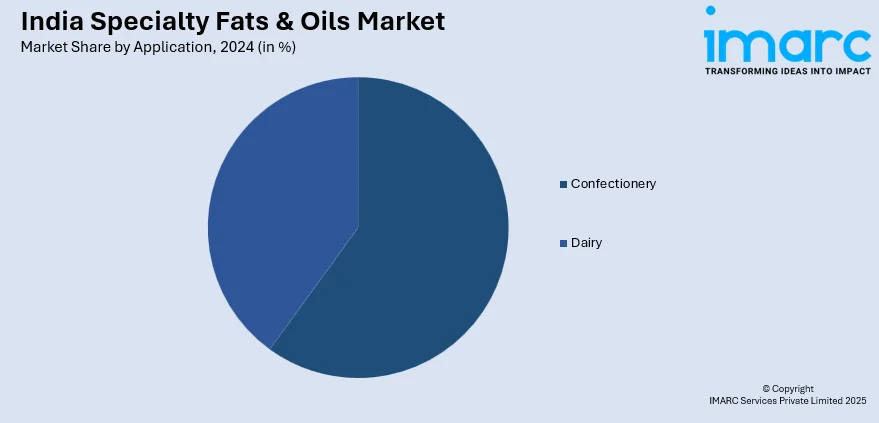

Application Insights:

- Confectionery

- Dairy

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes confectionery and dairy.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Specialty Fats & Oils Market News:

- January 2025: KRBL announced its plans to introduce a new edible oil brand in February, a key step toward increasing its product offering. The firm is also planning to join the spices and staple food industries shortly as part of its effort to expand its goods and reach a larger client base.

- July 2024: Louis Dreyfus Company (LDC) relaunched its consumer-facing edible oil brand in India. The updated product range comprises Vibhor Refined Soybean Oil, Cottonseed Oil, Palm Olein Oil, Mustard Oil, and Premium Vanaspati, all of which are fortified with vitamins A and D. The brand's motto, 'Mera vishwas vibhor ke saath' (My faith in Vibhor), emphasizes its dedication to authenticity and excellence.

- July 2024: Adani Wilmar revealed its intention to invest over INR 600 crore this fiscal year to develop its edible oil manufacturing capacity and introduce new culinary items. The corporation hopes for increased volume growth with ongoing INR 3,400 crore expansion plans.

India Specialty Fats & Oils Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Specialty Fats, Specialty Oils |

| Applications Covered | Confectionery, Dairy |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India specialty fats & oils market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India specialty fats & oils market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India specialty fats & oils industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The specialty fats & oils market in India was valued at USD 1.79 Billion in 2024.

The India specialty fats & oils market is projected to exhibit a CAGR of 4.46% during 2025-2033, reaching a value of USD 2.65 Billion by 2033.

The growth of the India specialty fats and oils market is supported by rising consumer demand for healthier cooking options, increasing disposable incomes, and expanding food processing industries. Additionally, advancements in food formulations, the popularity of convenience foods, and a shift towards plant-based alternatives are contributing to the market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)