India Specialty & Fine Chemicals Market Size, Share, Trends and Forecast by Product and Region, 2025-2033

India Specialty & Fine Chemicals Market Overview:

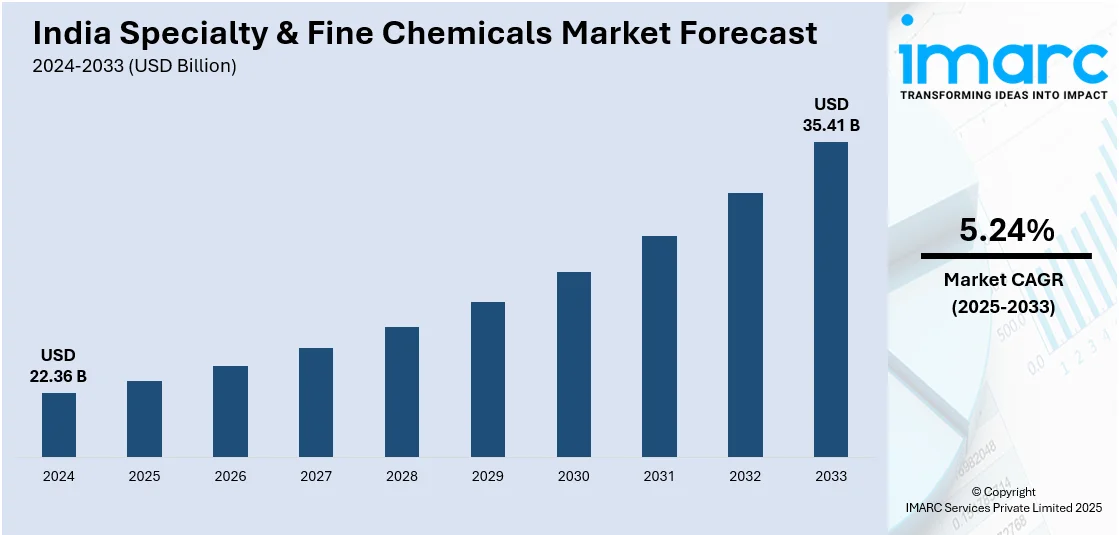

The India specialty & fine chemicals market size reached USD 22.36 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 35.41 Billion by 2033, exhibiting a growth rate (CAGR) of 5.24% during 2025-2033. The rising product demand in the pharmaceuticals, agrochemicals, and personal care sectors, favorable government incentives, increasing research and development (R&D) investments, and the shift towards eco-friendly formulations are among the key factors bolstering the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 22.36 Billion |

| Market Forecast in 2033 | USD 35.41 Billion |

| Market Growth Rate 2025-2033 | 5.24% |

India Specialty & Fine Chemicals Market Trends:

Increased Investments and Policy Support

The Indian government is actively pushing the specialized chemicals sector as a vital economic engine, implementing strategic initiatives to increase local manufacture and exports. A key project under discussion is a production-linked incentive (PLI) system aimed at attracting large investments, driving innovation, and expanding production capacity in the chemical sector. Additionally, India is set to receive USD 87 billion in petrochemical investments over the next decade to meet the growing demand for petrochemical products, further strengthening the specialty chemicals segment. The commitment to fostering a favorable investment climate is expected to accelerate industry expansion and technological advancements. As a result of these initiatives, the specialty chemicals sector is poised to play a crucial role in the broader chemical industry’s growth. With government support, rising global demand, and increased investments, India’s specialty chemicals market is set for robust expansion, reinforcing its position as a key player in the global chemical landscape.

To get more information on this market, Request Sample

Sustainability and Green Initiatives

Sustainability is emerging as a core priority in India’s specialty chemicals industry, driven by increasing environmental concerns and shifting consumer preferences. Leading manufacturers are investing in renewable energy and green hydrogen production, aligning with the rising demand for eco-friendly solutions in both domestic and global markets. This shift is further reinforced by consumer awareness, as a survey indicates that 60% of Indian consumers prioritize sustainably made or environmentally friendly products. To meet these expectations, companies are embracing greener manufacturing processes and integrating sustainable product innovations. The widespread adoption of green chemistry principles is not only reducing environmental impact but also enhancing the competitiveness of Indian specialty chemical manufacturers on the global stage. By prioritizing sustainability, the industry is positioning itself as a leader in eco-conscious innovation, thereby aiding in market expansion.

India Specialty & Fine Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product.

