India Specialty Paper Market Size, Share, Trends and Forecast by Type, Raw Material, Application, and Region, 2025-2033

India Specialty Paper Market Overview:

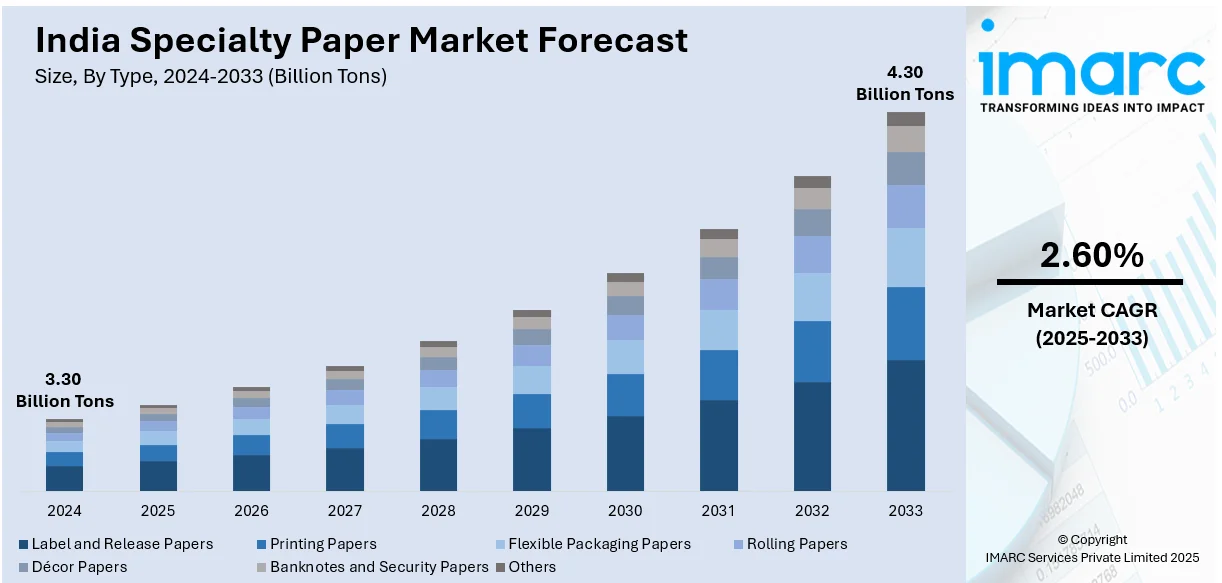

The India specialty paper market size reached 3.30 Billion Metric Tons in 2024. Looking forward, IMARC Group expects the market to reach 4.30 Billion Metric Tons by 2033, exhibiting a growth rate (CAGR) of 2.60% during 2025-2033. The India specialty paper market is driven by expanding packaging and e-commerce industries, rising demand for eco-friendly and sustainable paper solutions, government initiatives like Make in India, advancements in paper manufacturing technology, and increasing applications in labeling, food packaging, and security documents, supporting industrial and economic development across multiple sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 3.30 Billion Metric Tons |

| Market Forecast in 2033 | 4.30 Billion Metric Tons |

| Market Growth Rate 2025-2033 | 2.60% |

India Specialty Paper Market Trends:

Robust Expansion of the Manufacturing Sector

The economy of India has seen a stunning surge pattern in recent times, and this has provided a favorable landscape for many industries, such as specialty paper. The Gross Value Added (GVA) of the manufacturing sector, an indicator of major importance concerning industrial well-being, saw impressive advancement. As per the Annual Survey of Industries (ASI) published by the Ministry of Statistics and Programme Implementation (MoSPI), the GVA upsurged by 8.8% in current prices in 2020-21 and jumped by 26.6% in 2021-22 compared to the corresponding previous years. This strong performance reflects the resilience and booming of India's manufacturing prowess. The specialty paper sector, which forms an essential part of industries like packaging, labeling, and printing, gains directly from this economic upswell. With growing consumer demand and industries becoming multi-faceted, the demand for specialized paper products has grown stronger. The ASI report also points out that industrial production rose by over 35% in 2021-22 compared to the earlier year, indicating an amplification in production efforts in numerous manufacturing areas. This rise in industrial production translates to higher use of raw materials, such as specialty papers, to address the changing needs of both local and foreign markets. Moreover, the strategic geopolitical location of India has increased its status in international trade. The country's involvement in multilateral groups like the G20, Quad, and BRICS has deepened its influence on international affairs, further boosting its economic position. Such a high rank draws foreign investments and creates new markets for Indian goods, including specialty paper, thus promoting the development of the industry.

To get more information on this market, Request Sample

Government Initiatives to Boost Manufacturing

The Indian government has initiated numerous strategic measures to make the nation a world manufacturing hub, directly benefiting the market for specialty paper. With the aim to reinforce industrial prowess and encourage innovation, the "Make in India" campaign was initiated to position India as a top contributor to the international economy. These efforts are enabled by inclusive policies like the Production Linked Incentive (PLI) Schemes, PM GatiShakti, the National Logistics Policy, and fiscal reforms such as the Goods and Services Tax (GST). All these actions together have strengthened the business-friendliness and helped to generate investments across various industries, like specialty paper. The PLI Schemes, with a staggering outlay of ₹1.97 lakh crore, span 14 sectors designed to encourage investment in state-of-the-art technology and enhance global competitiveness. These schemes encourage manufacturers to boost production capacity, resulting in enhanced demand for specialty papers utilized in packaging and labeling high-quality products. In addition, India's significant improvement in enhancing its business environment is reflected in the jump from 142nd in 2014 to 63rd in the World Bank's Doing Business Report 2020. Such a high jump enhances investor confidence and asserts India's appeal to foreign investors, resulting in new manufacturing facilities and expansion of existing units. Therefore, the specialty paper industry witnesses propelled demand as these facilities require specialized paper products for their needs.

India Specialty Paper Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, raw material, and application.

Type Insights:

- Label and Release Papers

- Printing Papers

- Flexible Packaging Papers

- Rolling Papers

- Décor Papers

- Banknotes and Security Papers

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes label and release papers, printing papers, flexible packaging papers, rolling papers, décor papers, banknotes and security papers, and others.

Raw Material Insights:

- Pulp

- Fillers and Binders

- Additives

- Coatings

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes pulp, fillers and binders, additives, coatings, and others.

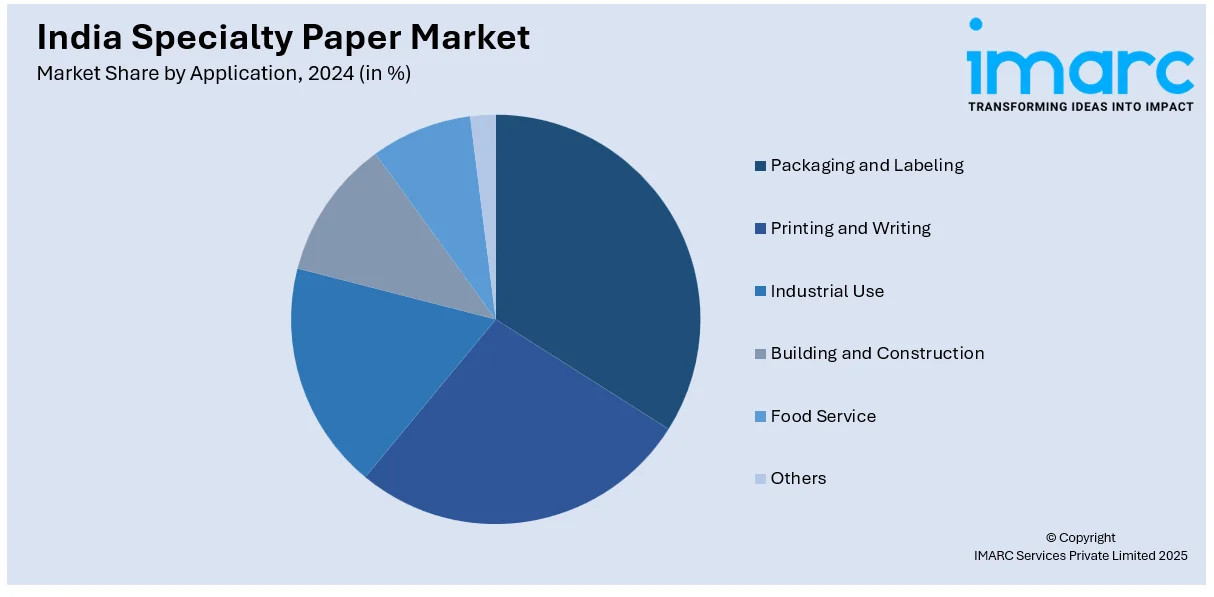

Application Insights:

- Packaging and Labeling

- Printing and Writing

- Industrial Use

- Building and Construction

- Food Service

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes packaging and labeling, printing and writing, industrial use, building and construction, food service, and others.

Regional Insights:

- North India

- South India

- East India

- West India

The report has also provided a comprehensive analysis of all the major regional markets, which include North India, South India, East India, and West India.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

India Specialty Paper Market News:

- October 2024: Preserve Brands launched luxury cotton paper packaging that is produced from fabric waste from India's clothing industry, benefiting rural artisans and environmentally friendly production. The move has escalated the application of specialty paper in high-end packaging to keep up with ecological trends. The innovation has improved the India specialty paper market by enhancing demand for sustainable and quality packaging products.

- June 2024: Solenis and PhaBuilder Biotechnology collaborated to create PHA-based technology for green paper packaging with a boost in biodegradability and minimal plastic utilization. The technology complements India's specialty paper industry by encouraging green alternatives in packaging usage. The trend towards sustainable packaging has elevated specialty paper demand with higher coatings and functional abilities.

India Specialty Paper Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Label and Release Papers, Printing Papers, Flexible Packaging Papers, Rolling Papers, Décor Papers, Banknotes and Security Papers, Others |

| Raw Materials Covered | Pulp, Fillers and Binders, Additives, Coatings, Others |

| Applications Covered | Packaging and Labeling, Printing and Writing, Industrial Use, Building and Construction, Food Service, Others |

| Regions Covered | North India, South India, East India, West India |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the India specialty paper market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the India specialty paper market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the India specialty paper industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The India specialty paper market reached 3.30 Billion Metric Tons in 2024.

The India specialty paper market is projected to exhibit a CAGR of 2.60% during 2025-2033, reaching 4.30 Billion Metric Tons by 2033.

The India specialty paper market is driven by rising demand for sustainable packaging as businesses shift away from plastics under regulatory and environmental pressure. Technological advances in manufacturing and government initiatives supporting industrial growth further accelerate the sector’s expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)