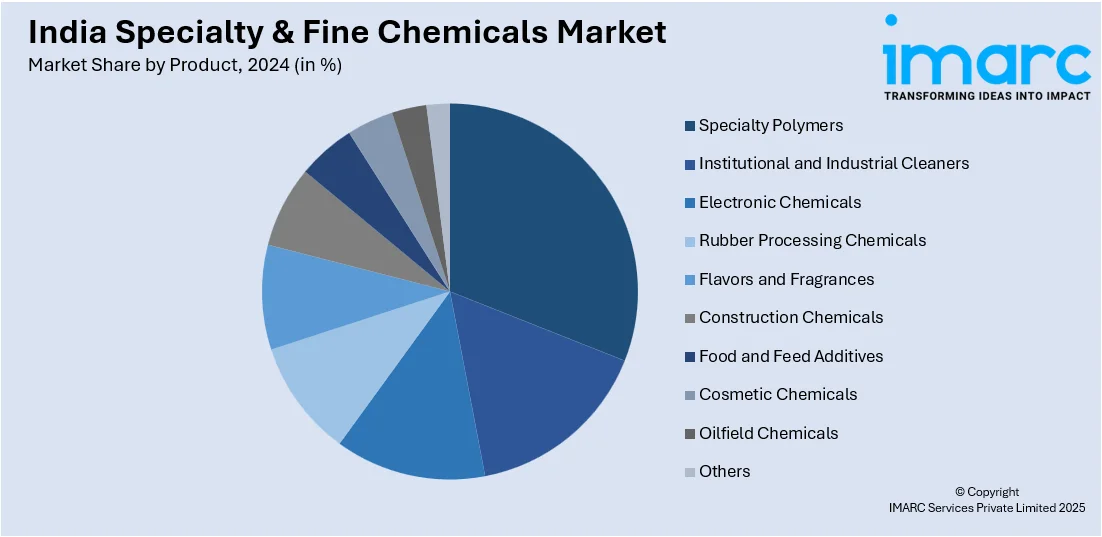

Product Insights:

- Specialty Polymers

- Institutional and Industrial Cleaners

- Electronic Chemicals

- Rubber Processing Chemicals

- Flavors and Fragrances

- Construction Chemicals

- Food and Feed Additives

- Cosmetic Chemicals

- Oilfield Chemicals

- Mining Chemicals

- Pharmaceutical and Nutraceutical Additives

- Plastic Additives

- Printing Inks

- CASE

- Specialty and Pulp Chemicals

- Specialty Textile Chemicals

- Catalysts

- Water Treatment Chemicals

- Corrosion Inhibitors

- Flame Retardants

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes specialty polymers, institutional and industrial cleaners, electronic chemicals, rubber processing chemicals, flavors and fragrances, construction chemicals, food and feed additives, cosmetic chemicals, oilfield chemicals, mining chemicals, pharmaceutical and nutraceutical additives, plastic additives, printing inks, CASE, specialty and pulp chemicals, specialty textile chemicals, catalysts, water treatment chemicals, corrosion inhibitors, flame retardants, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Specialty & Fine Chemicals Market News:

- March 2025: Thermax Chemical Solutions, a subsidiary of Thermax Ltd, partnered with Brazil's Oswaldo Cruz Química Indústria e Comércio Ltda (OCQ) to form a joint venture in India. Thermax holds a 51% stake, while OCQ owns 49%. The venture will produce acrylic resins at Thermax's Jhagadia plant in Gujarat, targeting industries like paints, adhesives, textiles, and infrastructure. Future plans include expanding production to polyester and alkyd resins.

- March 2025: Anupam Rasayan India signed a 10-year Letter of Intent (LoI) valued at approximately INR 922 crore (USD 106 million) with a leading and unnamed Korean multinational specializing in specialty chemicals. Under this agreement, Anupam Rasayan will supply a high-performance niche chemical, with deliveries expected to commence in FY26. The specialty chemical has applications in the aviation and electronics sectors.

- March 2025: Scimplify, a specialty chemicals startup, secured USD 40 million in a Series B funding round co-led by Accel and Bertelsmann India Investments, with participation from UMI, Omnivore, and 3one4 Capital. This investment raises Scimplify's total funding to USD 54 million. The company plans to use the funds to enhance its platform for developing, manufacturing, and distributing specialty chemicals, expand its international presence beyond the current 16 countries, and enter new industry segments.

- March 2025: Brenntag Specialties renewed its distribution agreement with Syensqo, a Belgian multinational specializing in advanced materials and specialty chemicals, to supply high-quality and sustainable aroma products, specifically Rhovanil Vanillin and Rhodiarome Ethylvanillin, to customers across Southeast Asia, Australia, New Zealand, and Taiwan. This partnership aims to serve key segments in the food and beverage markets, including bakery, chocolate, dairy, confectionery, and instant powder drinks.

India Specialty & Fine Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Specialty Polymers, Institutional and Industrial Cleaners, Electronic Chemicals, Rubber Processing Chemicals, Flavors and Fragrances, Construction Chemicals, Food and Feed Additives, Cosmetic Chemicals, Oilfield Chemicals, Mining Chemicals, Pharmaceutical and Nutraceutical Additives, Plastic Additives, Printing Inks, CASE, Specialty and Pulp Chemicals, Specialty Textile Chemicals, Catalysts, Water Treatment Chemicals, Corrosion Inhibitors, Flame Retardants, Other |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India specialty & fine chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India specialty & fine chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India specialty & fine chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The specialty & fine chemicals market in India was valued at USD 22.36 Billion in 2024.

The India specialty & fine chemicals market is projected to exhibit a CAGR of 5.24% during 2025-2033, reaching a value of USD 35.41 Billion by 2033.

The India specialty & fine chemicals market is being propelled by heightened demand from sectors like pharmaceuticals, agrochemicals, and personal care. A growing emphasis on advanced materials, heightened investments in research and development, along with favorable government policies for chemical production are further contributing to market growth both locally and in export sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)